Market By Type, Application, End-users, And Geography | Forecasts 2019-2027

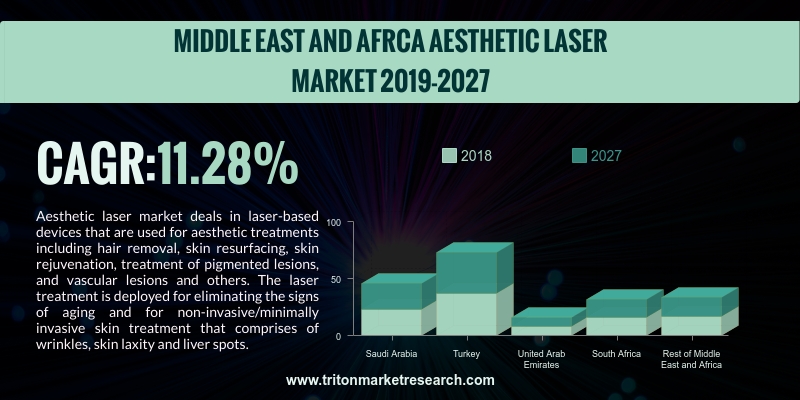

As per Triton's research report, the Middle East & African aesthetic lasers market is anticipated to upsurge with a compound annual growth rate of 11.28% in the forecasting years of 2019-2027.

Aesthetic laser market deals in laser-based devices that are used for aesthetic treatments including hair removal, skin resurfacing, skin rejuvenation, treatment of pigmented lesions, and vascular lesions and others. The laser treatment is deployed for eliminating the signs of aging and for non-invasive/minimally invasive skin treatment that comprises wrinkles, skin laxity and liver spots.

The Middle East & Africa aesthetic lasers market report considers the countries of:

O Saudi Arabia

O Turkey

O The UAE

O South Africa

O Rest of the Middle East & Africa

We provide additional customization based on your specific requirements. Request For Customization

Advancements in medical science and increased importance concerning one’s physical attributes have led many people to opt for cosmetic procedures. Middle Eastern people have taken note of this trend. Liposuction is currently the most sought-after type of cosmetic surgery by women; breast enlargement being the second. Abdominoplasty (or tummy tuck), cosmetic gynecology and nose jobs brought are some of the popular cosmetic procedures.

Islamic law advises one against undergoing cosmetic surgeries. This is the reason why many Muslim women choose to go for less invasive procedures. Botox injections are the most popular non-surgical procedure. Another procedure that has gained popularity is body contouring, that helps tighten the body by removing excess skin and fat without having to undergo surgery.

Triton's report provides detailed information about the market definition, key buying outlook, Porter’s five forces model, aesthetic laser evolution, key insights, vendor scorecard, estimation outlook, regulations and the supply chain outlook.

Some of the companies present in the aesthetic lasers market are Fotona, Strata Skin Sciences, Inc., Cutera, Inc., Inmode Aesthetic Solutions, Sciton, Inc., Sharp Light Technologies, Inc., Lutronic Corporation, Alltec GMBH, Lynton Lasers, Ltd., Aerolase, Cynosure (Acquired by Hologic), Solta Medical (Valeant Pharmaceuticals), Viora, Alma Laser, Inc., Lumenis, Ltd. (acquired by Xio) and Syneron Candela.

1. AESTHETIC

LASER MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTERS

FIVE FORCES MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE PRODUCTS

2.2.3. BARGAINING

POWER OF SUPPLIER

2.2.4. BARGAINING

POWER OF BUYER

2.2.5. INTENSITY

OF COMPETITIVE RIVALRY

2.3. VENDOR

SCORECARD

2.4. AESTHETIC

LASER EVOLUTION

2.5. MARKET

SHARE OUTLOOK

2.6. KEY

BUYING OUTLOOK

2.7. REGULATIONS

2.8. SUPPLY

CHAIN OUTLOOK

2.9. KEY

INSIGHTS

2.10.

MARKET DRIVERS

2.10.1.

CHANGING LIFESTYLE AND

INCREASING DISPOSABLE INCOME

2.10.2.

RISING MEDICAL TOURISM

2.10.3.

SURGING ADOPTION OF

NON-INVASIVE AND MINIMALLY INVASIVE AESTHETIC PROCEDURES

2.11.

MARKET RESTRAINTS

2.11.1.

LIMITATIONS IN LASER SYSTEMS

DEMONSTRATION

2.11.2.

DELUSION RELATED TO THE COSMETIC

SURGERIES

2.11.3.

STRICT GOVERNMENT GUIDELINES

2.12.

MARKET OPPORTUNITIES

2.12.1.

ADVANCEMENTS IN TECHNOLOGY

2.12.2.

LESS PRONE TO HUMAN ERRORS

DURING LASER SURGERIES BY THE SENSORS

USAGE

2.13.

MARKET CHALLENGE

2.13.1.

LARGE MARKET COMPETITION

3. AESTHETIC

LASER INDUSTRY OUTLOOK - BY TYPES

3.1.1. STANDALONE

LASERS

3.1.2. MULTIPLATFORM

LASERS

4. AESTHETIC

LASER INDUSTRY OUTLOOK - BY APPLICATION

4.1.1. HAIR

REMOVAL

4.1.2. SKIN

REJUVENATION

4.1.3. VASCULAR

LESIONS

4.1.4. PIGMENTED

LESION & TATTOO REMOVAL

4.1.5. OTHER

APPLICATIONS

5. AESTHETIC

LASER INDUSTRY OUTLOOK - BY END-USERS

5.1.1. PRIVATE

CLINICS

5.1.2. HOSPITALS

5.1.3. MEDICAL

SPAS

5.1.4. OTHER

END USERS

6. AESTHETIC

LASER INDUSTRY - REGIONAL OUTLOOK

6.1. MIDDLE

EAST AND AFRICA

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. SAUDI

ARABIA

6.1.1.2. TURKEY

6.1.1.3. UNITED

ARAB EMIRATES

6.1.1.4. SOUTH

AFRICA

6.1.1.5. REST

OF MIDDLE EAST AND AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. COMPETITIVE

ANALYSIS

7.2. AEROLASE

7.3. CUTERA

INC.

7.4. ALLTEC

GMBH

7.5. ALMA

LASER INC.

7.6. FOTONA

7.7. INMODE

AESTHETIC SOLUTIONS

7.8. CYNOSURE

(ACQUIRED BY HOLOGIC)

7.9. LYNTON

LASERS LTD

7.10.

LUMENIS LTD. (ACQUIRED BY XIO)

7.11.

LUTRONIC CORPORATION

7.12.

SCITON INC.

7.13.

SOLTA MEDICAL (VALEANT PHARMACEUTICALS)

7.14.

SHARP LIGHT

TECHNOLOGIES INC.

7.15.

VIORA

7.16.

STRATA SKIN SCIENCES INC.

7.17.

SYNERON CANDELA

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE

1 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET 2019-2027 ($ MILLION)

TABLE

2 NEW REGULATIONS FOR MEDICAL

DEVICE

TABLE

3 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE

4 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET BY APPLICATIONS 2019-2027 ($ MILLION)

TABLE

5 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET BY END-USERS 2019-2027 ($ MILLION)

TABLE

6 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET BY COUNTRIES 2019-2027 ($ MILLION)

FIGURE

1 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET 2019-2027 ($ MILLION)

FIGURE

2 EVOLUTION OF AESTHETIC LASER

FIGURE

3 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN STANDALONE LASERS 2019-2027 ($ MILLION)

FIGURE

4 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN MULTIPLATFORM LASERS 2019-2027 ($ MILLION)

FIGURE

5 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN HAIR REMOVAL 2019-2027 ($ MILLION)

FIGURE

6 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN SKIN REJUVENATION 2019-2027 ($ MILLION)

FIGURE

7 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN VASCULAR LESIONS 2019-2027 ($ MILLION)

FIGURE

8 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN PIGMENTED LESION & TATTOO REMOVAL 2019-2027 ($ MILLION)

FIGURE

9 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE

10 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN PRIVATE CLINICS 2019-2027 ($ MILLION)

FIGURE

11 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN HOSPITALS 2019-2027 ($ MILLION)

FIGURE

12 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN MEDICAL SPAS 2019-2027 ($ MILLION)

FIGURE

13 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET IN OTHER END USER 2019-2027 ($ MILLION)

FIGURE

14 MIDDLE EAST AND AFRICA AESTHETIC

LASER MARKET 2019-2027 ($ MILLION)

FIGURE

15 SAUDI ARABIA AESTHETIC LASER MARKET

2019-2027($ MILLION)

FIGURE

16 TURKEY AESTHETIC LASER MARKET

2019-2027($ MILLION)

FIGURE

17 UNITED ARAB EMIRATES AESTHETIC LASER

MARKET 2019-2027($ MILLION)

FIGURE

18 SOUTH AFRICA AESTHETIC LASER MARKET

2019-2027($ MILLION)

FIGURE

19 REST OF MIDDLE EAST AND AFRICA

AESTHETIC LASER MARKET 2019-2027($ MILLION)