Market By Type, Cable Type, Material, Application And Geography | Forecast 2019-2027

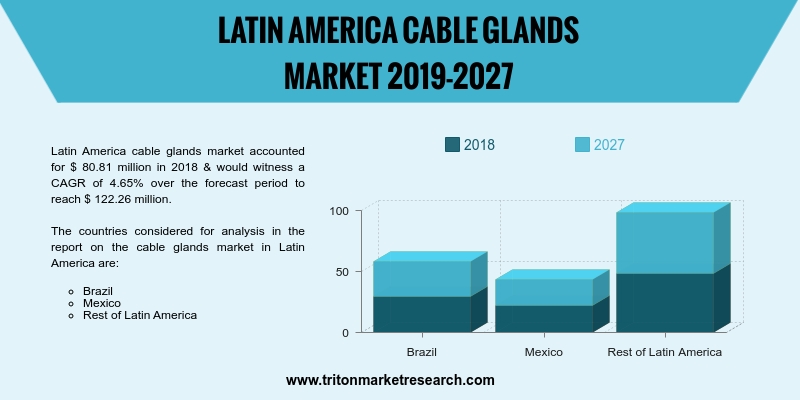

According to Triton Market Research, the Latin America cable glands market is set to proliferate with a CAGR of 4.65% in the forecast period of 2019-2027.

The countries considered in the report on Latin America’s cable glands market are:

• Brazil

• Mexico

• Rest of Latin America

Brazil has the most prominent mining industry in the Latin American region. It is the sixth-largest mining industry and producer of high-quality ores in the world. The increase in demand for mining activities in the country are fueling Brazil’s cable glands market. Brazil, as well as Argentina, are expected to grow on an upward trajectory in the forecast period, as a result of several initiatives by the government, which help generate employment.

Report Scope Can Be Customized Per Your Requirements. Request for Customization

With Latin America’s manufacturing industry showing a positive outlook, is expected that the market for cable glands in the region would showcase stable growth. Food processing, consumer durables, chemicals & petrochemicals, textiles, printing, steel and metallurgy are the major industries in Buenos Aires. Rosario is another industrial area, having oil refineries, steel-producing plants, chemical & tanning industries, and tractor and meat-packing plants. Santa Fe is known for its dairy industry, flour mills and zinc- & copper-smelting plants.

According to the World Economic Outlook report by the International Monetary Fund, the GDP of Argentina in 2016 was $879.4 billion. Argentina’s status in terms of economy is showing improvement, with the country undertaking diverse exporting ventures in industrial products, agricultural goods and textiles, making it a well-developed nation. The growth of Argentina’s industrial sector has generated employment avenues for its 43.9 million population. The rising demand for the industrial sector is propelling the growth of the Argentinian cable glands market.

Eaton Corporation is a company providing power management solutions. It caters to customers in the mechanical, electrical and hydraulic power markets. With manufacturing facilities all over the world, Eaton Corporation operates primarily in Latin America, Europe, North America and Asia.

ADE-1FC non-armored barrier gland, Capri 1F2 ADCC conduit gland and MIL 5015 ADE-1F2 DS (Double Seal) Series non-armored gland are some of the products that are part of the company’s product portfolio. Eaton Corporation reported revenues worth US $5,487.0 million for the second quarter that ended June 2018, showcasing an increase of 4.5% over the previous quarter. Eaton’s diversified product portfolio, coupled with its resilient financial performance, are expected to boost the growth of the company in the coming years.

1. LATIN AMERICA CABLE GLANDS MARKET – SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

RISING DEMAND FOR HAZARDOUS CABLE GLANDS

2.2.2.

SWELLING DEMAND FOR CABLE CONNECTORS IN THE AEROSPACE SECTOR

2.3. PORTER’S FIVE FORCES ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

COST

2.4.2.

SCALABILITY

2.4.3.

EASE OF USE

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

GOVERNMENT REGULATIONS FUEL THE DEMAND FOR CABLE GLANDS

2.7.2.

RESTORATION OF ELECTRICAL NETWORKS IN SEVERAL REGIONS

2.7.3.

RISE IN CONSTRUCTION UNDERTAKINGS IN DEVELOPING REGIONS

2.7.4.

WIDE ADOPTION OF AUTOMATION

2.8. MARKET RESTRAINTS

2.8.1.

VARIABILITY IN RAW MATERIAL PRICES

2.9. MARKET OPPORTUNITIES

2.9.1.

EMERGING GROWTH IN BUDDING MARKETS

2.9.2.

SURGE IN COUNT OF DATA CENTERS

2.10. MARKET CHALLENGES

2.10.1.

SUSPENSION OF THE LOCAL MARKETS

3. LATIN AMERICA CABLE GLANDS MARKET OUTLOOK –

BY TYPE

3.1. INDUSTRIAL

3.2. HAZARDOUS

3.2.1.

INCREASED SAFETY

3.2.2.

FLAME-PROOF

3.2.3.

EMC CABLE GLANDS

3.2.4.

OTHERS

4. LATIN AMERICA CABLE GLANDS MARKET OUTLOOK –

BY CABLE TYPE

4.1. ARMORED

4.2. UNARMORED

5. LATIN AMERICA CABLE GLANDS MARKET OUTLOOK –

BY MATERIAL

5.1. BRASS

5.2. STAINLESS STEEL

5.3. PLASTIC/NYLON

5.4. OTHERS

6. LATIN AMERICA CABLE GLANDS MARKET OUTLOOK –

BY APPLICATION

6.1. OIL & GAS

6.2. MINING

6.3. AEROSPACE

6.4. MANUFACTURING & PROCESSING

6.5. CHEMICAL

6.6. OTHERS

7. LATIN AMERICA CABLE GLANDS MARKET – REGIONAL

OUTLOOK

7.1. LATIN AMERICA

7.1.1.

MARKET BY TYPE

7.1.2.

MARKET BY HAZARDOUS

7.1.3.

MARKET BY CABLE TYPE

7.1.4.

MARKET BY APPLICATION

7.1.5.

COUNTRY ANALYSIS

7.1.5.1. BRAZIL

7.1.5.2. MEXICO

7.1.5.3. REST OF LATIN AMERICA

8. COMPETITIVE LANDSCAPE

8.1. ABB LTD.

8.2. AMPHENOL CORPORATION

8.3. EATON CORPORATION

8.4. EMERSON ELECTRIC CO.

8.5. HUBBEL INCORPORATED

8.6. THOMAS & BETTS

8.7. CMP PRODUCTS LTD.

8.8. CORTEM S.p.A

8.9. BARTEC

8.10. JACOB GMBH

8.11. SEALCON LLC

8.12. R. STAHL AG

9. METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: LATIN AMERICA CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: LATIN AMERICA CABLE GLANDS MARKET, BY TYPE, 2019-2027 (IN $

MILLION)

TABLE 5: LATIN AMERICA CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN

$ MILLION)

TABLE 6: LATIN AMERICA CABLE GLANDS MARKET, BY CABLE TYPE, 2019-2027 (IN

$ MILLION)

TABLE 7: LATIN AMERICA CABLE GLANDS MARKET, BY MATERIAL, 2019-2027 (IN $

MILLION)

TABLE 8: LATIN AMERICA CABLE GLANDS MARKET, BY APPLICATION, 2019-2027

(IN $ MILLION)

TABLE 9: LATIN AMERICA CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: LATIN AMERICA

CABLE GLANDS MARKET, BY TYPE, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 3: KEY BUYING

IMPACT ANALYSIS

FIGURE 4: LATIN AMERICA

CABLE GLANDS MARKET, BY INDUSTRIAL, 2019-2027 (IN $ MILLION)

FIGURE 5: LATIN AMERICA

CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN $ MILLION)

FIGURE 6: LATIN AMERICA

CABLE GLANDS MARKET, BY INCREASED SAFETY, 2019-2027 (IN $ MILLION)

FIGURE 7: LATIN AMERICA

CABLE GLANDS MARKET, BY FLAME-PROOF, 2019-2027 (IN $ MILLION)

FIGURE 8: LATIN AMERICA

CABLE GLANDS MARKET, BY EMC CABLE GLANDS, 2019-2027 (IN $ MILLION)

FIGURE 9: LATIN AMERICA

CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: LATIN

AMERICA CABLE GLANDS MARKET, BY ARMORED, 2019-2027 (IN $ MILLION)

FIGURE 11: LATIN

AMERICA CABLE GLANDS MARKET, BY UNARMORED, 2019-2027 (IN $ MILLION)

FIGURE 12: LATIN

AMERICA CABLE GLANDS MARKET, BY BRASS, 2019-2027 (IN $ MILLION)

FIGURE 13: LATIN

AMERICA CABLE GLANDS MARKET, BY STAINLESS STEEL, 2019-2027 (IN $ MILLION)

FIGURE 14: LATIN

AMERICA CABLE GLANDS MARKET, BY PLASTIC/NYLON, 2019-2027 (IN $ MILLION)

FIGURE 15: LATIN

AMERICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN

AMERICA CABLE GLANDS MARKET, BY OIL & GAS, 2019-2027 (IN $ MILLION)

FIGURE 17: LATIN

AMERICA CABLE GLANDS MARKET, BY MINING, 2019-2027 (IN $ MILLION)

FIGURE 18: LATIN

AMERICA CABLE GLANDS MARKET, BY AEROSPACE, 2019-2027 (IN $ MILLION)

FIGURE 19: LATIN

AMERICA CABLE GLANDS MARKET, BY MANUFACTURING & PROCESSING, 2019-2027 (IN $

MILLION)

FIGURE 20: LATIN

AMERICA CABLE GLANDS MARKET, BY CHEMICAL, 2019-2027 (IN $ MILLION)

FIGURE 21: LATIN

AMERICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 22: LATIN

AMERICA CABLE GLANDS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 23: BRAZIL CABLE

GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: MEXICO CABLE

GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: REST OF

LATIN AMERICA CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)