Market By Category, Source, Product And Geography | Forecast 2019-2027

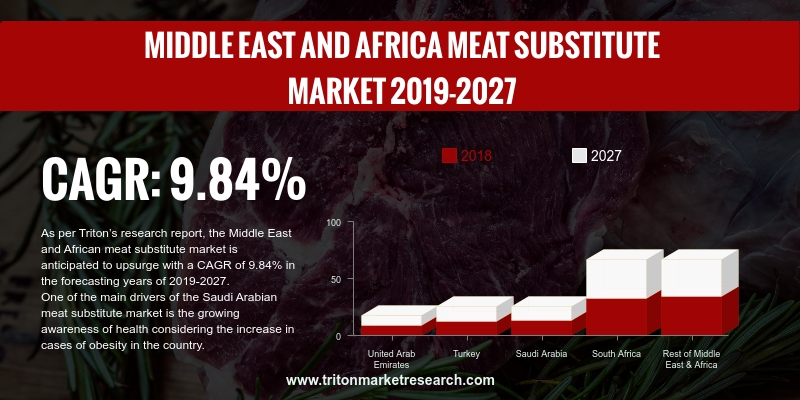

As per Triton’s research report, the Middle East and African meat substitute market is anticipated to upsurge with a CAGR of 9.84% in the forecasting years of 2019-2027.

The countries included in the report on the Middle East and Africa’s meat substitute market are:

• South Africa

• Saudi Arabia

• Turkey

• The UAE

• Rest of MEA

Report scope can be customized per your requirements. Request For Customization

One of the main drivers of the Saudi Arabian meat substitute market is the growing awareness of health considering the increase in cases of obesity in the country. In order to express dissent over unethical practices in the livestock trade, people have started abstaining from meat and animal products. Livestock farming causes damage to the environment by leading to land & water degradation and large amounts of greenhouse gas emissions. Hence, numerous people in the country have adopted veganism. Saudi has witnessed an increase in demand for plant-based food options, which can be attributed to the country’s youth. The increasing public cognizance regarding the environment, animal rights and good health have also been instrumental in promoting the growth of this market. Along with this, around a dozen vegan restaurants are expected to come up in the Middle East, which will help in fueling the growth of this market further.

The meat substitute market in Turkey has shown steady growth due to its citizens accepting a plant-based diet. In addition to the concerns regarding food products, Turkish consumers have become sensitive about the use of animal fibers on textiles or testing cosmetics on animals. Furthermore, the Vegan & Vegetarian Association of Turkey has been spreading awareness on veganism. In a first, a vegan festival was organized in the country in Didim. Regional festivals have been instrumental in educating people about the importance of veganism. There are a plethora of vegetarian and vegan options such as couscous, dolmades, falafel and hummus available in the country. This will help in boosting the market in the coming years.

Cauldron Foods Limited produces vegetable-based foods. It offers falafels, vegetarian sausages, burgers, pâtés, bakes, snacks, ready meals, and tofus. The company was founded in 1979; as of November 1, 2005, Cauldron Foods Limited was operating as a subsidiary of Premier Foods plc. The company offers Mediterranean sausages and a varied range of Moroccan falafel, Middle Eastern falafel and Persian falafels, which cater to the tastes of consumers in the Middle East.

1.

MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

GROWING ADOPTION OF WHEAT-BASED FOODS

2.2.2.

RISE IN VEGAN CAFES AND RESTAURANTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1.

UPSURGE IN HEALTH-CONSCIOUS POPULACE

2.6.2.

HIGH DEMAND FOR PLANT-BASED DIET

2.6.3.

INCREASE IN OBESITY AIDS MARKET GROWTH

2.7. MARKET RESTRAINTS

2.7.1.

EASY ACCESS TO ALTERNATIVE PRODUCTS

2.8. MARKET OPPORTUNITIES

2.8.1.

GROWING ADOPTION OF VEGANISM

2.8.2.

INFILTRATION OF RETAIL CHAIN

2.9. MARKET CHALLENGES

2.9.1.

HIGH COST LEVIED ON ANALOG MEAT

2.9.2.

RISE IN ALLERGIES OWING TO SOYA-BASED PRODUCTS

3.

MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET OUTLOOK - BY CATEGORY

3.1. FROZEN

3.2. REFRIGERATED

3.3. SHELF-STABLE

4.

MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET OUTLOOK - BY SOURCE

4.1. SOY-BASED

4.2. WHEAT-BASED

4.3. MYCOPROTEIN

4.4. OTHER SOURCES

5.

MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET OUTLOOK - BY PRODUCT

5.1. TOFU-BASED

5.2. TEMPEH-BASED

5.3. TVP-BASED

5.4. SEITAN-BASED

5.5. QUORN-BASED

5.6. OTHER PRODUCTS

6.

MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET - REGIONAL OUTLOOK

6.1. MIDDLE EAST AND AFRICA

6.1.1.

UNITED ARAB EMIRATES

6.1.2.

TURKEY

6.1.3.

SAUDI ARABIA

6.1.4.

SOUTH AFRICA

6.1.5.

REST OF MIDDLE EAST & AFRICA

7.

COMPETITIVE LANDSCAPE

7.1. AMY’S KITCHEN INC.

7.2. BEYOND MEAT

7.3. CAULDRON FOODS LTD

7.4. QUORN FOODS LTD

7.5. KELLOGG CO.

7.6. TOFURKY

7.7. SUPERBOM

7.8. MEATLESS B.V.

7.9. VBITES FOOD LTD.

7.10. MGP INGREDIENTS

7.11. IMPOSSIBLE FOODS INC.

7.12. CONAGRA BRANDS INC.

7.13. THE CAMPBELL SOUP COMPANY

7.14. SONIC BIOCHEM LTD

7.15. VEGABOM HEALTHY OPTION

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY CATEGORY,

2019-2027 (IN $ MILLION)

TABLE 5: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY SOURCE,

2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY PRODUCT,

2019-2027 (IN $ MILLION)

TABLE 7: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

FIGURE 1: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY CATEGORY,

2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY FROZEN,

2019-2027 (IN $ MILLION)

FIGURE 4: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY

REFRIGERATED, 2019-2027 (IN $ MILLION)

FIGURE 5: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY

SHELF-STABLE, 2019-2027 (IN $ MILLION)

FIGURE 6: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY SOY-BASED,

2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY WHEAT-BASED,

2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY MYCOPROTEIN,

2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY OTHER

SOURCES, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY TOFU-BASED,

2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY

TEMPEH-BASED, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY TVP-BASED,

2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY

SEITAN-BASED, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY

QUORN-BASED, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, BY OTHER

PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND AFRICA MEAT SUBSTITUTE MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: UNITED ARAB EMIRATES MEAT SUBSTITUTE MARKET, 2019-2027 (IN $

MILLION)

FIGURE 18: TURKEY MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: SAUDI ARABIA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SOUTH AFRICA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: REST OF MIDDLE EAST & AFRICA MEAT SUBSTITUTE MARKET,

2019-2027 (IN $ MILLION)