Market By Product, Test Type, Technology And Geography | Forecast 2019-2027

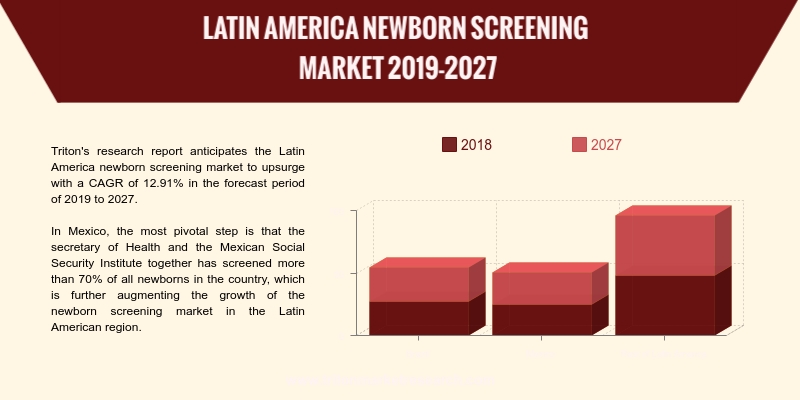

Triton's research report anticipates the Latin America newborn screening market to upsurge with a CAGR of 12.91% in the forecast period of 2019 to 2027.

The countries considered in the report on Latin America’s newborn screening market are:

• Brazil

• Mexico

• Rest of Latin America

Report scope can be customized per your requirements. Request For Customization

In Mexico, the most pivotal step is that the secretary of Health and the Mexican Social Security Institute together has screened more than 70% of all newborns in the country, which is further augmenting the growth of the newborn screening market in the Latin American region. According to the Canadian PKU and Allied Disorders Association, the combined population accounts for around 600 million, with annual births that account for 11 million. The newborn screening programs that have been going on for around 20-30 years in the countries which mainly include Cuba, Costa Rica, Uruguay and Chile are constantly focusing on expanding their coverage, and in the present scenario, all these four countries have a reach to around 99% of the newborn population of the country. According to the association, Chile has expanded newborn screening to include around 25 conditions in 2015, and the researchers in Cuba have reported on launching several new screening techniques considering both traditional and future screening. In the present scenario, newborn screening in Cuba has been decentralized through more than 175 laboratories.

A rise in the global population of the world has been observed, owing to the rising fertility rate. According to the WHO, 130 million infants are born in per year, of which 2.6 million die in the first 28 days of their life. Newborn infants are more prone to infection, which can occur at any time from the first day of life. Newborn screening tests are done to diagnose the congenital or inborn abnormalities of metabolism to identify the disease in neonatal investigations. The growing fertility rate is likely to raise the demand for newborn screening market. These tests are done immediately after the birth of the baby, and are able to detect metabolic, genetic and developmental disorders in newborns.

1. LATIN

AMERICA NEWBORN SCREENING MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. DEMAND

FOR NEWBORN SCREENING INSTRUMENTS IS RISING STEADILY

2.2.2. GROWTH

IN DRY BLOOD SPOT TEST

2.2.3. TECHNIQUES

USED IN NEWBORN SCREENING TESTS

2.3. EVOLUTION

& TRANSITION OF NEWBORN SCREENING

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. RELIABILITY

2.5.2. COST

2.5.3. AVAILABILITY

2.5.4. TECHNOLOGICAL

ADVANCEMENT

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.8.1. RAW

MATERIAL SUPPLIERS

2.8.2. MANUFACTURERS

2.8.3. DISTRIBUTORS

2.8.4. END-USERS

2.9. REGULATORY

FRAMEWORK

2.10. INDUSTRY

PLAYER POSITIONING

2.11. KEY

MARKET STRATEGIES

2.11.1. PRODUCT

LAUNCH

2.12. MARKET

DRIVERS

2.12.1. INCREASE

IN OCCURRENCES OF NEWBORN DISEASES

2.12.2. GROWING

NUMBER OF INFANTS WITH BIRTH DEFECT

2.12.3. BACKING

OF GOVERNMENT TOWARDS NEWBORN CHILD HEALTH

2.12.4. RISING

AWARENESS FOR PEDIATRIC CONGENITAL HEART DISEASE

2.13. MARKET

RESTRAINTS

2.13.1. ABSENCE

OF PROPER HEALTHCARE INFRASTRUCTURE FOR NEWBORN BABIES IN DEVELOPING COUNTRIES

2.13.2. SOCIO-ECONOMIC

HURDLES IN THE IMPLEMENTATION OF NEWBORN CHILD SCREENING

2.14. MARKET

OPPORTUNITIES

2.14.1. INCREASING

FERTILITY RATES ACROSS THE GLOBE IS CREATING DYNAMIC GROWTH

2.14.2. NEWBORN

SCREENING HELPS IN EARLY IDENTIFICATION AND MANAGEMENT OF AFFECTED NEWBORNS

2.14.3. TECHNOLOGICAL

ADVANCEMENTS IN NEWBORN SCREENING

2.14.4. INCREASE

IN NUMBER OF PREGNANT WOMEN WITH ADVANCED MATERNAL AGE

2.15. MARKET

CHALLENGES

2.15.1. DEARTH

OF SKILLED PROFESSIONAL IN HEALTHCARE INDUSTRY

2.15.2. MAINTENANCE

OF EQUIPMENT IN HOSPITAL

3. NEWBORN

SCREENING MARKET OUTLOOK - BY PRODUCT

3.1. NEWBORN

SCREENING INSTRUMENTS

3.2. NEWBORN

SCREENING REAGENTS & ASSAY KITS

4. NEWBORN

SCREENING MARKET OUTLOOK - BY TEST TYPE

4.1. HEARING

SCREEN TEST

4.2. CRITICAL

CONGENITAL HEART DISEASE (CCHD) TEST

4.3. DRY

BLOOD SPOT TEST

5. NEWBORN

SCREENING MARKET OUTLOOK - BY TECHNOLOGY

5.1. TANDEM

MASS SPECTROMETRY

5.2. PULSE

OXIMETRY

5.3. ENZYME-BASED

ASSAYS

5.4. DNA-BASED

ASSAYS

5.5. ELECTROPHORESIS

5.6. OTHERS

6. NEWBORN

SCREENING MARKET - REGIONAL OUTLOOK

6.1. BRAZIL

6.2. MEXICO

6.3. REST

OF LATIN AMERICA

7. COMPETITIVE

LANDSCAPE

7.1. SCIEX

7.2. BIOTEK

INSTRUMENTS, INC.

7.3. BIO-RAD

LABORATORIES, INC.

7.4. CARDINAL

HEALTH, INC.

7.5. GE

HEALTHCARE LIMITED

7.6. AGILENT

TECHNOLOGIES, INC.

7.7. MASIMO

CORPORATION

7.8. NATUS

MEDICAL, INCORPORATED

7.9. MEDTRONIC

PLC

7.10. THERMO

FISHER SCIENTIFIC, INC.

7.11. NEOGEN

LABS PVT. LTD.

7.12. PERKINELMER,

INC.

7.13. ZENTECH

S.A.

7.14. WATERS

CORPORATION

7.15. TRIVITRON

HEALTHCARE

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: LATIN AMERICA

NEWBORN SCREENING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: REGULATORY

FRAMEWORK

TABLE 5: LIST OF

PRODUCT LAUNCHES

TABLE 6: INFANT

MORTALITY RATE IN DEVELOPING COUNTRIES (TOTAL DEATHS/ 1000 LIVE BIRTHS)

TABLE 7: LATIN AMERICA

NEWBORN SCREENING MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 8: LATIN AMERICA

NEWBORN SCREENING MARKET, BY TEST TYPE, 2019-2027 (IN $ MILLION)

TABLE 9: LATIN AMERICA

NEWBORN SCREENING MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 10: LATIN AMERICA

NEWBORN SCREENING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: PORTER’S FIVE

FORCE ANALYSIS

FIGURE 2: KEY BUYING IMPACT

ANALYSIS

FIGURE 3: INDUSTRY

COMPONENTS

FIGURE 4: INDUSTRY

PLAYER POSITIONING IN 2018 (IN %)

FIGURE 5: FERTILITY

RATE (AVERAGE BIRTHS PER WOMAN IN %) IN 2017

FIGURE 6: LATIN AMERICA

NEWBORN SCREENING MARKET, BY NEWBORN SCREENING INSTRUMENTS, 2019-2027 (IN $

MILLION)

FIGURE 7: LATIN AMERICA

NEWBORN SCREENING MARKET, BY NEWBORN SCREENING REAGENTS & ASSAY KITS,

2019-2027 (IN $ MILLION)

FIGURE 8: LATIN AMERICA

NEWBORN SCREENING MARKET, BY HEARING SCREEN TEST, 2019-2027 (IN $ MILLION)

FIGURE 9: LATIN AMERICA

NEWBORN SCREENING MARKET, BY CRITICAL CONGENITAL HEART DISEASE (CCHD) TEST,

2019-2027 (IN $ MILLION)

FIGURE 10: LATIN

AMERICA NEWBORN SCREENING MARKET, BY DRY BLOOD SPOT TEST, 2019-2027 (IN $

MILLION)

FIGURE 11: LATIN

AMERICA NEWBORN SCREENING MARKET, BY TANDEM MASS SPECTROMETRY, 2019-2027 (IN $

MILLION)

FIGURE 12: LATIN

AMERICA NEWBORN SCREENING MARKET, BY PULSE OXIMETRY, 2019-2027 (IN $ MILLION)

FIGURE 13: LATIN

AMERICA NEWBORN SCREENING MARKET, BY ENZYME-BASED ASSAY, 2019-2027 (IN $

MILLION)

FIGURE 14: LATIN

AMERICA NEWBORN SCREENING MARKET, BY DNA-BASED ASSAYS, 2019-2027 (IN $ MILLION)

FIGURE 15: LATIN

AMERICA NEWBORN SCREENING MARKET, BY ELECTROPHORESIS, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN

AMERICA NEWBORN SCREENING MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 17: LATIN

AMERICA NEWBORN SCREENING MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 18: BRAZIL

NEWBORN SCREENING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: MEXICO

NEWBORN SCREENING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: REST OF

LATIN AMERICA NEWBORN SCREENING MARKET, 2019-2027 (IN $ MILLION)