Market By Type, Technology, Application, End-user And Geography | Forecast 2019-2027

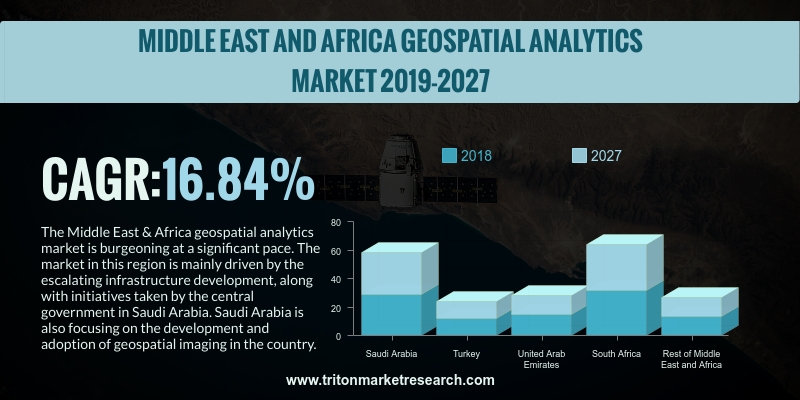

The Triton Market Research report states that the Middle East & Africa geospatial analytics market is expected to grow at a CAGR of 16.84% during the forecast period from 2019 to 2027.

The countries considered in the Middle East & Africa geospatial analytics market are:

• Saudi Arabia

• Turkey

• United Arab Emirates

• South Africa

• Rest of the Middle East & Africa

We provide additional customization based on your specific requirements. Request For Customization

The Middle East & Africa geospatial analytics market is burgeoning at a significant pace. The market in this region is mainly driven by the escalating infrastructure development, along with initiatives taken by the central government in Saudi Arabia. Saudi Arabia is also focusing on the development and adoption of geospatial imaging in the country. The latest trend in the Saudi Arabia geospatial analytics market displays that both the private organizations and the government have started depending on geospatial information to improve infrastructural developments, such as energy & power, urban expansions and natural resources. Additionally, roadways, utility services, health and education are also amortizing geospatial technology & other associated tools for planning, executing and decision-making process.

In the UAE, GIS and RS are considered as strong and effective tools that can aid in tourism planning and decision-making. The rise in population in UAE, as well as the rapid growth of towns has amplified the risk to natural resources and archeological sites. Satellite remote sensing data helps in evaluating the natural resources and monitor the changes. GIS and RS are used to find the natural environment and archaeological heritage resources that may be endangered by increased urban growth. The tourism resources in the country require tools, which support effective decision-making for sustainable development. The UAE government is planning to take initiatives by creating tourism databases and a GIS system, so that planners can be accessed for archaeological heritage information, as a part of the development planning processes.

1. MIDDLE

EAST & AFRICA GEOSPATIAL ANALYTICS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF GEOSPATIAL ANALYTICS

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. REGULATORY

FRAMEWORK

2.7. VENDOR

SCORECARD

2.8. KEY

IMPACT ANALYSIS

2.9. MARKET

DRIVERS

2.9.1. COMMERCIALIZATION

OF SPATIAL DATA

2.9.2. RISING

DEMAND FROM DIFFERENT END-USER INDUSTRIES

2.9.3. TECHNOLOGICAL

ADVANCEMENTS

2.10.

MARKET RESTRAINTS

2.10.1.

HIGH COSTS ASSOCIATED WITH

GEOSPATIAL TECHNOLOGIES

2.10.2.

OPERATIONAL & LEGAL

CONCERNS

2.11.

MARKET OPPORTUNITIES

2.11.1.

USE OF BIG DATA & CLOUD IN

GEOSPATIAL ANALYTICS

2.11.2.

INCREASED SMART CITY &

INFRASTRUCTURE PROJECTS

2.11.3.

HIGH USAGE IN ENVIRONMENTAL MONITORING & LAND MANAGEMENT

2.12.

MARKET CHALLENGES

2.12.1.

PRIVACY & SECURITY

CONCERNS

2.12.2.

INTEROPERABILITY ISSUES

3. MIDDLE

EAST & AFRICA GEOSPATIAL ANALYTICS MARKET OUTLOOK - BY TYPE

3.1. SURFACE

ANALYSIS

3.2. NETWORK

ANALYSIS

3.3. GEO-VISUALIZATION

3.4. OTHER

TYPES

4. MIDDLE

EAST & AFRICA GEOSPATIAL ANALYTICS MARKET OUTLOOK - BY TECHNOLOGY

4.1. REMOTE

SENSING

4.2. MIDDLE

EAST & AFRICA POSITIONING SYSTEM (GPS)

4.3. GEOGRAPHIC

INFORMATION SYSTEM (GIS)

4.4. OTHER

TECHNOLOGIES

5. MIDDLE

EAST & AFRICA GEOSPATIAL ANALYTICS MARKET OUTLOOK - BY APPLICATION

5.1. SURVEYING

5.2. DISASTER

RISK REDUCTION & MANAGEMENT

5.3. MEDICINE

& PUBLIC SAFETY

5.4. OTHER

APPLICATIONS

6. MIDDLE

EAST & AFRICA GEOSPATIAL ANALYTICS MARKET OUTLOOK - BY END-USER

6.1. BUSINESS

6.2. UTILITY

& COMMUNICATION

6.3. DEFENSE

& INTELLIGENCE

6.4. GOVERNMENT

6.5. AUTOMOTIVE

6.6. OTHER

END-USER

7. MIDDLE

EAST & AFRICA GEOSPATIAL ANALYTICS MARKET - REGIONAL OUTLOOK

7.1. UNITED

ARAB EMIRATES

7.2. TURKEY

7.3. SAUDI

ARABIA

7.4. SOUTH

AFRICA

7.5. REST

OF MIDDLE EAST & AFRICA

8. COMPETITIVE

LANDSCAPE

8.1. ATKINS

8.2. AUTODESK,

INC.

8.3. BENTLEY

SYSTEMS, INC.

8.4. CRITIGEN

LLC

8.5. EOS

DATA ANALYTICS, INC.

8.6. ESRI,

INC. (ENVIRONMENTAL SYSTEMS RESEARCH INSTITUTE)

8.7. FUGRO

8.8. GENERAL

ELECTRICAL COMPANY

8.9. GOOGLE,

INC.

8.10. HARRIS CORPORATION

8.11. HEXAGON AB (SUBSIDIARY: INTERGRAPH)

8.12. MDA CORPORATION (MACDONALD DETTWILER, AND ASSOCIATES)

8.13. PITNEY BOWES, INC.

8.14. TRIMBLE GEOSPATIAL

8.15. URTHECAST CORPORATION

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE

1: MARKET ATTRACTIVENESS MATRIX FOR GEOSPATIAL ANALYTICS MARKET

TABLE

2: VENDOR SCORECARD OF GEOSPATIAL ANALYTICS MARKET

TABLE

3: REGULATORY FRAMEWORK OF GEOSPATIAL ANALYTICS MARKET

TABLE

4: MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, COUNTRY OUTLOOK,

2019-2027 (IN $ MILLION)

TABLE

5: MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, BY TYPE, 2019-2027 (IN

$ MILLION)

TABLE

6: MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, BY TECHNOLOGY,

2019-2027 (IN $ MILLION)

TABLE

7: MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, BY APPLICATION,

2019-2027 (IN $ MILLION)

TABLE

8: MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, BY END-USER, 2019-2027

(IN $ MILLION)

TABLE

9: MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, COUNTRY OUTLOOK,

2019-2027 (IN $ MILLION)

FIGURE 1: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 2: PORTER’S FIVE

FORCE ANALYSIS OF GEOSPATIAL ANALYTICS MARKET

FIGURE 3: KEY IMPACT

ANALYSIS

FIGURE 4: TIMELINE OF

GEOSPATIAL ANALYTICS

FIGURE 5: USE OF

LOCATION-BASED DATA IN NUMEROUS INDUSTRIES (IN %)

FIGURE 6: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY SURFACE ANALYSIS, 2019-2027 (IN $

MILLION)

FIGURE 7: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY NETWORK ANALYSIS, 2019-2027 (IN $

MILLION)

FIGURE 8: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY GEO-VISUALIZATION, 2019-2027 (IN $

MILLION)

FIGURE 9: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY OTHER TYPE OF ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 10: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY REMOTE SENSING, 2019-2027 (IN $

MILLION)

FIGURE 11: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY MIDDLE EAST & AFRICA

POSITIONING SYSTEM (GPS), 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY GEOGRAPHIC INFORMATION SYSTEM

(GIS), 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY OTHER TECHNOLOGIES, 2019-2027 (IN

$ MILLION)

FIGURE 14: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY SURVEYING, 2019-2027 (IN $

MILLION)

FIGURE 15: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY DISASTER RISK REDUCTION &

MANAGEMENT, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY MEDICINE & PUBLIC SAFETY,

2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN

$ MILLION)

FIGURE 18: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY BUSINESS, 2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY UTILITY & COMMUNICATION,

2019-2027 (IN $ MILLION)

FIGURE 20: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY DEFENSE & INTELLIGENCE,

2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY GOVERNMENT, 2019-2027 (IN $

MILLION)

FIGURE 22: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY AUTOMOTIVE, 2019-2027 (IN $

MILLION)

FIGURE 23: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, BY OTHER END-USER, 2019-2027 (IN $

MILLION)

FIGURE 24: MIDDLE EAST

& AFRICA GEOSPATIAL ANALYTICS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN

%)

FIGURE 25: UNITED ARAB

EMIRATES GEOSPATIAL ANALYTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: SAUDI ARABIA

GEOSPATIAL ANALYTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: TURKEY

GEOSPATIAL ANALYTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: SOUTH AFRICA

GEOSPATIAL ANALYTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: REST OF

MIDDLE EAST & AFRICA GEOSPATIAL ANALYTICS MARKET, 2019-2027 (IN $ MILLION)