Market By Type, Application, And Geography | Forecast 2019-2027

The Latin America process oil market is estimated to grow at a CAGR of 4.11% in terms of revenue and 3.95% in terms of volume over the forecasting years 2019-2027.

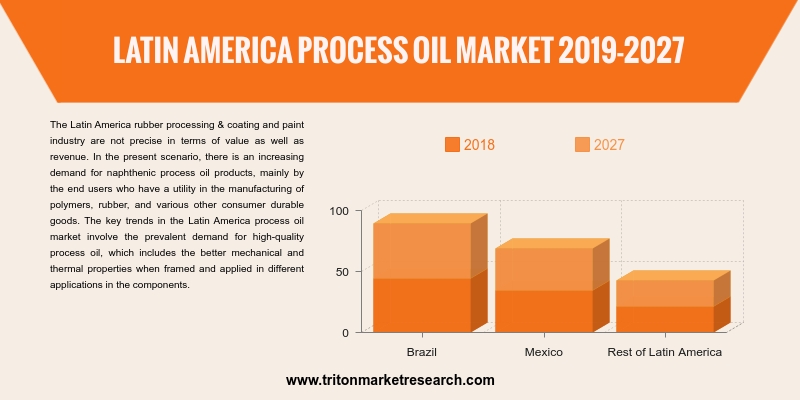

The countries analyzed in the Latin America process oil market are:

• Mexico

• Brazil

• Rest of Latin America

Report scope can be customized per your requirements. Request For Customization

The process oil market in Latin America is driven by the increasing demand for naphthenic process oil products. There is also a prevalent demand for high-quality process oil which incorporates better mechanical and thermal properties when it is used in different applications in the components. It is a key trend in the Latin America process oil market. The increasing application of rubber process oil in the tire manufacturing process has been contributing to the growth of the automobile sector, thereby driving the process oil market. The technologically advanced rubber process oil help in extending the durability of the tire and reducing the cost.

Brazil covers almost half of Latin America’s land as well as population. The country has the largest automotive market in the region. The growing demand for non-carcinogenic process oil, followed by paraffin and aromatic oil, is boosting the process oil market. The tire & rubber segment is predicted to fuel the process oil market with the highest CAGR during the forecasting period. The rising demand for tires in the automobile industry is propelling the process oil market in the country.

Ergon North & South America has a supply and distribution network that is centered on process oil and crude oil storage terminal. The company deals with the processing of crude oil, producing & marketing specialty asphalt products, marketing naphthenic & paraffinic specialty oils, and manufacturing & marketing road maintenance products and machinery. The company has its business operations across the world, including regions such as Latin America, North America, Asia-Pacific, Europe and the Middle East and Africa.

1. LATIN

AMERICA PROCESS OIL MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL

2.2.1. BARGAINING

POWER OF BUYERS

2.2.2. BARGAINING

POWER OF SUPPLIERS

2.2.3. THREAT

OF NEW ENTRANTS

2.2.4. THREAT

OF SUBSTITUTES

2.2.5. THREAT

OF RIVALRY

2.3. MARKET

TRENDS

2.4. MARKET

SHARE OUTLOOK

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. KEY

INSIGHT

2.7. MARKET

DRIVERS

2.7.1. INCREASING

DEMAND FOR PROCESS OIL IN THE TEXTILE INDUSTRY

2.7.2. GROWING

PERSONAL CARE INDUSTRY

2.7.3. RISING

VEHICULAR PRODUCTION AND GROWING AUTOMOTIVE SECTOR

2.8. MARKET

RESTRAINTS

2.8.1. RESTRICTIONS

IN THE USAGE OF POLYCYCLIC AROMATIC HYDROCARBON (PAH)

2.8.2. EMERGENCE

OF DRY-TYPE TRANSFORMERS

2.9. MARKET

OPPORTUNITIES

2.9.1. OPPORTUNITIES

PRESENTED BY ADHERING TO THE USAGE OF LOW POLYAROMATIC HYDROCARBON (PAH) OILS

2.9.2. MOUNTING

EXPLORATION ACTIVITY OF HYDROCARBONS IN NON-OPEC REGIONS

2.10.

MARKET CHALLENGES

2.10.1.

FLUCTUATING RAW MATERIAL PRICES

2.10.2.

CHANGING CRUDE OIL PRICES

3. PROCESS

OIL MARKET OUTLOOK – BY TYPE

3.1. NAPHTHENIC

OIL

3.2. PARAFFIN

3.3. AROMATIC

3.4. NON-CARCINOGENIC

4. PROCESS

OIL MARKET OUTLOOK – BY APPLICATION

4.1. TIRE

& RUBBER

4.2. POLYMER

4.3. PERSONAL

CARE

4.4. TEXTILE

4.5. OTHER

APPLICATIONS

5. PROCESS

OIL MARKET – REGIONAL OUTLOOK

5.1. LATIN

AMERICA

5.1.1. COUNTRY

ANALYSIS

5.1.1.1. BRAZIL

5.1.1.2. MEXICO

5.1.1.3. REST

OF LATIN AMERICA

6. COMPANY

PROFILES

6.1. CHEVRON

CORPORATION

6.2. GAZPROM

6.3. GP

PETROLEUMS

6.4. APAR

INDUSTRIES LTD.

6.5. LANXESS

PROCESS OIL

6.6. ROYAL

DUTCH SHELL PLC

6.7. HINDUSTAN

PETROLEUM CORPORATION LTD.

6.8. HOLLYFRONTIER

REFINING & MARKETING INC.

6.9. CALUMET

SPECIALTY PRODUCTS PARTNERS, L.P.

6.10.

ERGON NORTH & SOUTH AMERICA

6.11.

TOTAL S.A.

6.12.

PETROCHINA COMPANY LTD.

6.13.

IDEMITSU KOSAN CO., LTD.

6.14.

EXXON MOBIL CHEMICAL COMPANY

6.15.

PETROBRAS

6.16.

REPSOL S.A.

6.17.

SASOL

6.18.

IRANOL COMPANY

6.19.

JX NIPPON OIL & GAS EXPLORATION

6.20.

NYNAS AB

6.21.

SUNOCO LP

6.22.

LUKOIL

6.23.

ORGKHIM BIOCHEMICAL HOLDING

6.24.

PANAMA PETROCHEM LTD.

6.25.

PETRONAS LUBRICANTS INTERNATIONAL

6.26.

ROSNEFT

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 LATIN AMERICA PROCESS OIL MARKET, 2019-2027 ($ MILLION)

TABLE 2 LATIN AMERICA PROCESS OIL MARKET, 2019-2027 (KILOTONS)

TABLE 3 TYPE OF PROCESS OIL

TABLE 4 GROUPING AS PER REFINING PROCESS

TABLE 5 PROPERTIES OF LIGHT NEUTRAL BASE OILS

TABLE 6 CHARACTERISTICS OF TEMPERATURE ON VISCOSITY

TABLE 7 CARCINOGENIC CLASSIFICATIONS OF PAH COMPOUNDS BY SPECIFIC

AGENCIES

TABLE 8 LATIN AMERICA PROCESS OIL MARKET, BY TYPE, 2019-2027 ($

MILLION)

TABLE 9 COMPARISON OF DIFFERENT TYPES OF RUBBER PROCESS OIL

TABLE 10 LATIN AMERICA PROCESS OIL MARKET, BY TYPE,

2019-2027 (KILOTONS)

TABLE 11 LATIN AMERICA PROCESS OIL MARKET, BY APPLICATION,

2019-2027 ($ MILLION)

TABLE 12 PROCESS OIL PRODUCTS USED IN TEXTILE

INDUSTRIES

TABLE 13 PRODUCT TYPE FOR HOT MELT ADHESIVE

MANUFACTURING INDUSTRY

TABLE 14 LATIN AMERICA PROCESS OIL MARKET, BY

COUNTRY, 2019-2027 ($ MILLION)

TABLE 15 LATIN AMERICA PROCESS OIL MARKET, BY

COUNTRY, 2019-2027 (KILOTONS)

FIGURE 1 LATIN AMERICA PROCESS OIL MARKET,

2019-2027 ($ MILLION)

FIGURE 2 LATIN AMERICA PROCESS OIL MARKET,

2019-2027 (KILOTONS)

FIGURE 3 PROCESS OIL COMPANY MARKET SHARE OUTLOOK

2018 (%)

FIGURE 4 LATIN AMERICA PROCESS OIL MARKET, BY

NAPHTHENIC OIL, 2019-2027 ($ MILLION)

FIGURE 5 LATIN AMERICA PROCESS OIL MARKET, BY

NAPHTHENIC OIL, 2019-2027 (KILOTONS)

FIGURE 6 LATIN AMERICA PROCESS OIL MARKET, BY

PARAFFIN, 2019-2027 ($ MILLION)

FIGURE 7 LATIN AMERICA PROCESS OIL MARKET, BY

PARAFFIN, 2019-2027 (KILOTONS)

FIGURE 8 LATIN AMERICA PROCESS OIL MARKET, BY

AROMATIC, 2019-2027 ($ MILLION)

FIGURE 9 LATIN AMERICA PROCESS OIL MARKET, BY

AROMATIC, 2019-2027 (KILOTONS)

FIGURE 10 LATIN AMERICA PROCESS OIL MARKET, BY

NON-CARCINOGENIC, 2019-2027 ($ MILLION)

FIGURE 11 LATIN AMERICA PROCESS OIL MARKET, BY

NON-CARCINOGENIC, 2019-2027 (KILOTONS)

FIGURE 12 LATIN AMERICA PROCESS OIL MARKET, BY TIRE

& RUBBER, 2019-2027 ($ MILLION)

FIGURE 13 LATIN AMERICA PROCESS OIL MARKET, BY POLYMER,

2019-2027 ($ MILLION)

FIGURE 14 LATIN AMERICA PROCESS OIL MARKET, BY PERSONAL

CARE, 2019-2027 ($ MILLION)

FIGURE 15 LATIN AMERICA PROCESS OIL MARKET, BY TEXTILE,

2019-2027 ($ MILLION)

FIGURE 16 LATIN AMERICA PROCESS OIL MARKET, BY OTHER

APPLICATION, 2019-2027 ($ MILLION)

FIGURE 17 PASSENGER CAR PRODUCTION IN LATIN AMERICA

2017

FIGURE 18 BRAZIL PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 19 BRAZIL PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 20 MEXICO PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 21 MEXICO PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 22 REST OF LATIN AMERICA PROCESS OIL MARKET,

2019-2027 ($ MILLION)

FIGURE 23 REST OF LATIN AMERICA PROCESS OIL MARKET, 2019-2027 (KILOTONS)