Market By Type, Cable Type, Material, Application And Geography | Forecast 2019-2027

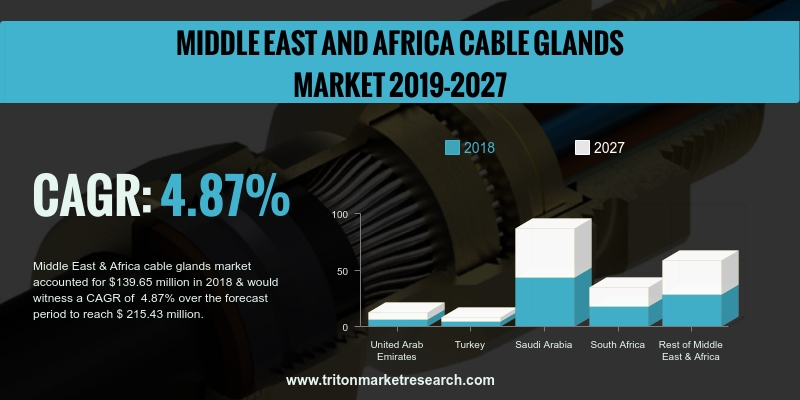

As per a research report by Triton, the Middle East and Africa’s market for cable glands would upsurge with a CAGR of 4.87% in the forecast years from 2019-2027.

The countries scrutinized in the Middle East and Africa cable glands market are:

• The United Arab Emirates

• Turkey

• South Africa

• Saudi Arabia

• Rest of MEA

Report Scope Can Be Customized Per Your Requirements. Request for Customization

The mining industry in South Africa is flourishing, owing to which, the cable glands market in the country is showcasing steady growth. South Africa has abundant mineral resources, and as a result, mining has become one of the fastest-growing industries in the country. The untapped South African market possesses 40% of the world’s known resources, with approximately 36,000 tons of undeveloped resources. South Africa boasts of an extremely high level of technical & production expertise and extensive R&D activities, along with world-class primary processing facilities for aluminum, platinum, gold, stainless steel and carbon steel.

Moreover, the country’s diversified manufacturing base showcases its resilience and potential to compete at the global level. Agro-processing, metals, chemicals, automotive, electronics, information & communication technology, and textiles, clothing & footwear are some of the dominant industries in South Africa. Experts have forecast the manufacturing sector in South Africa to double its output in 2025, which will make it one of the most lucrative industries to work in. The proliferation of the manufacturing industry is thus expected to fuel the demand for cable glands in the country, propelling the growth of the South African cable glands market.

ABB Ltd. is a multinational company providing power and automation technologies. The company offers products, services, solutions and systems to increase power reliability, improve energy efficiency and enhance productivity. It caters to both, the industrial, as well as, commercial customers. The company operates in Europe, the Middle East and Africa, the Americas and Asia. EXCG Series, NPG Quick-Connect™ Series, MSG Series, FSCG Series are the series of cable gland products the company provides. The company generated revenues worth US$ 8,889 million for the second quarter that ended June 2018, depicting an increase of 3% over the previous quarter.

1. MIDDLE

EAST AND AFRICA CABLE GLANDS MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. RISING

DEMAND FOR HAZARDOUS CABLE GLANDS

2.2.2. SWELLING

DEMAND FOR CABLE CONNECTORS IN THE AEROSPACE SECTOR

2.3. PORTERS

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. SCALABILITY

2.4.3. EASE

OF USE

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. MARKET

DRIVERS

2.7.1. GOVERNMENT

REGULATIONS FUEL THE DEMAND FOR CABLE GLANDS

2.7.2. RESTORATION

OF ELECTRICAL NETWORKS IN SEVERAL REGIONS

2.7.3. RISE

IN CONSTRUCTION UNDERTAKINGS IN DEVELOPING REGIONS

2.7.4. WIDE

ADOPTION OF AUTOMATION

2.8. MARKET

RESTRAINTS

2.8.1. VARIABILITY

IN RAW MATERIAL PRICES

2.9. MARKET

OPPORTUNITIES

2.9.1. EMERGING

GROWTH IN BUDDING MARKETS

2.9.2. SURGE

IN COUNT OF DATA CENTERS

2.10. MARKET

CHALLENGES

2.10.1.

SUSPENSION OF THE LOCAL

MARKETS

3. MIDDLE

EAST AND AFRICA CABLE GLANDS MARKET OUTLOOK – BY TYPE

3.1. INDUSTRIAL

3.2. HAZARDOUS

3.2.1. INCREASED

SAFETY

3.2.2. FLAME-PROOF

3.2.3. EMC

CABLE GLANDS

3.2.4. OTHERS

4. MIDDLE

EAST AND AFRICA CABLE GLANDS MARKET OUTLOOK – BY CABLE TYPE

4.1. ARMORED

4.2. UNARMORED

5. MIDDLE

EAST AND AFRICA CABLE GLANDS MARKET OUTLOOK – BY MATERIAL

5.1. BRASS

5.2. STAINLESS

STEEL

5.3. PLASTIC/NYLON

5.4. OTHERS

6. MIDDLE

EAST AND AFRICA CABLE GLANDS MARKET OUTLOOK – BY APPLICATION

6.1. OIL

& GAS

6.2. MINING

6.3. AEROSPACE

6.4. MANUFACTURING

& PROCESSING

6.5. CHEMICAL

6.6. OTHERS

7. MIDDLE

EAST AND AFRICA CABLE GLANDS MARKET – REGIONAL OUTLOOK

7.1. MIDDLE

EAST AND AFRICA

7.1.1. UNITED

ARAB EMIRATES

7.1.2. TURKEY

7.1.3. SAUDI

ARABIA

7.1.4. SOUTH

AFRICA

7.1.5. REST

OF MIDDLE EAST & AFRICA

8. COMPETITIVE

LANDSCAPE

8.1. ABB

LTD.

8.2. AMPHENOL

CORPORATION

8.3. EATON

CORPORATION

8.4. EMERSON

ELECTRIC CO.

8.5. HUBBEL INCORPORATED

8.6. THOMAS

& BETTS

8.7. CMP

PRODUCTS LTD.

8.8. CORTEM

S.p.A

8.9. BARTEC

8.10. JACOB

GMBH

8.11. SEALCON

LLC

8.12. R.

STAHL AG

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 5: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY CABLE TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY MATERIAL, 2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 9: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY TYPE, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 3: KEY BUYING

IMPACT ANALYSIS

FIGURE 4: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY INDUSTRIAL, 2019-2027 (IN $ MILLION)

FIGURE 5: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN $ MILLION)

FIGURE 6: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY INCREASED SAFETY, 2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY FLAME-PROOF, 2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY EMC CABLE GLANDS, 2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY ARMORED, 2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY UNARMORED, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY BRASS, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY STAINLESS STEEL, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY PLASTIC/NYLON, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY OIL & GAS, 2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY MINING, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY AEROSPACE, 2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY MANUFACTURING & PROCESSING, 2019-2027

(IN $ MILLION)

FIGURE 20: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY CHEMICAL, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 22: MIDDLE EAST

AND AFRICA CABLE GLANDS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 23: UNITED ARAB

EMIRATES CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: TURKEY CABLE

GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: SAUDI ARABIA

CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: SOUTH AFRICA

CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: REST OF

MIDDLE EAST & AFRICA CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)