Market By Type, Application, Technology And Geography | Forecast 2019-2027

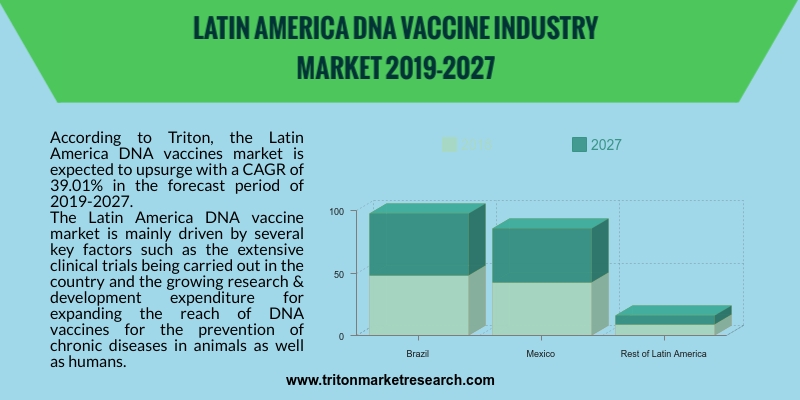

According to Triton, the Latin America DNA vaccines market is expected to upsurge with a CAGR of 39.01% in the forecast period of 2019-2027.

The countries that have been considered in Latin America’s DNA vaccines market are:

• Brazil

• Mexico

• Rest of Latin America

The Latin America DNA vaccine market is mainly driven by several key factors such as the extensive clinical trials being carried out in the country and the growing research & development expenditure for expanding the reach of DNA vaccines for the prevention of chronic diseases in animals as well as humans. A clinical trial was sponsored by the National Institute of Allergy and Infectious Diseases (NIAID) in Brazil for the experimental development of IL-12 DNA adjuvant, and for developing IL-15 DNA adjuvant and HIV-1 gag DNA vaccine for prevention against the HIV/AIDS infection. The Brazil government’s implementation of the People’s Law School’s (PLS) 200 laws for the smooth approval of clinical trials and health data digitization, allows advanced patient data analytics, and thus promotes smooth clinical trials. These supportive laws are increasingly promoting the growth of the Latin America DNA vaccine market.

We provide additional customization based on your specific requirements. Request For Customization

Mexico is the world’s eleventh-largest pharmaceutical market and Latin America’s second-largest market after Brazil. In FY 2017, the pharmaceutical sales in Mexico were $9.8 billion. The country’s pharmaceutical market has been segmented into patented drugs, which represent the market by 51% in terms of value, 35% by generics and the rest 14% are represented by over-the-counter products. The COFEPRIS, which is Mexico’s regulatory body for the sector, states that generics represent over 80% of the market by volume. Mexico receives most of its foreign supplies of pharmaceutical products from the United States. The US exported $904 million to the country in 2017, which accounted for 21% of the import market in total.

Madison Vaccines, Incorporated is a clinical-stage biopharmaceutical company, which is focused on developing cancer therapies. It focuses on the advancing innovative therapies in three distinct phases - metastases, pre-metastatic and late-stage, along with the castrate-resistant disease. The company chiefly develops therapeutic plasmid DNA vaccines for the treatment of cancer.

1.

LATIN AMERICA DNA VACCINES MARKET -

SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREATS OF SUBSTITUTE PRODUCT

2.2.3.

BARGAINING POWER OF BUYER

2.2.4.

BARGAINING POWER OF SUPPLIER

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. VALUE CHAIN OUTLOOK

2.5. REGULATORY

FRAMEWORK

2.6. KEY INSIGHTS

2.7. KEY BUYING OUTLOOK

2.8. MARKET DRIVERS

2.8.1.

SURGE IN NEW VACCINE DEVELOPMENT

2.8.2.

RISE IN THE USAGE OF DNA VACCINES FOR ANIMAL HEALTHCARE

2.8.3.

RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES

2.9. MARKET RESTRAINTS

2.9.1.

LACK OF LEGAL AND ETHICAL FRAMEWORK

2.9.2.

STRINGENT GOVERNMENT REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

GROWING DEMAND FOR GENE THERAPY

2.10.2.

STEADY VACCINES ARE EASY TO STORE AND

TRANSPORT

2.10.3.

INCREASING NUMBER OF CLINICAL TRIALS ON HUMANS

2.11.

MARKET CHALLENGES

2.11.1.

VARIATION IN THE REGULATORY PATHWAY AND THE POINTS OF CONSIDERATION

REGARDING ENVIRONMENTAL VALUATION

3.

DNA VACCINES MARKET OUTLOOK - BY TYPE

3.1. ANIMAL DNA VACCINE

3.2. HUMAN DNA VACCINE

4.

DNA VACCINES MARKET OUTLOOK - BY APPLICATION

4.1. HUMAN DISEASE

4.2. VETERINARY DISEASE

5.

DNA VACCINES MARKET OUTLOOK - BY TECHNOLOGY

5.1. PLASMID DNA VACCINES

5.2. PLASMID DNA DELIVERY

6.

DNA VACCINES MARKET OUTLOOK - BY REGION

6.1. LATIN AMERICA

6.1.1.1.

BRAZIL

6.1.1.2.

MEXICO

6.1.1.3.

REST OF LATIN AMERICA

7.

COMPETITIVE LANDSCAPE

7.1. ASTELLAS PHARMA, INC.

7.2. DENDREON CORPORATION (ACQUIRED BY SANPOWER

GROUP)

7.3. ELI LILLY AND COMPANY

7.4. EUROGENTEC S.A.

7.5. GLAXOSMITHKLINE, INC.

7.6. INOVIO PHARMACEUTICALS, INC.

7.7. MADISON VACCINES, INCORPORATED (MVI)

7.8. MERCK & CO.

7.9. MERIAL LIMITED (ACQUIRED BY BOEHRINGER

INGELHEIM)

7.10.

NOVARTIS AG

7.11.

SANOFI

7.12.

VGXI

7.13.

VICAL, INCORPORATED

7.14.

XENETIC BIOSCIENCES, INC.

7.15.

ZOETIS, INC.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 LATIN AMERICA DNA

VACCINES MARKET 2019-2027 ($ MILLION)

TABLE 2 INTERVENTION AND

PHASE OF SOME DISEASES/CONDITIONS

TABLE 3 REGULATIONS TO

FOLLOW BEFORE COMMERCIALIZATION

TABLE 4 TEMPERATURE

REQUIREMENT IN PRESERVATION FOR VARIOUS VACCINES

TABLE 5 APPROACHES BEING

TESTED TO ENHANCE THE LOW IMMUNOGENICITY

TABLE 6 CLINICAL TRIALS ON

HUMANS INVOLVING DNA VACCINES

TABLE 7 LATIN AMERICA DNA

VACCINES MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 8 LATIN AMERICA DNA

VACCINES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 9 LATIN AMERICA DNA

VACCINES MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 10 LATIN AMERICA DNA

VACCINES MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 LATIN AMERICA DNA

VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 2 VALUE CHAIN ANALYSIS

FOR DNA VACCINE INDUSTRY

FIGURE 3 LATIN AMERICA DNA

VACCINES MARKET IN VETERINARY DISEASES 2019-2027

($ MILLION)

FIGURE 4 CLINICAL TRIALS OF

GENE THERAPY

FIGURE 5 LATIN AMERICA DNA

VACCINES MARKET IN ANIMAL DNA VACCINES 2019-2027

($ MILLION)

FIGURE 6 LATIN AMERICA DNA

VACCINES MARKET IN HUMAN DNA VACCINES 2019-2027

($ MILLION)

FIGURE 7 LATIN AMERICA DNA

VACCINES MARKET SHARE BY APPLICATION 2018 & 2027 (%)

FIGURE 8 LATIN AMERICA DNA

VACCINES MARKET IN HUMAN DISEASES 2019-2027 ($ MILLION)

FIGURE 9 LATIN AMERICA DNA

VACCINES MARKET IN VETERINARY DISEASES 2019-2027 ($ MILLION)

FIGURE 10 LATIN AMERICA DNA

VACCINES MARKET IN PLASMID DNA VACCINES TECHNOLOGY

2019-2027 ($ MILLION)

FIGURE 11 LATIN AMERICA DNA

VACCINES MARKET IN PLASMID DNA DELIVERY TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 12 BRAZIL DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 13 MEXICO DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 14 REST OF LATIN AMERICA

DNA VACCINES MARKET 2019-2027 ($ MILLION)