Market By Vehicle Type, Application, And Geography | Forecast 2019-2027

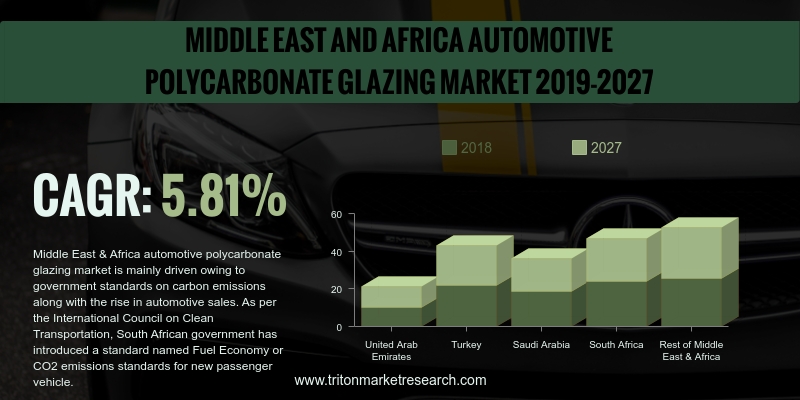

As per a Triton report, the Middle East and African automotive polycarbonate glazing market would upsurge with a CAGR of 5.81% in the projected years of 2019-2027.

The countries reviewed in the report on the Middle East and Africa market for automotive polycarbonate glazing are:

• The United Arab Emirates

• Turkey

• South Africa

• Saudi Arabia

• Rest of MEA

Enhanced aesthetic appeal, improved air ventilation, and better driving experience are factors that have significantly raised the demand for sunroofs in automotives in the United Arab Emirates. Original equipment manufacturers in the country have been using advanced technologies for the manufacture of sunroofs, which includes using composite materials (such as polycarbonates) for the development of lightweight sunroofing solutions, and this leads to a further increase in the demand for sunroofs. The rising consumer inclination towards purchasing vehicles fitted with sunroofs is further contributing to the wide-scale adoption of sunroofs. The usage of lightweight sunroofs helps enhance the efficiency of vehicles, and this is a major factor that has led to the development of the automotive polycarbonate glazing market in the UAE.

The automotive industry in Turkey is projected to witness substantial growth over the forecasting period, which can be attributed to the increasing usage of lightweight composites in vehicular components in a bid to save fuel. The wide-scale usage of polycarbonates, which are a key element used in manufacturing automotive components, is expected to foster the Turkish market growth. Besides, factors such as increased investments, rapid model additions, and facility upgrades, have also been instrumental in fueling the automotive industry in the country, which is expected to raise the demand for polycarbonates, thereby, driving the growth of Turkey’s automotive polycarbonate glazing market.

Founded in 1976, SABIC is a Saudi Arabian public company, with its headquarters in Riyadh. SABIC produces chemicals, agri-nutrients, plastics, commodities, and metals - it is one of the key producers of polyphenylene, polycarbonate, and polyetherimide. LEXAN resin and LEXAN MARGARD FHC10 are some of the company’s prime products. SABIC’s products have been largely adopted by the automotive, aviation, alternative energy, electronics, construction, and healthcare industries. Using its global application technology, the company develops more than 150 polycarbonate and agrinutrient products each year.

1. MIDDLE

EAST AND AFRICA AUTOMOTIVE

POLYCARBONATE GLAZING MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. SIDE

WINDOW IS A RAPIDLY GROWING APPLICATION OF THE AUTOMOTIVE POLYCARBONATE GLAZING

MARKET

2.2.2. PASSENGER

VEHICLE HAS THE MOST PROMINENT SHARE IN THE AUTOMOTIVE POLYCARBONATE GLAZING

MARKET

2.2.3. FRONT

WINDSHIELD IS THE LARGEST APPLICATION

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. KEY

BUYING CRITERIA

2.7. MARKET

DRIVERS

2.7.1. RISING

POPULARITY OF LIGHTWEIGHT GLAZING

2.7.2. STRICT

CARBON EMISSION RULES & REGULATIONS DUE TO CLIMATE CHANGE

2.7.3. INCREASING

APPLICATION OF SUNROOFS IN CARS

2.8. MARKET

RESTRAINTS

2.8.1. REGULATIONS

RELATED TO THE USE OF POLYCARBONATE FOR WINDSCREENS

2.8.2. INCREASING

COST OF AUTOMOTIVE POLYCARBONATE GLAZING

2.9. MARKET

OPPORTUNITIES

2.9.1. RISING

TREND OF THE ELECTRIC VEHICLE MARKET

2.9.2. ADVANCEMENT

IN AUTOMOTIVE DESIGNS

2.10.

MARKET CHALLENGES

2.10.1.

UNSTABLE POLITICAL AND

TERRITORIAL SITUATION

3. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET OUTLOOK - BY VEHICLE TYPE

3.1. PASSENGER

VEHICLE

3.2. COMMERCIAL

VEHICLE

4. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET OUTLOOK - BY APPLICATION

4.1. SIDE

WINDOW

4.2. FRONT

WINDSHIELD

4.3. SUNROOF

4.4. REAR

WINDSHIELD

4.5. LARGE

WINDSCREEN

4.6. HYDROPHOBIC

GLAZING

4.7. HEAD-UP

DISPLAY

4.8. SWITCHABLE

GLAZING

5. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET – MIDDLE EAST AND AFRICA

5.1. THE

UNITED ARAB EMIRATES

5.2. TURKEY

5.3. SAUDI

ARABIA

5.4. SOUTH

AFRICA

5.5. REST

OF MIDDLE EAST & AFRICA

6. COMPETITIVE

LANDSCAPE

6.1. CHI MEI CORPORATION

6.2. IDEMITSU KOSAN CO. LTD

6.3. SABIC

6.4. ENGEL AUSTRIA GMBH

6.5. TEIJIN LTD

6.6. WEBASTO SE

6.7. RENIAS CO., LTD.

6.8. SUMITOMO CHEMICAL CO. LTD

6.9. TRINSEO S.A.

6.10. MITSUBISHI CHEMICAL CORPORATION

6.11. COVESTRO AG

6.12. KRD SICHERHEITSTECHNIK GMBH

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY VEHICLE TYPE, 2019-2027

(IN $ MILLION)

TABLE 4: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY APPLICATION, 2019-2027

(IN $ MILLION)

TABLE 5: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY APPLICATION, 2018 &

2027 (IN %)

FIGURE 2: SIDE WINDOW

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3: PASSENGER

VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: FRONT

WINDSHIELD MARKET, 2019-2027 (IN $ MILLION)

FIGURE 5: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 6: MARKET

ATTRACTIVENESS INDEX

FIGURE 7: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY PASSENGER VEHICLE,

2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COMMERCIAL VEHICLE,

2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SIDE WINDOW, 2019-2027

(IN $ MILLION)

FIGURE 10: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY FRONT WINDSHIELD,

2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SUNROOF, 2019-2027 (IN $

MILLION)

FIGURE 12: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY REAR WINDSHIELD,

2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY LARGE WINDSCREEN,

2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY HYDROPHOBIC GLAZING,

2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY HEAD-UP DISPLAY,

2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SWITCHABLE GLAZING,

2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST

AND AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 18: THE UNITED

ARAB EMIRATES AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: TURKEY

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SAUDI ARABIA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: SOUTH AFRICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: REST OF

MIDDLE EAST & AFRICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN

$ MILLION)