Market By Component, Fidelity, End-user And Geography | Forecast 2019-2027

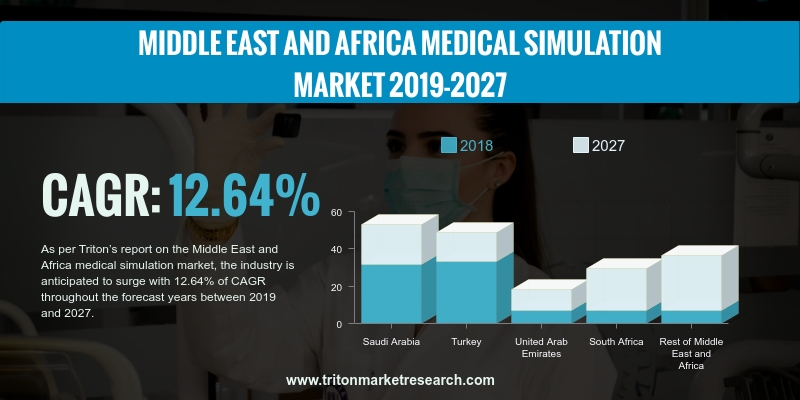

As per Triton’s report on the Middle East and Africa medical simulation market, the industry is anticipated to surge with 12.64% of CAGR throughout the forecast years between 2019 and 2027.

The countries reviewed in the report on the medical simulation market in the Middle East and Africa are:

• The UAE

• Turkey

• South Africa

• Saudi Arabia

• Rest of MEA

It took South Africa longer than a decade to gain access to simulation training facilities at all of its local universities. Though simulation for medical education in well-resourced settings is uncommon in lower-income countries, it has shown exponential growth in South Africa. As of 2018, medical students in the country were using robots for simulation, which are known as Hal. Hals are able to experience bleeding, seizures, traumatic shock, cardiac arrest and many others. These symptoms are embedded while programming the robot, and they enable practicing surgeons & doctors to establish a proper diagnosis.

Report scope can be customized per your requirements. Request For Customization

Besides, at the University of Johannesburg (UJ) in 2014, medical students entered into a collaboration with Philips for the purpose of developing a state-of-the-art medical simulation facility on its Doornfontein campus. This collaboration between Stellenbosch University and Medtronic led to the formation of the Sunskill simulation laboratory in South Africa. The laboratory is making use of iSTAN patient simulators and a LapVR interventional simulator to train students for laparoscopic surgery, which is aimed at transforming healthcare education in the country. All such advancements in technology in South Africa have thereby stabilized its market for medical simulation. The expensive high-fidelity equipment, however, is hindering the market growth.

Gaumard Scientific Company is engaged in the manufacture and distribution of simulators for healthcare education. It provides products for pediatric care, obstetrics, trauma care, emergency life support, surgical care, respiratory, men’s health skills trainers, women’s health skills trainers, nursing skill trainers, nursing care and learning modules, among others. The Pediatric HAL S2225, one of the company’s product offerings, is the most advanced pediatric patient simulator in the world. Gaumard has a presence across various regions in the world, including the Middle East and Africa.

1. MIDDLE

EAST AND AFRICA MEDICAL SIMULATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL OUTLOOK

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. BARGAINING

POWER OF SUPPLIERS

2.2.5. THREAT

OF COMPETITIVE RIVALRY

2.3. MARKET

TRENDS

2.4. REGULATORY

OUTLOOK

2.5. MARKET

SHARE OUTLOOK

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. MARKET

DRIVERS

2.7.1. GROWING

CONCERN FOR PATIENT SAFETY

2.7.2. INCREASING

DEMAND FOR MINIMALLY INVASIVE SURGERY (MIS)

2.8. MARKET

RESTRAINTS

2.8.1. HIGH

COST OF MEDICAL SIMULATORS

2.8.2. LACK

OF SKILLED PROFESSIONALS

2.8.3. AVERSENESS

TO ADOPT NEW SIMULATION TECHNOLOGIES

2.9. MARKET

OPPORTUNITIES

2.9.1. TECHNOLOGICAL

ADVANCEMENTS

2.9.2. OPPORTUNITIES

FOR CARRYING OUT SIMULATION IN THE EMERGING MARKETS

2.10.

MARKET CHALLENGES

2.10.1.

CHALLENGES IN THE MEDICAL

SIMULATION OPRATION

3. MEDICAL

SIMULATION MARKET OUTLOOK – BY COMPONENT

3.1. MODEL-BASED

SIMULATION

3.2. WEB-BASED

SIMULATION

3.3. SIMULATION

TRAINING SERVICES

4. MEDICAL

SIMULATION MARKET OUTLOOK – BY FIDELITY

4.1. LOW-FIDELITY

4.2. MEDIUM-FIDELITY

4.3. HIGH-FIDELITY

5. MEDICAL

SIMULATION MARKET OUTLOOK – BY END-USER

5.1. ACADEMIC

INSTITUTIONS & RESEARCH CENTERS

5.2. HOSPITALS

& CLINICS

5.3. MILITARY

ORGANIZATIONS

6. MEDICAL

SIMULATION MARKET – REGIONAL OUTLOOK

6.1. MIDDLE

EAST AND AFRICA

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. SAUDI

ARABIA

6.1.1.2. TURKEY

6.1.1.3. THE

UNITED ARAB EMIRATES

6.1.1.4. SOUTH

AFRICA

6.1.1.5. REST

OF MIDDLE EAST & AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. GAUMARD

SCIENTIFIC COMPANY

7.2. CANADIAN

AVIATION ELECTRONICS (CAE)

7.3. MENTICE

AB

7.4. KYOTO

KAGAKU CO., LTD.

7.5. SIMULAIDS,

INC.

7.6. KINDHEART,

INC.

7.7. 3D

SYSTEMS CORPORATION

7.8. LAERDAL

MEDICAL AS

7.9. SURGICAL

SCIENCE SWEDEN AB

7.10.

LIMBS & THINGS LTD.

7.11.

INTELLIGENT ULTRASOUND GROUP

PLC (FORMERLY MEDAPHOR GROUP PLC)

7.12.

NASCO

7.13.

SIMULAB CORPORATION

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 MIDDLE EAST AND AFRICA MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

TABLE 2 COST OF SIMULATION EQUIPMENT

TABLE 3 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY COMPONENT 2019-2027 ($ MILLION)

TABLE 4 MIDDLE EAST AND AFRICA MEDICAL

SIMULATION MARKET BY FIDELITY 2019-2027 ($ MILLION)

TABLE 5 MIDDLE EAST AND AFRICA MEDICAL

SIMULATION MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 6 MIDDLE EAST AND AFRICA MEDICAL

SIMULATION MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET 2019-2027 ($ MILLION)

FIGURE 2 COMPANY MARKET SHARE OUTLOOK OF MEDICAL

SIMULATION 2018 (%)

FIGURE 3 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY MODEL-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 4 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY WEB-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 5 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY SIMULATION TRAINING SERVICES 2019-2027 ($ MILLION)

FIGURE 6 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY LOW-FIDELITY 2019-2027 ($ MILLION)

FIGURE 7 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY MEDIUM-FIDELITY 2019-2027 ($ MILLION)

FIGURE 8 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY HIGH-FIDELITY 2019-2027 ($ MILLION)

FIGURE 9 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY ACADEMIC INSTITUTIONS & RESEARCH CENTERS 2019-2027 ($ MILLION)

FIGURE 10 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY HOSPITALS & CLINICS 2019-2027 ($ MILLION)

FIGURE 11 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET BY MILITARY ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 12 MIDDLE EAST AND AFRICA MEDICAL SIMULATION

MARKET 2019-2027 ($ MILLION)

FIGURE 13 SAUDI ARABIA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 14 TURKEY MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)

FIGURE 15 THE UNITED ARAB EMIRATES MEDICAL SIMULATION

MARKET 2019-2027 ($ MILLION)

FIGURE 16 SOUTH AFRICA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 17 REST OF MIDDLE EAST & AFRICA MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)