Market By Component, Deployment Model, Database Type, Type Of Analysis, Application, Organization Size, Industrial Vertical And Geography | Forecast 2019-2027

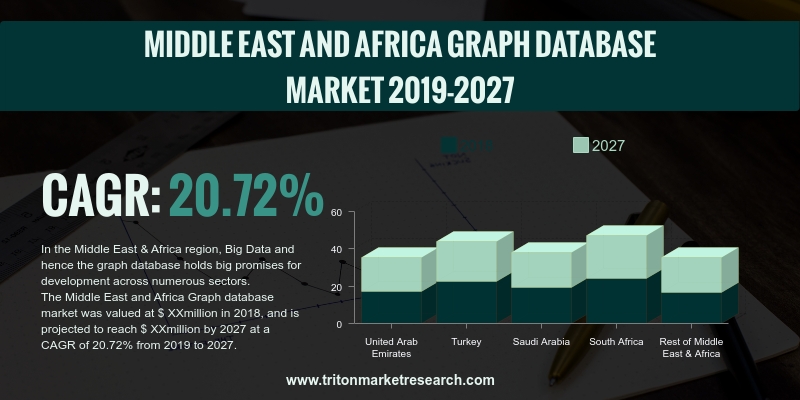

According to Triton Market Research, the graph database market in the Middle East and Africa is expected to grow exponentially at a CAGR of 20.72% for the forecasting period of 2019-2027.

Following are the countries that are included in the graph database market analysis of the Middle East and Africa region:

• The United Arab Emirates

• South Africa

• Saudi Arabia

• Turkey

• Rest of MEA

The graph database market in the Middle East and Africa is anticipated to be promising in terms of the development of various sectors such as the government and public sector, life sciences, retail & e-commerce, and media & entertainment.

The UAE has been focusing on its adoption of Big Data solutions for their smart city projects. This will contribute to the transformation of various government services, such as transportation, infrastructure, communications, economic services, urban planning, and electricity. For instance, due to the rapid increase in the use of the internet, graph database management systems are set to optimize the huge amount of data for better enhancement in communication. Turkey is implementing the use of graph database analytics with regards to progress in business operations and developing new business and revenue streams. Many Turkish corporations are showing interest in analyzing the diversified information to achieve their business objectives.

Egypt shows a high potential for the growth of the graph database market. In 2018, Link Datacenter became the first provider in Egypt by collaborating with Microsoft Egypt to provide Azure Stack Cloud Services through their Datacenters. Graph database is valuable for reporting and auditing in cloud infrastructure. Similarly, in Nigeria, an increase in the adoption of numerous cloud computing solutions by major organizations is set to result in market growth opportunities.

Teradata Corporation (TDC) is an enterprise software company that provides database management solutions in software, hardware, business consulting, and support services for the entire analytics network of the companies. The company had launched several products in 2019. Teradata Vantage is a modern analytics platform that enables companies to drive business value. It also provides access to a wide variety of prescriptive, descriptive, and predictive analytics that contribute to autonomous decision-making of a company.

1. MIDDLE

EAST AND AFRICA GRAPH DATABASE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. CLOUD

IS THE FASTEST-GROWING DEPLOYMENT MODEL

2.2.2. SOFTWARE

IS DOMINANT IN THE COMPONENT SEGMENT OF THE GRAPH DATABASE MARKET

2.2.3. RECOMMENDATION

ENGINE IS RAPIDLY ADOPTING GRAPH DATABASE

2.2.4. RELATIONAL

(SQL) GRAPH DATABASE IS THE PROMINENT DATABASE

2.2.5. LARGE

ENTERPRISES ARE THE MAJOR IMPLEMENTER OF GRAPH DATABASE

2.2.6. TRANSPORTATION

& LOGISTICS INDUSTRIAL VERTICAL IS THE FASTEST-GROWING USER OF GRAPH

DATABASE

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. VALUE

CHAIN ANALYSIS

2.7. MARKET

DRIVERS

2.7.1. INCREASE

IN THE USE OF GRAPH DATABASE IN THE GOVERNMENT SECTOR

2.7.2. INCREASING

DEMAND FOR GRAPH DATABASE IN DATA-INTENSIVE ERA

2.7.3. RISING

DEPENDENCE OF BUSINESS DECISIONS ON DATA

2.7.4. GROWTH

IN ONLINE MARKETING

2.8. MARKET

RESTRAINTS

2.8.1. AVAILABILITY

OF SKILLED WORKFORCE

2.8.2. COST

OF GRAPH DATABASE

2.9. MARKET

OPPORTUNITIES

2.9.1. ADVANCEMENT

IN TECHNOLOGY

2.9.2. BLOOMING

BIG DATA SCENARIO

2.10.

MARKET CHALLENGES

2.10.1.

DATA SECURITY CONCERNS

2.10.2.

DATA STORAGE CAPACITY CONCERNS

3. GRAPH

DATABASE MARKET OUTLOOK - BY COMPONENT

3.1. SOFTWARE

3.2. SERVICES

4. GRAPH

DATABASE MARKET OUTLOOK - BY DEPLOYMENT MODEL

4.1. ON-PREMISE

DEPLOYMENT MODEL

4.2. CLOUD

DEPLOYMENT MODEL

5. GRAPH

DATABASE MARKET OUTLOOK - BY DATABASE TYPE

5.1. RELATIONAL

(SQL) DATABASE

5.2. NON-RELATIONAL

(NoSQL)

6. GRAPH

DATABASE MARKET OUTLOOK - BY TYPE OF ANALYSIS

6.1. PATH

ANALYSIS

6.2. CONNECTIVITY

ANALYSIS

6.3. COMMUNITY

ANALYSIS

6.4. CENTRALITY

ANALYSIS

7. GRAPH

DATABASE MARKET OUTLOOK - BY APPLICATION

7.1. FRAUD

DETECTION & RISK MANAGEMENT

7.2. MASTER

DATA MANAGEMENT

7.3. CUSTOMER

ANALYTICS

7.4. IDENTITY

AND ACCESS MANAGEMENT

7.5. RECOMMENDATION

ENGINE

7.6. PRIVACY

AND RISK COMPLIANCE

7.7. OTHER

APPLICATIONS

8. GRAPH

DATABASE MARKET OUTLOOK - BY ORGANIZATION SIZE

8.1. LARGE

ENTERPRISES

8.2. SMALL

& MEDIUM ENTERPRISES

9. GRAPH

DATABASE MARKET OUTLOOK - BY INDUSTRIAL VERTICAL

9.1. BFSI

9.2. RETAIL

AND E-COMMERCE

9.3. IT AND

TELECOM

9.4. HEALTHCARE

AND LIFE SCIENCE

9.5. GOVERNMENT

AND PUBLIC SECTOR

9.6. MEDIA

& ENTERTAINMENT

9.7. MANUFACTURING

9.8. TRANSPORTATION

& LOGISTICS

9.9. OTHER

INDUSTRIAL VERTICALS

10. GRAPH

DATABASE MARKET – MIDDLE EAST AND AFRICA

10.1.

THE UNITED ARAB EMIRATES

10.2.

TURKEY

10.3.

SAUDI ARABIA

10.4.

SOUTH AFRICA

10.5.

REST OF MIDDLE EAST & AFRICA

11. COMPETITIVE

LANDSCAPE

11.1.

ORACLE CORPORATION

11.2.

TERADATA CORPORATION (TDC)

11.3.

NEO4J, INC.

11.4.

ORIENT DB (ACQUIRED BY CALLIDUSCLOUD)

11.5.

DATASTAX, INC.

11.6.

MONGODB INC. (MDB)

11.7.

MICROSOFT, INC.

11.8.

OBJECTIVITY, INC.

11.9.

FRANZ INC.

11.10.

STARDOG UNION INC.

12. RESEARCH

METHODOLOGY & SCOPE

12.1.

RESEARCH SCOPE & DELIVERABLES

12.1.1.

OBJECTIVES OF STUDY

12.1.2.

SCOPE OF STUDY

12.2.

SOURCES OF DATA

12.2.1.

PRIMARY DATA SOURCES

12.2.2.

SECONDARY DATA SOURCES

12.3.

RESEARCH METHODOLOGY

12.3.1.

EVALUATION OF PROPOSED MARKET

12.3.2.

IDENTIFICATION OF DATA SOURCES

12.3.3.

ASSESSMENT OF MARKET DETERMINANTS

12.3.4.

DATA COLLECTION

12.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY COMPONENT, 2019-2027 (IN $ MILLION)

TABLE 4: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY DEPLOYMENT MODEL, 2019-2027 (IN $ MILLION)

TABLE 5: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY DATABASE TYPE, 2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY TYPE OF ANALYSIS, 2019-2027 (IN $ MILLION)

TABLE 7: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY ORGANIZATION SIZE, 2019-2027 (IN $ MILLION)

TABLE 9: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY INDUSTRIAL VERTICAL, 2019-2027 (IN $ MILLION)

TABLE 10: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: CLOUD DEPLOYMENT

MODEL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3: GRAPH DATABASE

SOFTWARE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: RECOMMENDATION

ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 5: RELATIONAL (SQL)

GRAPH DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 6: LARGE ENTERPRISES

USING GRAPH DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 7: TRANSPORTATION &

LOGISTICS USING GRAPH DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 8: PORTER’S FIVE FORCES

ANALYSIS

FIGURE 9: MARKET

ATTRACTIVENESS INDEX

FIGURE 10: VALUE CHAIN FOR

GRAPH DATABASE

FIGURE 11: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY ON-PREMISE DEPLOYMENT MODEL, 2019-2027 (IN $

MILLION)

FIGURE 14: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY CLOUD DEPLOYMENT MODEL, 2019-2027 (IN $

MILLION)

FIGURE 15: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY RELATIONAL (SQL), 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY NON-RELATIONAL (NOSQL) DATABASE, 2019-2027 (IN

$ MILLION)

FIGURE 17: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY PATH ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY CONNECTIVITY ANALYSIS, 2019-2027 (IN $

MILLION)

FIGURE 19: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY COMMUNITY ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 20: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY CENTRALITY ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY FRAUD DETECTION & RISK MANAGEMENT,

2019-2027 (IN $ MILLION)

FIGURE 22: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY MASTER DATA MANAGEMENT, 2019-2027 (IN $

MILLION)

FIGURE 23: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY CUSTOMER ANALYTICS, 2019-2027 (IN $ MILLION)

FIGURE 24: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY IDENTITY AND ACCESS MANAGEMENT, 2019-2027 (IN

$ MILLION)

FIGURE 25: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY RECOMMENDATION ENGINE, 2019-2027 (IN $

MILLION)

FIGURE 26: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY PRIVACY AND RISK COMPLIANCE, 2019-2027 (IN $

MILLION)

FIGURE 27: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 28: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY LARGE ENTERPRISES, 2019-2027 (IN $ MILLION)

FIGURE 29: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY SMALL AND MEDIUM ENTERPRISES, 2019-2027 (IN $

MILLION)

FIGURE 30: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY BFSI SECTOR, 2019-2027 (IN $ MILLION)

FIGURE 31: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY RETAIL AND E-COMMERCE, 2019-2027 (IN $

MILLION)

FIGURE 32: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY IT AND TELECOM, 2019-2027 (IN $ MILLION)

FIGURE 33: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY HEALTHCARE AND LIFE SCIENCE, 2019-2027 (IN $

MILLION)

FIGURE 34: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY GOVERNMENT AND PUBLIC SECTOR, 2019-2027 (IN $

MILLION)

FIGURE 35: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY MEDIA & ENTERTAINMENT, 2019-2027 (IN $

MILLION)

FIGURE 36: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY MANUFACTURING, 2019-2027 (IN $ MILLION)

FIGURE 37: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY TRANSPORTATION & LOGISTICS, 2019-2027 (IN

$ MILLION)

FIGURE 38: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, BY OTHER INDUSTRIAL VERTICALS, 2019-2027 (IN $

MILLION)

FIGURE 39: MIDDLE EAST AND

AFRICA GRAPH DATABASE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 40: THE UNITED ARAB

EMIRATES GRAPH DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: TURKEY GRAPH

DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 42: SAUDI ARABIA GRAPH

DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 43: SOUTH AFRICA GRAPH

DATABASE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 44: REST OF MIDDLE EAST

& AFRICA GRAPH DATABASE MARKET, 2019-2027 (IN $ MILLION)