Market By New Software Licenses & Support Services, Deployment Type, Verticals, End User And Geography | Forecasts 2019-2027

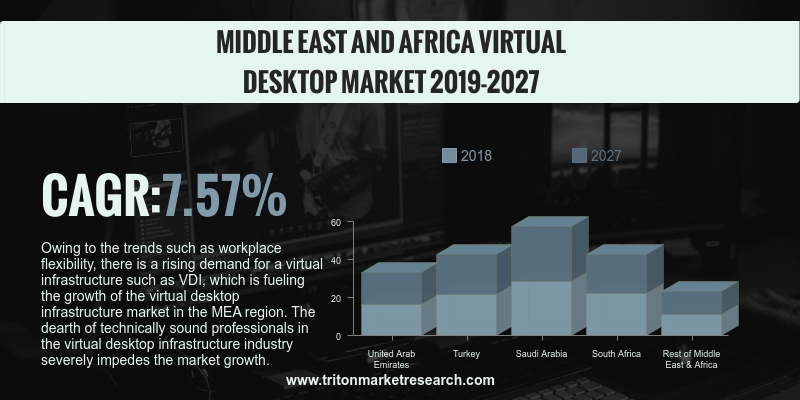

As per Triton's research report, the Middle East & African virtual desktop infrastructure market is anticipated to upsurge with a CAGR of 7.57% in the forecasting years of 2019-2027.

The VDI Middle East & Africa market report has considered countries such as:

O The United Arab Emirates

O Saudi Arabia

O Turkey

O South Africa

O Rest of the Middle East & Africa

Report scope can be customized per your requirements. Request For Customization

Owing to the trends such as workplace flexibility, there is a rising demand for a virtual infrastructure such as VDI, which is fueling the growth of the virtual desktop infrastructure market in the MEA region. The dearth of technically sound professionals in the virtual desktop infrastructure industry severely impedes market growth. Lack of technical training and education with regard to virtual desktop infrastructure is a key restraining factor hampering the virtual desktop infrastructure market growth.

Triton's report provides information about the evolution & transition of the virtual desktop infrastructure, industry components, Porter’s five force analysis, market attractiveness index, regulatory framework, market definition, key market strategies, vendor scorecard, key impact analysis and key insights regarding the industry.

1. VIRTUAL

DESKTOP INFRASTRUCTURE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. IT

INFRASTRUCTURE BECOMING CHEAP DUE TO INNOVATIONS

2.2.2. LARGE

ENTERPRISES TO DOMINATE THE END USER SEGMENT

2.2.3. FINANCIAL

SERVICES IS THE FASTEST GROWING VERTICAL

2.3. EVOLUTION

& TRANSITION OF VIRTUAL DESKTOP INFRASTRUCTURE

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTES

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. COMPANY

BACKGROUND & EXPERIENCE

2.5.2. COST

2.5.3. CUSTOMIZABILITY

2.5.4. SCALABILITY

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.8.1. SUPPLIERS

2.8.2. SERVICE

DEVELOPMENT

2.8.3. CLOUD

SERVICES & MANAGEMENT

2.8.4. END

USERS

2.9. REGULATORY

FRAMEWORK

2.10.

KEY MARKET STRATEGIES

2.10.1.

RESEARCH & PRODUCT LAUNCH

2.10.2.

MERGER & ACQUISITION

2.10.3.

PARTNERSHIP

2.11.

MARKET DRIVERS

2.11.1.

RISING WORKPLACE FLEXIBILITY

2.11.2.

INCREASED ADOPTION OF CLOUD

SERVICES

2.11.3.

RISE IN BRING YOUR OWN DEVICE

(BYOD) CULTURE

2.12.

MARKET RESTRAINTS

2.12.1.

PROBLEMS ASSOCIATED WITH

TRAINING AND EDUCATION

2.12.2.

PRIVACY CONCERNS

2.12.3.

BANDWIDTH DEMAND TOO HIGH

2.13.

MARKET OPPORTUNITIES

2.13.1.

RISING ADOPTION OF CLOUD-BASED

VIRTUAL DESKTOP INFRASTRUCTURE

2.13.2.

DESKTOP AS A SERVICE: A RISING

TREND

2.14.

MARKET CHALLENGES

2.14.1.

COMPATIBILITY ISSUES &

INTRICATE SYSTEM

2.14.2.

RISING FREE SERVICES PROVIDED

BY COMPANIES TO INCREASE THEIR MARKET SHARE

3. VIRTUAL

DESKTOP INFRASTRUCTURE MARKET OUTLOOK - BY NEW SOFTWARE LICENSES & SUPPORT

SERVICES

3.1. NEW

SOFTWARE LICENSES

3.2. SUPPORT

SERVICES

4. VIRTUAL

DESKTOP INFRASTRUCTURE MARKET OUTLOOK - BY DEPLOYMENT TYPE

4.1. ON-PREMISE

4.2. CLOUD-BASED

5. VIRTUAL

DESKTOP INFRASTRUCTURE MARKET OUTLOOK - BY VERTICALS

5.1. INFORMATION

TECHNOLOGY

5.2. FINANCIAL

SERVICES

5.3. MANUFACTURING

5.4. LEGAL

5.5. HEALTHCARE

5.6. EDUCATION

5.7. RETAIL

5.8. PUBLIC

SECTOR/GOVERNMENT

5.9. OTHER

APPLICATIONS

6. VIRTUAL

DESKTOP INFRASTRUCTURE MARKET OUTLOOK - BY END USER

6.1. LARGE

ENTERPRISES

6.2. SMALL

AND MEDIUM ENTERPRISES

7. VIRTUAL

DESKTOP INFRASTRUCTURE MARKET - REGIONAL OUTLOOK

7.1. MIDDLE

EAST & AFRICA

7.1.1. UNITED

ARAB EMIRATES

7.1.2. TURKEY

7.1.3. SAUDI

ARABIA

7.1.4. SOUTH

AFRICA

7.1.5. REST

OF THE MIDDLE EAST & AFRICA

8. COMPETITIVE

LANDSCAPE

8.1. HIVEIO

8.2. CISCO

SYSTEMS

8.3. CITRIX

SYSTEMS

8.4. DINCLOUD

8.5. DIZZION,

INC.

8.6. FUJIAN

CENTERM INFORMATION (CENTERM)

8.7. HEWLETT

PACKARD

8.8. HUAWEI

TECHNOLOGIES

8.9. IGEL

TECHNOLOGY

8.10.

LISTEQ

8.11.

MICROSOFT CORPORATION

8.12.

NCOMPUTING

8.13.

NETAPP

8.14.

THINSPACE TECHNOLOGY, LTD.

8.15.

VMWARE, INC.

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: REGULATORY

FRAMEWORK

TABLE 5: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, 2019-2027 (IN $

MILLION)

TABLE 6: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY NEW SOFTWARE

LICENSES & SUPPORT SERVICES, 2019-2027 (IN $ MILLION)

TABLE 7: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY DEPLOYMENT TYPE,

2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY VERTICALS,

2019-2027 (IN $ MILLION)

TABLE 9: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY END USER, 2019-2027

(IN $ MILLION)

FIGURE 1: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY VERTICAL, 2018

& 2027 (IN %)

FIGURE 2: PORTER’S

FIVE FORCE ANALYSIS

FIGURE 3: KEY

BUYING IMPACT ANALYSIS

FIGURE 4: MARKET

COMPONENTS

FIGURE 5: WORKING

OF DESKTOP AS A SERVICE

FIGURE 6: MIDDLE EAST

& AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY NEW SOFTWARE LICENSES,

2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY SUPPORT SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY ON-PREMISE,

2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY CLOUD BASED,

2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY INFORMATION

TECHNOLOGY, 2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY FINANCIAL SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY MANUFACTURING,

2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY LEGAL, 2019-2027

(IN $ MILLION)

FIGURE 14: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY HEALTHCARE,

2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY EDUCATION,

2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY RETAIL, 2019-2027

(IN $ MILLION)

FIGURE 17: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY PUBLIC

SECTOR/GOVERNMENT, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY OTHER APPLICATIONS,

2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY LARGE ENTERPRISES,

2019-2027 (IN $ MILLION)

FIGURE 20: THE MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, BY SMALL & MEDIUM

ENTERPRISES, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE

EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 22: THE UNITED

ARAB EMIRATES VIRTUAL DESKTOP INFRASTRUCTURE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: TURKEY

VIRTUAL DESKTOP INFRASTRUCTURE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: SAUDI

ARABIA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: SOUTH

AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: REST OF THE

MIDDLE EAST & AFRICA VIRTUAL DESKTOP INFRASTRUCTURE MARKET, 2019-2027 (IN $

MILLION)