Market by Product, Type, End-user, and Geography | Forecast 2019-2027

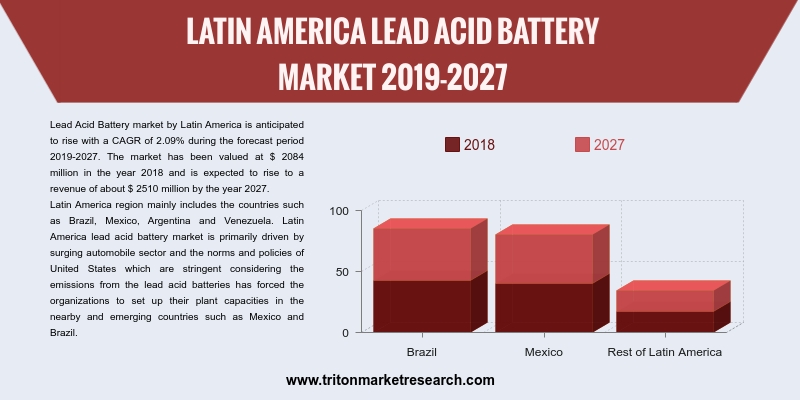

According to Triton, the Latin America lead-acid battery market would proliferate in terms of revenue for the forecast years 2019-2027, showcasing a CAGR of 2.09%.

The countries reviewed in the lead-acid battery market in Latin America are:

• Brazil

• Mexico

• Rest of Latin America

The surging automobile sector primarily drives growth in the Latin America lead-acid battery market. Besides, the stringent policies laid down by the US regarding the emission from lead-acid batteries has compelled companies to set up their factories in nearby countries like Brazil and Mexico. At present, the Mexican automobile sector is on a growth trajectory, which is raising the demand for the manufacture of lead-acid batteries in Latin America.

In Brazil, the production of automobiles witnessed a 14.2% jump and the sales grew by 9.1% in July from June 2019. The highest sales of lead-acid batteries are witnessed in the automobile sector, and thus, the booming of this sector would lead to a growth in the Brazil lead-acid market. Moreover, the country’s telecommunication sector is being deregulated. This is another major sector where lead-acid batteries are in use, and the deregulations would help in fueling the growth of the lead-acid battery market in the country.

The amount of data generated from devices such as smartphones, laptops, and tablets is expected to surge considerably in the coming years. For instance, the average smartphone is predicted to generate 5.3 GB of mobile data traffic per month by the year 2022, increasing from 1.1 GB per month in 2017. This surge in data suggests an increase in demand for data centers in the coming years. Lead-acid batteries are employed in data centers as part of the UPS systems, and the increasing number of data centers would thereby add to the growth of the country’s lead-acid battery market.

EnerSys manufactures, markets, and distributes industrial batteries. The company’s industrial battery product line includes reserve power products and motive power products. It is the pioneer of ‘Cyclone,’ which operates in extreme temperatures. EnerSys operates in Latin America, North America, Europe, the Middle East and Africa, and the Asia-Pacific. In December 2018, the company completed the acquisition of the Alpha Technologies Group. It was predicted that this acquisition would consolidate EnerSys’ position in the market and help the company deliver high-quality products across various markets.

1. LATIN

AMERICA LEAD—ACID BATTERY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. RELIABLE

PERFORMANCE OF LEAD—ACID BATTERIES INCREASES THEIR SALES

2.2.2. LOW

ENERGY DENSITY OF LEAD—ACID BATTERY REDUCES THEIR SELLING POTENTIAL

2.2.3. VRLA

BATTERIES ARE FASTEST-GROWING LEAD—ACID BATTERIES BY TYPE

2.3. EVOLUTION

& TRANSITION OF LEAD—ACID BATTERY

2.4. PORTER’S

FIVE FORCES ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. APPLICATION

2.5.2. COST

2.5.3. LIFE

SPAN

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.9. MARKET

DRIVERS

2.9.1. COMPARATIVELY

LOW COST

2.9.2. HIGH

SUSTAINABILITY AS COMPARED TO ALTERNATIVE PRODUCTS

2.9.3. GROWING

DEMAND FROM HYBRID ELECTRIC VEHICLES

2.10. MARKET

RESTRAINTS

2.10.1.

SLOWDOWN IN AUTOMOTIVE SECTOR

2.10.2.

INCREASING LEAD POLLUTION

2.11. MARKET

OPPORTUNITIES

2.11.1.

GROWTH OF OFF-GRID RENEWABLE

ENERGY GENERATION

2.11.2.

INCREASING USE OF SLA

BATTERIES IN DATA CENTERS

2.12. MARKET

CHALLENGES

2.12.1.

ADOPTION OF DRY BATTERIES

3. LATIN

AMERICA LEAD—ACID BATTERY MARKET OUTLOOK – BY PRODUCT

3.1. SLI

BATTERIES

3.2. MICRO

HYBRID BATTERIES

4. LATIN

AMERICA LEAD—ACID BATTERY MARKET OUTLOOK – BY TYPE

4.1. FLOODED

BATTERIES

4.2. ENHANCED

FLOODED BATTERIES

4.3. VRLA

BATTERIES

5. LATIN

AMERICA LEAD—ACID BATTERY MARKET OUTLOOK – BY END-USER

5.1. AUTOMOTIVE

5.2. TELECOMMUNICATION

5.3. UPS

5.4. OTHERS

6. LATIN

AMERICA LEAD—ACID BATTERY MARKET – REGIONAL OUTLOOK

6.1. BRAZIL

6.2. MEXICO

6.3. REST

OF LATIN AMERICA

7. COMPETITIVE

LANDSCAPE

7.1. B.B.

BATTERY CO.

7.2. C&D

TECHNOLOGIES, INC. (ACQUIRED BY KPS CAPITAL PARTNER)

7.3. CROWN

BATTERY

7.4. CSB

BATTERY COMPANY LTD. (ACQUIRED BY HITACHI CHEMICAL ENERGY TECHNOLOGY)

7.5. EAST

PENN MANUFACTURING

7.6. ENERSYS

7.7. EXIDE

TECHNOLOGIES, INC.

7.8. GS

YUASA CORPORATION

7.9. CLARIOS

(FORMERLY JOHNSONS CONTROLS POWER SOLUTIONS)

7.10. NARADA

POWER SOURCE CO., LTD.

7.11. NIPRESS

7.12. NORTHSTAR

7.13. TOSHIBA

CORPORATION

7.14. ZIBO

TORCH ENERGY CO., LTD.

7.15. REEM

BATTERIES & POWER APPLIANCES CO. SAOC

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: BATTERY

TECHNOLOGY COMPARISON

TABLE 3: VENDOR

SCORECARD

TABLE 4: TECHNICAL PERFORMANCE

COMPARISON OF BATTERY

TABLE 5: WORLDWIDE

LITHIUM-ION BATTERY CAPACITY

TABLE 6: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 7: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 8: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY END USER, 2019-2027 (IN $ MILLION)

TABLE 9: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: RECYCLING

RATES-PERCENTAGE OF RECLAIMED MATERIAL IN UNITED STATES

FIGURE 2: TIMELINE OF

LEAD—ACID BATTERY

FIGURE 3: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 4: KEY BUYING

IMPACT ANALYSIS

FIGURE 5: MARKET

ATTRACTIVENESS INDEX

FIGURE 6: INDUSTRY

COMPONENTS

FIGURE 7: ENERGY

CONSUMPTION BY BATTERIES IN MEGAJOULES PER KG

FIGURE 8: AVERAGE CO2

EMISSIONS PER KG BY BATTERY TECHNOLOGIES

FIGURE 9: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY SLI BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 10: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY MICRO HYBRID BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 11: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY FLOODED BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 12: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY ENHANCED FLOODED BATTERIES, 2019-2027 (IN

$ MILLION)

FIGURE 13: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY VRLA BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 14: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 15: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY TELECOMMUNICATION, 2019-2027 (IN $

MILLION)

FIGURE 16: LATIN AMERICA

LEAD—ACID BATTERY MARKET, BY UPS, 2019-2027 (IN $ MILLION)

FIGURE 17: LATIN

AMERICA LEAD—ACID BATTERY MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 18: LATIN

AMERICA LEAD—ACID BATTERY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 19: BRAZIL

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: MEXICO

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: REST OF

LATIN AMERICA LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)