Market By Deployment, Type, Application And Geography | Forecast 2019-2027

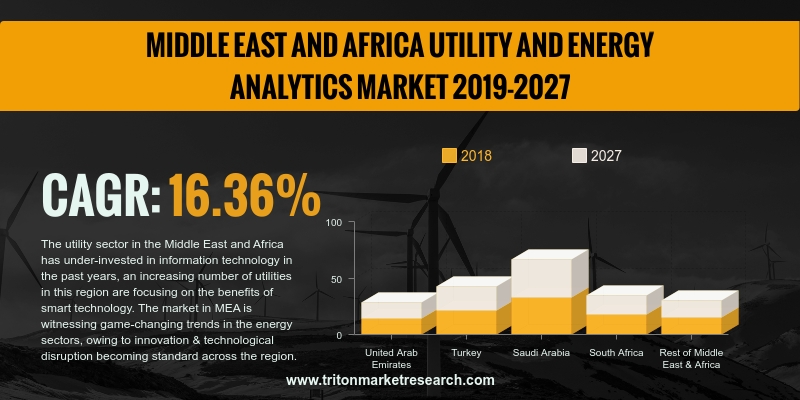

As per Triton’s research report, the Middle East and African utility and energy analytics market is anticipated to upsurge with a CAGR of 16.36% in the forecasting years of 2019-2027.

The countries that have been included in the report on the Middle East and Africa’s utility and energy analytics market are:

• The UAE

• Saudi Arabia

• South Africa

• Turkey

• Rest of MEA

Report scope can be customized per your requirements. Request For Customization

Although the utility sector in the Middle East and Africa has under-invested in information technology in the past years, an increasing number of utilities in this region are focusing on the benefits of smart technology. The market in MEA is witnessing game-changing trends in the energy sectors, owing to innovation & technological disruption becoming standard across the region. Data analytics comes across as a key trend shaping the region’s energy sector. The rise in demand for implementing dynamic smart grid solutions in the Middle East and Africa is expected to bridge the gap between the current supply and growing demand. Moreover, implementing smart grid initiatives could also solve issues of energy efficiency, and would thus drive the need for demand response management systems.

The energy sector in Turkey is one of the most promising & developing sectors in the economy. The country has become one of the fastest-growing energy markets worldwide, paralleling its economic growth documented over the last ten years. The energy market in Turkey has become competitive by attracting investments from the private sector. The Turkish power sector is a combination of both private & public entities; around 50% of the electricity generation in Turkey takes place through the state-owned EUAS, which runs both hydroelectric and thermal plants. Rapid growth and liberalization are being witnessed in Turkey’s energy market, owing to privatization, strategic alliances and licensing deals in the market. This privatization program has given the Turkish energy sector a highly competitive structure and new growth avenues.

Siemens AG is a global technology company with core activities in the areas of automation, electrification and digitization. It primarily serves oil & gas companies, public utility companies, transportation companies, independent power producers, hospitals & diagnostics centres, infrastructure developers and network operators. The company has two main business verticals: industrial business and financial services. Siemens operates its business across Europe, the Middle East, Africa, the Commonwealth of the Independent States, the Americas and the Asia-Pacific.

1. MIDDLE EAST AND AFRICA UTILITY AND ENERGY

ANALYTICS MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

HYBRID ANALYTICS IS FASTEST-GROWING IN DEPLOYMENT

2.2.2.

DISTRIBUTION PLANNING SECTOR IS THE FASTEST-GROWING APPLICATION

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

PRICE

2.4.2.

MODE OF DEPLOYMENT

2.4.3.

APPLICATION

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

GROWING CONSUMER FOCUS ON ENERGY CONSUMPTION PATTERN ANALYSIS

2.7.2.

DEMAND FOR ENERGY AND UTILITY ANALYTICS INCREASES WITH EMPHASIS ON

RENEWABLE ENERGY

2.8. MARKET RESTRAINTS

2.8.1.

DEPLOYMENT REQUIRES HIGH CAPITAL INVESTMENT

2.9. MARKET OPPORTUNITIES

2.9.1.

ENERGY AND UTILITY INDUSTRY ADOPTS CLOUD TECHNOLOGY

2.9.2.

DEVELOPMENT OF SMART CITIES AND INFRASTRUCTURES

2.10. MARKET CHALLENGES

2.10.1. SECURITY ISSUES

2.10.2. LACK OF INDUSTRIAL EXPERTISE

3. MIDDLE EAST AND AFRICA UTILITY AND ENERGY

ANALYTICS MARKET OUTLOOK - BY DEPLOYMENT

3.1. CLOUD

3.2. ON-PREMISES

3.3. HYBRID

4. MIDDLE EAST AND AFRICA UTILITY AND ENERGY

ANALYTICS MARKET OUTLOOK - BY TYPE

4.1. SOFTWARE

4.2. SERVICES

5. MIDDLE EAST AND AFRICA UTILITY AND ENERGY

ANALYTICS MARKET OUTLOOK - BY APPLICATION

5.1. METER OPERATION

5.2. LOAD FORECASTING

5.3. DEMAND RESPONSE

5.4. DISTRIBUTION PLANNING

5.5. OTHER APPLICATIONS

6. MIDDLE EAST AND AFRICA UTILITY AND ENERGY

ANALYTICS MARKET - REGIONAL OUTLOOK

6.1. MIDDLE EAST AND AFRICA

6.2. UNITED ARAB EMIRATES

6.3. TURKEY

6.4. SAUDI ARABIA

6.5. SOUTH AFRICA

6.6. REST OF MIDDLE EAST & AFRICA

7. COMPETITIVE LANDSCAPE

7.1. CAPGEMINI SE

7.2. ORACLE CORPORATION

7.3. ABB CORPORATION

7.4. SAS INSTITUTE INC.

7.5. SIEMENS AG

7.6. IBM CORPORATION

7.7. GENERAL ELECTRIC COMPANY

7.8. SAP SE

7.9. INFOSYS LIMITED

7.10. WIPRO LIMITED

7.11. BUILDING IQ INC.

7.12. SCHNEIDER ELECTRIC SE

7.13. TERADATA CORPORATION

7.14. CISCO SYSTEMS INC.

7.15. EATON CORPORATION

8. RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY DEPLOYMENT,

2019-2027 (IN $ MILLION)

TABLE 4: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

TYPE, 2019-2027 (IN $ MILLION)

TABLE 5: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: HYBRID UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 3: DISTRIBUTION PLANNING UTILITY AND ENERGY ANALYTICS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE FORCE ANALYSIS

FIGURE 5: KEY BUYING IMPACT ANALYSIS

FIGURE 6: MARKET ATTRACTIVENESS INDEX

FIGURE 7: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

CLOUD, 2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

ON-PREMISES, 2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET, BY

HYBRID, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY SERVICE, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY METER OPERATION, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY LOAD FORECASTING, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY DEMAND RESPONSE, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY DISTRIBUTION PLANNING, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

BY OTHER APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST AND AFRICA UTILITY AND ENERGY ANALYTICS MARKET,

REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 18: UNITED ARAB EMIRATES UTILITY AND ENERGY ANALYTICS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 19: TURKEY UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 20: SAUDI ARABIA UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 21: SOUTH AFRICA UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 22: REST OF MIDDLE EAST & AFRICA UTILITY AND ENERGY ANALYTICS

MARKET, 2019-2027 (IN $ MILLION)