Market By Product, Application, Indication, End-user And Geography | Forecast 2019-2027

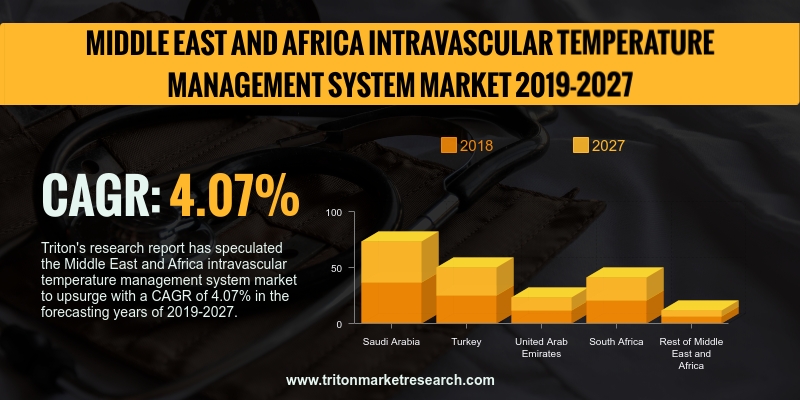

Triton's research report has speculated the Middle East and Africa intravascular temperature management system market to upsurge with a CAGR of 4.07% in the forecasting years of 2019-2027.

The report on the Middle East and Africa’s intravascular temperature management system market are:

• Saudi Arabia

• Turkey

• The United Arab Emirates

• South Africa

• Rest of the Middle East & Africa

The Middle East and Africa intravascular temperature management system market is driven by the increasing prevalence of diseases such as cancer, growth in the geriatric population and the rising healthcare expenditure across countries such as the UAE, Saudi Arabia, Lebanon, Qatar, and South Africa.

Report scope can be customized per your requirements. Request For Customization

According to the National Centre for Biotechnological Information (NCBI), colorectal cancer is the second-most prevalent type of cancer in Saudi Arabia that affected 10.3% of the population in 2016 and is the most common malignancy in males affecting 11.8% males in the country. According to an oncology report, the increasing prevalence of CRC creates an urgent need for prognostic/predictive cancer cell identification procedures. Healthcare modernization and a growing middle-class population will support growth within Saudi Arabia’s prescription drug market over the coming years. Saudi Arabia has the largest market for prescription drugs in the Gulf Cooperation Council, which is expected to continue as the uptake of generic and patented drugs continues on an upward trajectory. Patented medicines’ sales in the country continue to be driven by the rising demand for chronic-disease treatments, which, in turn, are boosting the Saudi Arabia intravascular temperature management system market.

The increasing awareness about intravascular temperature management systems, regional disease burden and the increasing health insurance penetration have led to the growth of the market in the rest of MEA countries. In addition, the strong distribution channel of global players such as BD, Stryker and 3M in this region propels the growth of the market.

Stryker Corporation is a US-based medical technology company working in three segments – orthopedic, neurotechnology & spine and the ‘MedSurg’ segment. The orthopedic segment provides an implant for use in trauma, extremities surgery and knee & hip joint replacement. The neurotechnology and spine segment provides neurovascular and neurosurgical devices, which include products used for minimally-invasive endovascular techniques. The MedSurg segment offers surgical navigation & surgical equipment systems, patient handling & emergency medical equipment, endoscopic & communication systems and reprocessed & remanufacture medical devices, along with other medical devices for use in several medical specialities.

1.

MIDDLE EAST AND AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET

- SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

BARGAINING POWER OF BUYERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. MARKET ATTRACTIVENESS INDEX

2.4. KEY INSIGHT

2.4.1.

AMBULATORY SURGICAL CENTERS ARE ANTICIPATED TO GROW AT A SIGNIFICANT

RATE DURING THE FORECAST PERIOD

2.4.2.

PRE-OPERATIVE CARE IS A WIDELY USED APPLICATION

2.4.3.

CONSUMABLES SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE

2.4.4.

ACUTE MYOCARDIAL INFARCTION (AMI) IS THE LARGEST REVENUE-GENERATING

INDICATION

2.5. VENDOR SCORECARD

2.6. MARKET POSITION OUTLOOK

2.7. MARKET DRIVERS

2.7.1.

RISE IN THE PREVALENCE OF CARDIOVASCULAR DISEASE

2.7.2.

SURGE IN THE NUMBER OF SURGICAL PROCEDURES

2.8. MARKET RESTRAINTS

2.8.1.

SIGNIFICANT COST OF SURGERIES ASSOCIATED WITH INTRAVASCULAR TEMPERATURE

MANAGEMENT SYSTEM

2.9. MARKET OPPORTUNITIES

2.9.1.

ADVANCEMENT IN TECHNOLOGY

2.9.2.

GROWTH OPPORTUNITIES IN THE DEVELOPING ECONOMIES

2.10.

MARKET CHALLENGES

2.10.1.

STRINGENT REGULATION

3.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY PRODUCT

3.1. SYSTEM

3.2. CONSUMABLES

4.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY

APPLICATION

4.1. PREOPERATIVE CARE

4.2. OPERATIVE CARE

4.3. POST-OPERATIVE CARE

4.4. ACUTE/CRITICAL CARE

5.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY INDICATION

5.1. ACUTE MYOCARDIAL INFARCTION (AMI)

5.2. STROKE

5.3. CARDIAC ARREST

5.4. FEVER/INFECTION

5.5. OTHER INDICATION

6.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY END-USER

6.1. SURGICAL CENTERS

6.2. EMERGENCY CARE UNITS

6.3. AMBULATORY SURGICAL CENTERS

6.4. OTHER END-USER

7.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET - REGIONAL OUTLOOK

7.1. MIDDLE EAST AND AFRICA

7.1.1.

COUNTRY ANALYSIS

7.1.1.1.

SAUDI ARABIA

7.1.1.2.

TURKEY

7.1.1.3.

UNITED ARAB EMIRATES

7.1.1.4.

SOUTH AFRICA

7.1.1.5.

REST OF MIDDLE EAST & AFRICA

8.

COMPANY PROFILES

8.1. ASAHI KASEI CORP.

8.2. VYAIRE MEDICAL, INC.

8.3. INDITHERM PLC (ACQUIRED BY INSPIRATION

HEALTHCARE)

8.4. BECTON, DICKINSON AND COMPANY

8.5. BIEGLER GMBH

8.6. THE 37COMPANY

8.7. ESTILL MEDICAL TECHNOLOGIES, INC.

8.8. GERATHERM MEDICAL AG

8.9. MEDTRONIC PLC

8.10.

THE SURGICAL COMPANY B.V.

8.11.

SMITHS GROUP PLC

8.12.

STIHLER ELECTRONIC GMBH (ACQUIRED BY GENTHERM GMBH)

8.13.

BELMONT INSTRUMENT CORPORATION

8.14.

STRYKER CORPORATION

8.15.

3M COMPANY

8.16.

ZOLL MEDICAL CORPORATION

9.

RESEARCH METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE & DELIVERABLES

9.1.1.

OBJECTIVES OF STUDY

9.1.2.

SCOPE OF STUDY

9.2. SOURCES OF DATA

9.2.1.

PRIMARY DATA SOURCES

9.2.2.

SECONDARY DATA SOURCES

9.3. RESEARCH METHODOLOGY

9.3.1.

EVALUATION OF PROPOSED MARKET

9.3.2.

IDENTIFICATION OF DATA SOURCES

9.3.3.

ASSESSMENT OF MARKET DETERMINANTS

9.3.4.

DATA COLLECTION

9.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

TABLE 2 INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM COMPANY MARKET POSITION OUTLOOK 2018

TABLE 3 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027

($ MILLION)

TABLE 4 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($

MILLION)

TABLE 5 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION

2019-2027 ($ MILLION)

TABLE 6 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027

($ MILLION)

TABLE 7 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY COUNTRY 2019-2027

($ MILLION)

FIGURE 1 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 2 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY SYSTEM 2019-2027

($ MILLION)

FIGURE 3 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY CONSUMABLES

2019-2027 ($ MILLION)

FIGURE 4 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRE-OPERATIVE CARE

2019-2027 ($ MILLION)

FIGURE 5 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY OPERATIVE CARE

2019-2027 ($ MILLION)

FIGURE 6 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY POST-OPERATIVE

CARE 2019-2027 ($ MILLION)

FIGURE 7 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY ACUTE/CRITICAL

CARE 2019-2027 ($ MILLION)

FIGURE 8 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY ACUTE MYOCARDIAL

INFARCTION (AMI) 2019-2027 ($ MILLION)

FIGURE 9 MIDDLE EAST AND

AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY STROKE 2019-2027

($ MILLION)

FIGURE 10 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY CARDIAC ARREST 2019-2027

($ MILLION)

FIGURE 11 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY FEVER/INFECTION 2019-2027

($ MILLION)

FIGURE 12 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY OTHER INDICATION

2019-2027 ($ MILLION)

FIGURE 13 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY SURGICAL CENTERS 2019-2027

($ MILLION)

FIGURE 14 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY EMERGENCY CARE UNITS

2019-2027 ($ MILLION)

FIGURE 15 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY AMBULATORY SURGICAL

CENTERS 2019-2027 ($ MILLION)

FIGURE 16 MIDDLE EAST AND AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY OTHER END-USER 2019-2027

($ MILLION)

FIGURE 17 SAUDI ARABIA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 18 TURKEY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 19 UNITED ARAB EMIRATES

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 20 SOUTH AFRICA

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 21 REST OF MIDDLE EAST

& AFRICA INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($

MILLION)