Market By Drugs & Devices And Geography | Forecast 2019- 2027

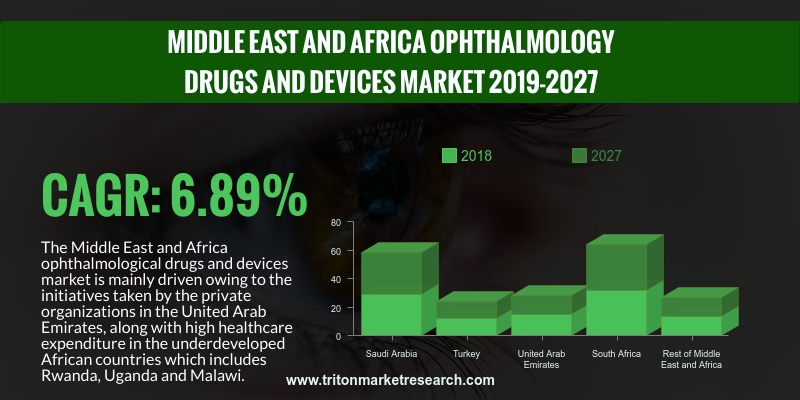

Triton’s research report on the Middle East and African ophthalmology drugs and devices market estimates the market to upsurge with a CAGR of 6.89% in the forecasting years of 2019-2027.

The report on the Middle East and Africa’s ophthalmology drugs and devices market includes the countries of:

• The United Arab Emirates

• Saudi Arabia

• Turkey

• South Africa

• Rest of the Middle East & Africa

Report scope can be customized per your requirements. Request For Customization

The Middle East and Africa ophthalmological drugs and devices market is mainly driven owing to the initiatives taken by the private organizations in the United Arab Emirates, along with high healthcare expenditure in the underdeveloped African countries which includes Rwanda, Uganda and Malawi. The United Arab Emirates government has taken initiatives to enhance the ophthalmological medical services in the country, which includes the establishment of eye specialty hospitals, specifically in the urban and semi-urban provinces of the country. According to company sources, Moorefield’s, which is a UK-based healthcare center, has launched Moorefield’s Eye Hospital Center in the city of Abu Dhabi in cooperation with UE Medical, a UAE-based organization that aims to offer efficient & cost-effective ophthalmological medical services to the individuals of the country. The Moorefield’s eye hospital would be accompanying a team of expert ophthalmologists, who precisely focus on medical retinal diseases, such as diabetic retinopathy, which has a high prevalence in the country.

The demand for intraocular lenses and phacoemulsification devices is rising as a result of the increasing prevalence of cataracts. As per the WHO, unoperated cataracts and uncorrected refractive errors are the top two causes of vision impairment. Increasing incidences of ocular and ophthalmic conditions are the major factor driving the demand for intraocular lenses and phacoemulsification devices, as intraocular lens are planted in humans when the natural lens is surgically removed due to cataract, and phacoemulsification devices are required to perform cataract surgeries. Furthermore, various governments across the globe are also providing incentives on the cataract surgeries, further providing plenty of growth opportunities for the ophthalmology drug and devices market.

Allergan, Inc. is an Irish pharmaceutical company, that develops, manufactures, markets and distributes specialty-branded, biosimilar and OTC products. The company operates in several countries around the world, including the US, Canada, China, India and other high growth markets of Europe, Southeast Asia, the Middle East and Latin America.

1.

MIDDLE EAST AND AFRICA OPHTHALMOLOGY DRUGS AND DEVICES MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES ANALYSIS

2.2.1.

BARGAINING POWER OF BUYERS

2.2.2.

BARGAINING POWER OF SUPPLIER

2.2.3.

THREATS OF NEW ENTRANTS

2.2.4.

THREATS OF SUBSTITUTES

2.2.5.

COMPETITIVE RIVALRY

2.3. STRATEGIC OUTLOOK

2.4. KEY INSIGHT

2.5. VALUE CHAIN OUTLOOK

2.6. KEY BUYING STANDARDS

2.7. INVESTMENT OUTLOOK

2.8. SUPPLY CHAIN OUTLOOK

2.9. MARKET DRIVERS

2.9.1.

INCREASING OPHTHALMIC DISORDERS DUE TO HIGH BLOOD SUGAR

2.9.2.

UPSURGE IN HEALTHCARE SPENDING

2.9.3.

TECHNOLOGICAL ADVANCEMENT

2.10.

MARKET RESTRAINTS

2.10.1.

EXPIRATIONS OF BRAND PATENTS HAVE AFFECTED THE PHARMACEUTICAL INDUSTRY

2.10.2.

LOW COGNIZANCE RELATED TO OPHTHALMIC DRUGS

2.10.3.

DRUG APPROVALS DELAY AND NUMBER OF DRUGS IN THE PIPELINE

2.11.

MARKET OPPORTUNITIES

2.11.1.

DEMAND FOR PHACOEMULSIFICATION DEVICES AND INTRAOCULAR LENSES IS

INCREASING

2.12.

MARKET CHALLENGES

2.12.1.

DIFFICULTIES ASSOCIATED WITH THE CONDUCT OF OCULAR DISEASES

3.

OPHTHALMOLOGY DRUGS AND DEVICES MARKET OUTLOOK - BY DRUGS AND DEVICES

3.1. DEVICES

3.1.1.

DIAGNOSTIC & MONITORING EQUIPMENT

3.1.1.1.

OPTICAL COHERENCE TOMOGRAPHY

3.1.1.2.

OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

3.1.1.3.

FUNDUS CAMERA MARKET

3.1.1.4.

OPHTHALMOSCOPES

3.1.1.5.

RETINOSCOPE

3.1.1.6.

PACHYMETER

3.1.1.7.

WAVEFRONT ABERROMETERS

3.1.1.8.

PERIMETERS/VISUAL FIELD ANALYZER

3.1.1.9.

AUTOREFRACTORS/PHOROPTER

3.1.1.10.

SPECULAR MICROSCOPE

3.1.1.11.

CORNEAL TOPOGRAPHERS

3.1.1.12.

OTHER DIAGNOSTIC & MONITORING EQUIPMENT MARKET

3.1.2.

SURGERY DEVICES

3.1.2.1.

CATARACT SURGERY DEVICES

3.1.2.2.

GLAUCOMA SURGERY DEVICES

3.1.2.3.

REFRACTIVE SURGERY DEVICES

3.1.2.4.

VITREORETINAL SURGERY DEVICES

3.1.3.

VISION CARE

3.2. DRUGS

3.2.1.

GLAUCOMA DRUG

3.2.2.

RETINAL DISORDER DRUG

3.2.3.

DRY EYE DRUG

3.2.4.

ALLERGIC CONJUNCTIVITIS, INFLAMMATION AND CONJUNCTIVITIS DRUG

3.2.5.

DRUGS BY USE OF PRESERVATION

3.2.5.1.

PRESERVED DRUGS

3.2.5.2.

PRESERVATIVE-FREE DRUGS

4.

OPHTHALMOLOGY DRUGS AND DEVICES MARKET - REGIONAL OUTLOOK

4.1.1.

UNITED ARAB EMIRATES

4.1.2.

SAUDI ARABIA

4.1.3.

TURKEY

4.1.4.

SOUTH AFRICA

4.1.5.

REST OF MIDDLE EAST & AFRICA

5.

COMPETITIVE LANDSCAPE

5.1. ALLERGAN, INC.

5.2. BAYER

5.3. CARL ZEISS AG

5.4. ESSILOR INTERNATIONAL S.A.

5.5. GLAXOSMITHKLINE

5.6. JOHNSON & JOHNSON, INC.

5.7. NOVARTIS INTERNATIONAL AG

5.8. PFIZER

5.9. ROCHE HOLDING AG

5.10.

SANTEN PHARMACEUTICAL CO., LTD.

6.

METHODOLOGY AND SCOPE

6.1. RESEARCH SCOPE

6.2. SOURCES OF DATA

6.3. RESEARCH METHODOLOGY

TABLE 1 MIDDLE EAST AND

AFRICA OPHTHALMOLOGY DRUGS AND DEVICES MARKET 2019-2027 ($ MILLION)

TABLE 2 COMMON CAUSES OF

LOSS OF VISION IN THE ELDERLY

TABLE 3 SELECTED LISTS OF

GLAUCOMA DRUGS IN LATE-STAGE CLINICAL TRIALS

TABLE 4 MIDDLE EAST AND

AFRICA OPHTHALMOLOGY DRUGS AND DEVICES MARKET BY DRUGS AND DEVICES 2019-2027 ($

MILLION)

TABLE 5 MIDDLE EAST AND

AFRICA DEVICES MARKET IN DIAGNOSTIC & MONITORING EQUIPMENT BY TYPES 2019-2027 ($ MILLION)

TABLE 6 MIDDLE EAST AND AFRICA

DEVICES MARKET IN SURGERY DEVICE BY TYPES 2019-2027 ($ MILLION)

TABLE 7 MIDDLE EAST AND

AFRICA DRUGS AND DEVICES MARKET IN DRUGS BY TYPES 2019-2027 ($ MILLION)

TABLE 8 MIDDLE EAST AND

AFRICA OPHTHALMOLOGY DRUGS AND DEVICES MARKET BY COUNTRIES 2019-2027 ($

MILLION)

FIGURE 1

MIDDLE EAST AND AFRICA OPHTHALMOLOGY DRUGS AND DEVICES MARKET 2019-2027

FIGURE 2 MIDDLE

EAST AND AFRICA DRUGS AND DEVICES MARKET IN DEVICES 2019-2027 ($ MILLION)

FIGURE 3 MIDDLE

EAST AND AFRICA DEVICES MARKET IN DIAGNOSTIC & MONITORING EQUIPMENT

2019-2027 ($ MILLION)

FIGURE 4 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN OPTICAL

COHERENCE TOMOGRAPHY 2019-2027 ($ MILLION)

FIGURE 5 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN OPHTHALMIC

ULTRASOUND IMAGING SYSTEMS 2019-2027 ($ MILLION)

FIGURE 6 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN FUNDUS CAMERA

MARKET 2019-2027 ($ MILLION)

FIGURE 7 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN OPHTHALMOSCOPES

2019-2027 ($ MILLION)

FIGURE 8 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN RETINOSCOPE

2019-2027 ($ MILLION)

FIGURE 9 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN PACHYMETER

2019-2027 ($ MILLION)

FIGURE 10 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN WAVEFRONT

ABERROMETERS 2019-2027 ($ MILLION)

FIGURE 11

MIDDLE EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN

PERIMETERS/VISUAL FIELD ANALYZER 2019-2027 ($ MILLION)

FIGURE 12 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN

AUTOREFRACTORS/PHOROPTER 2019-2027 ($ MILLION)

FIGURE 13 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN SPECULAR MICROSCOPE

2019-2027 ($ MILLION)

FIGURE 14 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN CORNEAL

TOPOGRAPHERS 2019-2027 ($ MILLION)

FIGURE 15 MIDDLE

EAST AND AFRICA DIAGNOSTIC & MONITORING EQUIPMENT MARKET IN OTHER

DIAGNOSTIC & MONITORING EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 16 MIDDLE

EAST AND AFRICA DEVICES MARKET IN SURGERY DEVICE 2019-2027 ($ MILLION)

FIGURE 17 MIDDLE

EAST AND AFRICA SURGERY DEVICES MARKET IN CATARACT SURGERY DEVICES 2019-2027 ($

MILLION)

FIGURE 18 MIDDLE

EAST AND AFRICA SURGERY DEVICES MARKET IN GLAUCOMA SURGERY DEVICES 2019-2027 ($

MILLION)

FIGURE 19 MIDDLE

EAST AND AFRICA SURGERY DEVICES MARKET IN REFRACTIVE SURGERY DEVICES 2019-2027

($ MILLION)

FIGURE 20 MIDDLE

EAST AND AFRICA SURGERY DEVICES MARKET IN VITREORETINAL SURGERY DEVICES

2019-2027 ($ MILLION)

FIGURE 21 MIDDLE

EAST AND AFRICA DEVICES MARKET IN VISION CARE MARKET 2019-2027 ($ MILLION)

FIGURE 22 MIDDLE

EAST AND AFRICA DRUGS AND DEVICES MARKET IN DRUGS 2019-2027 ($ MILLION)

FIGURE 23 MIDDLE

EAST AND AFRICA DRUGS MARKET IN GLAUCOMA DRUG 2019-2027 ($ MILLION)

FIGURE 24 MIDDLE

EAST AND AFRICA DRUGS MARKET IN RETINAL DISORDER DRUG 2019-2027 ($ MILLION)

FIGURE 25 MIDDLE

EAST AND AFRICA DRUGS MARKET IN DRY EYE DRUG 2019-2027 ($ MILLION)

FIGURE 26 MIDDLE

EAST AND AFRICA DRUGS MARKET IN ALLERGIC CONJUNCTIVITIS, INFLAMMATION AND

CONJUNCTIVITIS DRUG 2019-2027 ($ MILLION)

FIGURE 27 MIDDLE

EAST AND AFRICA DRUGS BY USE OF PRESERVATION IN PRESERVED DRUGS 2019-2027 ($

MILLION)

FIGURE 28 MIDDLE

EAST AND AFRICA DRUGS BY USE OF PRESERVATION IN PRESERVATIVE-FREE DRUGS

2019-2027 ($ MILLION)

FIGURE 29 MIDDLE

EAST AND AFRICA PRESERVATIVE-FREE DRUGS MARKET IN SINGLE-DOSE 2019-2027 ($

MILLION)

FIGURE 30 MIDDLE

EAST AND AFRICA PRESERVATIVE-FREE DRUGS MARKET IN MULTI-DOSE 2019-2027 ($

MILLION)

FIGURE 31 SAUDI

ARABIA COUNTRIES OPHTHALMOLOGY DRUGS AND DEVICES MARKET 2019-2027 ($ MILLION)

FIGURE 32 TURKEY

COUNTRIES OPHTHALMOLOGY DRUGS AND DEVICES MARKET 2019-2027 ($ MILLION)

FIGURE 33 UNITED

ARAB EMIRATES COUNTRIES OPHTHALMOLOGY DRUGS AND DEVICES MARKET 2019-2027 ($

MILLION)

FIGURE 34 SOUTH

AFRICA COUNTRIES OPHTHALMOLOGY DRUGS AND DEVICES MARKET 2019-2027 ($ MILLION)

FIGURE 35 REST

OF MIDDLE EAST & AFRICA COUNTRIES OPHTHALMOLOGY DRUGS AND DEVICES MARKET

2019-2027 ($ MILLION)