Market By Vehicle Type, Power Source, Technology And Geography | Forecast 2019-2027

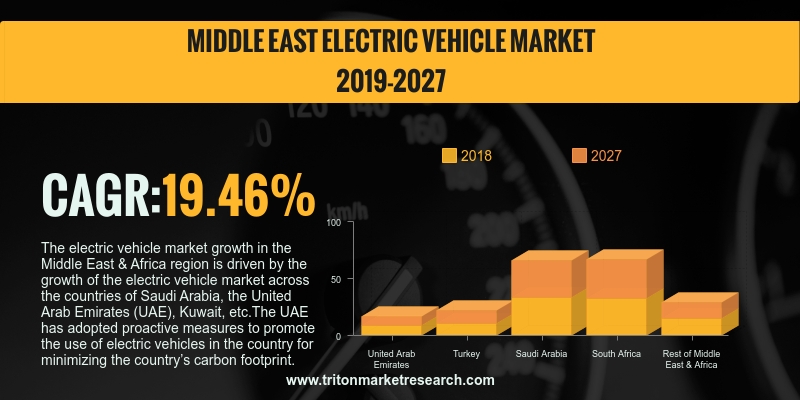

Triton Market Research has estimated the Middle East & Africa electric vehicle market to show an upward trend in terms of revenue and grow rapidly with a CAGR of 19.46% in the forecasting years 2019-2027.

The countries that have been analyzed for the Middle East & Africa electric vehicle market region are:

• The UAE

• Turkey

• Saudi Arabia

• South Africa

• Rest of MEA

Report scope can be customized per your requirements. Request For Customization

The UAE has adopted proactive measures to promote the use of electric vehicles in the country for minimizing the country’s carbon footprint. The Dubai Silicon Oasis Authority (DSOA) and the Dubai Water and Electricity Authority (DEWA) have installed EV charging stations in the Emirates, which are expected to encourage the usage of EVs in the UAE. Furthermore, (as of 2016), there was no luxury tax, VAT (Value Added Tax) or special consumption tax on electric vehicles in the UAE. The Dubai government is expected to offer non-financial incentives like free public parking for electric vehicles to influence people to purchase EVs instead of conventional fossil fuel-driven vehicles.

Saudi Arabia derives approximately 90% of its export earnings from the petroleum sector, which also accounts for almost half of the GDP of the country. Saudi Arabia has become largely dependent on oil due to this reason. However, the country now wants to cut down on the domestic consumption of oil, making more oil available for export, as well as to cut down its carbon emissions. The automotive companies on South Africa have appealed to the government to create a market for electric vehicles in the country or face the prospect of the sector being left behind in international developments. Companies like Nissan and BMW have been pushing the South African government to waive-off the import duty on electric vehicles to make them more affordable.

The electric vehicle market report from Triton includes vital information about the evolution & transition of electric vehicles, regulatory framework, market definition, Porter's five force analysis, key insights, market attractiveness matrix, key market strategies, industry player positioning, market opportunity insights, vendor scorecard, introduction of electric vehicles, key impact analysis and the industry components.

1. MIDDLE

EAST & AFRICA ELECTRIC VEHICLE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. INTRODUCTION:

ELECTRIC VEHICLES

2.4. EVOLUTION

& TRANSITION OF ELECTRIC VEHICLES

2.5. PORTER'S

FIVE FORCE ANALYSIS

2.6. MARKET

ATTRACTIVENESS MATRIX

2.7. INDUSTRY

COMPONENTS

2.8. REGULATORY

FRAMEWORK

2.9. VENDOR

SCORECARD

2.10.

KEY IMPACT ANALYSIS

2.11.

MARKET OPPORTUNITY INSIGHTS

2.12.

INDUSTRY PLAYER POSITIONING

2.13.

KEY MARKET STRATEGIES

2.14.

MARKET DRIVERS

2.14.1.

PROACTIVE GOVERNMENT POLICIES

TO PROMOTE THE USE OF ELECTRIC VEHICLES

2.14.2.

COST-EFFECTIVENESS

OF ELECTRIC VEHICLES OVER THEIR GAS-POWERED COUNTERPARTS

2.14.3.

TRANSPORT CONTRIBUTING TO

GREENHOUSE GAS (GHG) EMISSIONS, AIR POLLUTION & ENERGY CONSUMPTION

2.14.4.

INCREASING PER CAPITA INCOME

2.15.

MARKET RESTRAINTS

2.15.1.

LACK OF ELECTRIC VEHICLES

CHARGING STATIONS

2.15.2.

HIGH COST OF ELECTRIC VEHICLES

2.16.

MARKET OPPORTUNITIES

2.16.1.

RISE IN LITHIUM-ION BATTERY

PRODUCTION CAPACITIES

2.16.2.

GOVERNMENT INITIATIVES TO

LIMIT GREENHOUSE GASES

2.16.3.

INCREASED RESEARCH &

DEVELOPMENT EXPENDITURE TOWARDS DEVELOPMENT OF EVs

2.17.

MARKET CHALLENGES

2.17.1.

LACK OF PUBLIC AWARENESS

2.17.2.

PERFORMANCE ISSUES

3. MIDDLE

EAST & AFRICA ELECTRIC VEHICLE INDUSTRY OUTLOOK - BY VEHICLE TYPE

3.1. COMMERCIAL

VEHICLES

3.2. PASSENGER

CARS

3.3. TWO

WHEELERS

3.4. OTHER

VEHICLES

4. MIDDLE

EAST & AFRICA ELECTRIC VEHICLE INDUSTRY OUTLOOK - BY POWER SOURCE

4.1. STORED

ELECTRICITY

4.2. ON

BOARD ELECTRICITY GENERATOR

5. MIDDLE

EAST & AFRICA ELECTRIC VEHICLE INDUSTRY OUTLOOK - BY TECHNOLOGY

5.1. HYBRID

ELECTRIC VEHICLE

5.2. BATTERY

ELECTRICAL VEHICLES

5.3. PLUG-IN

HYBRID ELECTRICAL VEHICLE

6. MIDDLE

EAST & AFRICA ELECTRIC VEHICLE INDUSTRY - REGIONAL OUTLOOK

6.1. UNITED

ARAB EMIRATES

6.2. TURKEY

6.3. SAUDI

ARABIA

6.4. SOUTH

AFRICA

6.5. REST

OF MIDDLE EAST & AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. BAYERISCHE

MOTOREN WERKE AG

7.2. BYD

COMPANY, LTD.

7.3. DAIMLER

AG

7.4. FIAT

CHRYSLER AUTOMOBILES N.V.

7.5. FORD

MOTOR COMPANY

7.6. GENERAL

MOTORS COMPANY

7.7. GROUPE

PSA

7.8. HONDA

MOTOR COMPANY

7.9. HYUNDAI

MOTORS

7.10.

MITSUBISHI

7.11.

NISSAN MOTOR CO., LTD.

7.12.

TESLA MOTORS, INC.

7.13.

TOYOTA INDUSTRIES CORPORATION

7.14.

VOLKSWAGEN AG

7.15.

ZHEJIANG GEELY HOLDING GROUP

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE

1. MARKET ATTRACTIVENESS MATRIX FOR ELECTRIC VEHICLE MARKET

TABLE

2. VENDOR SCORECARD OF ELECTRIC VEHICLE MARKET

TABLE

3. REGULATORY FRAMEWORK OF ELECTRIC VEHICLE MARKET

TABLE

4. KEY STRATEGIC DEVELOPMENTS IN ELECTRIC VEHICLE MARKET

TABLE

5. BENEFITS & LIMITATIONS OF ELECTRIC VEHICLES

TABLE

6. WORLDWIDE LITHIUM-ION BATTERY PRODUCTION CAPACITY (GWH)

TABLE

7. COST COMPARISON OF EVs TO THEIR GAS-POWERED COUNTERPART

TABLE

8. PROJECTED ELECTRICITY-POWERED TWO-WHEELER SALES IN THE UNITED STATES IN 2015

AND 2024, BY TYPE (IN UNITS)

TABLE

9. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, COUNTRY OUTLOOK, 2019-2027

(IN $ MILLION)

TABLE

10. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE,

2019-2027 (IN $ MILLION)

TABLE

11. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, BY POWER SOURCE,

2019-2027 (IN $ MILLION)

TABLE

12. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019-2027

(IN $ MILLION)

TABLE

13. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, COUNTRY OUTLOOK,

2019-2027 (IN $ MILLION)

FIGURE 1. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 2. PORTER’S FIVE

FORCE ANALYSIS OF ELECTRIC VEHICLE MARKET

FIGURE 3. KEY IMPACT

ANALYSIS

FIGURE 4. TIMELINE OF

ELECTRIC VEHICLE

FIGURE 5. MARKET

OPPORTUNITY INSIGHTS, BY VEHICLE TYPE, 2018

FIGURE 6. INDUSTRY

COMPONENTS OF ELECTRIC VEHICLE MARKET

FIGURE 7. KEY PLAYER

POSITIONING IN 2018 (%)

FIGURE 8. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY COMMERCIAL VEHICLES, 2019-2027 (IN $

MILLION)

FIGURE 9. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY PASSENGER CARS, 2019-2027 (IN $

MILLION)

FIGURE 10. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY TWO WHEELERS, 2019-2027 (IN $ MILLION)

FIGURE 11. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY OTHER VEHICLES, 2019-2027 (IN $

MILLION)

FIGURE 12. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY POWER SOURCE, 2018 & 2027 (IN %)

FIGURE 13. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY STORED ELECTRICITY, 2019-2027 (IN $

MILLION)

FIGURE 14. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY ON BOARD ELECTRICITY GENERATOR,

2019-2027 (IN $ MILLION)

FIGURE 15. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2018 & 2027 (IN %)

FIGURE 16. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY HYBRID ELECTRIC VEHICLE, 2019-2027 (IN

$ MILLION)

FIGURE 17. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY BATTERY ELECTRICAL VEHICLES, 2019-2027

(IN $ MILLION)

FIGURE 18. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, BY PLUG-IN HYBRID ELECTRICAL VEHICLE,

2019-2027 (IN $ MILLION)

FIGURE 19. MIDDLE EAST

& AFRICA ELECTRIC VEHICLE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 20. UNITED ARAB

EMIRATES ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21. SAUDI ARABIA

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22. TURKEY

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23. SOUTH AFRICA

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24. REST OF

MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)