Market By Component Type, Delivery Mode, Analytics Type, Application, End-users And Geography | Forecast 2019-2027

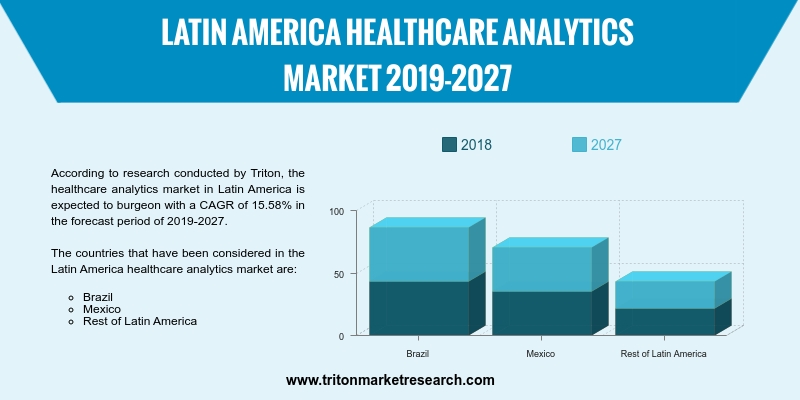

According to research conducted by Triton, the healthcare analytics market in Latin America is expected to burgeon with a CAGR of 15.58% in the forecast period of 2019-2027.

The countries that have been considered in the Latin America healthcare analytics market are:

• Brazil

• Mexico

• Rest of Latin America

Report scope can be customized per your requirements. Request For Customization

The Latin America healthcare analytics market would be on the constant rise owing to the rising healthcare expenditure, along with the rising prevalence of chronic diseases, which includes diabetes and cardiovascular diseases. This is fueling the adoption and growth of IoT solutions in the region, further augmenting the adoption and development of the healthcare analytics market in Latin America. According to the trade.gov, Brazil has the world’s sixth-largest GDP and the fourth-highest population among the list of countries that have a precise growth rate, considering people over the age of 60. Population over the forthcoming 15 years indicates a huge potential market exists for healthcare analytics products, solutions, and services in the country.

In 2018, the disease profile of the Mexican population was another driver considering the adoption & introduction of telehealth services and mobile health. According to the International Trade Organization, over 90% of private healthcare expenditure in the country occurs out of pocket that makes long-term financial conditions for the individuals catastrophic in terms of finances. The non-communicable diseases which include cancer, diabetes and heart diseases are prevalent, and in the present scenario, telehealth & mobile health services can be an impactful factor in the diagnosis & patient monitoring of these diseases. For instance: Mexican government states that the country’s inability to control the escalating diabetes ratio is creating a major economic burden on the entire healthcare system, and the IoT solution & services can benefit in the patient monitoring & diagnosis of these chronic diseases that is further augmenting the growth of healthcare analytics market in the country.

Verisk Analytics, Inc. is a US-based risk assessment and data analytics firm. The company offers decision analytics and risk assessment services for professionals in many fields, including financial services, property and casualty insurance, human resources and healthcare energy government. Verisk has a strong customer base. It serves customers operating in insurance, energy & specialized markets and financial services sectors in the Americas, Europe, Asia, Africa and Oceania. Verisk’s focus on inorganic growth strategy has been a major strength for the company.

1.

LATIN AMERICA HEALTHCARE ANALYTICS MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. KEY FACTORS OUTLOOK

2.4. ATTRIBUTES OF BIG DATA IN HEALTHCARE

2.5. KEY INSIGHT

2.6. MARKET ATTRACTIVENESS INDEX

2.7. MARKET DRIVERS

2.7.1.

SURGE IN POPULATION HEALTH ANALYTICS DEMAND

2.7.2.

RISING ADOPTION OF BUSINESS INTELLIGENCE

2.7.3.

GROWING USAGE OF BIG DATA TECHNOLOGIES IN THE HEALTHCARE INDUSTRY

2.8. MARKET RESTRAINTS

2.8.1.

DATA SECURITY AND PRIVACY MANAGEMENT CONCERN

2.8.2.

LACK OF SKILLED PROFESSIONALS

2.9. MARKET OPPORTUNITIES

2.9.1.

RISING OPPORTUNITIES IN THE CLOUD-BASED ANALYTICS SOLUTIONS

2.9.2.

EMERGING DIGITAL TECHNOLOGIES SUCH AS TELEHEALTH

2.10.

MARKET CHALLENGES

2.10.1.

RISE IN DATA BREACHES AND MEDICAL IDENTITY THEFT CASES

2.10.2.

CONTINUED USAGE OF PREVAILING ANALYTICS TOOLS

3.

HEALTHCARE ANALYTICS MARKET OUTLOOK- BY COMPONENT TYPE

3.1. SERVICES

3.2. SOFTWARE

3.3. HARDWARE

4.

HEALTHCARE ANALYTICS MARKET OUTLOOK - BY DELIVERY MODE

4.1. ON-DEMAND

4.2. ON-PREMISE

5.

HEALTHCARE ANALYTICS MARKET OUTLOOK - BY ANALYTICS TYPE

5.1. DESCRIPTIVE ANALYTICS

5.2. PREDICTIVE ANALYTICS

5.3. PRESCRIPTIVE ANALYTICS

5.4. DIAGNOSTIC ANALYTICS

6.

HEALTHCARE ANALYTICS MARKET OUTLOOK - BY APPLICATION

6.1. CLINICAL ANALYTICS

6.1.1.

CLINICAL DECISION SUPPORT

6.1.2.

QUALITY IMPROVEMENT AND CLINICAL BENCHMARKING

6.1.3.

REGULATORY REPORTING AND COMPLIANCE

6.1.4.

COMPARATIVE ANALYTICS/COMPARATIVE EFFECTIVENESS

6.1.5.

PRECISION HEALTH

6.2. FINANCIAL ANALYTICS

6.2.1.

REVENUE CYCLE MANAGEMENT (RCM)

6.2.2.

CLAIMS ANALYTICS

6.2.3.

PAYMENT INTEGRITY AND FRAUD, WASTE AND ABUSE (FWA)

6.2.4.

RISK MANAGEMENT ANALYTICS

6.3. OPERATIONAL AND ADMINISTRATIVE ANALYTICS

6.3.1.

WORKFORCE ANALYTICS

6.3.2.

SUPPLY CHAIN ANALYTICS

6.3.3.

STRATEGIC ANALYTICS

6.4. POPULATION HEALTH ANALYTICS

7.

HEALTHCARE ANALYTICS MARKET OUTLOOK - BY END-USERS

7.1. PAYER

7.1.1.

EMPLOYERS AND PRIVATE EXCHANGES

7.1.2.

GOVERNMENT AGENCIES

7.1.3.

PRIVATE INSURANCE COMPANIES

7.2. PROVIDER

7.2.1.

HOSPITALS, PHYSICIAN PRACTICES AND IDNS

7.2.2.

POST-ACUTE CARE ORGANIZATIONS

7.2.3.

AMBULATORY SETTINGS

7.3. ACOS, HIES, MCOS AND TPAS

8.

HEALTHCARE ANALYTICS MARKET - REGIONAL OUTLOOK

8.1. LATIN AMERICA

8.1.1.

COUNTRY ANALYSIS

8.1.1.1.

BRAZIL

8.1.1.2.

MEXICO

8.1.1.3.

REST OF LATIN AMERICA

9.

COMPANY PROFILES

9.1. 3M COMPANY

9.2. ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

9.3. ELSEVIER B.V.

9.4. HEALTH CATALYST

9.5. MCKESSON CORP.

9.6. CERNER CORP.

9.7. MEDEANALYTICS

9.8. OPTUM, INC.

9.9. IBM CORP.

9.10.

SAS INSTITUTE, INC.

9.11.

ORACLE CORPORATION

9.12.

VERISK ANALYTICS

9.13.

INFORMATION BUILDERS, INC.

10. RESEARCH METHODOLOGY & SCOPE

10.1.

RESEARCH SCOPE & DELIVERABLES

10.1.1.

OBJECTIVES OF STUDY

10.1.2.

SCOPE OF STUDY

10.2.

SOURCES OF DATA

10.2.1.

PRIMARY DATA SOURCES

10.2.2.

SECONDARY DATA SOURCES

10.3.

RESEARCH METHODOLOGY

10.3.1.

EVALUATION OF PROPOSED MARKET

10.3.2.

IDENTIFICATION OF DATA SOURCES

10.3.3.

ASSESSMENT OF MARKET DETERMINANTS

10.3.4.

DATA COLLECTION

10.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET 2019-2027 ($ MILLION)

TABLE 2 ATTRIBUTES OF BIG

DATA IN HEALTHCARE

TABLE 3 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY COMPONENT TYPE 2019-2027 ($ MILLION)

TABLE 4 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY DELIVERY MODE 2019-2027 ($ MILLION)

TABLE 5 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY ANALYTICS TYPE 2019-2027 ($ MILLION)

TABLE 6 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 7 HEALTHCARE ANALYTICS

APPLICATION-BASED DATA

TABLE 8 LATIN AMERICA

CLINICAL ANALYTICS BY TYPES 2019-2027 ($ MILLION)

TABLE 9 LATIN AMERICA

FINANCIAL ANALYTICS BY TYPES 2019-2027 ($ MILLION)

TABLE 10 LATIN AMERICA

OPERATIONAL AND ADMINISTRATIVE ANALYTICS BY TYPES 2019-2027 ($ MILLION)

TABLE 11 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY END-USERS 2019-2027 ($ MILLION)

TABLE 12 LATIN AMERICA PAYER

MARKET BY TYPES 2019-2027 ($ MILLION)

TABLE 13 LATIN AMERICA

PROVIDER MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 14 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET 2019-2027 ($ MILLION)

FIGURE 2 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY SERVICES 2019-2027 ($ MILLION)

FIGURE 3 LATIN AMERICA HEALTHCARE

ANALYTICS MARKET BY SOFTWARE 2019-2027 ($ MILLION)

FIGURE 4 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY HARDWARE 2019-2027 ($ MILLION)

FIGURE 5 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY ON-DEMAND 2019-2027 ($ MILLION)

FIGURE 6 LATIN AMERICA HEALTHCARE

ANALYTICS MARKET BY ON-PREMISE 2019-2027 ($ MILLION)

FIGURE 7 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY DESCRIPTIVE ANALYTICS 2019-2027 ($ MILLION)

FIGURE 8 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY PREDICTIVE ANALYTICS 2019-2027 ($ MILLION)

FIGURE 9 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY PRESCRIPTIVE ANALYTICS 2019-2027 ($ MILLION)

FIGURE 10 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY DIAGNOSTIC ANALYTICS 2019-2027 ($ MILLION)

FIGURE 11 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY CLINICAL ANALYTICS 2019-2027 ($ MILLION)

FIGURE 12 LATIN AMERICA CLINICAL

ANALYTICS MARKET BY CLINICAL DECISION SUPPORT 2019-2027 ($ MILLION)

FIGURE 13 LATIN AMERICA CLINICAL

ANALYTICS MARKET BY QUALITY IMPROVEMENT AND CLINICAL BENCHMARKING 2019-2027 ($

MILLION)

FIGURE 14 LATIN AMERICA CLINICAL

ANALYTICS MARKET BY REGULATORY REPORTING AND COMPLIANCE 2019-2027 ($ MILLION)

FIGURE 15 LATIN AMERICA CLINICAL

ANALYTICS MARKET BY COMPARATIVE ANALYTICS/COMPARATIVE EFFECTIVENESS 2019-2027

($ MILLION)

FIGURE 16 LATIN AMERICA CLINICAL

ANALYTICS MARKET BY PRECISION HEALTH 2019-2027 ($ MILLION)

FIGURE 17 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY FINANCIAL ANALYTICS 2019-2027 ($ MILLION)

FIGURE 18 LATIN AMERICA FINANCIAL

ANALYTICS MARKET BY REVENUE CYCLE MANAGEMENT (RCM) 2019-2027 ($ MILLION)

FIGURE 19 LATIN AMERICA FINANCIAL

ANALYTICS MARKET BY CLAIMS ANALYTICS 2019-2027 ($ MILLION)

FIGURE 20 LATIN AMERICA FINANCIAL

ANALYTICS MARKET BY PAYMENT INTEGRITY AND FRAUD, WASTE, AND ABUSE (FWA)

2019-2027 ($ MILLION)

FIGURE 21 LATIN AMERICA FINANCIAL

ANALYTICS MARKET BY RISK MANAGEMENT ANALYTICS 2019-2027 ($ MILLION)

FIGURE 22 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY OPERATIONAL AND ADMINISTRATIVE ANALYTICS

2019-2027 ($ MILLION)

FIGURE 23 LATIN AMERICA

OPERATIONAL AND ADMINISTRATIVE ANALYTICS MARKET BY WORKFORCE ANALYTICS

2019-2027 ($ MILLION)

FIGURE 24 LATIN AMERICA

OPERATIONAL AND ADMINISTRATIVE ANALYTICS MARKET BY SUPPLYCHAIN ANALYTICS

2019-2027 ($ MILLION)

FIGURE 25 LATIN AMERICA

OPERATIONAL AND ADMINISTRATIVE ANALYTICS MARKET BY STRATEGIC ANALYTICS

2019-2027 ($ MILLION)

FIGURE 26 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY POPULATION HEALTH ANALYTICS 2019-2027 ($

MILLION)

FIGURE 27 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY PAYER 2019-2027 ($ MILLION)

FIGURE 28 LATIN AMERICA PAYER

MARKET BY EMPLOYERS AND PRIVATE EXCHANGES 2019-2027 ($ MILLION)

FIGURE 29 LATIN AMERICA PAYER

MARKET BY GOVERNMENT AGENCIES 2019-2027 ($ MILLION)

FIGURE 30 LATIN AMERICA PAYER

MARKET BY PRIVATE INSURANCE COMPANIES 2019-2027 ($ MILLION)

FIGURE 31 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY PROVIDER 2019-2027 ($ MILLION)

FIGURE 32 LATIN AMERICA PROVIDER

TYPE MARKET BY HOSPITALS, PHYSICIAN PRACTICES, AND IDNS 2019-2027 ($ MILLION)

FIGURE 33 LATIN AMERICA PROVIDER

TYPE MARKET BY POST-ACUTE CARE ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 34 LATIN AMERICA PROVIDER

TYPE MARKET BY AMBULATORY SETTINGS 2019-2027 ($ MILLION)

FIGURE 35 LATIN AMERICA

HEALTHCARE ANALYTICS MARKET BY ACOS, HIES, MCOS AND TPAS 2019-2027 ($ MILLION)

FIGURE 36 BRAZIL HEALTHCARE ANALYTICS

MARKET 2019-2027 ($ MILLION)

FIGURE 37 MEXICO HEALTHCARE

ANALYTICS MARKET 2019-2027 ($ MILLION)

FIGURE 38 REST OF LATIN AMERICA

HEALTHCARE ANALYTICS MARKET 2019-2027 ($ MILLION)