Market By Component, Fidelity, End-user And Geography | Forecast 2019-2027

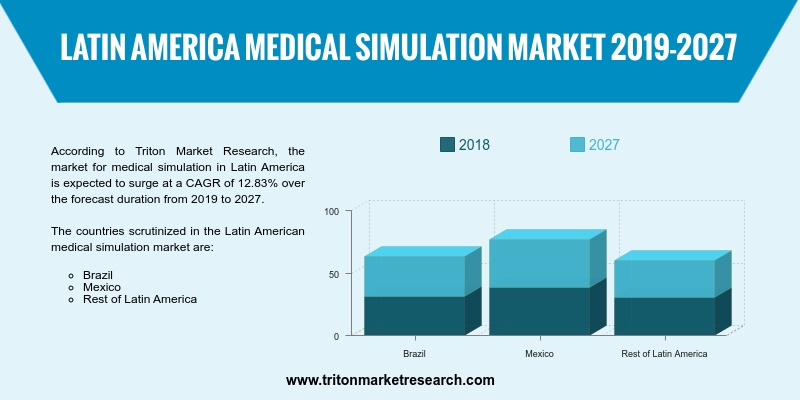

According to Triton Market Research, the market for medical simulation in Latin America is expected to surge at a CAGR of 12.83% over the forecast duration from 2019 to 2027.

The countries scrutinized in the Latin American medical simulation market are:

• Brazil

• Mexico

• Rest of Latin America

The Mexican Association for Clinical Simulation (AMSIC), founded in Mexico in 2007 as a non-profit organization, was created with an aim to promote research, scientific development and application of clinical simulation as a training strategy for health sciences professionals in Latin America. Additionally, in 2016, with the help of its Agency for International Development (USAID), the US Embassy in Mexico committed itself towards raising Mexico’s level of medical care. The simulation center at the UNAM’s Faculty of Medicine receives over 50,000 undergraduate as well as graduate students in various areas of medicine & healthcare, throughout the academic year, who perform more than 2,500 simulation practices throughout the year.

Report scope can be customized per your requirements. Request For Customization

The aforementioned developments in Mexico’s medical simulation practices depict that, the market would adopt greater simulation facilities as well as services by the simulation vendors. It is likely that the largest medical universities would be the primary end-users, as they have been quickly incorporating simulation practices in their various medical curricula. A plethora of both local vendors and international players supply medical simulation services in the region, but given the government’s low interest levels and the socio-economic construct of Mexico, moderate growth is expected in its medical simulation market.

Mentice AB is a company in the medical devices domain, offering simulation trainer systems. It offers simulators, training modules, as well as add-on products. The company’s products have the ability of tracking the motion of surgical instruments during a surgical procedure and provide feedback based on the simulation. Mentice MIST, Mentice VIST, Mentice VIST-C, Xitact ITP and Xitact IHP are some of the products which are a part of the company’s product portfolio. In May 2019, Mentice AB and RAD-AID entered into a collaboration for improving access to interventional radiology in the world’s resource-constrained regions, which also includes Latin America.

1. LATIN

AMERICA MEDICAL SIMULATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL OUTLOOK

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. BARGAINING

POWER OF SUPPLIERS

2.2.5. THREAT

OF COMPETITIVE RIVALRY

2.3. MARKET

TRENDS

2.4. REGULATORY

OUTLOOK

2.5. MARKET

SHARE OUTLOOK

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. MARKET

DRIVERS

2.7.1. GROWING

CONCERN FOR PATIENT SAFETY

2.7.2. INCREASING

DEMAND FOR MINIMALLY INVASIVE SURGERY (MIS)

2.8. MARKET

RESTRAINTS

2.8.1. HIGH

COST OF MEDICAL SIMULATORS

2.8.2. LACK

OF SKILLED PROFESSIONALS

2.8.3. AVERSENESS

TO ADOPT NEW SIMULATION TECHNOLOGIES

2.9. MARKET

OPPORTUNITIES

2.9.1. TECHNOLOGICAL

ADVANCEMENTS

2.9.2. OPPORTUNITIES

FOR CARRYING OUT SIMULATION IN THE EMERGING MARKETS

2.10.

MARKET CHALLENGES

2.10.1.

CHALLENGES IN THE MEDICAL

SIMULATION OPRATION

3. MEDICAL

SIMULATION MARKET OUTLOOK – BY COMPONENT

3.1. MODEL-BASED

SIMULATION

3.2. WEB-BASED

SIMULATION

3.3. SIMULATION

TRAINING SERVICES

4. MEDICAL

SIMULATION MARKET OUTLOOK – BY FIDELITY

4.1. LOW-FIDELITY

4.2. MEDIUM-FIDELITY

4.3. HIGH-FIDELITY

5. MEDICAL

SIMULATION MARKET OUTLOOK – BY END-USER

5.1. ACADEMIC

INSTITUTIONS & RESEARCH CENTERS

5.2. HOSPITALS

& CLINICS

5.3. MILITARY

ORGANIZATIONS

6. MEDICAL

SIMULATION MARKET – REGIONAL OUTLOOK

6.1. LATIN

AMERICA

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. BRAZIL

6.1.1.2. MEXICO

6.1.1.3. REST

OF LATIN AMERICA

7. COMPETITIVE

LANDSCAPE

7.1. GAUMARD

SCIENTIFIC COMPANY

7.2. CANADIAN

AVIATION ELECTRONICS (CAE)

7.3. MENTICE

AB

7.4. KYOTO

KAGAKU CO., LTD.

7.5. SIMULAIDS,

INC.

7.6. KINDHEART,

INC.

7.7. 3D

SYSTEMS CORPORATION

7.8. LAERDAL

MEDICAL AS

7.9. SURGICAL

SCIENCE SWEDEN AB

7.10.

LIMBS & THINGS LTD.

7.11.

INTELLIGENT ULTRASOUND GROUP

PLC (FORMERLY MEDAPHOR GROUP PLC)

7.12.

NASCO

7.13.

SIMULAB CORPORATION

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 LATIN AMERICA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

TABLE 2 COST OF SIMULATION EQUIPMENT

TABLE 3 LATIN AMERICA MEDICAL SIMULATION MARKET

BY COMPONENT 2019-2027 ($ MILLION)

TABLE 4 LATIN AMERICA MEDICAL SIMULATION MARKET

BY FIDELITY 2019-2027 ($ MILLION)

TABLE 5 LATIN AMERICA MEDICAL SIMULATION MARKET

BY END-USER 2019-2027 ($ MILLION)

TABLE 6 LATIN AMERICA MEDICAL SIMULATION MARKET

BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 LATIN AMERICA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 2 COMPANY MARKET SHARE OUTLOOK OF MEDICAL

SIMULATION 2018 (%)

FIGURE 3 LATIN AMERICA MEDICAL SIMULATION MARKET BY

MODEL-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 4 LATIN AMERICA MEDICAL SIMULATION MARKET BY

WEB-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 5 LATIN AMERICA MEDICAL SIMULATION MARKET BY

SIMULATION TRAINING SERVICES 2019-2027 ($ MILLION)

FIGURE 6 LATIN AMERICA MEDICAL SIMULATION MARKET BY

LOW-FIDELITY 2019-2027 ($ MILLION)

FIGURE 7 LATIN AMERICA MEDICAL SIMULATION MARKET BY

MEDIUM-FIDELITY 2019-2027 ($ MILLION)

FIGURE 8 LATIN AMERICA MEDICAL SIMULATION MARKET BY

HIGH-FIDELITY 2019-2027 ($ MILLION)

FIGURE 9 LATIN AMERICA MEDICAL SIMULATION MARKET BY

ACADEMIC INSTITUTIONS & RESEARCH CENTERS 2019-2027 ($ MILLION)

FIGURE 10 LATIN AMERICA MEDICAL SIMULATION MARKET BY

HOSPITALS & CLINICS 2019-2027 ($ MILLION)

FIGURE 11 LATIN AMERICA MEDICAL SIMULATION MARKET BY

MILITARY ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 12 BRAZIL MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)

FIGURE 13 MEXICO AMERICA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 14 REST OF LATIN AMERICA MEDICAL SIMULATION

MARKET 2019-2027 ($ MILLION)