Market by Product Type, Distribution Channel, User Demographics, and Geography | Forecast 2019-2027

The Latin America halal food & beverage market is estimated to grow at a CAGR of 3.23% for the forecasting years 2019-2027.

The countries analyzed in the halal food & beverage market in the Latin American region are:

• Brazil

• Mexico

• Rest of Latin America

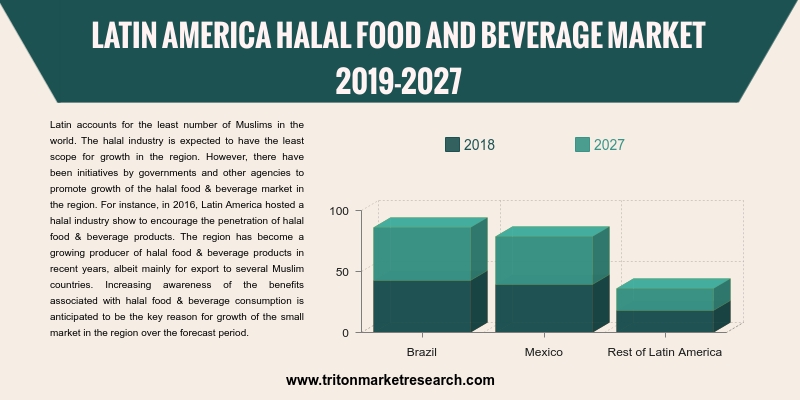

The halal food & beverage market in Latin America shows steady growth during the forecasted period. The region lacks in the Muslim population, which hampers the market growth. However, there are various initiatives taken by governments and other agencies to promote halal food. For instance, Latin America hosted a halal industry show to promote the penetration of halal food & beverage products. In recent years, the region has witnessed considerable growth in the production of these products.

Report scope can be customized per your requirements. Request For Customization

In Brazil, halal food has been receiving recognition among the non-Muslim population due to the increasing awareness about halal food and its consumption. The country is a major beef exporter in Latin America. Brazil’s beef exports to the Middle Eastern countries have been increased after the lifting of a ban by Saudi Arabia in 2016. Additionally, Brazil is making efforts to resolve issues such as trade disputes with Indonesia, which is expected to boost the growth of the halal food & beverage market. Moreover, the growing number of Islamic tourists in Brazil is also predicted to fuel market growth.

Allanasons Private Limited is a leading exporter of branded agro commodities and processed food products. The company exports products that include frozen & chilled meat, spices & coffee, aseptic & frozen fruits, and vegetable products. The main business segment of the company includes proteins, rendered products, coffee, FMCG, leather, and pet food. The company is known for its boneless buffalo meat cuts and exporting around 1 million metric tons of agro commodities annually.

1. LATIN

AMERICA HALAL FOOD & BEVERAGE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. FOOD

PREFERENCES

2.3. KEY

INSIGHTS

2.3.1. HALAL

MEAT & ALTERNATIVES TO LEAD AMONGST PRODUCT TYPE

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. REGULATORY

FRAMEWORK

2.8. VALUE

CHAIN ANALYSIS

2.9. MARKET

DRIVERS

2.9.1. GROWTH

IN MUSLIM POPULATION

2.9.2. AWARENESS

REGARDING HALAL FOOD AMONG NON-MUSLIM POPULATION

2.10. MARKET

RESTRAINTS

2.10.1. IMPLEMENTATION OF HALAL STANDARDS THROUGHOUT

THE VALUE CHAIN

2.11. MARKET

OPPORTUNITIES

2.11.1. INVESTMENT IN HALAL FOOD VALUE CHAIN

INTEGRATION

2.11.2. DEVELOPING TRACKING TECHNOLOGY

2.12. MARKET

CHALLENGES

2.12.1. ABSENCE OF VIABLE INTERNATIONAL SCHEMES TO

ACCREDIT HALAL CERTIFICATION BODIES

3. LATIN

AMERICA HALAL FOOD & BEVERAGE MARKET OUTLOOK – BY PRODUCT TYPE

3.1. HALAL

MEAT & ALTERNATIVES

3.2. HALAL

MILK & MILK PRODUCTS

3.3. HALAL

FRUITS & VEGETABLES

3.4. HALAL

GRAIN PRODUCTS

3.5. OTHERS

4. LATIN

AMERICA HALAL FOOD & BEVERAGE MARKET OUTLOOK – BY DISTRIBUTION CHANNELS

4.1. TRADITIONAL

RETAILERS

4.2. SUPERMARKETS

& HYPERMARKETS

4.3. ONLINE

4.4. OTHERS

5. LATIN

AMERICA HALAL FOOD & BEVERAGE MARKET OUTLOOK – BY USER DEMOGRAPHICS

5.1. MUSLIMS

5.2. NON-MUSLIMS

6. LATIN

AMERICA HALAL FOOD & BEVERAGE MARKET – REGIONAL OUTLOOK

6.1. BRAZIL

6.2. MEXICO

6.3. REST

OF LATIN AMERICA

7. COMPETITIVE

LANDSCAPE

7.1. NESTLÉ

7.2. CARGILL,

INC.

7.3. AL

ISLAMI FOODS

7.4. QL

FOODS SDN. BHD.

7.5. CRESCENT

FOODS

7.6. NEMA

FOOD CO

7.7. NAMET

7.8. KAWAN

FOOD BERHAD

7.9. HAOYUE

GROUP

7.10. ALLANASONS

PVT. LTD.

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: TASTE & FOOD

PREFERENCES

TABLE 3: VENDOR SCORECARD

TABLE 4: REGULATORY FRAMEWORK

TABLE 5: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 6: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY PRODUCT TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (IN $ MILLION)

TABLE 8: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY USER DEMOGRAPHICS, 2019-2027 (IN $ MILLION)

FIGURE 1: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY HALAL MEAT & ALTERNATIVES, 2019-2027 (IN $

MILLION)

FIGURE 2: PORTER’S FIVE FORCES

ANALYSIS

FIGURE 3: MARKET

ATTRACTIVENESS INDEX

FIGURE 4: VALUE CHAIN ANALYSIS

FIGURE 5: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY HALAL MEAT & ALTERNATIVES, 2019-2027 (IN $

MILLION)

FIGURE 6: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY HALAL MILK & MILK PRODUCTS, 2019-2027 (IN $

MILLION)

FIGURE 7: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY HALAL FRUITS & VEGETABLES, 2019-2027 (IN $

MILLION)

FIGURE 8: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY HALAL GRAIN PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 9: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY TRADITIONAL RETAILERS, 2019-2027 (IN $ MILLION)

FIGURE 11: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY SUPERMARKETS & HYPERMARKETS, 2019-2027 (IN $

MILLION)

FIGURE 12: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY ONLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 14: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY MUSLIM, 2019-2027 (IN $ MILLION)

FIGURE 15: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, BY NON-MUSLIM, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA HALAL

FOOD & BEVERAGE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: BRAZIL HALAL FOOD

& BEVERAGE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: MEXICO HALAL FOOD

& BEVERAGE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: REST OF LATIN AMERICA HALAL FOOD & BEVERAGE MARKET, 2019-2027 (IN $ MILLION)