Market By Source Type, Methodology, Applications, Products & Services, End-users And Geography | Forecast 2019-2027

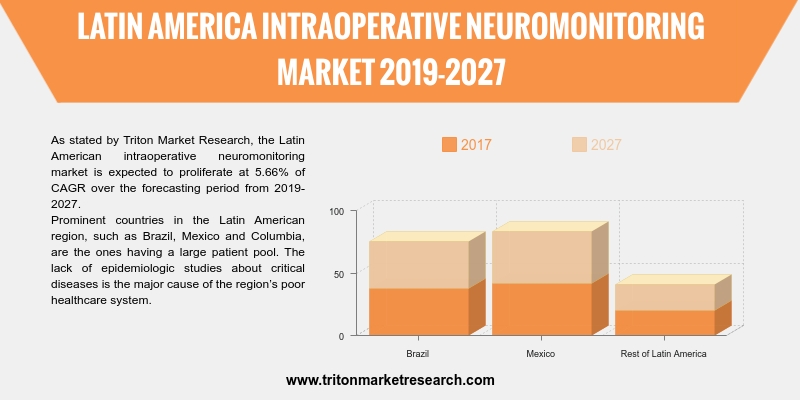

As stated by Triton Market Research, the Latin American intraoperative neuromonitoring market is expected to proliferate at 5.66% of CAGR over the forecasting period from 2019-2027.

The countries taken into account for the report on the intraoperative neuromonitoring market in Latin America are:

• Brazil

• Mexico

• Rest of Latin America

Prominent countries in the Latin American region, such as Brazil, Mexico and Columbia, are the ones having a large patient pool. The lack of epidemiologic studies about critical diseases is the major cause of the region’s poor healthcare system. The healthcare sector in Latin America is being developed with the support from the government and policies introduced to offer medical solutions along with medical aids.

Report scope can be customized per your requirements. Request For Customization

Latin America’s intraoperative neuromonitoring market is mainly driven by the growing market in Brazil. The Brazilian market is mainly driven by the rise in the aging population and the growing expenditure on healthcare in the country. Expenses on private and public healthcare in the country correspond to approximately 9.6% of the GDP. Revenues worth $10.4 billion were related to the purchase of medical equipment & devices. Imports of medical products & devices in 2016 amounted to $4.6 billion, a reduction of 16% from 2015. A few notable growth areas were in dental products and imaging diagnostics showed notable growth, where imports increased by 0.6% and 32.4%, respectively.

The rise in cases of sports injuries is also one of the key factors influencing Brazil’s IONM market. Brazil is a country where football is an extremely popular sport, where everyone, from children to elderly people, play the game. Football contributes to more than 75% of the sports injuries in the country.

NuVasive is a company engaged in the development and marketing of minimally invasive surgical products & solutions for spinal surgeries. It focuses on the applications for spine fusion surgeries, that involve biologics used for the spinal fusion process. The company provides products & services for treating neck, back and leg pain using innovative technologies. NuVasive was founded in 1999 and is present across Latin America, Europe, North America and the APAC.

1.

LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

OUTSOURCED INTRAOPERATIVE NEUROMONITORING IS EXPECTED TO DOMINATE THE

MARKET

2.2.2.

EP IS A WIDELY USED METHODOLOGY OF INTRAOPERATIVE NEUROMONITORING

2.2.3.

SPINAL SURGERY IS THE LARGEST APPLICATION OF INTRAOPERATIVE

NEUROMONITORING

2.2.4.

SERVICES SEGMENT IS GROWING AT A RAPID RATE

2.2.5.

AMBULATORY SURGICAL CENTERS (ASCs) ARE RAPIDLY ADOPTING INTRAOPERATIVE

NEUROMONITORING

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

INTENSITY OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1.

INCREASING NEUROLOGICAL AND OTHER DISORDERS LEADING TO SURGERIES

2.6.2.

TECHNOLOGICAL ADVANCEMENT

2.6.3.

REDUCTION OF COMPLICATION DURING COMPLEX SURGERIES USING INTRAOPERATIVE

NEUROMONITORING

2.6.4.

INCREASING AGING POPULATION

2.7. MARKET RESTRAINTS

2.7.1.

HIGH COST OF IONM DEVICES AND SERVICES

2.7.2.

LACK OF SKILLED OPERATORS

2.8. MARKET OPPORTUNITIES

2.8.1.

RISE IN THE DEMAND FOR THE USE OF INTRAOPERATIVE NEUROMONITORING FOR MINIMALLY

INVASIVE SURGERIES

2.8.2.

DEVELOPMENT OF REMOTE INTRAOPERATIVE NEUROMONITORING

2.8.3.

EMERGENCE OF PORTABLE INTRAOPERATIVE NEUROMONITORING

2.9. MARKET CHALLENGES

2.9.1.

AVAILABILITY OF LESS COSTLY SUBSTITUTES

3.

INTRAOPERATIVE NEUROMONITORING MARKET OUTLOOK - BY SOURCE TYPE

3.1. INSOURCED INTRAOPERATIVE NEUROMONITORING

3.2. OUTSOURCED INTRAOPERATIVE NEUROMONITORING

4.

INTRAOPERATIVE NEUROMONITORING MARKET OUTLOOK - BY METHODOLOGY

4.1. EEG MONITORING

4.2. EMG MONITORING

4.3. EP MONITORING

4.3.1.

SEP MONITORING

4.3.2.

TCMEP MONITORING

4.3.3.

BAEP MONITORING

4.3.4.

VEP MONITORING

5.

INTRAOPERATIVE NEUROMONITORING MARKET OUTLOOK - BY APPLICATIONS

5.1. SPINAL SURGERY

5.2. ENT SURGERY

5.3. NEUROSURGERY

5.4. VASCULAR SURGERY

5.5. ORTHOPEDIC SURGERY

5.6. OTHER SURGERIES

6.

INTRAOPERATIVE NEUROMONITORING MARKET OUTLOOK - BY PRODUCTS &

SERVICES

6.1. SYSTEMS

6.2. ACCESSORIES

6.3. SERVICES

7.

INTRAOPERATIVE NEUROMONITORING MARKET OUTLOOK - BY END-USERS

7.1. HOSPITALS

7.2. AMBULATORY SURGICAL CENTERS (ASCs)

8.

INTRAOPERATIVE NEUROMONITORING MARKET - LATIN AMERICA

8.1. BRAZIL

8.2. MEXICO

8.3. REST OF LATIN AMERICA

9.

COMPETITIVE LANDSCAPE

9.1. ACCURATE NEUROMONITORING

9.2. INOMED MEDIZINTECHNIK GMBH

9.3. CADWELL

9.4. MOBERG RESEARCH, INC. (DAYONE MEDICAL LLC)

9.5. CNS NEUROMONITORING

9.6. COMPUTATIONAL DIAGNOSTICS

9.7. EMOTIV

9.8. INTRANERVE

9.9. MEDSURANT MONITORING

9.10.

MEDTRONIC

9.11.

NATUS MEDICAL

9.12.

SPECIALTYCARE

9.13.

NEUROMONITORING TECHNOLOGIES

9.14.

NEUROSENTINEL

9.15.

NIHON KOHDEN

9.16.

NUVASIVE

9.17.

CHECKPOINT SURGICAL

9.18.

ZYNEX

9.19.

ORIMTEC

10. RESEARCH METHODOLOGY & SCOPE

10.1.

RESEARCH SCOPE & DELIVERABLES

10.1.1.

OBJECTIVES OF STUDY

10.1.2.

SCOPE OF STUDY

10.2.

SOURCES OF DATA

10.2.1.

PRIMARY DATA SOURCES

10.2.2.

SECONDARY DATA SOURCES

10.3.

RESEARCH METHODOLOGY

10.3.1.

EVALUATION OF PROPOSED MARKET

10.3.2.

IDENTIFICATION OF DATA SOURCES

10.3.3.

ASSESSMENT OF MARKET DETERMINANTS

10.3.4.

DATA COLLECTION

10.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY SOURCE

TYPE, 2019-2027 (IN $ MILLION)

TABLE 4: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

METHODOLOGY, 2019-2027 (IN $ MILLION)

TABLE 5: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

APPLICATIONS, 2019-2027 (IN $ MILLION)

TABLE 6: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

PRODUCTS & SERVICES, 2019-2027 (IN $ MILLION)

TABLE 7: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

END-USERS, 2019-2027 (IN $ MILLION)

TABLE 8: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

APPLICATIONS, 2018 & 2027 (IN %)

FIGURE 2: LATIN AMERICA OUTSOURCED INTRAOPERATIVE NEUROMONITORING

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3: LATIN AMERICA EP MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: LATIN AMERICA SPINAL SURGERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 5: LATIN AMERICA SERVICES MARKET, 2019-2027 (IN $ MILLION)

FIGURE 6: LATIN AMERICA AMBULATORY SURGICAL CENTERS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 7: PORTER’S FIVE FORCE ANALYSIS

FIGURE 8: MARKET ATTRACTIVENESS INDEX

FIGURE 9: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

INSOURCED INTRAOPERATIVE NEUROMONITORING, 2019-2027 (IN $ MILLION)

FIGURE 10: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

OUTSOURCED INTRAOPERATIVE NEUROMONITORING, 2019-2027 (IN $ MILLION)

FIGURE 11: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY EEG

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 12: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY EMG

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 13: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY EP

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 14: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY SEP

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 15: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY TCMEP

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY BAEP

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 17: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY VEP

MONITORING, 2019-2027 (IN $ MILLION)

FIGURE 18: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

SPINAL SURGERY, 2019-2027 (IN $ MILLION)

FIGURE 19: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY ENT

SURGERY, 2019-2027 (IN $ MILLION)

FIGURE 20: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY NEUROSURGERY,

2019-2027 (IN $ MILLION)

FIGURE 21: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

VASCULAR SURGERY, 2019-2027 (IN $ MILLION)

FIGURE 22: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

ORTHOPEDIC SURGERY, 2019-2027 (IN $ MILLION)

FIGURE 23: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY OTHER

SURGERIES, 2019-2027 (IN $ MILLION)

FIGURE 24: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

SYSTEMS, 2019-2027 (IN $ MILLION)

FIGURE 25: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

ACCESSORIES, 2019-2027 (IN $ MILLION)

FIGURE 26: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 27: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

HOSPITALS, 2019-2027 (IN $ MILLION)

FIGURE 28: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, BY

AMBULATORY SURGICAL CENTERS (ASCs), 2019-2027 (IN $ MILLION)

FIGURE 29: LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 30: BRAZIL INTRAOPERATIVE NEUROMONITORING MARKET, 2019-2027 (IN $

MILLION)

FIGURE 31: MEXICO INTRAOPERATIVE NEUROMONITORING MARKET, 2019-2027 (IN $

MILLION)

FIGURE 32: REST OF LATIN AMERICA INTRAOPERATIVE NEUROMONITORING MARKET,

2019-2027 (IN $ MILLION)