Market By Product, Function, Deployment, End-user And Geography | Forecast 2019-2027

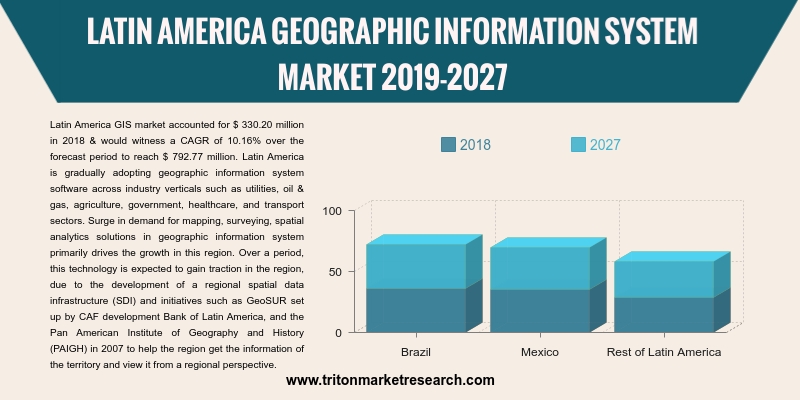

The Latin America geographic information system (GIS) market is estimated to grow at a CAGR of 10.16% in terms of revenue during the forecasting the years 2019-2027.

The countries analyzed in the geographic information system (GIS) market in the Latin American region are:

• Brazil

• Mexico

• Rest of Latin America

Report scope can be customized per your requirements. Request For Customization

The geographic information system market in Latin America is growing steadily. GIS software are gradually being adopted in different sectors, like oil & gas, utilities, government, agriculture, healthcare, and transport. The increased demand for surveying, mapping, and spatial analytics solutions in GIS primarily drives market growth. Brazil is expected to capture most of the market share in the GIS market during the forecasting period. The country also holds a higher position for geospatial readiness than its counterparts. Moreover, the government has been investing in formulating different strategies and national space programs to promote space capabilities.

For instance, the Brazilian Ministry of Defense announced a revamping of the country’s space program in 2017. Additionally, MapLink (geolocation platform provider) has been delivering traffic information in Brazil since 2000. The company has also launched an app in which real-time information about traffic and locations in Brazil can be found. The company provides services that include customized mapping solutions, real-time traffic information for the largest Brazillian cities, and geolocation APIs as part of the LBS local group, which includes location aggregator Apontador. MapLink has also partnered with Google to offer its Maps platform for businesses in Latin America. Such strategic initiatives are expected to boost the growth of the GIS market in Brazil.

Caliper Corporation is a private organization developing mapping, transportation, redistricting, traffic simulation, and GIS software. The company offers TransCAF Transportation Planning Software, Trans Modeler Traffic Stimulation Software, and Maptitude Geographic Information System Software packages. It also provides support with extensive technical services in GIS applications and training, database development, and software customization. For instance, Maptitude is a GIS software that provides users with maps, tools, and demographic data to analyze business needs. The company has its operations across Latin America, North America, Europe, Asia-Pacific, and the Middle East and Africa.

1. LATIN

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. GROWING

DEMAND FOR SERVICE SECTOR

2.2.2. INCORPORATION

OF GIS IN BUSINESS INTELLIGENCE

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISE

IN ADOPTION OF GIS

2.6.2. INCREASING

DEMAND FOR SPATIAL DATA

2.6.3. DEVELOPMENT

OF SMART CITIES

2.7. MARKET

RESTRAINTS

2.7.1. HIGH

COSTS LEVIED ON GIS SOFTWARE

2.8. MARKET

OPPORTUNITIES

2.8.1. USE OF

GIS IN DISASTER MANAGEMENT

2.9. MARKET

CHALLENGES

2.9.1. STERN

RULES AND REGULATIONS

2.9.2. EASY

ACCESS OF OPEN SOURCE GEOGRAPHIC INFORMATION SYSTEM (GIS)

3. LATIN

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY PRODUCT

3.1. SOFTWARE

3.2. DATA

3.3. SERVICE

4. LATIN

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY FUNCTION

4.1. MAPPING

4.2. SURVEYING

4.3. LOCATION-BASED

SERVICES

4.4. NAVIGATION

AND TELEMATICS

4.5. OTHERS

5. LATIN

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY DEPLOYMENT

5.1. DESKTOP

GIS

5.2. SERVER

GIS

5.3. DEVELOPER

GIS

5.4. MOBILE

GIS

5.5. OTHERS

6. LATIN

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY END-USER

6.1. DEFENSE

6.2. AGRICULTURE

6.3. OIL

& GAS

6.4. CONSTRUCTION

6.5. UTILITIES

6.6. TRANSPORTATION

& LOGISTICS

6.7. OTHERS

7. LATIN

AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET – REGIONAL OUTLOOK

7.1. BRAZIL

7.2. MEXICO

7.3. REST

OF LATIN AMERICA

8. COMPETITIVE

LANDSCAPE

8.1. HEXAGON

AB

8.2. ESRI

8.3. AUTODESK

INC.

8.4. BENTLEY

SYSTEMS INC.

8.5. GENERAL

ELECTRIC COMPANY

8.6. PITNEY

BOWES INC.

8.7. TRIMBLE

INC.

8.8. MACDONALD,

DETTWILER AND ASSOCIATES CORPORATION

8.9. CALIPER

CORPORATION

8.10. COMPUTER

AIDED DEVELOPMENT CORPORATION LIMITED (CADCORP)

8.11. SUPERMAP

SOFTWARE CO. LTD.

8.12. HI-TARGET

SURVEYING INSTRUMENT CO. LTD.

8.13. TAKOR

GROUP LTD

8.14. ATKINS.

8.15. FUGRO N.V

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: LATIN AMERICA GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2019-2027 (IN $

MILLION)

TABLE 5: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY FUNCTION, 2019-2027 (IN $

MILLION)

TABLE 6: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEPLOYMENT, 2019-2027 (IN $

MILLION)

TABLE 7: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY END-USER, 2019-2027 (IN $

MILLION)

TABLE 8: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 3: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SOFTWARE, 2019-2027 (IN $

MILLION)

FIGURE 4: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DATA, 2019-2027 (IN $ MILLION)

FIGURE 5: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SERVICE, 2019-2027 (IN $

MILLION)

FIGURE 6: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY MAPPING, 2019-2027 (IN $

MILLION)

FIGURE 7: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SURVEYING, 2019-2027 (IN $

MILLION)

FIGURE 8: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY LOCATION-BASED SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 9: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY NAVIGATION AND TELEMATICS,

2019-2027 (IN $ MILLION)

FIGURE 10: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 11: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DESKTOP GIS, 2019-2027 (IN $

MILLION)

FIGURE 12: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SERVER GIS, 2019-2027 (IN $

MILLION)

FIGURE 13: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEVELOPER GIS, 2019-2027 (IN $

MILLION)

FIGURE 14: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY MOBILE GIS, 2019-2027 (IN $

MILLION)

FIGURE 15: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEFENSE, 2019-2027 (IN $

MILLION)

FIGURE 17: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY AGRICULTURE, 2019-2027 (IN $

MILLION)

FIGURE 18: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OIL & GAS, 2019-2027 (IN $

MILLION)

FIGURE 19: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY CONSTRUCTION, 2019-2027 (IN $

MILLION)

FIGURE 20: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY UTILITIES, 2019-2027 (IN $

MILLION)

FIGURE 21: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY TRANSPORTATION & LOGISTICS,

2019-2027 (IN $ MILLION)

FIGURE 22: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 23: LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, REGIONAL OUTLOOK, 2018 & 2027

(IN %)

FIGURE 24: BRAZIL GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: MEXICO GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: REST OF LATIN AMERICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)