Market By Type, End-user And Geography | Forecast 2019-2027

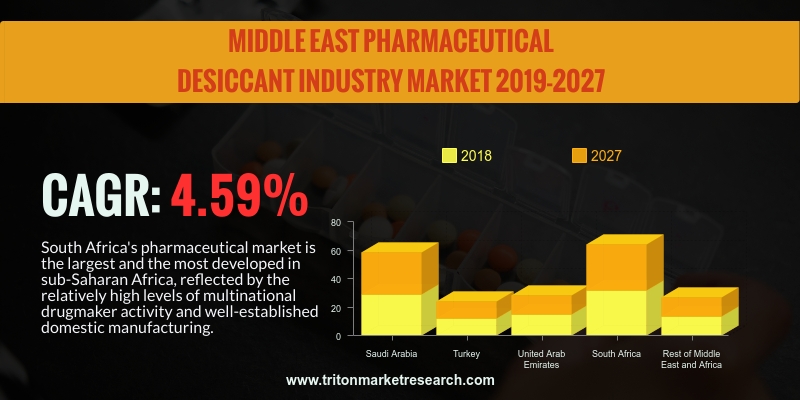

Triton Market Research’s report has determined the Middle East and Africa’s pharmaceutical desiccant market to upsurge with a CAGR of 4.59% throughout the forecasting years of 2019-2027.

The countries that have been included in the report on the Middle East and Africa’s pharmaceutical desiccant market are:

• The United Arab Emirates

• Saudi Arabia

• Turkey

• South Africa

• Rest of the Middle East & Africa

South Africa's pharmaceutical market is the largest and the most developed in sub-Saharan Africa, reflected by the relatively high levels of multinational drugmaker activity and well-established domestic manufacturing. Looking forward, regulatory advancements will take time to materialize, and drugmakers will face a number of headwinds in the form of a weak local currency and an uncertain macroeconomic and political environment. While this is likely to weigh on investor perceptions, opportunities for foreign drugmakers to grasp a foothold in the market remain abundant, particularly in the generic medicines sector.

Report scope can be customized per your requirements. Request For Customization

Pharmaceuticals witnessed an increase in expenditure of 4.8% from ZAR 43.3 billion in 2017 to ZAR 45.4 billion in 2018. Healthcare witnessed a 7.5% increase in expenditure from ZAR 31 billion to 31.8 billion. There will be an increase in demand for generic prescription drugs as the combination of rising incomes, the roll-out of national health insurance and better healthcare infrastructure spur the demand for medicines.

Factors such as government pricing policy focused on reducing costs, government procurement favoring domestic companies, lack of universal healthcare insurance & funding shortcomings in the public healthcare system, slow drug approvals process and vast inequality between infrastructure & provision of care in the public & private sectors are restraining the development of the pharmaceuticals and healthcare industry. Also, threats from countries like India and China offering low-cost generic drugs could replace the domestic players in the region. In January 2017, a new clinical trials unit (CTU) opened at the Medical City at King Saud University, seeking to fill a gap in the rate of clinical trials in the Kingdom. In December 2017, GlaxoSmithKline upped its stake to 75% of Glaxo Saudi Arabia Limited, with plans to expand manufacturing in the Kingdom.

Headquartered in Muttenz, Switzerland, Clariant International AG is a speciality chemicals company. It is engaged in the development, manufacturing, distribution and sales of a wide range of speciality chemicals that are used in customers’ manufacturing & treatment processes. The company's products find applications in the home care, industrial, crop protection, automotive, paints & coatings, plastic, refining, pharmaceuticals and transportation markets. Clariant operates through a network of manufacturing facilities, R&D and technical centres globally. The company sells its products in the Americas, Europe, the Middle East, Asia and Africa.

1.

MIDDLE EAST AND AFRICA PHARMACEUTICAL

DESICCANT MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES ANALYSIS

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

BARGAINING POWER OF SUPPLIERS

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

THREAT OF SUBSTITUTES

2.2.5.

COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. SUPPLY CHAIN ANALYSIS

2.5. KEY INSIGHT

2.6. MARKET DRIVERS

2.6.1.

INCREASING GERIATRIC POPULATION

2.6.2.

GOVERNMENT INITIATIVES TAKEN TO ENSURE QUALITY OF DRUGS

2.6.3.

CONTINUOUS GROWTH IN THE PHARMACEUTICAL INDUSTRY

2.7. MARKET RESTRAINTS

2.7.1.

VARIABLE TEMPERATURES HAMPER PHARMACEUTICAL PRODUCTS

2.7.2.

STRINGENT REGULATIONS

2.8. MARKET OPPORTUNITIES

2.8.1.

ESTABLISHMENT OF STRONGER PRESENCE IN VARYING CONSUMER PREFERENCES

2.9. MARKET CHALLENGES

2.9.1.

GROWING CUSTOMER EXPECTANCIES

2.9.2.

PRICING IS MARKET-BASED RATHER THAN COST-BASED

3.

PHARMACEUTICAL DESICCANT MARKET OUTLOOK - BY TYPES

3.1. SILICA GEL

3.2. ACTIVATED ALUMINA

3.3. CARBONCLAY DESICCANT

3.4. MOLECULAR SIEVES

3.5. OTHER TYPES

4.

PHARMACEUTICAL DESICCANT MARKET OUTLOOK - BY END-USER

4.1. TABLETS

4.2. API'S

4.3. CAPSULES

4.4. NUTRACEUTICAL PRODUCT PACKAGING

4.5. DIAGNOSTIC KIT

5.

PHARMACEUTICAL DESICCANT MARKET - REGIONAL OUTLOOK

5.1. MIDDLE EAST AND AFRICA

5.1.1.

COUNTRY ANALYSIS

5.1.1.1.

UNITED ARAB EMIRATES

5.1.1.2.

SAUDI ARABIA

5.1.1.3.

TURKEY

5.1.1.4.

SOUTH AFRICA

5.1.1.5.

REST OF MIDDLE EAST & AFRICA

6.

COMPANY PROFILES

6.1. CAPITOL SCIENTIFIC, INC.

6.2. CLARIANT

6.3. CSP TECHNOLOGIES, INC.

6.4. DESICCARE, INC.

6.5. E. I. DU PONT DE NEMOURS AND COMPANY

6.6. MULTISORB TECHNOLOGIES

6.7. MUNTERS AB

6.8. OKER-CHEMIE GMBH

6.9. PROFLUTE AB

6.10.

ROTOR SOURCE, INC.

6.11.

SANNER GMBH

6.12.

W. R. GRACE & CO.

7.

METHODOLOGY AND SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)

TABLE 2 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET BY TYPES 2019-2027 ($ MILLION)

TABLE 3 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET BY END-USERS 2019-2027 ($ MILLION)

TABLE 4 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET BY COUNTRIES 2019-2027 ($ MILLION)

FIGURE 1 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE 2 PORTER’S FIVE FORCES

ANALYSIS OF MIDDLE EAST AND AFRICA PHARMACEUTICAL DESICCANT MARKET

FIGURE 3 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN SILICA GEL 2019-2027 ($ MILLION)

FIGURE 4 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN ACTIVATED ALUMINA 2019-2027 ($

MILLION)

FIGURE 5 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN CARBONCLAY DESICCANT 2019-2027 ($

MILLION)

FIGURE 6 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN MOLECULAR SIEVE 2019-2027 ($ MILLION)

FIGURE 7 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN OTHER TYPES 2019-2027 ($ MILLION)

FIGURE 8 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN DESICCANT TABLETS 2019-2027 ($

MILLION)

FIGURE 9 MIDDLE EAST AND

AFRICA PHARMACEUTICAL DESICCANT MARKET IN API 2019-2027 ($ MILLION)

FIGURE 10 MIDDLE EAST AND AFRICA

PHARMACEUTICAL DESICCANT MARKET IN DESICCANT CAPSULES 2019-2027 ($ MILLION)

FIGURE 11 MIDDLE EAST AND AFRICA

PHARMACEUTICAL DESICCANT MARKET IN NUTRACEUTICAL PRODUCTS PACKAGING 2019-2027

($ MILLION)

FIGURE 12 MIDDLE EAST AND AFRICA

PHARMACEUTICAL DESICCANT MARKET IN DIAGNOSTIC KITS 2019-2027 ($ MILLION)

FIGURE 13 SAUDI ARABIA

PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE 14 TURKEY PHARMACEUTICAL

DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE 15 UNITED ARAB EMIRATES

PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE 16 SOUTH AFRICA

PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)

FIGURE 17 REST OF MIDDLE EAST

& AFRICA PHARMACEUTICAL DESICCANT MARKET 2019-2027 ($ MILLION)