Market By Type, Application, Technology And Geography | Forecast 2019-2027

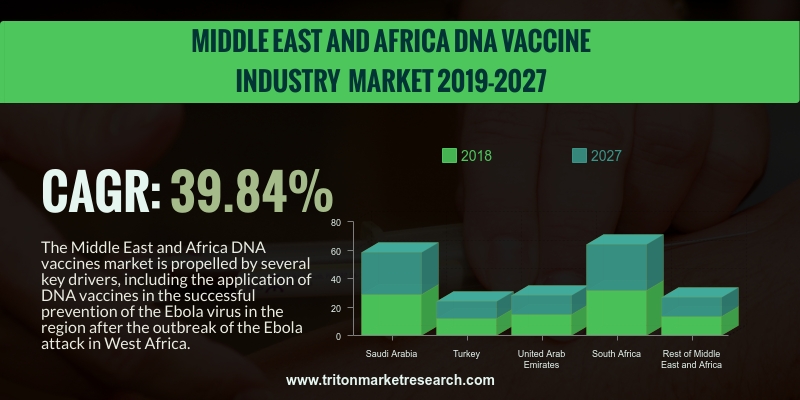

As per Triton’s research report, the Middle East and African DNA vaccines market has been speculated to upsurge with a CAGR of 39.84% in the forecast years of 2019-2027.

The report on the Middle East and Africa DNA vaccines market includes the countries of:

• Saudi Arabia

• Turkey

• The United Arab Emirates

• South Africa

• Rest of the Middle East & Africa

The Middle East and Africa DNA vaccines market is propelled by several key drivers, including the application of DNA vaccines in the successful prevention of the Ebola virus in the region after the outbreak of the Ebola attack in West Africa. After this outbreak, extensive research has been conducted to cost-effectively control the spreading of the virus in both, the animals and humans. The increased prevalence of lifestyle-linked rare genetic diseases, such as chromosome abnormality, congenital disorder, Phenylketonuria, etc., is expected to boost research for developing a cost-effective DNA vaccine, thus boosting the DNA vaccine market’s growth in the MEA region.

We provide additional customization based on your specific requirements. Request For Customization

Healthcare modernization and a growing middle class will support growth within Saudi Arabia’s prescription drugs market over the coming years. The country has the largest market for prescription drugs in the GCC, which is expected to continue, as the uptake of generic and patented drugs continues on an upward trajectory. The sales of patented medicines in Saudi continue to be driven by the rising demand for chronic diseases’ treatments, which combines well with the strong preference by physicians and patients for branded, high-value drugs. Saudi Arabia’s generic drugs market will be supported by the government’s encouragement of generic substitution as a means to control costs within the sector. The development of the OTC medicines market in the country will continue on a slow trajectory as prescription drugs dominate the production base and maintain an overriding share of the market. Saudi Arabia’s advances to promote local pharmaceutical manufacturing will continue to support domestic producers’ competitiveness in the market, with multinational drugmakers holding a significant share.

Sanofi is a pharmaceutical manufacturer based in France. The company manufactures drugs for oncology, diabetes, cardiovascular and central nervous system disorders, along with DNA vaccines. Sanofi has its global presence in more than 170 countries (in the regions of North America, Latin America, APAC, Europe and Africa) and has more than 87 manufacturing sites, spread over 38 countries. The company had already generated a revenue of $33.8 billion at the end of 2016.

1.

MIDDLE EAST AND AFRICA DNA VACCINES MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREATS OF SUBSTITUTE PRODUCT

2.2.3.

BARGAINING POWER OF BUYER

2.2.4.

BARGAINING POWER OF SUPPLIER

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. VALUE CHAIN OUTLOOK

2.5. KEY INSIGHTS

2.6. REGULATORY FRAMEWORK

2.7. KEY BUYING OUTLOOK

2.8. MARKET DRIVERS

2.8.1.

SURGE IN NEW VACCINE DEVELOPMENT

2.8.2.

RISE IN THE USAGE OF DNA VACCINES FOR ANIMAL HEALTHCARE

2.8.3.

RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES

2.9. MARKET RESTRAINTS

2.9.1.

LACK OF LEGAL AND ETHICAL FRAMEWORK

2.9.2.

STRINGENT GOVERNMENT REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

GROWING DEMAND FOR GENE THERAPY

2.10.2.

STEADY VACCINES ARE EASY TO STORE AND

TRANSPORT

2.10.3.

INCREASING NUMBER OF CLINICAL TRIALS ON HUMANS

2.11.

MARKET CHALLENGES

2.11.1.

VARIATION IN THE REGULATORY PATHWAY AND THE POINTS OF CONSIDERATION

REGARDING ENVIRONMENTAL VALUATION

3.

DNA VACCINES MARKET OUTLOOK - BY TYPE

3.1. ANIMAL DNA VACCINE

3.2. HUMAN DNA VACCINE

4.

DNA VACCINES MARKET OUTLOOK - BY APPLICATION

4.1. HUMAN DISEASE

4.2. VETERINARY DISEASE

5.

DNA VACCINES MARKET OUTLOOK - BY TECHNOLOGY

5.1. PLASMID DNA VACCINES

5.2. PLASMID DNA DELIVERY

6.

DNA VACCINES MARKET OUTLOOK - BY REGION

6.1. MIDDLE EAST AND AFRICA

6.1.1.

SAUDI ARABIA

6.1.2.

TURKEY

6.1.3.

THE UNITED ARAB EMIRATES

6.1.4.

SOUTH AFRICA

6.1.5.

REST OF MIDDLE EAST & AFRICA

7.

COMPETITIVE LANDSCAPE

7.1. ASTELLAS PHARMA, INC.

7.2. DENDREON CORPORATION (ACQUIRED BY SANPOWER

GROUP)

7.3. ELI LILLY AND COMPANY

7.4. EUROGENTEC S.A.

7.5. GLAXOSMITHKLINE, INC.

7.6. INOVIO PHARMACEUTICALS, INC.

7.7. MADISON VACCINES, INCORPORATED (MVI)

7.8. MERCK & CO.

7.9. MERIAL LIMITED (ACQUIRED BY BOEHRINGER

INGELHEIM)

7.10.

NOVARTIS AG

7.11.

SANOFI

7.12.

VGXI

7.13.

VICAL, INCORPORATED

7.14.

XENETIC BIOSCIENCES, INC.

7.15.

ZOETIS, INC.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET 2019-2027 ($ MILLION)

TABLE 2 INTERVENTION AND

PHASE OF SOME DISEASES/CONDITIONS

TABLE 3 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET IN VETERINARY DISEASES 2019-2027 ($ MILLION)

TABLE 4 TEMPERATURE

REQUIREMENT IN PRESERVATION FOR VARIOUS VACCINES

TABLE 5 APPROACHES BEING

TESTED TO ENHANCE THE LOW IMMUNOGENICITY

TABLE 6 CLINICAL TRIALS ON

HUMANS INVOLVING DNA VACCINES

TABLE 7 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 8 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 9 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 10 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 2 VALUE CHAIN ANALYSIS

FOR DNA VACCINE INDUSTRY

FIGURE 3 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET IN VETERINARY DISEASES

2019-2027 ($ MILLION)

FIGURE 4 CLINICAL TRIALS OF

GENE THERAPY

FIGURE 5 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET IN ANIMAL DNA VACCINES

2019-2027 ($ MILLION)

FIGURE 6 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET IN HUMAN DNA VACCINES

2019-2027 ($ MILLION)

FIGURE 7 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET SHARE BY APPLICATION 2018 & 2027 (%)

FIGURE 8 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET IN HUMAN DISEASES 2019-2027 ($ MILLION)

FIGURE 9 MIDDLE EAST AND

AFRICA DNA VACCINES MARKET IN VETERINARY DISEASES 2019-2027 ($ MILLION)

FIGURE 10 MIDDLE EAST AND AFRICA

DNA VACCINES MARKET IN PLASMID DNA VACCINES TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 11 MIDDLE EAST AND AFRICA

DNA VACCINES MARKET IN PLASMID DNA DELIVERY TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 12 SAUDI ARABIA DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 13 TURKEY DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 14 THE UNITED ARAB

EMIRATES DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 15 SOUTH AFRICA DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 16 REST OF MIDDLE EAST &

AFRICA DNA VACCINES MARKET 2019-2027 ($ MILLION)