Market By Demographics, Products, Devices, Services And Geography | Forecast 2019-2027

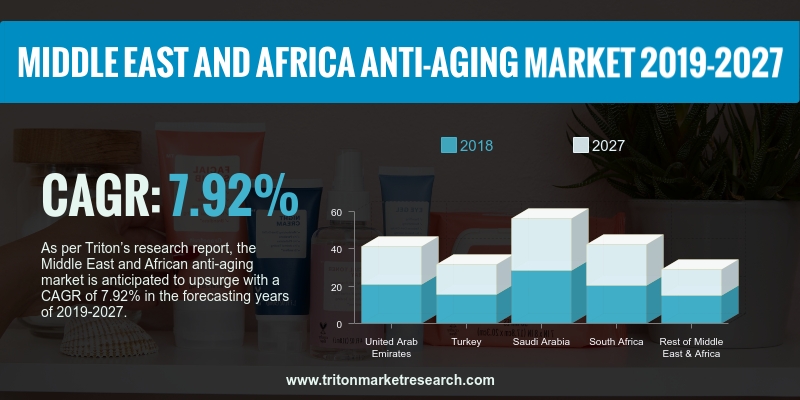

As per Triton’s research report, the Middle East and African anti-aging market is anticipated to upsurge with a CAGR of 7.92% in the forecasting years of 2019-2027.

The countries included in the report on the anti-aging market in the Middle East and Africa are:

• The United Arab Emirates

• South Africa

• Saudi Arabia

• Turkey

• Rest of MEA

The UAE is a major leader in developing skincare products among the countries of the Middle East and Africa. The hot and sunny climate of the country acts as a driving force bolstering the massive demand for anti-aging devices that fight against the signs of premature skin aging and photo-aging. The rise in technological & scientific innovations in the aesthetic sector of the country also acts as a prominent driver for the anti-aging devices market of the UAE. The young population of the country aged between 25 and 40 years constitutes the majority of the anti-aging device customers. These consumers mainly prefer treatments that provide preventive skin care measures. The country also witnesses considerable adoption of hand-held direct-to-consumer anti-aging devices. Favorable governmental policies and healthcare reforms have facilitated the growth of the UAE anti-aging devices market.

Saudi Arabia is amongst the top countries of the Middle East and Africa working extensively on the development, manufacture and commercialization of anti-aging devices. Increased awareness about the signs of aging, increase in obesity and sedentary routine are fueling the growth of the anti-aging devices market in Saudi Arabia. Additionally, the gradual success of public health policies and socioeconomic development of the country are expected to lead the growth of the market in the upcoming years.

Lumenis Ltd. was established in 1966 and is headquartered in Hakidma, Israel. It deals with the development & manufacturing of minimally-invasive clinical solutions for surgical, ophthalmology and aesthetic markets. The company mainly provides hair removal and skin treatment solutions for wrinkles, burns & scars, leg veins, tattoo removal and others. Lumenis has over 220 registered patents and FDA clearance; it has also installed more than 80,000 systems successfully in over 100 countries worldwide, which makes the company stronger to compete with other market players. Lumenis was acquired by the Chinese company Xio in October 2015.

1.

MIDDLE EAST AND AFRICA ANTI-AGING MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PARENT MARKET ANALYSIS: BEAUTY & PERSONAL

CARE MARKET

2.3. EVOLUTION & TRANSITION OF ANTI-AGING

PRODUCTS, SERVICES & DEVICES

2.4. KEY INSIGHTS

2.4.1. ADVENT OF MULTIFUNCTIONAL PRODUCTS AND UV

ABSORBERS

2.4.2. INCREASING DEMAND FOR ANTI-AGING HAIR CARE

PRODUCTS

2.4.3. HIGH NUMBER OF START-UPS

2.4.4. RISING AWARENESS TOWARDS THE AGING SIGNS

2.5. PORTER’S FIVE FORCE ANALYSIS

2.5.1. BARGAINING POWER OF BUYERS

2.5.2. BARGAINING POWER OF SUPPLIERS

2.5.3. THREAT OF NEW ENTRANTS

2.5.4. THREAT OF SUBSTITUTE

2.5.5. THREAT OF COMPETITIVE RIVALRY

2.6. KEY IMPACT ANALYSIS

2.6.1. BRAND VALUE

2.6.2. PRODUCTS REVIEWS

2.6.3. COST

2.6.4. FORMULATION

2.7. MARKET ATTRACTIVENESS INDEX

2.8. VENDOR SCORECARD

2.9. INDUSTRY COMPONENTS

2.9.1. SUPPLIERS

2.9.2. RESEARCH & DEVELOPMENT

2.9.3. MANUFACTURING/PRODUCTION

2.9.4. DISTRIBUTION & MARKETING

2.9.5. END-USERS

2.10. REGULATORY FRAMEWORK

2.11. MARKET DRIVERS

2.11.1. UPSURGE IN AGING POPULATION

2.11.2. GROWING POPULATION WITH OBESITY

2.11.3. AGGREGATED AWARENESS OF ANTI-AGING PRODUCTS

2.11.4. NOVEL INVENTIONS IN ANTI-AGING TREATMENTS

2.12. MARKET RESTRAINTS

2.12.1. SHIFTING CONSUMER PREFERENCE TOWARDS NATURAL

& ORGANIC PRODUCTS

2.12.2. LOGISTICS CONCERNS

2.12.3. SIDE-EFFECTS OF ANTI-AGING PRODUCTS

2.13. MARKET OPPORTUNITIES

2.13.1. RISING HOUSEHOLD DISPOSABLE INCOME PER CAPITA

2.13.2. ENHANCED MARKETING AND PROMOTION TECHNIQUES

2.13.3. RAPID ADOPTION OF HAIR RESTORATION

TECHNOLOGIES

2.14. MARKET CHALLENGES

2.14.1. ADOPTION OF HOME REMEDIES BY MAJOR PORTION OF

CONSUMERS

2.14.2. STRINGENT GOVERNMENT REGULATIONS REGARDING

COSMETICS AND DEVICES

3.

MIDDLE EAST AND AFRICA ANTI-AGING MARKET OUTLOOK - BY DEMOGRAPHICS

3.1. BABY BOOMERS

3.2. GENERATION X

3.3. GENERATION Y

4.

MIDDLE EAST AND AFRICA ANTI-AGING MARKET OUTLOOK - BY PRODUCTS

4.1. UV ABSORBERS

4.2. ANTI-WRINKLE

4.3. ANTI-STRETCH MARKS

4.4. HAIR COLOR

5.

MIDDLE EAST AND AFRICA ANTI-AGING MARKET OUTLOOK - BY DEVICES

5.1. ANTI-CELLULITE TREATMENT DEVICES

5.2. MICRODERM ABRASION DEVICES

5.3. AESTHETIC LASER DEVICES

5.4. RADIOFREQUENCY DEVICES

6.

MIDDLE EAST AND AFRICA ANTI-AGING MARKET OUTLOOK - BY SERVICES

6.1. ANTI-PIGMENTATION THERAPY

6.2. ADULT ACNE THERAPY

6.3. BREAST AUGMENTATION

6.4. LIPOSUCTION SERVICES

6.5. ABDOMINOPLASTY

6.6. CHEMICAL PEEL

6.7. EYELID SURGERY

6.8. HAIR RESTORATION

6.9. SCLEROTHERAPY

6.10. OTHER SERVICES

7.

MIDDLE EAST AND AFRICA ANTI-AGING MARKET - REGIONAL OUTLOOK

7.1. UNITED ARAB EMIRATES

7.2. TURKEY

7.3. SAUDI ARABIA

7.4. SOUTH AFRICA

7.5. REST OF MIDDLE EAST & AFRICA

8.

COMPETITIVE LANDSCAPE

8.1. LUMENIS LTD. (ACQUIRED BY XIO)

8.2. SOLTA MEDICAL (VALEANT PHARMACEUTICALS)

8.3. ALMA LASERS, INC. (ACQUIRED BY FOSUN PHARMA)

8.4. LUTRONIC CORPORATION

8.5. OLAY (ACQUIRED BY PROCTER & GAMBLE)

8.6. BEIERSDORF (ACQUIRED BY TCHIBO HOLDING AG)

8.7. SYNERON CANDELA

8.8. AVON PRODUCTS, INC.

8.9. COTY, INC.

8.10. PERSONAL MICRODERM

8.11. ALLERGAN PLC

8.12. L’ORÉAL S.A.

8.13. PHOTOMEDEX, INC. (ACQUIRED BY RADIANCY, INC.)

8.14. REVLON

8.15. CYNOSURE (ACQUIRED BY HOLOGIC)

9.

RESEARCH METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE & DELIVERABLES

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

TABLE 2: EVOLUTION & TRANSITION OF ANTI-AGING PRODUCTS, SERVICES

& DEVICES

TABLE 3: PROMINENT START-UPS IN ANTI-AGING MARKET

TABLE 4: VENDOR SCORECARD

TABLE 5: REGULATORY FRAMEWORK

TABLE 6: PRODUCERS GROWTH IN ANTI-AGING MARKET

TABLE 7: REGION WISE GROWTH IN AGING POPULATION, 2015-2050F

TABLE 8: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY DEMOGRAPHICS,

2019-2027 (IN $ MILLION)

TABLE 9: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY PRODUCTS, DEVICES

& SERVICES, 2019-2027 (IN $ MILLION)

TABLE 10: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY PRODUCTS,

2019-2027 (IN $ MILLION)

TABLE 11: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY DEVICES, 2019-2027

(IN $ MILLION)

TABLE 12: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY SERVICES,

2019-2027 (IN $ MILLION)

TABLE 13: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

FIGURE 1: KEY BUYING IMPACT ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: WORLDWIDE GERIATRIC POPULATION (AGED 65 YEARS & ABOVE),

2014-2022 (IN MILLION)

FIGURE 5: COUNTRIES WITH MOST OBESE POPULATION (IN %)

FIGURE 6: PATENT APPLICATIONS RECEIVED FOR ANTI-AGING MOISTURIZERS WITH

NATURAL INGREDIENTS

FIGURE 7: HOUSEHOLD DISPOSABLE INCOME PER CAPITA OF OECD COUNTRIES IN

2017 (IN $)

FIGURE 8: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY BABY BOOMERS,

2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY GENERATION X,

2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY GENERATION Y,

2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY UV ABSORBERS,

2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY ANTI-WRINKLE,

2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY ANTI-STRETCH

MARKS, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY HAIR COLOR,

2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY ANTI-CELLULITE

TREATMENT DEVICES, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY MICRODERM

ABRASION DEVICES, 2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY AESTHETIC LASER

DEVICES, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY RADIOFREQUENCY

DEVICES, 2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY

ANTI-PIGMENTATION THERAPY, 2019-2027 (IN $ MILLION)

FIGURE 20: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY ADULT ACNE

THERAPY, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY BREAST

AUGMENTATION, 2019-2027 (IN $ MILLION)

FIGURE 22: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY LIPOSUCTION

SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 23: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY ABDOMINOPLASTY,

2019-2027 (IN $ MILLION)

FIGURE 24: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY CHEMICAL PEEL,

2019-2027 (IN $ MILLION)

FIGURE 25: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY EYELID SURGERY,

2019-2027 (IN $ MILLION)

FIGURE 26: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY HAIR

RESTORATION, 2019-2027 (IN $ MILLION)

FIGURE 27: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY SCLEROTHERAPY,

2019-2027 (IN $ MILLION)

FIGURE 28: MIDDLE EAST AND AFRICA ANTI-AGING MARKET, BY OTHER SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 29: UNITED ARAB EMIRATES ANTI-AGING MARKET, 2019-2027 (IN $

MILLION)

FIGURE 30: TURKEY ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: SAUDI ARABIA ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: SOUTH AFRICA ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33: REST OF MIDDLE EAST & AFRICA ANTI-AGING MARKET, 2019-2027

(IN $ MILLION)