Market By End-user, Derivatives And Geography | Forecast 2019-2027

After a detailed analysis, Triton Market Research has concluded that the global methanol market is expected to display an upward trend and is estimated to grow at a CAGR of 5.42% in terms of revenue over the forecast period from 2019 to 2027. The market was assessed to be worth $34547 million in the year 2018 and is predicted to generate a revenue of approximately $56151 million by the year 2027.

Report scope can be customized per your requirements. Request For Customization

Methanol is also known by the names wood alcohol, methyl alcohol and wood spirit. It includes a methyl group (CH3) linked with a hydroxyl group (OH). It’s the simplest form of a long series of organic compounds known as alcohols. Methanol used to be manufactured by the destructive distillation of wood. Today, natural gas, used in the manufacturing of methanol, is being replaced by coal. An alternative method of manufacturing methanol is by solid biomass such as agricultural and industrial waste, in place of syngas.

Within this report from Triton on the methanol market, the market definition and the key insights regarding the industry have been discussed. Also, the market attractiveness matrix, vendor scorecard and Porter’s five force analysis have been studied for the methanol industry.

Market drivers like the rising acceptance of the MTO technology, rise in the demand for petrochemicals, need for conventional transportation fuels and the promotion of methanol as an alternative fuel by the government are fueling the growth of the methanol market. However, the industry is facing restraints like the scarcity of raw materials and the use of fuel grade ethanol or bioethanol instead of methanol which are obstructing the market growth.

Key opportunities like the increase in the demand for bio-based products, the development in technology for biorefining and the application of methanol as a marine fuel can be leveraged by the industry to get towards the projected growth.

Challenges such as the unstable methanol prices, economic slowdown which is hindering the demand for methanol and the regulations & policies are being faced by the industry at this moment.

To get detailed insights on segments, Download Sample Report

Geographies covered for global methanol market are:

• North America: the United States and Canada

• Europe: the United Kingdom, Germany, France, Italy, Spain, the Netherlands, Russia and Rest of Europe

• Asia-Pacific: China, Japan, India, South Korea, Malaysia & Indonesia, Australia & New Zealand and Rest of Asia-Pacific

• Latin America: Brazil, Mexico and Rest of Latin America

• The Middle East and Africa: the United Arab Emirates, Turkey, Saudi Arabia, South Africa and Rest of the Middle East and Africa.

The report on the global methanol market has been segmented as follows:

• End-User:

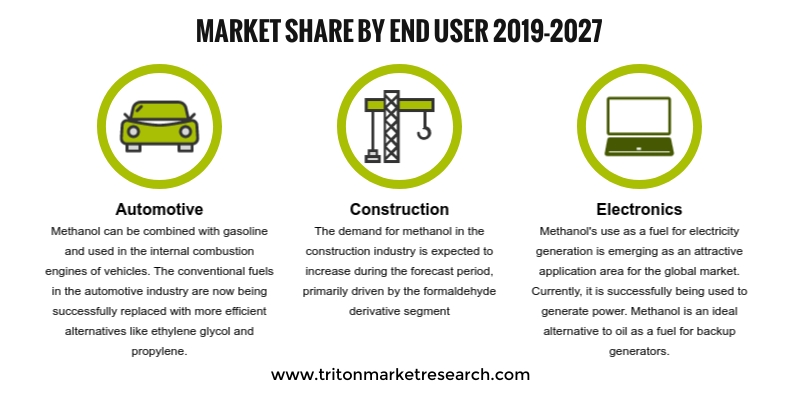

O Automotive

O Construction

O Electronics

O Paints and Coatings

O Others

• Derivatives:

O Formaldehyde

O Acetic acid

O Gasoline

O DME

O MTBE and TAME

O Others

Some of the prominent players in the methanol market are Methanol Holdings (Trinidad), Limited (MHTL), Mitsubishi Chemicals, BASF AG, Teijin, Mitsui & Co Ltd, Valero Marketing and Supply Company, Zagros Petrochemical Company (ZPC), Celanese Corporation, Saudi Basic Industries Corporation, Petroliam Nasional Berhad (PETRONAS), Methanex Corporation and Qatar Fuel Additives Company Limited.

Each of these companies have been strategically analyzed for the methanol market in detail. The company profiles help to get into the information about the key market players in this industry and how much hold they have on the market. In spite of being technologically intensive, the immense growth opportunities are attracting new companies to enter the market and thus accelerate the intensity of competition.

1. GLOBAL

METHANOL MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. AUTOMOTIVE

SECTOR HOLDS THE LARGEST MARKET SHARE

2.2.2. FORMALDEHYDE

IS WIDELY USED DERIVATIVE OF METHANOL

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISING

ACCEPTANCE OF THE MTO TECHNOLOGY

2.6.2. RISE

IN THE DEMAND FOR PETROCHEMICALS

2.6.3. NEED

FOR CONVENTIONAL TRANSPORTATION FUELS

2.6.4. PROMOTION

OF METHANOL AS AN ALTERNATIVE FUEL BY THE GOVERNMENT

2.7. MARKET

RESTRAINTS

2.7.1. SCARCITY

OF RAW MATERIALS

2.7.2. USE

OF FUEL GRADE ETHANOL OR BIOETHANOL INSTEAD OF METHANOL

2.8. MARKET

OPPORTUNITIES

2.8.1. INCREASE

IN THE DEMAND FOR BIO-BASED PRODUCTS

2.8.2. DEVELOPMENT

IN TECHNOLOGY FOR BIOREFINING

2.8.3. APPLICATION

OF METHANOL AS A MARINE FUEL

2.9. MARKET

CHALLENGES

2.9.1. UNSTABLE METHANOL PRICES

2.9.2. ECONOMIC SLOWDOWN HINDERS THE DEMAND FOR

METHANOL

2.9.3. REGULATIONS AND POLICIES

3. METHANOL

MARKET OUTLOOK - BY END-USER

3.1. AUTOMOTIVE

3.2. CONSTRUCTION

3.3. ELECTRONICS

3.4. PAINTS

AND COATINGS

3.5. OTHER

END-USERS

4. METHANOL

MARKET OUTLOOK - BY DERIVATIVES

4.1. FORMALDEHYDE

4.2. ACETIC

ACID

4.3. GASOLINE

4.4. DME

4.5. MTBE

& TAME

4.6. OTHER

DERIVATIVES

5. METHANOL

MARKET - REGIONAL OUTLOOK

5.1. NORTH

AMERICA

5.1.1. MARKET

BY END-USER

5.1.2. MARKET

BY DERIVATIVES

5.1.3. COUNTRY

ANALYSIS

5.1.3.1. UNITED

STATES

5.1.3.2. CANADA

5.2. EUROPE

5.2.1. MARKET

BY END-USER

5.2.2. MARKET

BY DERIVATIVES

5.2.3. COUNTRY

ANALYSIS

5.2.3.1. UNITED

KINGDOM

5.2.3.2. GERMANY

5.2.3.3. FRANCE

5.2.3.4. SPAIN

5.2.3.5. ITALY

5.2.3.6. RUSSIA

5.2.3.7. THE

NETHERLANDS

5.2.3.8. REST

OF EUROPE

5.3. ASIA-PACIFIC

5.3.1. MARKET

BY END-USER

5.3.2. MARKET

BY DERIVATIVES

5.3.3. COUNTRY

ANALYSIS

5.3.3.1. CHINA

5.3.3.2. JAPAN

5.3.3.3. INDIA

5.3.3.4. SOUTH

KOREA

5.3.3.5. MALAYSIA

& INDONESIA

5.3.3.6. AUSTRALIA

& NEW ZEALAND

5.3.3.7. REST

OF ASIA-PACIFIC

5.4. LATIN

AMERICA

5.4.1. MARKET

BY END-USER

5.4.2. MARKET

BY DERIVATIVES

5.4.3. COUNTRY

ANALYSIS

5.4.3.1. BRAZIL

5.4.3.2. MEXICO

5.4.3.3. REST

OF LATIN AMERICA

5.5. MIDDLE

EAST AND AFRICA

5.5.1. MARKET

BY END-USER

5.5.2. MARKET

BY DERIVATIVES

5.5.3. COUNTRY

ANALYSIS

5.5.3.1. UNITED

ARAB EMIRATES

5.5.3.2. TURKEY

5.5.3.3. SAUDI

ARABIA

5.5.3.4. SOUTH

AFRICA

5.5.3.5. REST

OF MIDDLE EAST AND AFRICA

6. COMPETITIVE

LANDSCAPE

6.1. BASF

AG

6.2. CELANESE

CORPORATION

6.3. QATAR

FUEL ADDITIVES COMPANY LIMITED

6.4. METHANOL

HOLDINGS (TRINIDAD) LIMITED (MHTL)

6.5. METHANEX

CORPORATION

6.6. MITSUBISHI

CHEMICALS

6.7. MITSUI

& CO., LTD.

6.8. PETROLIAM

NASIONAL BERHAD (PETRONAS)

6.9. SAUDI

BASIC INDUSTRIES CORPORATION

6.10.

TEIJIN

6.11.

VALERO MARKETING AND SUPPLY

COMPANY

6.12.

ZAGROS PETROCHEMICAL COMPANY

(ZPC)

7. METHODOLOGY

& SCOPE

7.1. RESEARCH

SCOPE

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1: GLOBAL

METHANOL MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: GLOBAL

METHANOL MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 5: GLOBAL

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

TABLE 6: GLOBAL

METHANOL MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 7: NORTH AMERICA

METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 8: NORTH AMERICA

METHANOL MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 9: NORTH AMERICA

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

TABLE 10: EUROPE

METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 11: EUROPE

METHANOL MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 12: EUROPE

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

TABLE 13: ASIA-PACIFIC

METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 14: ASIA-PACIFIC

METHANOL MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 15: ASIA-PACIFIC

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

TABLE 16: LATIN AMERICA

METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 17: LATIN AMERICA

METHANOL MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 18: LATIN AMERICA

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

TABLE 19: MIDDLE EAST

AND AFRICA METHANOL MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 20: MIDDLE EAST

AND AFRICA METHANOL MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 21: MIDDLE EAST

AND AFRICA METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 1: GLOBAL

METHANOL MARKET, BY END-USER, 2018 & 2027 (IN %)

FIGURE 2: GLOBAL AUTOMOTIVE

MARKET FOR METHANOL, 2019-2027 (IN $ MILLION)

FIGURE 3: GLOBAL

FORMALDEHYDE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE

FORCE ANALYSIS

FIGURE 5: GLOBAL

METHANOL MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 6: GLOBAL

METHANOL MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 7: GLOBAL

METHANOL MARKET, BY ELECTRONICS, 2019-2027 (IN $ MILLION)

FIGURE 8: GLOBAL

METHANOL MARKET, BY PAINTS AND COATINGS, 2019-2027 (IN $ MILLION)

FIGURE 9: GLOBAL

METHANOL MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 10: GLOBAL

METHANOL MARKET, BY FORMALDEHYDE, 2019-2027 (IN $ MILLION)

FIGURE 11: GLOBAL

METHANOL MARKET, BY ACETIC ACID, 2019-2027 (IN $ MILLION)

FIGURE 12: GLOBAL

METHANOL MARKET, BY GASOLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: GLOBAL

METHANOL MARKET, BY DME, 2019-2027 (IN $ MILLION)

FIGURE 14: GLOBAL

METHANOL MARKET, BY MTBE & TAME, 2019-2027 (IN $ MILLION)

FIGURE 15: GLOBAL

METHANOL MARKET, BY OTHER DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 16: GLOBAL

METHANOL MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: UNITED

STATES METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: CANADA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: UNITED

KINGDOM METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: GERMANY

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: FRANCE

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: SPAIN

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: ITALY

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: RUSSIA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: THE

NETHERLANDS METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: REST OF

EUROPE METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: CHINA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: JAPAN

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: INDIA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: SOUTH KOREA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: MALAYSIA

& INDONESIA METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: AUSTRALIA

& NEW ZEALAND METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33: REST OF

ASIA-PACIFIC METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 34: BRAZIL

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 35: MEXICO

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 36: REST OF

LATIN AMERICA METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 37: UNITED ARAB

EMIRATES METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 38: TURKEY

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 39: SAUDI ARABIA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 40: SOUTH AFRICA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: REST OF

MIDDLE EAST AND AFRICA METHANOL MARKET, 2019-2027 (IN $ MILLION)