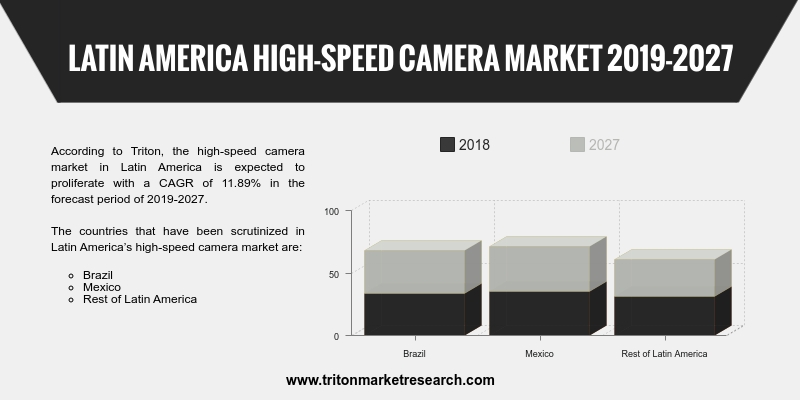

According to Triton, the high-speed camera market in Latin America is expected to proliferate with a CAGR of 11.89% in the forecast period of 2019-2027.

The countries that have been scrutinized in Latin America’s high-speed camera market are:

• Brazil

• Mexico

• Rest of Latin America

Companies manufacturing in Mexico offer direct labor rates similar to those that manufacture in China, offering considerable decrease in raw material transportation costs & the ability to include just-in-time manufacturing practices into the current supply chain. These companies can also benefit from the country’s educated, highly-skilled & motivated workforce, that includes engineers, supervisors and professionals at all levels. Owing to its vast, varied labor pool, Mexico is an excellent option for companies from almost all industries for manufacturing, for increasing and retaining a high level of global competitiveness. The above factors will drive the manufacturing market in Mexico. If the market consists of United States and Canada, then the manufacturer needs to produce high-quality products. High-speed cameras are used to detect faults in the production process, which increase the quality. Hence, a rise in adoption rates for high-speed cameras in Mexico will be observed.

AMETEK, Inc. is engaged in the designing and sales of electronic instruments & devices. The company’s product portfolio consists of electrical cord reels, electromechanical devices, gauges, medical materials, titanium alloys and motion control systems. AMETEK provides high-speed cameras by Phantom High-Speed Company. It caters to hospitals, oil & gas and educational facilities. AMETEK is present across North America, Latin America, Asia and Europe and is headquartered in Pennsylvania, the United States.

1. LATIN AMERICA HIGH-SPEED CAMERA MARKET -

SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

VARIOUS APPLICATIONS OF HIGH-SPEED CAMERAS IN AUTOMOTIVE INDUSTRY

2.2.2.

USE OF HIGH-SPEED CAMERA HAS BEEN INCREASING RAPIDLY IN THE MEDIA &

ENTERTAINMENT INDUSTRY

2.2.3.

INCREASED INCORPORATION OF HIGH-SPEED IMAGING DEVICES FOR PRODUCT

DEVELOPMENT AND PROCESS OPTIMIZATION

2.2.4.

INCREASE IN USAGE OF HIGH-SPEED CAMERA IN SPORTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

COST

2.4.2.

FRAME RATE

2.4.3.

VIDEO STORAGE

2.4.4.

EVENT DURATION

2.4.5.

SUPPORT AND SERVICE

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

ADVANCEMENTS IN THE FIELD OF SEMICONDUCTOR TECHNOLOGIES EMPOWERING

HIGH-SPEED CAMERA

2.7.2.

INCREASED DEMAND OF HIGH-SPEED CAMERA FOR RESEARCH AND DEVELOPMENT

2.7.3.

INCREASED AVAILABILITY OF ELECTRONIC & OPTIC COMPONENTS

2.8. MARKET RESTRAINTS

2.8.1.

STORAGE CAPACITY A MAJOR LIMITATION TO PROLONGED USE OF HIGH-SPEED

CAMERAS

2.9. MARKET OPPORTUNITIES

2.9.1.

GROWTH IN USAGE OF HIGH-SPEED CAMERAS IN INTELLIGENT TRANSPORTATION

SYSTEM (ITS)

2.9.2.

LUCRATIVE OPPORTUNITIES FROM AEROSPACE, DEFENSE & MANUFACTURING

SECTOR

2.10. MARKET CHALLENGES

2.10.1.

HIGH COST OF HIGH-SPEED CAMERAS REDUCES THE CONSUMER BASE

3. LATIN AMERICA HIGH-SPEED CAMERA MARKET

OUTLOOK - BY RESOLUTION

3.1. 0-2 MEGAPIXEL

3.2. 2-5 MEGAPIXEL

3.3. GREATER THAN 5 MEGAPIXEL

4. LATIN AMERICA HIGH-SPEED CAMERA MARKET

OUTLOOK - BY SPECTRUM

4.1. VISIBLE RGB

4.2. INFRARED

4.3. X-RAY

5. LATIN AMERICA HIGH-SPEED CAMERA MARKET

OUTLOOK - BY FRAME RATE

5.1. 1000-5000 FRAMES PER SECOND

5.2. 5000-20000 FRAMES PER SECOND

5.3. 20000-100000 FRAMES PER SECOND

5.4. 100000+ FRAMES PER SECOND

6. LATIN AMERICA HIGH-SPEED CAMERA MARKET

OUTLOOK - BY COMPONENT

6.1. IMAGE SENSOR

6.2. PROCESSORS

6.3. LENS

6.4. MEMORY

6.5. FANS & COOLING

6.6. OTHERS

7. LATIN AMERICA HIGH-SPEED CAMERA MARKET

OUTLOOK - BY APPLICATION

7.1. AUTOMOTIVE & TRANSPORTATION

7.2. RETAIL

7.3. AEROSPACE & DEFENSE

7.4. HEALTHCARE

7.5. MEDIA & ENTERTAINMENT

7.6. OTHERS

8. LATIN AMERICA HIGH-SPEED CAMERA MARKET -

REGIONAL OUTLOOK

8.1. BRAZIL

8.2. MEXICO

8.3. REST OF LATIN AMERICA

9. COMPETITIVE LANDSCAPE

9.1. AMETEK

9.2. AOS TECHNOLOGIES AG

9.3. DEL IMAGING SYSTEMS LLC

9.4. FASTEC IMAGING CORPORATION

9.5. HS VISION GMBH

9.6. INTEGRATED DESIGN TOOLS

9.7. IX CAMERAS, INC.

9.8. LAETUS GMBH

9.9. LUMENERA CORPORATION

9.10. MIKROTRON GMBH

9.11. OPTRONIS GMBH

9.12. PCO AG

9.13. PHOTOMETRICS

9.14. PHOTRON LTD.

9.15. WEISSCAM GMBH

10. RESEARCH METHODOLOGY & SCOPE

10.1. RESEARCH SCOPE & DELIVERABLES

10.2. SOURCES OF DATA

10.3. RESEARCH METHODOLOGY

TABLE 1: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY RESOLUTION,

2019-2027 (IN $ MILLION)

TABLE 4: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 2019-2027

(IN $ MILLION)

TABLE 5: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY FRAME RATE,

2019-2027 (IN $ MILLION)

TABLE 6: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY COMPONENT, 2019-2027

(IN $ MILLION)

TABLE 7: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY APPLICATION,

2019-2027 (IN $ MILLION)

TABLE 8: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: KEY BUYING IMPACT ANALYSIS

FIGURE 3: MARKET ATTRACTIVENESS INDEX

FIGURE 4: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY 0-2 MEGAPIXEL,

2019-2027 (IN $ MILLION)

FIGURE 5: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY 2-5 MEGAPIXEL,

2019-2027 (IN $ MILLION)

FIGURE 6: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY GREATER THAN 5

MEGAPIXEL, 2019-2027 (IN $ MILLION)

FIGURE 7: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY VISIBLE RGB,

2019-2027 (IN $ MILLION)

FIGURE 8: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY INFRARED, 2019-2027

(IN $ MILLION)

FIGURE 9: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY X-RAY, 2019-2027

(IN $ MILLION)

FIGURE 10: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY 1000-5000 FPS,

2019-2027 (IN $ MILLION)

FIGURE 11: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY 5000-20000 FPS,

2019-2027 (IN $ MILLION)

FIGURE 12: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY 20000-100000 FPS,

2019-2027 (IN $ MILLION)

FIGURE 13: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY 100000+ FPS,

2019-2027 (IN $ MILLION)

FIGURE 14: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY IMAGE SENSOR,

2019-2027 (IN $ MILLION)

FIGURE 15: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY PROCESSORS,

2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY LENS, 2019-2027

(IN $ MILLION)

FIGURE 17: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY MEMORY, 2019-2027

(IN $ MILLION)

FIGURE 18: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY FANS &

COOLING, 2019-2027 (IN $ MILLION)

FIGURE 19: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY OTHERS, 2019-2027

(IN $ MILLION)

FIGURE 20: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY AUTOMOTIVE &

TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 21: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY RETAIL, 2019-2027

(IN $ MILLION)

FIGURE 22: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY AEROSPACE &

DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 23: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY HEALTHCARE,

2019-2027 (IN $ MILLION)

FIGURE 24: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY MEDIA &

ENTERTAINMENT, 2019-2027 (IN $ MILLION)

FIGURE 25: LATIN AMERICA HIGH-SPEED CAMERA MARKET, BY OTHERS, 2019-2027

(IN $ MILLION)

FIGURE 26: LATIN AMERICA HIGH-SPEED CAMERA MARKET, REGIONAL OUTLOOK,

2018 & 2027 (IN %)

FIGURE 27: BRAZIL HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: MEXICO HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: REST OF LATIN AMERICA HIGH-SPEED CAMERA MARKET, 2019-2027 (IN

$ MILLION)