Market by Product Type, Distribution Channel, User Demographics, and Geography | Forecast 2019-2027

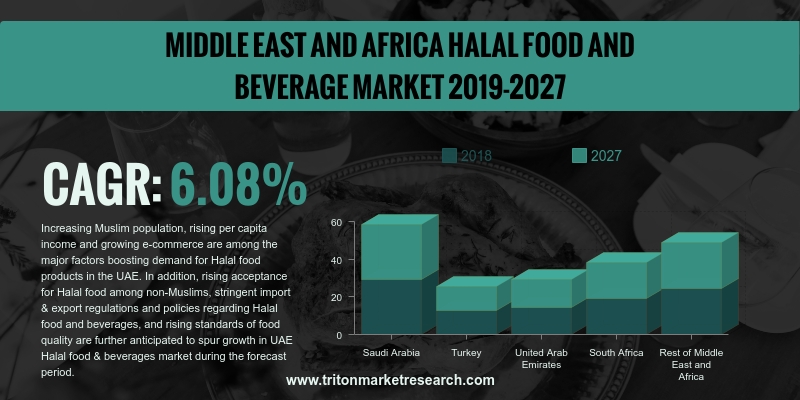

According to Triton Market Research, the Middle East and Africa halal food & beverage market is expected to grow exponentially at a CAGR of 6.08% for the forecasting years 2019-2027.

Following are the countries included in the halal food & beverage market analysis of the Middle East and Africa region:

• Saudi Arabia

• Turkey

• The United Arab Emirates

• South Africa

• Rest of MEA

Report scope can be customized per your requirements. Request For Customization

It is estimated that Saudi Arabia would be the fastest-growing country as well as holding the largest market share for the growth of the halal food & beverage market during the forecasted period. The country is also the largest food & beverage producer in the Gulf region. However, the rapidly increasing population has resulted in surpassing the food supply and forcing the country to depend on imports, which boosts the demand for halal food products. The Government of Saudi Arabia has been introducing new policies to encourage greater production of halal food. These policies are expected to make the country self-sufficient in terms of food & beverage production and provide better schemes for domestic producers to vary in livestock, such as poultry, camel, sheep, and dairy production.

Similarly, the growing Muslim population, surging e-commerce sector, and rising per capita income are the key factors that drive the halal food & beverage market in the United Arab Emirates. The country is known as the global leader in the halal food & beverage market and is planning to strengthen this position by implementing internationally recognized certification standards and encouraging re-exports of halal products through the trading centers of the Gulf states. Moreover, rising standards of food quality, stringent import & export regulations, and rising acceptance for halal food among non-Muslims are further predicted to fuel the growth of the halal food & beverage market in the UAE. For instance, Dubai Exports is signing a memorandum of understanding with trade authorities from food-exporting countries across the world to improve global halal trade and create a halal trade network by using common standards for halal items.

Al Islami Foods manufactures and distributes halal food products. It is a subsidiary of the Dubai Cooperative Society. It offers a wide range of products that include halal and specialty food items. The company procures its raw materials from several other countries such as Brazil, Egypt, Belgium, Vietnam, and the Netherlands. It mainly operates in the Middle East and Africa region and hires third party operators to manage its foreign markets.

1. MIDDLE

EAST AND AFRICA HALAL FOOD & BEVERAGE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. FOOD

PREFERENCES

2.3. KEY

INSIGHTS

2.3.1. HALAL

MEAT & ALTERNATIVES TO LEAD AMONGST PRODUCT TYPE

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. REGULATORY

FRAMEWORK

2.8. VALUE

CHAIN ANALYSIS

2.9. MARKET

DRIVERS

2.9.1. GROWTH

IN MUSLIM POPULATION

2.9.2. AWARENESS

REGARDING HALAL FOOD AMONG NON-MUSLIM POPULATION

2.10. MARKET

RESTRAINTS

2.10.1. IMPLEMENTATION OF HALAL STANDARDS THROUGHOUT

THE VALUE CHAIN

2.11. MARKET

OPPORTUNITIES

2.11.1. INVESTMENT IN HALAL FOOD VALUE CHAIN

INTEGRATION

2.11.2. DEVELOPING TRACKING TECHNOLOGY

2.12. MARKET

CHALLENGES

2.12.1. ABSENCE OF VIABLE INTERNATIONAL SCHEMES TO

ACCREDIT HALAL CERTIFICATION BODIES

3. MIDDLE

EAST AND AFRICA HALAL FOOD & BEVERAGE MARKET OUTLOOK – BY PRODUCT TYPE

3.1. HALAL

MEAT & ALTERNATIVES

3.2. HALAL

MILK & MILK PRODUCTS

3.3. HALAL

FRUITS & VEGETABLES

3.4. HALAL

GRAIN PRODUCTS

3.5. OTHERS

4. MIDDLE

EAST AND AFRICA HALAL FOOD & BEVERAGE MARKET OUTLOOK – BY DISTRIBUTION

CHANNELS

4.1. TRADITIONAL

RETAILERS

4.2. SUPERMARKETS

& HYPERMARKETS

4.3. ONLINE

4.4. OTHERS

5. MIDDLE

EAST AND AFRICA HALAL FOOD & BEVERAGE MARKET OUTLOOK – BY USER DEMOGRAPHICS

5.1. MUSLIMS

5.2. NON-MUSLIMS

6. MIDDLE

EAST AND AFRICA HALAL FOOD & BEVERAGE MARKET – REGIONAL OUTLOOK

6.1. UNITED

ARAB EMIRATES

6.2. TURKEY

6.3. SAUDI

ARABIA

6.4. SOUTH

AFRICA

6.5. REST

OF MIDDLE EAST & AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. NESTLÉ

7.2. CARGILL,

INC.

7.3. AL

ISLAMI FOODS

7.4. QL

FOODS SDN. BHD.

7.5. CRESCENT

FOODS

7.6. NEMA

FOOD CO.

7.7. NAMET

7.8. KAWAN FOOD

BERHAD

7.9. HAOYUE

GROUP

7.10. ALLANASONS

PVT. LTD.

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: TASTE & FOOD

PREFERENCES

TABLE 3: VENDOR SCORECARD

TABLE 4: REGULATORY FRAMEWORK

TABLE 5: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY PRODUCT TYPE, 2019-2027 (IN $

MILLION)

TABLE 7: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (IN

$ MILLION)

TABLE 8: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY USER DEMOGRAPHICS, 2019-2027 (IN $

MILLION)

FIGURE 1: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY HALAL MEAT & ALTERNATIVES,

2019-2027 (IN $ MILLION)

FIGURE 2: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 3: MARKET

ATTRACTIVENESS INDEX

FIGURE 4: VALUE CHAIN ANALYSIS

FIGURE 5: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY HALAL MEAT & ALTERNATIVES,

2019-2027 (IN $ MILLION)

FIGURE 6: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY HALAL MILK & MILK PRODUCTS,

2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE EAST AND AFRICA

HALAL FOOD & BEVERAGE MARKET, BY HALAL FRUITS & VEGETABLES, 2019-2027

(IN $ MILLION)

FIGURE 8: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY HALAL GRAIN PRODUCTS, 2019-2027 (IN

$ MILLION)

FIGURE 9: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY TRADITIONAL RETAILERS, 2019-2027

(IN $ MILLION)

FIGURE 11: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY SUPERMARKETS & HYPERMARKETS, 2019-2027

(IN $ MILLION)

FIGURE 12: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY ONLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY MUSLIM, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, BY NON-MUSLIM, 2019-2027 (IN $

MILLION)

FIGURE 16: MIDDLE EAST AND

AFRICA HALAL FOOD & BEVERAGE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN

%)

FIGURE 17: UNITED ARAB

EMIRATES HALAL FOOD & BEVERAGE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: TURKEY HALAL FOOD

& BEVERAGE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: SAUDI ARABIA HALAL

FOOD & BEVERAGE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SOUTH AFRICA HALAL

FOOD & BEVERAGE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: REST OF MIDDLE EAST

& AFRICA HALAL FOOD & BEVERAGE MARKET, 2019-2027 (IN $ MILLION)