Market By Insulation Type, Mounting, Phase And Geography | Forecasts 2019-2027

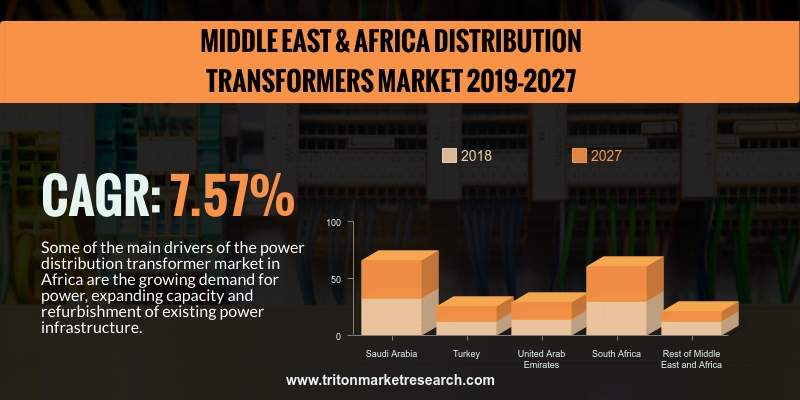

As per Triton's research report, the Middle East & African distribution transformers market is anticipated to upsurge with a CAGR of 7.87% in the forecasting years of 2019-2027.

The Middle East & Africa market report on distribution transformers considers countries:

O The UAE

O Turkey

O South Africa

O Saudi Arabia

O Rest of the Middle East & Africa

Some of the main drivers of the power distribution transformer market in Africa are the growing demand for power, expanding capacity and refurbishment of existing power infrastructure. Sub-Saharan Africa is starved of electricity. A large amount of the power infrastructure in Africa is underdeveloped. A majority of the economies in Africa are either undergoing change or are poorly developed and thus, improving the power infrastructure will be of prime importance for the forecasted period.

We provide additional customization based on your specific requirements. Request For Customization

The digital transformation of utilities in the distribution transformer refers to the collaboration of real-time entities and integrating the system to a cloud platform into the distribution transformers. Collaborating such technologies into the system would enable the maintenance staff to monitor faults efficiently. The introduction of smart grids, an electricity supply network that uses the digital platform to detect a change in local usage creates great opportunities for the growth of the distribution transformer market.

Transformers are a vital part of the power system. Their reliable operation and on-time delivery have a direct effect on the demand for the distribution transformers. Ineffective planning for installing transformer and operations have proven to be challenging for the growth of the distribution transformer market.

Triton's report on the distribution transformers market provides information about Porter’s five force model, market definition, key market insights and the key buying outlook.

Lemi Trafo JSC, Kirloskar Electric Company Limited, Areva SA, Hammond Power Solutions, Inc., CelME SRL, Wilson Power Solutions, Schneider Electric, Siemens AG, Ormazabal Velatia, Emerson Electric Co., Hitachi, Ltd., Bowers Electrical, Ltd., Crompton Greaves Ltd., Brush Electrical Machines, Ltd., Eaton Corporation PLC, ABB Ltd., General Electric, Hyosung Corporation and Starkstrom Gerätebau GMBH are the companies that have been exhaustively profiled in this report.

1. DISTRIBUTION

TRANSFORMERS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCE MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. BARGAINING

POWER OF BUYERS

2.2.3. BARGAINING

POWER OF SUPPLIERS

2.2.4. THREAT

OF SUBSTITUTE PRODUCTS

2.2.5. COMPETITIVE

RIVALRY BETWEEN EXISTING PLAYERS

2.3. KEY

MARKET INSIGHTS

2.4. KEY

BUYING OUTLOOK

2.5. MARKET

DRIVERS

2.5.1. INCREASING

FOCUS ON ELECTRICAL SAFETY AND ENVIRONMENTAL PROTECTION

2.5.2. IMPLEMENTATION

OF SMART GRID ELECTRIFYING THE MARKET

2.5.3. TECHNOLOGICAL

ADVANCEMENT IN TRANSFORMER INDUSTRY

2.6. MARKET

RESTRAINTS

2.6.1. FAILURE

OF ELECTRICITY IN DISTRIBUTION TRANSFORMER

2.6.2. EQUIPMENT

STANDARDIZATION

2.7. MARKET

OPPORTUNITIES

2.7.1. RENEWABLE

GENERATION OF ENERGY CREATES OPPORTUNITY FOR MIDDLE EAST AND AFRICA

DISTRIBUTION TRANSFORMER MARKET

2.7.2. COLLABORATION

OF TECHNOLOGIES INTO THE DIGITAL TRANSFORMER SYSTEM

2.8. MARKET

CHALLENGES

2.8.1. INEFFICIENCIES

IN OPERATIONS OF TRANSFORMERS

3. DISTRIBUTION

TRANSFORMERS INDUSTRY OUTLOOK - BY INSULATION TYPE

3.1. DRY

TYPE

3.2. OIL-FILLED

4. DISTRIBUTION

TRANSFORMERS INDUSTRY OUTLOOK - BY MOUNTING

4.1. PAD-

MOUNTED

4.2. POLE-MOUNTED

4.3. UNDERGROUND

VAULT

5. DISTRIBUTION

TRANSFORMERS INDUSTRY OUTLOOK - BY PHASE

5.1. SINGLE-PHASE

5.2. THREE-PHASE

6. DISTRIBUTION

TRANSFORMER INDUSTRY – MIDDLE EAST AND AFRICA

6.1. COUNTRY

ANALYSIS

6.1.1. SAUDI

ARABIA

6.1.2. TURKEY

6.1.3. UNITED

ARAB EMIRATES

6.1.4. SOUTH

AFRICA

6.1.5. REST

OF MIDDLE EAST AND AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. ABB

LTD.

7.2. AREVA

SA

7.3. BOWERS

ELECTRICAL LTD.

7.4. BRUSH

ELECTRICAL MACHINES LTD.

7.5. CELME SRL

7.6. CROMPTON

GREAVES LTD.

7.7. EATON

CORPORATION PLC

7.8. EMERSON

ELECTRIC CO.

7.9. GENERAL

ELECTRIC

7.10.

HAMMOND POWER SOLUTIONS, INC.

7.11.

HITACHI LTD.

7.12.

HYOSUNG CORPORATION

7.13.

KIRLOSKAR ELECTRIC COMPANY

LIMITED

7.14.

LEMI TRAFO JSC

7.15.

ORMAZABAL VELATIA

7.16.

SIEMENS AG

7.17.

SCHNEIDER ELECTRIC

7.18.

STARKSTROM GERÄTEBAU GMBH

7.19.

WILSON POWER SOLUTIONS

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

RESEARCH METHODOLOGY

TABLE 1 MIDDLE EAST AND AFRICA DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)

TABLE 2 THREAT OF NEW ENTRANTS ANALYSIS IN

DISTRIBUTION TRANSFORMERS MARKET

TABLE 3 BARGAINING POWER OF BUYER ANALYSIS IN

DISTRIBUTION TRANSFORMERS MARKET

TABLE 4 BARGAINING POWER OF SUPPLIERS ANALYSIS

IN DISTRIBUTION TRANSFORMERS MARKET

TABLE 5 THREAT OF SUBSTITUTE PRODUCTS ANALYSIS

IN DISTRIBUTION MARKET

TABLE 6 COMPETITIVE RIVALRY BETWEEN EXISTING

PLAYERS IN DISTRIBUTION TRANSFORMERS MARKET

TABLE 7 CAUSES OF FAILURES IN DISTRIBUTION

TRANSFORMER

TABLE 8 MIDDLE EAST AND AFRICA DISTRIBUTION

TRANSFORMER BY INSULATION TYPE 2019-2027 ($ MILLION)

TABLE 9 MIDDLE EAST AND AFRICA DISTRIBUTION

TRANSFORMER MARKET BY MOUNTING 2019-2027 ($MILLION)

TABLE 10 MIDDLE EAST AND AFRICA DISTRIBUTION

TRANSFORMER MARKET BY PHASE 2019-2027 ($ MILLION)

TABLE 11 MIDDLE EAST AND AFRICA DISTRIBUTION

TRANSFORMER MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 PORTER’S 5 FORCE MODEL OF DISTRIBUTION

TRANSFORMER MARKET

FIGURE 2 REASONS FOR FAILURE IN DISTRIBUTION TRANSFORMERS

FIGURE 3 MIDDLE EAST AND AFRICA DRY TYPE

DISTRIBUTION TRANSFORMERS MARKET 2019-2027 ($ MILLION)

FIGURE 4 MIDDLE EAST AND AFRICA OIL FILLED

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 5 MIDDLE EAST AND AFRICA PAD MOUNTED DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 6 MIDDLE EAST AND AFRICA POLE MOUNTED

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 7 MIDDLE EAST AND AFRICA UNDERGROUND VAULT

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 8 MIDDLE EAST AND AFRICA SINGLE PHASE POWER

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 9 MIDDLE EAST AND AFRICA THREE PHASE POWER

DISTRIBUTION TRANSFORMER MARKET 2019-2027 ($ MILLION)

FIGURE 10 SAUDI ARABIA DISTRIBUTION TRANSFORMER MARKET

2019-2027 ($ MILLION)

FIGURE 11 TURKEY DISTRIBUTION TRANSFORMER MARKET

2019-2027 ($ MILLION)

FIGURE 12 UNITED ARAB EMIRATES DISTRIBUTION TRANSFORMER

MARKET 2019-2027 ($ MILLION)

FIGURE 13 SOUTH AFRICA DISTRIBUTION TRANSFORMER MARKET

2019-2027 ($ MILLION)

FIGURE 14 REST OF MIDDLE EAST AND AFRICA DISTRIBUTION

TRANSFORMER MARKET 2019-2027 ($ MILLION)