Market By Display Type, Technology, Application, Industry Vertical, And Geography | Forecast 2019-2027

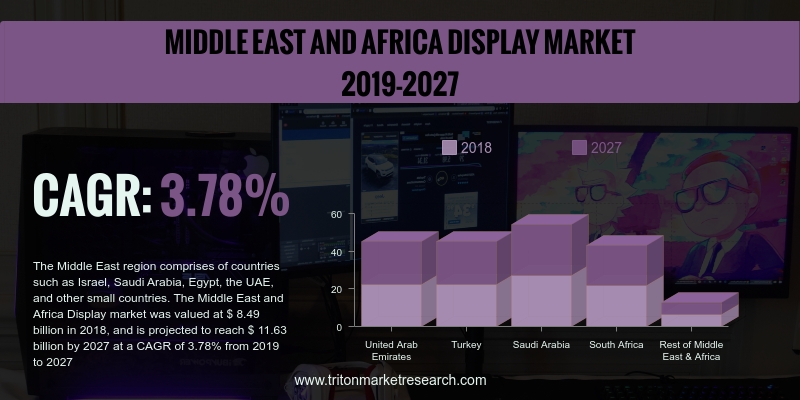

As per a Triton report, the display market in the Middle East and African region would exhibit revenue growth, with a CAGR of 3.78% during the forecast years from 2019 to 2027.

The countries reviewed in the Middle East and Africa display market report are:

• The United Arab Emirates

• Turkey

• Saudi Arabia

• South Africa

• Rest of the MEA

Report scope can be customized per your requirements. Request For Customization

In the Middle East and Africa region, the growing number of middle-class consumers and the increase in the youth population are providing companies potential for the growth of the display market. Given the economic inequality in the region, electronic product manufacturers, in a bid to cater to the large, diverse consumer group, have devised various strategies to market their products. There is an increasingly high demand for smartphones in the world, and this is the primary driving factor for the industry growth in this region. There exist several opportunities for the growth of the smartphone market in the less economically developed nations in the near future, and it is indicated it would grow at a rapid rate in the coming years.

The volume sales of mobile phones sold across retail outlets are significantly larger than other portable consumer electronic devices. The surge in the sales of mobile phones can be attributed to the rising demand for smartphones; whereas, the demand for phones with simpler features is witnessing a downfall. The growth in the population’s disposable incomes, enhanced internet availability, reduction in internet connection prices, and better quality coverage are primarily aiding the growth of smartphones in the MEA region. The growth of the smartphone market is thus expected to strengthen the growth of the display market in the Middle East and Africa over the forecasting period.

LG Display Co., Ltd. is known for its innovative displays. Displays manufactured by the company have found applications in the automotive sector and for commercial purposes. The company has been making substantial investments in the R&D of advanced technologies such as thin-film and flexible-panel displays. With over 53,000 employees, LG Display Co., Ltd. operates across Latin America, the Asia-Pacific, the Middle East, Africa, North America, and Europe. In May 2018, the company launched the LG G7 ThinQ, incorporated with micro-LED. In November, in the same year, LG Display entered into a collaboration with Apple for the supply of OLED panels.

1. MIDDLE

EAST AND AFRICA DISPLAY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. VEHICLE

DISPLAY IS A RAPIDLY GROWING APPLICATION IN THE DISPLAY MARKET

2.2.2. FLAT-PANEL

DISPLAY IS THE LARGEST DISPLAY TYPE DURING THE FORECAST PERIOD

2.2.3. CONSUMER

ELECTRONICS IS THE LARGEST INDUSTRIAL VERTICAL USING DISPLAYS DURING THE FORECAST

PERIOD

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISING

DEMAND FOR OLED DEVICES

2.6.2. INCREASING

DEMAND FOR TOUCH-BASED DEVICES

2.7. MARKET

RESTRAINTS

2.7.1. STAGNATION

IN THE GROWTH OF DESKTOP PC, NOTEBOOK AND TABLET

2.7.2. INCREASING

COST OF CERTAIN DISPLAY TECHNOLOGIES

2.8. MARKET

OPPORTUNITIES

2.8.1. INCREASING

USE OF AR/VR DEVICES

2.9. MARKET

CHALLENGES

2.9.1. UNSTABLE

PRICING OF DISPLAY PANELS

3. DISPLAY

MARKET OUTLOOK – BY DISPLAY TYPE

3.1. FLAT-PANEL

DISPLAY

3.2. FLEXIBLE-PANEL

DISPLAY

3.3. TRANSPARENT-PANEL

DISPLAY

4. DISPLAY

MARKET OUTLOOK – BY TECHNOLOGY

4.1. OLED

4.2. QUANTUM

DOT

4.3. LED

4.4. LCD

4.5. E-PAPER

4.6. OTHER

TECHNOLOGIES

5. DISPLAY

MARKET OUTLOOK – BY APPLICATION

5.1. SMARTPHONE

& TABLET

5.2. SMART

WEARABLE

5.3. TELEVISION

& DIGITAL SIGNAGE

5.4. PC

& LAPTOP

5.5. VEHICLE

DISPLAY

5.6. OTHER

APPLICATIONS

6. DISPLAY

MARKET OUTLOOK – BY INDUSTRY VERTICAL

6.1. HEALTHCARE

6.2. CONSUMER

ELECTRONICS

6.3. BFSI

6.4. RETAIL

6.5. MILITARY

& DEFENSE

6.6. AUTOMOTIVE

6.7. OTHER

INDUSTRY VERTICALS

7. DISPLAY

MARKET – MIDDLE EAST AND AFRICA

7.1. THE

UNITED ARAB EMIRATES

7.2. TURKEY

7.3. SAUDI

ARABIA

7.4. SOUTH

AFRICA

7.5. REST

OF MIDDLE EAST & AFRICA

8. COMPETITIVE

LANDSCAPE

8.1. AU

OPTRONICS CORP.

8.2. CORNING

INCORPORATED

8.3. E

INK HOLDINGS INC.

8.4. HANNSTAR

DISPLAY CORPORATION

8.5. JAPAN

DISPLAY INC.

8.6. KENT

DISPLAYS, INC.

8.7. LG

DISPLAY

8.8. NEC

DISPLAY SOLUTIONS, LTD.

8.9. SAMSUNG

ELECTRONICS CO., LTD.

8.10.

SONY CORPORATION

9. RESEARCH

METHODOLOGY & SCOPE

9.1. RESEARCH

SCOPE & DELIVERABLES

9.1.1. OBJECTIVES

OF STUDY

9.1.2. SCOPE

OF STUDY

9.2. SOURCES

OF DATA

9.2.1. PRIMARY

DATA SOURCES

9.2.2. SECONDARY

DATA SOURCES

9.3. RESEARCH

METHODOLOGY

9.3.1. EVALUATION

OF PROPOSED MARKET

9.3.2. IDENTIFICATION

OF DATA SOURCES

9.3.3. ASSESSMENT

OF MARKET DETERMINANTS

9.3.4. DATA

COLLECTION

9.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY COUNTRY, 2019-2027 (IN $ BILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY DISPLAY TYPE, 2019-2027 (IN $ BILLION)

TABLE 4: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY TECHNOLOGY, 2019-2027 (IN $ BILLION)

TABLE 5: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY APPLICATION, 2019-2027 (IN $ BILLION)

TABLE 6: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY INDUSTRY VERTICAL, 2019-2027 (IN $ BILLION)

TABLE 7: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY COUNTRY, 2019-2027 (IN $ BILLION)

FIGURE 1: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: MIDDLE EAST

AND AFRICA VEHICLE DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 3: MIDDLE EAST

AND AFRICA FLAT-PANEL DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 4: MIDDLE EAST

AND AFRICA CONSUMER ELECTRONICS MARKET, 2019-2027 (IN $ BILLION)

FIGURE 5: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 6: MARKET

ATTRACTIVENESS INDEX

FIGURE 7: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY FLAT-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 8: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY FLEXIBLE-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 9: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY TRANSPARENT-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 10: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY OLED, 2019-2027 (IN $ BILLION)

FIGURE 11: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY QUANTUM DOT DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 12: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY LED, 2019-2027 (IN $ BILLION)

FIGURE 13: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY LCD, 2019-2027 (IN $ BILLION)

FIGURE 14: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY E-PAPER, 2019-2027 (IN $ BILLION)

FIGURE 15: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY OTHER TECHNOLOGIES, 2019-2027 (IN $ BILLION)

FIGURE 16: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY SMARTPHONE & TABLET, 2019-2027 (IN $ BILLION)

FIGURE 17: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY SMART WEARABLE, 2019-2027 (IN $ BILLION)

FIGURE 18: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY TELEVISION & DIGITAL SIGNAGE, 2019-2027 (IN $

BILLION)

FIGURE 19: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY PC & LAPTOP, 2019-2027 (IN $ BILLION)

FIGURE 20: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY VEHICLE DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 21: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ BILLION)

FIGURE 22: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY HEALTHCARE, 2019-2027 (IN $ BILLION)

FIGURE 23: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY CONSUMER ELECTRONICS, 2019-2027 (IN $ BILLION)

FIGURE 24: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY BFSI, 2019-2027 (IN $ BILLION)

FIGURE 25: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY RETAIL, 2019-2027 (IN $ BILLION)

FIGURE 26: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY MILITARY & DEFENSE, 2019-2027 (IN $ BILLION)

FIGURE 27: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ BILLION)

FIGURE 28: MIDDLE EAST

AND AFRICA DISPLAY MARKET, BY OTHER INDUSTRY VERTICALS, 2019-2027 (IN $

BILLION)

FIGURE 29: MIDDLE EAST

AND AFRICA DISPLAY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 30: THE UNITED

ARAB EMIRATES DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 31: TURKEY

DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 32: SAUDI ARABIA

DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 33: SOUTH AFRICA

DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 34: REST OF

MIDDLE EAST & AFRICA DISPLAY MARKET, 2019-2027 (IN $ BILLION)