Market By Product, Function, Deployment, End-user And Geography | Forecast 2019-2027

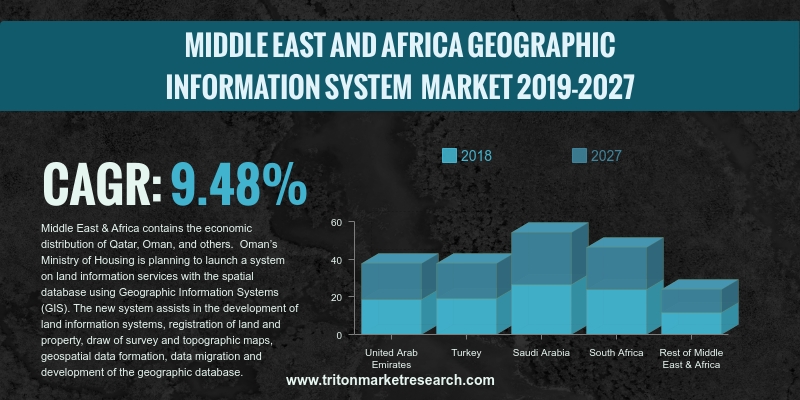

According to Triton Market Research, the geographic information system (GIS) market in the Middle East and Africa is expected to grow at a CAGR of 9.48% for the forecasting period of 2019-2027.

Following countries are included in the geographic information system (GIS) market analysis of the Middle East and Africa region:

• Saudi Arabia

• Turkey

• The United Arab Emirates

• South Africa

• Rest of MEA

Report scope can be customized per your requirements. Request For Customization

The GIS market is growing progressively in Saudi Arabia due to the rise in its space programs. For instance, Zenoss, through its first system integrator partnership with Saudi Telecom Solutions (STCS), announced a strategic expansion into the infrastructure operations management market in Saudi Arabia. The objective of this collaboration is to deploy a software-defined IT operation platform for the STCS Cloud, which provides infrastructure software solutions, and development platforms as a service and provide service assurance to the managed telephony services customers of the company. GIS is highly used in the telecom sector to locate and overhaul faults in the public telephone network in a more efficient way. It also improves telecom response to reported telephone faults.

The United Arab Emirates has made considerable progress in integrating geospatial technologies and information in its various government infrastructure projects. The country also has huge government support for small- and medium-sized enterprises (SMEs) and startups. This is anticipated to boost the demand for GIS in the UAE.

General Electric Company is an industrial corporation that provides industrial equipment and financial services. It offers a variety of products that include aircraft engines, power generation, oil & gas production equipment, medical imaging products, and financing and industrial products. It serves various industries such as telecommunication, water, transportation, aerospace, power, and healthcare. For example, Smallworld is a software solution that manages a comprehensive, accurate, and integrated geospatial view of the entire network. It is primarily used in telecommunication and utilities. The company has its operations across the Middle East and Africa, North America, Latin America, Europe, and Asia-Pacific.

1. MIDDLE

EAST AND AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. GROWING

DEMAND FOR SERVICE SECTOR

2.2.2.

INCORPORATION OF GIS IN BUSINESS INTELLIGENCE

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISE

IN ADOPTION OF GIS

2.6.2. INCREASING

DEMAND FOR SPATIAL DATA

2.6.3. DEVELOPMENT

OF SMART CITIES

2.7. MARKET

RESTRAINTS

2.7.1. HIGH

COSTS LEVIED ON GIS SOFTWARE

2.8. MARKET

OPPORTUNITIES

2.8.1. USE OF

GIS IN DISASTER MANAGEMENT

2.9. MARKET

CHALLENGES

2.9.1. STERN

RULES AND REGULATIONS

2.9.2. EASY

ACCESS OF OPEN SOURCE GEOGRAPHIC INFORMATION SYSTEM (GIS)

3. MIDDLE

EAST AND AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY PRODUCT

3.1. SOFTWARE

3.2. DATA

3.3. SERVICE

4. MIDDLE

EAST AND AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY

FUNCTION

4.1. MAPPING

4.2. SURVEYING

4.3. LOCATION-BASED

SERVICES

4.4. NAVIGATION

AND TELEMATICS

4.5. OTHERS

5. MIDDLE

EAST AND AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY DEPLOYMENT

5.1. DESKTOP

GIS

5.2. SERVER

GIS

5.3. DEVELOPER

GIS

5.4. MOBILE

GIS

5.5. OTHERS

6. MIDDLE

EAST AND AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY

END-USER

6.1. DEFENSE

6.2. AGRICULTURE

6.3. OIL

& GAS

6.4. CONSTRUCTION

6.5. UTILITIES

6.6. TRANSPORTATION

& LOGISTICS

6.7. OTHERS

7. MIDDLE

EAST AND AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET – REGIONAL OUTLOOK

7.1. UNITED

ARAB EMIRATES

7.2. TURKEY

7.3. SAUDI

ARABIA

7.4. SOUTH

AFRICA

7.5. REST

OF MIDDLE EAST & AFRICA

8. COMPETITIVE

LANDSCAPE

8.1. HEXAGON

AB

8.2. ESRI

8.3. AUTODESK

INC.

8.4. BENTLEY

SYSTEMS INC.

8.5. GENERAL

ELECTRIC COMPANY

8.6. PITNEY

BOWES INC.

8.7. TRIMBLE

INC.

8.8. MACDONALD,

DETTWILER AND ASSOCIATES CORPORATION

8.9. CALIPER

CORPORATION

8.10. COMPUTER

AIDED DEVELOPMENT CORPORATION LIMITED (CADCORP)

8.11. SUPERMAP

SOFTWARE CO. LTD.

8.12. HI-TARGET

SURVEYING INSTRUMENT CO. LTD.

8.13. TAKOR

GROUP LTD

8.14. ATKINS.

8.15. FUGRO N.V

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2019-2027 (IN $

MILLION)

TABLE 5: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY FUNCTION, 2019-2027 (IN $

MILLION)

TABLE 6: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEPLOYMENT, 2019-2027 (IN

$ MILLION)

TABLE 7: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY END-USER, 2019-2027 (IN $

MILLION)

TABLE 8: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2018 & 2027

(IN %)

FIGURE 2: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 3: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SOFTWARE, 2019-2027 (IN $

MILLION)

FIGURE 4: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DATA, 2019-2027 (IN $

MILLION)

FIGURE 5: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SERVICE, 2019-2027 (IN $

MILLION)

FIGURE 6: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY MAPPING, 2019-2027 (IN $

MILLION)

FIGURE 7: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SURVEYING, 2019-2027 (IN

$ MILLION)

FIGURE 8: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY LOCATION-BASED SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY NAVIGATION AND

TELEMATICS, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 11: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DESKTOP GIS, 2019-2027

(IN $ MILLION)

FIGURE 12: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY SERVER GIS, 2019-2027 (IN

$ MILLION)

FIGURE 13: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEVELOPER GIS, 2019-2027

(IN $ MILLION)

FIGURE 14: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY MOBILE GIS, 2019-2027 (IN

$ MILLION)

FIGURE 15: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 16: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY DEFENSE, 2019-2027 (IN $

MILLION)

FIGURE 17: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY AGRICULTURE, 2019-2027

(IN $ MILLION)

FIGURE 18: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OIL & GAS, 2019-2027

(IN $ MILLION)

FIGURE 19: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY CONSTRUCTION, 2019-2027

(IN $ MILLION)

FIGURE 20: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY UTILITIES, 2019-2027 (IN

$ MILLION)

FIGURE 21: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY TRANSPORTATION &

LOGISTICS, 2019-2027 (IN $ MILLION)

FIGURE 22: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 23: MIDDLE EAST AND

AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, REGIONAL OUTLOOK, 2018 &

2027 (IN %)

FIGURE 24: UNITED ARAB

EMIRATES GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: TURKEY GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: SAUDI ARABIA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: SOUTH AFRICA

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: REST OF MIDDLE EAST

& AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $

MILLION)