Market By Type, End-users, Technology And Geography | Forecast 2019-2027

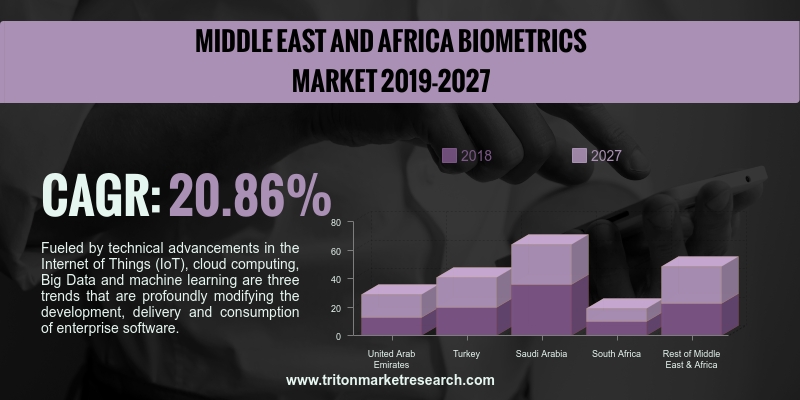

As per Triton’s research report, the Middle East and African biometrics market is anticipated to upsurge with a CAGR of 20.86% in the forecasting years of 2019-2027.

The countries considered in the biometrics market report on the Middle East and Africa are:

• The United Arab Emirates

• Turkey

• Saudi Arabia

• South Africa

• Rest of Middle East & Africa

Saudi Arabia has experienced cyberattacks in the past, such as ‘Shamoon’, which disrupted many organizations. The country is expected to have targeted security attacks owing to the growing number of cybercrimes. The National Cyber Security Centrum (NCSC) of Saudi Arabia has predicted that Advanced Persistent Threat (APT) is one of the primary means used for detecting cyberattacks, emphasizing the need for advanced authentication technologies. According to a MasterCard study, Saudi Arabia has been accelerating its efforts to achieve a cashless economy. With a readiness score of 57, the country has eliminated the primary barriers to achieving this objective. Many investments in the country towards achieving a cashless economy have been taking place.

The Saudi Arabian Monetary Authority (SAMA) has recently agreed to a deal with Ripple, a blockchain provider which enables cashless transactions and cross border payments. This increases the need for better authentication technologies in the country. Companies such as Gemalto have been deploying national ID cards which contain demographics, facial image & fingerprints and can also be used as a travel document. The validity span of the card is 10 years according to the use of such smart cards; they need sophisticated authentication technologies to prevent incidents of phishing attacks. In January 2016, the Saudi Ministry of Interior announced that the buyers of SIM cards would be fingerprinted. These fingerprints will be shared with the National Information Centre to verify identity of the buyer.

Siemens AG is a global technology company with core activities in the areas of automation, electrification and digitization. It offers products, solutions & services for power generation; medical imaging & laboratory diagnostics; oil & gas production and transportation; infrastructure & building technologies; industrial technologies & automation systems; transmission & distribution; mobility & logistics solutions and audiology solutions. The company primarily caters to public utility companies, oil & gas companies, independent power producers, transportation companies, hospitals & diagnostics centres, infrastructure developers and network operators. Siemens has business operations across the Middle East, Europe, Africa, the Commonwealth of the Independent States, the Americas and the Asia-Pacific.

1.

MIDDLE EAST

AND AFRICA BIOMETRICS MARKET - SUMMARY

2.

INDUSTRY

OUTLOOK

2.1. MARKET DEFINITION

2.2. COMPONENTS OF A BIOMETRIC ACCESS CONTROL SYSTEM

2.2.1.

INPUT

EXTRACTION

2.2.2.

TRANSMISSION

& SIGNAL PROCESSING

2.2.3.

QUALITY

ASSESSMENT

2.2.4.

DATA STORAGE

2.3. KEY INSIGHTS

2.3.1.

FAVORABLE

GOVERNMENT INITIATIVES

2.3.2.

INTRODUCTION

OF MULTIMODAL BIOMETRIC TECHNOLOGY

2.3.3.

RAPID ADOPTION

BY BANKING & FINANCIAL SERVICE INDUSTRIES

2.4. PORTER’S FIVE FORCE ANALYSIS

2.4.1.

BARGAINING

POWER OF BUYERS

2.4.2.

BARGAINING

POWER OF SUPPLIERS

2.4.3.

THREAT OF NEW

ENTRANTS

2.4.4.

THREAT OF

SUBSTITUTE

2.4.5.

THREAT OF

COMPETITIVE RIVALRY

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. INDUSTRY COMPONENTS

2.7.1.

CORE

TECHNOLOGY

2.7.2.

PHYSICAL COMPONENTS

MANUFACTURER

2.7.3.

INTEGRATED

BIOMETRIC DEVICES

2.7.4.

MARKETING AND

DISTRIBUTION

2.7.5.

END-USERS

2.8. MARKET DRIVERS

2.8.1.

INCREASED

SAFETY & SECURITY CONCERNS

2.8.2.

RISE IN

IDENTITY THREATS & RELATED COSTS

2.8.3.

IMMENSE

PROLIFERATION OF SMARTPHONES & TABLETS WITH BIOMETRIC CAPABILITIES

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COST OF

TECHNOLOGY

2.9.2.

DIFFICULTIES

IN INTEGRATING BIOMETRICS INTO EXISTING SOFTWARE

2.10. MARKET OPPORTUNITIES

2.10.1.

THRIVING

E-COMMERCE INDUSTRY

2.10.2.

EMERGENCE OF

E-PASSPORT

2.11. MARKET CHALLENGES

2.11.1.

TECHNICAL

LIMITATIONS ASSOCIATED WITH BIOMETRIC TECHNOLOGY

2.11.2.

DATA SECURITY

& PRIVACY ISSUES

3.

MIDDLE EAST

AND AFRICA BIOMETRICS MARKET OUTLOOK – BY TYPE

3.1. FIXED

3.2. MOBILE

4.

MIDDLE EAST

AND AFRICA BIOMETRICS MARKET OUTLOOK – BY END-USERS

4.1. GOVERNMENT

4.2. TRANSPORTATION

4.3. BFSI

4.4. HEALTHCARE

4.5. IT & TELECOMMUNICATION

4.6. RETAIL

4.7. OTHER END-USERS

5.

MIDDLE EAST

AND AFRICA BIOMETRICS MARKET OUTLOOK – BY TECHNOLOGY

5.1. FINGERPRINT RECOGNITION

5.2. IRIS RECOGNITION

5.3. FACIAL RECOGNITION

5.4. HAND GEOMETRY

5.5. VEIN ANALYSIS

5.6. VOICE RECOGNITION

5.7. DNA ANALYSIS

5.8. GAIT

5.9. EEG/ECG

5.10. OTHER TECHNOLOGIES

6.

MIDDLE EAST

AND AFRICA BIOMETRICS MARKET – REGIONAL OUTLOOK

6.1. UNITED ARAB EMIRATES

6.2. TURKEY

6.3. SAUDI ARABIA

6.4. SOUTH AFRICA

6.5. REST OF MIDDLE EAST & AFRICA

7.

COMPETITIVE

LANDSCAPE

7.1. AWARE, INC.

7.2. BIO-KEY INTERNATIONAL, INC.

7.3. CROSSMATCH TECHNOLOGIES, INC.

7.4. FINGERPRINT CARDS AB

7.5. FUJITSU LIMITED

7.6. FULCRUM BIOMETRICS LLC

7.7. GEMALTO N.V.

7.8. HID GLOBAL CORPORATION

7.9. IMAGEWARE SYSTEMS

7.10. IRIS ID SYSTEMS, INC.

7.11. M2SYS TECHNOLOGIES, INC.

7.12. NEC CORPORATION

7.13. NUANCE COMMUNICATIONS, INC.

7.14. IDEMIA FRANCE S.A.S. (SAFRAN IDENTITY & SECURITY S.A.S.)

7.15. PRECISE BIOMETRICS AB

7.16. SIEMENS AG

8.

RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

TABLE 2: GOVERNMENT INITIATIVES & POLICIES RELATED TO BIOMETRICS

TABLE 3: VENDOR SCORECARD

TABLE 4: INSTANCES OF IDENTITY THEFTS IN KEY GEOGRAPHIES, 2017

TABLE 5: SOME OF THE PROMISING E-PASSPORT PROJECTS

TABLE 6: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY TYPE, 2019-2027

(IN $ MILLION)

TABLE 7: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY END-USERS,

2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY TECHNOLOGY,

2019-2027 (IN $ MILLION)

TABLE 9: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

FIGURE 1: BASIC COMPONENTS OF BIOMETRIC AUTHENTICATION SYSTEMS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: INTERNAL PROCESS FOR IDENTIFICATION BY BIOMETRIC TECHNOLOGY

FIGURE 5: AVERAGE CYBERCRIME COST IN KEY GEOGRAPHIES, AUGUST 2017 (IN $

MILLION)

FIGURE 6: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY FIXED, 2019-2027

(IN $ MILLION)

FIGURE 7: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY MOBILE, 2019-2027

(IN $ MILLION)

FIGURE 8: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY GOVERNMENT, 2019-2027

(IN $ MILLION)

FIGURE 9: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY TRANSPORTATION,

2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY BFSI, 2019-2027

(IN $ MILLION)

FIGURE 11: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY HEALTHCARE,

2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY IT &

TELECOMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY RETAIL,

2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY OTHER END-USERS,

2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY FINGERPRINT

RECOGNITION, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY IRIS

RECOGNITION, 2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY FACIAL

RECOGNITION, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY HAND GEOMETRY,

2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY VEIN ANALYSIS,

2019-2027 (IN $ MILLION)

FIGURE 20: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY VOICE

RECOGNITION, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY DNA ANALYSIS,

2019-2027 (IN $ MILLION)

FIGURE 22: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY GAIT, 2019-2027

(IN $ MILLION)

FIGURE 23: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY EEG/ECG,

2019-2027 (IN $ MILLION)

FIGURE 24: MIDDLE EAST AND AFRICA BIOMETRICS MARKET, BY OTHER

TECHNOLOGIES, 2019-2027 (IN $ MILLION)

FIGURE 25: UNITED ARAB EMIRATES BIOMETRICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 26: TURKEY BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: SAUDI ARABIA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: SOUTH AFRICA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: REST OF MIDDLE EAST & AFRICA BIOMETRICS MARKET, 2019-2027

(IN $ MILLION)