Market By Display Type, Technology, Application, Industry Vertical, And Geography | Forecast 2019-2027

According to Triton Market Research, Latin America’s display market would proliferate with a CAGR of 3.24% over the forecast duration of 2019-2027.

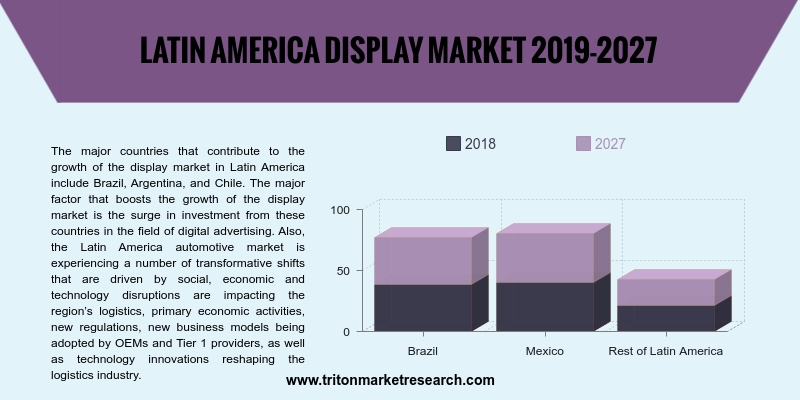

The countries assessed in the report on Latin America’s display market are:

• Brazil

• Mexico

• Rest of Latin America

There has been an increase in the sales of wearables sales in Brazil, with the local market becoming more sophisticated. This segment has gained traction, with a large number of manufacturers investing in product development and more number of consumers showing interest in purchasing these devices. Owing to the miniaturization capabilities and improved communication offered by wearables, have led to a growth in their popularity, thus driving the growth of the wearable sensors market in Brazil.

Report scope can be customized per your requirements. Request For Customization

Besides, Brazil’s smartphone industry also showed a boost in revenue in the first half of 2019, with 8% revenue growth as compared to the first half of 2018. Samsung, with its product development and innovation, manufactures phones that cater to consumers from various economic strata, thus attracting a large consumer base. The rise in the number of people using smartphones, as well as, smart wearables are fueling the growth of the display market in Brazil.

Samsung Electronics Co., Ltd. is a leading conglomerate involved several businesses worldwide, including consumer electronics and device solutions. The company offers several products, such as color TVs, computers, monitors, printers, smartphones, smartwatches & fitness trackers digital cameras, network systems, semiconductor & display business parts, and thin-film transistor liquid crystal displays (TFT-LCDs), among others.

Samsung Electronics Co., Ltd. has business operations in Asia, Latin America, Europe, North America, and the Middle East and Africa. In June 2018, the company launched “The Wall,” which is a first-of-its-kind modular micro-LED TV. In February, in the same year, Samsung Electronics entered into a collaboration with San’an Optoelectronics for co-developing micro-LED displays.

1. LATIN

AMERICA DISPLAY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. VEHICLE

DISPLAY IS A RAPIDLY GROWING APPLICATION IN THE DISPLAY MARKET

2.2.2. FLAT-PANEL

DISPLAY IS THE LARGEST DISPLAY TYPE DURING THE FORECAST PERIOD

2.2.3. CONSUMER

ELECTRONICS IS THE LARGEST INDUSTRIAL VERTICAL USING DISPLAYS DURING THE

FORECAST PERIOD

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISING

DEMAND FOR OLED DEVICES

2.6.2. INCREASING

DEMAND FOR TOUCH-BASED DEVICES

2.7. MARKET

RESTRAINTS

2.7.1. STAGNATION

IN THE GROWTH OF DESKTOP PC, NOTEBOOK, AND TABLET

2.7.2. INCREASING

COST OF CERTAIN DISPLAY TECHNOLOGIES

2.8. MARKET

OPPORTUNITIES

2.8.1. INCREASING

USE OF AR/VR DEVICES

2.9. MARKET

CHALLENGES

2.9.1. UNSTABLE

PRICING OF DISPLAY PANELS

3. DISPLAY

MARKET OUTLOOK – BY DISPLAY TYPE

3.1. FLAT-PANEL

DISPLAY

3.2. FLEXIBLE-PANEL

DISPLAY

3.3. TRANSPARENT-PANEL

DISPLAY

4. DISPLAY

MARKET OUTLOOK – BY TECHNOLOGY

4.1. OLED

4.2. QUANTUM

DOT

4.3. LED

4.4. LCD

4.5. E-PAPER

4.6. OTHER

TECHNOLOGIES

5. DISPLAY

MARKET OUTLOOK – BY APPLICATION

5.1. SMARTPHONE

& TABLET

5.2. SMART

WEARABLE

5.3. TELEVISION

& DIGITAL SIGNAGE

5.4. PC

& LAPTOP

5.5. VEHICLE

DISPLAY

5.6. OTHER

APPLICATIONS

6. DISPLAY

MARKET OUTLOOK – BY INDUSTRY VERTICAL

6.1. HEALTHCARE

6.2. CONSUMER

ELECTRONICS

6.3. BFSI

6.4. RETAIL

6.5. MILITARY

& DEFENSE

6.6. AUTOMOTIVE

6.7. OTHER

INDUSTRY VERTICALS

7. DISPLAY

MARKET – LATIN AMERICA

7.1. BRAZIL

7.2. MEXICO

7.3. REST

OF LATIN AMERICA

8. COMPETITIVE

LANDSCAPE

8.1. AU

OPTRONICS CORP.

8.2. CORNING

INCORPORATED.

8.3. E

INK HOLDINGS INC.

8.4. HANNSTAR

DISPLAY CORPORATION DISPLAY CORPORATION

8.5. JAPAN

DISPLAY INC.

8.6. KENT

DISPLAYS, INC.

8.7. LG

DISPLAY

8.8. NEC

DISPLAY SOLUTIONS, LTD.

8.9. SAMSUNG

ELECTRONICS CO., LTD.

8.10.

SONY CORPORATION

9. RESEARCH

METHODOLOGY & SCOPE

9.1. RESEARCH

SCOPE & DELIVERABLES

9.1.1. OBJECTIVES

OF STUDY

9.1.2. SCOPE

OF STUDY

9.2. SOURCES

OF DATA

9.2.1. PRIMARY

DATA SOURCES

9.2.2. SECONDARY

DATA SOURCES

9.3. RESEARCH

METHODOLOGY

9.3.1. EVALUATION

OF PROPOSED MARKET

9.3.2. IDENTIFICATION

OF DATA SOURCES

9.3.3. ASSESSMENT

OF MARKET DETERMINANTS

9.3.4. DATA

COLLECTION

9.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: LATIN AMERICA

DISPLAY MARKET, BY COUNTRY, 2019-2027 (IN $ BILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: LATIN AMERICA

DISPLAY MARKET, BY DISPLAY TYPE, 2019-2027 (IN $ BILLION)

TABLE 4: LATIN AMERICA

DISPLAY MARKET, BY TECHNOLOGY, 2019-2027 (IN $ BILLION)

TABLE 5: LATIN AMERICA

DISPLAY MARKET, BY APPLICATION, 2019-2027 (IN $ BILLION)

TABLE 6: LATIN AMERICA

DISPLAY MARKET, BY INDUSTRY VERTICAL, 2019-2027 (IN $ BILLION)

TABLE 7: LATIN AMERICA

DISPLAY MARKET, BY COUNTRY, 2019-2027 (IN $ BILLION)

FIGURE 1: LATIN AMERICA

DISPLAY MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: LATIN AMERICA

VEHICLE DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 3: LATIN AMERICA

FLAT-PANEL DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 4: LATIN AMERICA

CONSUMER ELECTRONICS MARKET, 2019-2027 (IN $ BILLION)

FIGURE 5: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 6: MARKET

ATTRACTIVENESS INDEX

FIGURE 7: LATIN AMERICA

DISPLAY MARKET, BY FLAT-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 8: LATIN AMERICA

DISPLAY MARKET, BY FLEXIBLE-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 9: LATIN AMERICA

DISPLAY MARKET, BY TRANSPARENT-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 10: LATIN

AMERICA DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 11: LATIN

AMERICA DISPLAY MARKET, BY QUANTUM DOT DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 12: LATIN

AMERICA DISPLAY MARKET, BY LED, 2019-2027 (IN $ BILLION)

FIGURE 13: LATIN

AMERICA DISPLAY MARKET, BY LCD, 2019-2027 (IN $ BILLION)

FIGURE 14: LATIN

AMERICA DISPLAY MARKET, BY E-PAPER, 2019-2027 (IN $ BILLION)

FIGURE 15: LATIN

AMERICA DISPLAY MARKET, BY OTHER TECHNOLOGIES, 2019-2027 (IN $ BILLION)

FIGURE 16: LATIN

AMERICA DISPLAY MARKET, BY SMARTPHONE & TABLET, 2019-2027 (IN $ BILLION)

FIGURE 17: LATIN

AMERICA DISPLAY MARKET, BY SMART WEARABLE, 2019-2027 (IN $ BILLION)

FIGURE 18: LATIN

AMERICA DISPLAY MARKET, BY TELEVISION & DIGITAL SIGNAGE, 2019-2027 (IN $

BILLION)

FIGURE 19: LATIN

AMERICA DISPLAY MARKET, BY PC & LAPTOP, 2019-2027 (IN $ BILLION)

FIGURE 20: LATIN

AMERICA DISPLAY MARKET, BY VEHICLE DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 21: LATIN AMERICA

DISPLAY MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ BILLION)

FIGURE 22: LATIN

AMERICA DISPLAY MARKET, BY HEALTHCARE, 2019-2027 (IN $ BILLION)

FIGURE 23: LATIN

AMERICA DISPLAY MARKET, BY CONSUMER ELECTRONICS, 2019-2027 (IN $ BILLION)

FIGURE 24: LATIN

AMERICA DISPLAY MARKET, BY BFSI, 2019-2027 (IN $ BILLION)

FIGURE 25: LATIN

AMERICA DISPLAY MARKET, BY RETAIL, 2019-2027 (IN $ BILLION)

FIGURE 26: LATIN

AMERICA DISPLAY MARKET, BY MILITARY & DEFENSE, 2019-2027 (IN $ BILLION)

FIGURE 27: LATIN AMERICA

DISPLAY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ BILLION)

FIGURE 28: LATIN

AMERICA DISPLAY MARKET, BY OTHER INDUSTRIAL VERTICALS, 2019-2027 (IN $ BILLION)

FIGURE 29: LATIN

AMERICA DISPLAY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 30: BRAZIL DISPLAY

MARKET, 2019-2027 (IN $ BILLION)

FIGURE 31: MEXICO

DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 32: REST OF

LATIN AMERICA DISPLAY MARKET, 2019-2027 (IN $ BILLION)