Market By Insulation Type, Mounting, Phase And Geography | Forecasts 2019-2027

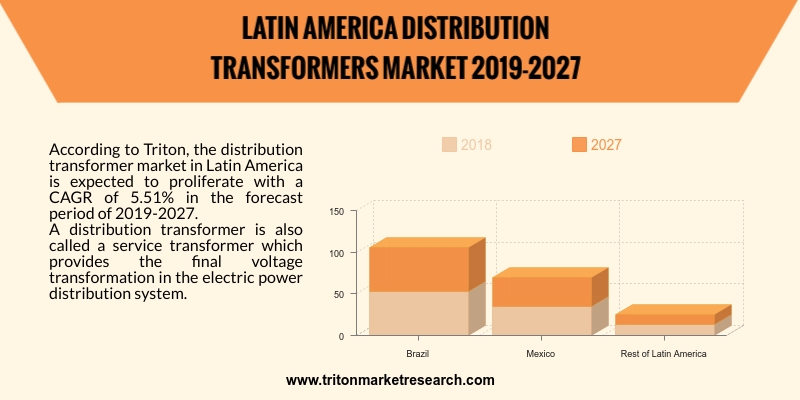

According to Triton, the distribution transformer market in Latin America is expected to proliferate with a CAGR of 5.51% in the forecast period of 2019-2027.

The countries included in the Latin America distribution transformer market report are:

O Brazil

O Mexico

O Rest of Latin America

A distribution transformer is also called a service transformer which provides the final voltage transformation in the electric power distribution system. These transformers are utilized for lower voltage distribution networks and are generally rated <200MVA. They work at low efficiency from 50% to 70%, have a low magnetic loss, are easy in installation and have a small size. They are generally pole-mounted and are installed in city locations to offer utilization of voltage at consumer terminals, and are frequently used for the power supply of outside settlements.

We provide additional customization based on your specific requirements. Request For Customization

Expanding urban cities, rising population levels, increasing demand for power, renovation of existing power or grid networks and industrialization are the main drivers for the growth of the distribution transformers market in Latin America. A system of contract auctions provides a mechanism to bring forward investment in new generation and transmission capacity, as well as to diversify the power mix. Transformers are an integral part of the power system. Their reliable operation and on-time delivery directly affect the distribution transformer market’s demand. Ineffective planning for transformer installation and operations are challenging the market growth.

The Latin America distribution transformers market report analyzes information about the market definition, Porter’s five force model, key market insights and the key buying outlook.

The prominent market players in the distribution transformers market are Kirloskar Electric Company Limited, Areva SA, Hammond Power Solutions, Inc., CelME SRL, Wilson Power Solutions, Schneider Electric, Siemens AG, Ormazabal Velatia, Emerson Electric Co., Hitachi, Ltd., Lemi Trafo JSC, Bowers Electrical, Ltd., Crompton Greaves Ltd., Brush Electrical Machines, Ltd., Eaton Corporation PLC, ABB Ltd., General Electric, Hyosung Corporation and Starkstrom Gerätebau GMBH.

1. DISTRIBUTION

TRANSFORMERS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCE MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. BARGAINING

POWER OF BUYERS

2.2.3. BARGAINING

POWER OF SUPPLIERS

2.2.4. THREAT

OF SUBSTITUTE PRODUCTS

2.2.5. COMPETITIVE

RIVALRY BETWEEN EXISTING PLAYERS

2.3. KEY

MARKET INSIGHTS

2.4. KEY

BUYING OUTLOOK

2.5. MARKET

DRIVERS

2.5.1. INCREASING

FOCUS ON ELECTRICAL SAFETY AND ENVIRONMENTAL PROTECTION

2.5.2. IMPLEMENTATION

OF SMART GRID ELECTRIFYING THE MARKET

2.5.3. TECHNOLOGICAL

ADVANCEMENT IN TRANSFORMER INDUSTRY

2.6. MARKET

RESTRAINTS

2.6.1. FAILURE

OF ELECTRICITY IN DISTRIBUTION TRANSFORMER

2.6.2. EQUIPMENT

STANDARDIZATION

2.7. MARKET

OPPORTUNITIES

2.7.1. RENEWABLE

GENERATION OF ENERGY CREATES OPPORTUNITY FOR LATIN AMERICA DISTRIBUTION

TRANSFORMER MARKET

2.7.2. COLLABORATION

OF TECHNOLOGIES INTO THE DIGITAL TRANSFORMER SYSTEM

2.8. MARKET

CHALLENGES

2.8.1. INEFFICIENCIES

IN OPERATIONS OF TRANSFORMERS

3. DISTRIBUTION

TRANSFORMERS INDUSTRY OUTLOOK - BY INSULATION TYPE

3.1. DRY

TYPE

3.2. OIL-FILLED

4. DISTRIBUTION

TRANSFORMERS INDUSTRY OUTLOOK - BY MOUNTING

4.1. PAD-

MOUNTED

4.2. POLE-MOUNTED

4.3. UNDERGROUND

VAULT

5. DISTRIBUTION

TRANSFORMERS INDUSTRY OUTLOOK - BY PHASE

5.1. SINGLE-PHASE

5.2. THREE-PHASE

6. DISTRIBUTION

TRANSFORMER INDUSTRY – LATIN AMERICA

6.1. COUNTRY

ANALYSIS

6.1.1. BRAZIL

6.1.2. MEXICO

6.1.3. REST

OF LATIN AMERICA

7. COMPETITIVE

LANDSCAPE

7.1. ABB

LTD.

7.2. AREVA

SA

7.3. BOWERS

ELECTRICAL LTD.

7.4. BRUSH

ELECTRICAL MACHINES LTD.

7.5. CELME SRL

7.6. CROMPTON

GREAVES LTD.

7.7. EATON

CORPORATION PLC

7.8. EMERSON

ELECTRIC CO.

7.9. GENERAL

ELECTRIC

7.10.

HAMMOND POWER SOLUTIONS, INC.

7.11.

HITACHI LTD.

7.12.

HYOSUNG CORPORATION

7.13.

KIRLOSKAR ELECTRIC COMPANY

LIMITED

7.14.

LEMI TRAFO JSC

7.15.

ORMAZABAL VELATIA

7.16.

SIEMENS AG

7.17.

SCHNEIDER ELECTRIC

7.18.

STARKSTROM GERÄTEBAU GMBH

7.19.

WILSON POWER SOLUTIONS

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1 LATIN AMERICA DISTRIBUTION TRANSFORMER

MARKET 2019-2027 ($ MILLION)

TABLE 2 THREAT OF NEW ENTRANTS ANALYSIS IN

DISTRIBUTION TRANSFORMERS MARKET

TABLE 3 BARGAINING POWER OF BUYER ANALYSIS IN

DISTRIBUTION TRANSFORMERS MARKET

TABLE 4 BARGAINING POWER OF SUPPLIERS ANALYSIS

IN DISTRIBUTION TRANSFORMERS MARKET

TABLE 5 THREAT OF SUBSTITUTE PRODUCTS ANALYSIS

IN DISTRIBUTION MARKET

TABLE 6 COMPETITIVE RIVALRY BETWEEN EXISTING

PLAYERS IN DISTRIBUTION TRANSFORMERS MARKET

TABLE 7 CAUSES OF FAILURES IN DISTRIBUTION

TRANSFORMER

TABLE 8 LATIN AMERICA DISTRIBUTION TRANSFORMER

BY INSULATION TYPE 2019-2027 ($ MILLION)

TABLE 9 LATIN AMERICA DISTRIBUTION TRANSFORMER

MARKET BY MOUNTING 2019-2027 ($MILLION)

TABLE 10 LATIN AMERICA DISTRIBUTION TRANSFORMER

MARKET BY PHASE 2019-2027 ($ MILLION)

TABLE 11 LATIN AMERICA DISTRIBUTION TRANSFORMER

MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 PORTER’S 5 FORCE MODEL OF DISTRIBUTION

TRANSFORMER MARKET

FIGURE 2 REASONS FOR FAILURE IN DISTRIBUTION

TRANSFORMERS

FIGURE 3 LATIN AMERICA DRY TYPE DISTRIBUTION

TRANSFORMERS MARKET 2019-2027 ($ MILLION)

FIGURE 4 LATIN AMERICA OIL FILLED DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 5 LATIN AMERICA PAD MOUNTED DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 6 LATIN AMERICA POLE MOUNTED DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 7 LATIN AMERICA UNDERGROUND VAULT

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 8 LATIN AMERICA SINGLE PHASE POWER

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 9 LATIN AMERICA THREE PHASE POWER

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 10 BRAZIL DISTRIBUTION TRANSFORMER MARKET

2019-2027 ($ MILLION)

FIGURE 11 MEXICO DISTRIBUTION TRANSFORMER MARKET

2019-2027 ($ MILLION)

FIGURE 12 REST OF LATIN AMERICA DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)