Market By Resolution, Spectrum, Frame Rate, Component, Application And Geography | Forecast 2019-2027

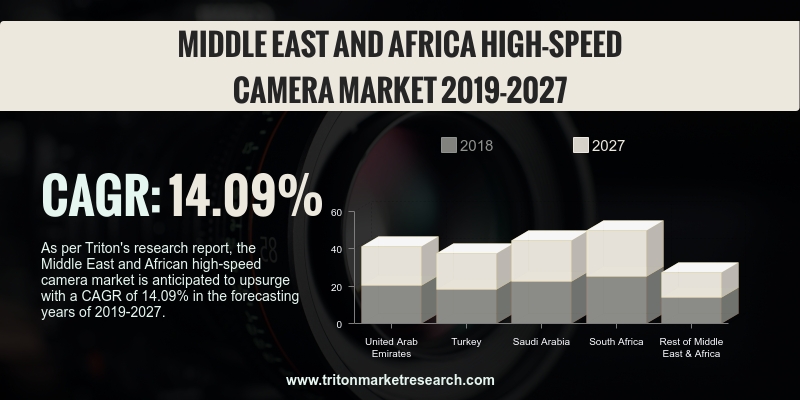

As per Triton's research report, the Middle East and African high-speed camera market is anticipated to upsurge with a CAGR of 14.09% in the forecasting years of 2019-2027.

The countries that have been considered in the report on the Middle East and Africa’s high-speed camera market are:

• United Arab Emirates

• Turkey

• Saudi Arabia

• South Africa

• Rest of Middle East & Africa

In 2018, the majority of the market share was captured by South Africa in the Middle East and Africa high-speed camera market. South Africa is facing socio-economic difficulties such as shortage of skilled labor, lack of technology & innovation, slow-growing economy and climatic change. It is adopting agreements and partnerships with various countries in the BRICS to develop smart infrastructures in the country. In addition, it is estimated that within ten years, South Africa will have immense innovation in industrialization. Such factors push the growth of the high-speed camera market in the region, thus promoting market extension.

South Africa’s manufacturing sector contributes 14% to the national GDP, and is the fourth-largest contributor to the economy. The South African manufacturing sector primarily produces goods that include: textiles, food processing, chemicals, electronics, automobiles and technology. The South Africa automotive sector is the backbone of the national industrial base, accounting for 6.8% of the GDP. The growth of the manufacturing and automotive industries in the country will improve the prospects of the South African high-speed camera market. On the other hand, cricket and football are popular sports in the country. These sports generate a lot of revenue and the event managers make utmost care to give the best possible experience to consumers. Slow-motion cameras or high-speed cameras gives a lot of detail to the players’ actions, thus helping the outcome and also increasing the entertainment value of the event.

Lumenera Corporation is a multinational company that manufactures and develops digital cameras for industrial & scientific applications. The company has a wide range of product portfolio. The automotive industry shows applications in high-speed camera, which is creating growth prospects for the company as it provides solutions to this industry. Lumenera has a strong global presence that includes Europe, North America, Asia, South America and the Middle East.

1. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA

MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

VARIOUS APPLICATIONS OF HIGH-SPEED CAMERAS IN AUTOMOTIVE INDUSTRY

2.2.2.

USE OF HIGH-SPEED CAMERAS HAS BEEN INCREASING RAPIDLY IN THE MEDIA &

ENTERTAINMENT INDUSTRY

2.2.3.

INCREASED INCORPORATION OF HIGH-SPEED IMAGING DEVICES FOR PRODUCT DEVELOPMENT

AND PROCESS OPTIMIZATION

2.2.4.

INCREASE IN USAGE OF HIGH-SPEED CAMERA IN SPORTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

COST

2.4.2.

FRAME RATE

2.4.3.

VIDEO STORAGE

2.4.4.

EVENT DURATION

2.4.5.

SUPPORT AND SERVICE

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

ADVANCEMENTS IN THE FIELD OF SEMICONDUCTOR TECHNOLOGIES EMPOWERING

HIGH-SPEED CAMERA

2.7.2.

INCREASED DEMAND FOR HIGH-SPEED CAMERA FOR RESEARCH AND DEVELOPMENT

2.7.3.

INCREASED AVAILABILITY OF ELECTRONIC & OPTIC COMPONENTS

2.8. MARKET RESTRAINTS

2.8.1.

STORAGE CAPACITY A MAJOR LIMITATION TO PROLONGED USE OF HIGH-SPEED

CAMERAS

2.9. MARKET OPPORTUNITIES

2.9.1.

GROWTH IN USAGE OF HIGH-SPEED CAMERAS IN INTELLIGENT TRANSPORTATION

SYSTEM (ITS)

2.9.2.

LUCRATIVE OPPORTUNITIES FROM AEROSPACE, DEFENSE & MANUFACTURING

SECTOR

2.10. MARKET CHALLENGES

2.10.1.

HIGH COST OF HIGH-SPEED CAMERAS REDUCES THE CONSUMER BASE

3. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET

OUTLOOK - BY RESOLUTION

3.1. 0-2 MEGAPIXEL

3.2. 2-5 MEGAPIXEL

3.3. GREATER THAN 5 MEGAPIXEL

4. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA

MARKET OUTLOOK - BY SPECTRUM

4.1. VISIBLE RGB

4.2. INFRARED

4.3. X-RAY

5. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA

MARKET OUTLOOK - BY FRAME RATE

5.1. 1000-5000 FRAMES PER SECOND

5.2. 5000-20000 FRAMES PER SECOND

5.3. 20000-100000 FRAMES PER SECOND

5.4. 100000+ FRAMES PER SECOND

6. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA

MARKET OUTLOOK - BY COMPONENT

6.1. IMAGE SENSOR

6.2. PROCESSORS

6.3. LENS

6.4. MEMORY

6.5. FANS & COOLING

6.6. OTHERS

7. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA

MARKET OUTLOOK - BY APPLICATION

7.1. AUTOMOTIVE & TRANSPORTATION

7.2. RETAIL

7.3. AEROSPACE & DEFENSE

7.4. HEALTHCARE

7.5. MEDIA & ENTERTAINMENT

7.6. OTHERS

8. MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA

MARKET - REGIONAL OUTLOOK

8.1. UNITED ARAB EMIRATES

8.2. TURKEY

8.3. SAUDI ARABIA

8.4. SOUTH AFRICA

8.5. REST OF MIDDLE EAST & AFRICA

9. COMPETITIVE LANDSCAPE

9.1. AMETEK

9.2. AOS TECHNOLOGIES AG

9.3. DEL IMAGING SYSTEMS LLC

9.4. FASTEC IMAGING CORPORATION

9.5. HS VISION GMBH

9.6. INTEGRATED DESIGN TOOLS

9.7. IX CAMERAS, INC.

9.8. LAETUS GMBH

9.9. LUMENERA CORPORATION

9.10. MIKROTRON GMBH

9.11. OPTRONIS GMBH

9.12. PCO AG

9.13. PHOTOMETRICS

9.14. PHOTRON LTD.

9.15. WEISSCAM GMBH

10. RESEARCH METHODOLOGY & SCOPE

10.1. RESEARCH SCOPE & DELIVERABLES

10.2. SOURCES OF DATA

10.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY RESOLUTION,

2019-2027 (IN $ MILLION)

TABLE 4: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY SPECTRUM,

2019-2027 (IN $ MILLION)

TABLE 5: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY FRAME RATE,

2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY COMPONENT,

2019-2027 (IN $ MILLION)

TABLE 7: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: KEY BUYING IMPACT ANALYSIS

FIGURE 3: MARKET ATTRACTIVENESS INDEX

FIGURE 4: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY 0-2

MEGAPIXEL, 2019-2027 (IN $ MILLION)

FIGURE 5: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY 2-5

MEGAPIXEL, 2019-2027 (IN $ MILLION)

FIGURE 6: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY GREATER

THAN 5 MEGAPIXEL, 2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY VISIBLE

RGB, 2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY INFRARED,

2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY X-RAY,

2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY 1000-5000

FPS, 2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY 5000-20000

FPS, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY

20000-100000 FPS, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY 100000+

FPS, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY IMAGE

SENSOR, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY

PROCESSORS, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY LENS,

2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY MEMORY,

2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY FANS

& COOLING, 2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY OTHERS,

2019-2027 (IN $ MILLION)

FIGURE 20: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY

AUTOMOTIVE & TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY RETAIL, 2019-2027

(IN $ MILLION)

FIGURE 22: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY AEROSPACE

& DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 23: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY

HEALTHCARE, 2019-2027 (IN $ MILLION)

FIGURE 24: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY MEDIA

& ENTERTAINMENT, 2019-2027 (IN $ MILLION)

FIGURE 25: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, BY OTHERS,

2019-2027 (IN $ MILLION)

FIGURE 26: MIDDLE EAST AND AFRICA HIGH-SPEED CAMERA MARKET, REGIONAL OUTLOOK,

2018 & 2027 (IN %)

FIGURE 27: UNITED ARAB EMIRATES HIGH-SPEED CAMERA MARKET, 2019-2027 (IN

$ MILLION)

FIGURE 28: TURKEY HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: SAUDI ARABIA HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $

MILLION)

FIGURE 30: SOUTH AFRICA HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $

MILLION)

FIGURE 31: REST OF MIDDLE EAST & AFRICA HIGH-SPEED CAMERA MARKET,

2019-2027 (IN $ MILLION)