Market By Product, Technology, End-user And Geography | Forecast 2019-2027

The detailed analysis of the global mammography system market shows that, in terms of revenue, the industry is estimated to grow at a CAGR of 7.28% during the forecasting years 2019-2027. The market was assessed to be worth $XX million in the year 2018 and is predicted to generate a revenue of approximately $XX million by the year 2027. The mammography system is an imaging device for the appropriate diagnosis and detection of breast cancer, that uses low dosage X-rays. Technological advancements in the diagnostic imaging industry have always played a crucial role in the early diagnosis of the diseases.

The developing healthcare infrastructure, increasing healthcare expenditure and the prevalence of breast cancer have aided in increasing the awareness about and adoption of mammography systems, thus driving the growth of the mammography system market. The increasing environmental aspects, including chemical, radioactive and biological factors, have elevated the prevalence of cancer, thus elevating the need for the development of best diagnostic & therapeutic procedures with less turnaround time, thereby boosting the mammography system market analysis.

Report scope can be customized per your requirements. Request For Customization

The study aims to get an overview of the mammography system market in terms of various factors. Within this report, the market definition and the key insights regarding the mammography system industry have been discussed. Also, Porter’s five forces model, regulatory framework, market share outlook, the timeline of the mammography system, reimbursement outlook and market attractiveness index have been studied in detail.

Market drivers like the rising awareness about the benefits of early cancer screening, growing older population, surging incidence of breast cancer and technological advancements are pushing the mammography system market growth. However, the industry is facing market restraints like the lack of skilled radiology specialists, continuous exposure to harmful radiations and the high cost of mammography devices, which are obstructing its growth.

Key opportunities like the increase in demand for 3D mammography and the huge demand for hybrid mammography can be leveraged by the industry to reach the projected growth. However, challenges such as the presence of substitute products, the incidence of inadequate reimbursements for mammography and stringent regulatory framework are being faced by this market.

To get detailed insights on segments, Download Sample Report

Geographies covered in the mammography system market by region are:

• North America: The United States and Canada

• Asia-Pacific: Japan, China, India, ASEAN countries, South Korea, Australia & New Zealand and Rest of Asia-Pacific

• Europe: The United Kingdom, Germany, Italy, Russia, Spain, France and Rest of Europe

• Latin America: Brazil, Mexico and Rest of Latin America

• Middle East and Africa: Turkey, the United Arab Emirates, South Africa, Saudi Arabia and Rest of the Middle East & Africa

The mammography system market has been segmented as follows:

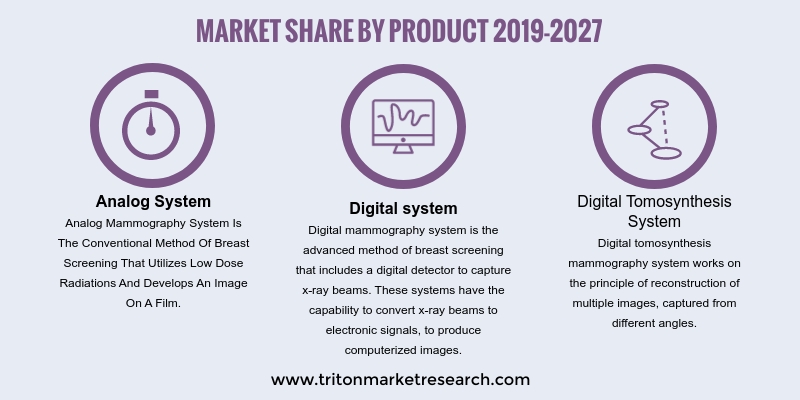

• By Product:

O Analog system

O Digital tomosynthesis system

O Digital system

• By Technology:

O 2-D Technology

O Combination Technology

O 3-D Technology

• By End-User:

O Hospitals

O Diagnostic centers

O Ambulatory centers

O Other end-users

The top companies that have been studied in the mammography system market are BMI Biomedical International S.r.l., General Medical Italia, QIAGEN N.V., Siemens AG, Bio-Rad Laboratories, Inc., Villa Sistemi Medicali S.p.A., Koninklijke Philips N.V., General Electric Company, Fujifilm Holdings Corporation, Siemens Healthineers, Metaltronica S.p.A., Planmed Oy, Konica Minolta, Inc., Hologic, Inc., General Medical Merate S.p.A., Carestream Health, Inc. and Canon, Inc.

The strategic analysis for each of these companies has been covered in detail. The mammography system market by company share helps to dive into the information about the key market players in this industry and how much hold they have on the market.

1.

GLOBAL MAMMOGRAPHY SYSTEM MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES MODEL OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. REGULATORY FRAMEWORK

2.4. PATENT OUTLOOK

2.5. TIMELINE OF MAMMOGRAPHY SYSTEM

2.6. REIMBURSEMENT OUTLOOK

2.7. MARKET SHARE OUTLOOK

2.8. MARKET TRENDS

2.9. KEY INSIGHT

2.10.

MARKET ATTRACTIVENESS INDEX

2.11.

MARKET DRIVERS

2.11.1.

RISING AWARENESS ABOUT THE BENEFITS OF EARLY CANCER SCREENING

2.11.2.

GROWING OLDER POPULATION

2.11.3.

SURGING INCIDENCE OF BREAST CANCER

2.11.4.

TECHNOLOGICAL ADVANCEMENTS

2.12.

MARKET RESTRAINTS

2.12.1.

LACK OF SKILLED RADIOLOGY SPECIALISTS

2.12.2.

CONTINUOUS EXPOSURE TO HARMFUL RADIATIONS

2.12.3.

HIGH COST OF MAMMOGRAPHY DEVICES

2.13.

MARKET OPPORTUNITIES

2.13.1.

INCREASE IN THE DEMAND OF 3D MAMMOGRAPHY

2.13.2.

HUGE DEMAND FOR HYBRID MAMMOGRAPHY

2.14.

MARKET CHALLENGES

2.14.1.

PRESENCE OF SUBSTITUTE PRODUCTS

2.14.2.

INCIDENCE OF INADEQUATE REIMBURSEMENTS FOR MAMMOGRAPHY

2.14.3.

STRINGENT REGULATORY FRAMEWORK

3.

MAMMOGRAPHY SYSTEM MARKET OUTLOOK - BY PRODUCT

3.1. ANALOG SYSTEM

3.2. DIGITAL SYSTEM

3.3. DIGITAL TOMOSYNTHESIS SYSTEM

4.

MAMMOGRAPHY SYSTEM MARKET OUTLOOK - BY TECHNOLOGY

4.1. 2-D TECHNOLOGY

4.2. 3-D TECHNOLOGY

4.3. COMBINATION TECHNOLOGY

5.

MAMMOGRAPHY SYSTEM MARKET OUTLOOK - BY END-USER

5.1. HOSPITALS

5.2. AMBULATORY CENTERS

5.3. DIAGNOSTIC CENTERS

5.4. OTHER END-USER

6.

MAMMOGRAPHY SYSTEM MARKET - REGIONAL OUTLOOK

6.1. NORTH AMERICA

6.1.1.

MARKET BY PRODUCT

6.1.2.

MARKET BY TECHNOLOGY

6.1.3.

MARKET BY END-USER

6.1.4.

COUNTRY ANALYSIS

6.1.4.1.

THE UNITED STATES

6.1.4.2.

CANADA

6.2. EUROPE

6.2.1.

MARKET BY PRODUCT

6.2.2.

MARKET BY TECHNOLOGY

6.2.3.

MARKET BY END-USER

6.2.4.

COUNTRY ANALYSIS

6.2.4.1.

GERMANY

6.2.4.2.

FRANCE

6.2.4.3.

THE UNITED KINGDOM

6.2.4.4.

ITALY

6.2.4.5.

SPAIN

6.2.4.6.

RUSSIA

6.2.4.7.

REST OF EUROPE

6.3. ASIA-PACIFIC

6.3.1.

MARKET BY PRODUCT

6.3.2.

MARKET BY TECHNOLOGY

6.3.3.

MARKET BY END-USER

6.3.4.

COUNTRY ANALYSIS

6.3.4.1.

CHINA

6.3.4.2.

JAPAN

6.3.4.3.

INDIA

6.3.4.4.

SOUTH KOREA

6.3.4.5.

AUSTRALIA & NEW ZEALAND

6.3.4.6.

ASEAN COUNTRIES

6.3.4.7.

REST OF ASIA-PACIFIC

6.4. LATIN AMERICA

6.4.1.

MARKET BY PRODUCT

6.4.2.

MARKET BY TECHNOLOGY

6.4.3.

MARKET BY END-USER

6.4.4.

COUNTRY ANALYSIS

6.4.4.1.

BRAZIL

6.4.4.2.

MEXICO

6.4.4.3.

REST OF LATIN AMERICA

6.5. MIDDLE EAST AND AFRICA

6.5.1.

MARKET BY PRODUCT

6.5.2.

MARKET BY TECHNOLOGY

6.5.3.

MARKET BY END-USER

6.5.4.

COUNTRY ANALYSIS

6.5.4.1.

SAUDI ARABIA

6.5.4.2.

TURKEY

6.5.4.3.

THE UNITED ARAB EMIRATES

6.5.4.4.

SOUTH AFRICA

6.5.4.5.

REST OF MIDDLE EAST & AFRICA

7.

COMPANY PROFILES

7.1. GENERAL MEDICAL MERATE S.p.A.

7.2. METALTRONICA S.p.A.

7.3. CARESTREAM HEALTH, INC.

7.4. SIEMENS AG

7.5. BMI BIOMEDICAL INTERNATIONAL S.R.L.

7.6. BIO-RAD LABORATORIES, INC.

7.7. FUJIFILM HOLDINGS CORPORATION

7.8. GENERAL ELECTRIC COMPANY

7.9. GENERAL MEDICAL ITALIA

7.10.

KONINKLIJKE PHILIPS N.V.

7.11.

VILLA SISTEMI MEDICALI S.p.A.

7.12.

HOLOGIC, INC.

7.13.

SIEMENS HEALTHINEERS

7.14.

QIAGEN N.V.

7.15.

KONICA MINOLTA, INC.

7.16.

CANON, INC.

7.17.

PLANMED OY

8.

RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.1.1.

OBJECTIVES OF STUDY

8.1.2.

SCOPE OF STUDY

8.2. SOURCES OF DATA

8.2.1.

PRIMARY DATA SOURCES

8.2.2.

SECONDARY DATA SOURCES

8.3. RESEARCH METHODOLOGY

8.3.1.

EVALUATION OF PROPOSED MARKET

8.3.2.

IDENTIFICATION OF DATA SOURCES

8.3.3.

ASSESSMENT OF MARKET DETERMINANTS

8.3.4.

DATA COLLECTION

8.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 2 SCREENING

MAMMOGRAPHY PAYMENT COVERAGE BY AGE GROUP

TABLE 3 BREAST

CANCER INCIDENCE BY COUNTRIES 2016-2021

TABLE 4 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 5 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 6 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 7 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 8 NORTH

AMERICA MAMMOGRAPHY SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 9 NORTH

AMERICA MAMMOGRAPHY SYSTEM MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 10 NORTH

AMERICA MAMMOGRAPHY SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 11 NORTH

AMERICA MAMMOGRAPHY SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 12 EUROPE

MAMMOGRAPHY SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 13 EUROPE

MAMMOGRAPHY SYSTEM MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 14 EUROPE

MAMMOGRAPHY SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 15 EUROPE

MAMMOGRAPHY SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 16 MAMMOGRAPHY

MACHINES IN DIFFERENT COUNTRIES IN THE EUROPE REGION

TABLE 17 ASIA-PACIFIC

MAMMOGRAPHY SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 18 ASIA-PACIFIC

MAMMOGRAPHY SYSTEM MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 19 ASIA-PACIFIC

MAMMOGRAPHY SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 20 ASIA-PACIFIC

MAMMOGRAPHY SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 21 LATIN

AMERICA MAMMOGRAPHY SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 22 LATIN

AMERICA MAMMOGRAPHY SYSTEM MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 23 LATIN

AMERICA MAMMOGRAPHY SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 24 LATIN

AMERICA MAMMOGRAPHY SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 25 MIDDLE

EAST AND AFRICA MAMMOGRAPHY SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 26 MIDDLE

EAST AND AFRICA MAMMOGRAPHY SYSTEM MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 27 MIDDLE

EAST AND AFRICA MAMMOGRAPHY SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 28 MIDDLE

EAST AND AFRICA MAMMOGRAPHY SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 GLOBAL

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 2 PATENT

OUTLOOK OF MAMMOGRAPHY SYSTEM MARKET

FIGURE 3 TIMELINE

OF MAMMOGRAPHY SYSTEM

FIGURE 4 MAMMOGRAPHY

SYSTEM COMPANY MARKET SHARE OUTLOOK 2018 (%)

FIGURE 5 GLOBAL

INCIDENCE OF BREAST CANCER IN ELDERLY WOMEN ABOVE 65 YEARS OF AGE

FIGURE 6 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY ANALOG SYSTEM 2019-2027 ($ MILLION)

FIGURE 7 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY DIGITAL SYSTEM 2019-2027 ($ MILLION)

FIGURE 8 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY DIGITAL TOMOSYNTHESIS SYSTEM 2019-2027 ($ MILLION)

FIGURE 9 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY 2-D TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 10 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY 3-D TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 11 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY COMBINATION TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 12 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY HOSPITALS 2019-2027 ($ MILLION)

FIGURE 13 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY AMBULATORY CENTERS 2019-2027 ($ MILLION)

FIGURE 14 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY DIAGNOSTIC CENTERS 2019-2027 ($ MILLION)

FIGURE 15 GLOBAL

MAMMOGRAPHY SYSTEM MARKET BY OTHER END-USER 2019-2027 ($ MILLION)

FIGURE 16 THE

UNITED STATES MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 17 CANADA

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 18 GERMANY

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 19 FRANCE

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 20 THE

UNITED KINGDOM MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 21 ITALY

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 22 SPAIN

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 23 RUSSIA

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 24 REST

OF EUROPE MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 25 CHINA

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 26 JAPAN

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 27 INDIA

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 28 SOUTH

KOREA MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 29 AUSTRALIA

& NEW ZEALAND MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 30 ASEAN

COUNTRIES MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 31 REST

OF ASIA-PACIFIC MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 32 BRAZIL

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 33 MEXICO

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 34 REST

OF LATIN AMERICA MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 35 SAUDI

ARABIA MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 36 TURKEY

MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 37 THE

UNITED ARAB EMIRATES MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 38 SOUTH

AFRICA MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 39 REST

OF MIDDLE EAST & AFRICA MAMMOGRAPHY SYSTEM MARKET 2019-2027 ($ MILLION)