Market By Type, End-user, Application And Geography | Forecast 2019-2027

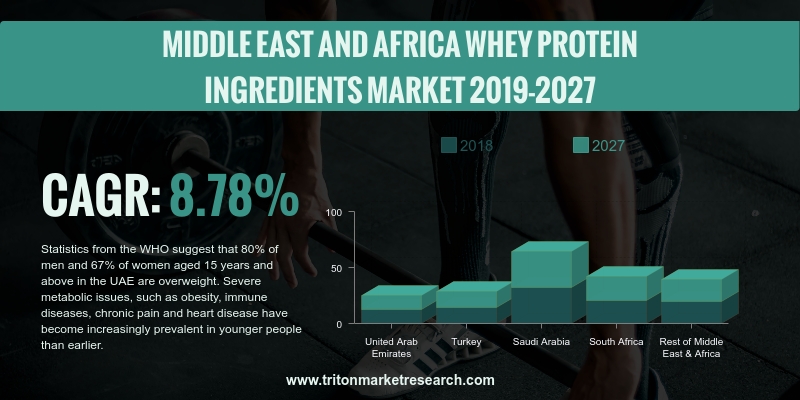

As per Triton’s research report, the Middle East and African whey protein ingredients market is anticipated to upsurge with a CAGR of 8.78% and 3.80%, in terms of revenue and volume, respectively, in the forecasting years of 2019-2027.

The countries that have been considered in the report on the whey protein ingredients market in the Middle East and Africa are:

• United Arab Emirates

• Turkey

• Saudi Arabia

• South Africa

• Rest of the Middle East & Africa

Report scope can be customized per your requirements. Request For Customization

Statistics from the WHO suggest that 80% of men and 67% of women aged 15 years and above in the UAE are overweight. Severe metabolic issues, such as obesity, immune diseases, chronic pain and heart disease have become increasingly prevalent in younger people than earlier. Considering this, many people in the UAE have started focusing on health & fitness, by exercising regularly to keep a fit, strong & healthy body and mind. With new boutique studios popping up in Abu Dhabi, Dubai, Kuwait and Bahrain every month, the Middle East has become a breeding ground for innovative workouts, in the last few years. A rise has been witnessed in some specific workouts across the country, which can be reflected in the number of classes, studios and people taking an interest in these styles. This trend will majorly help the adoption of whey protein ingredients in the UAE. In addition to this, in the United Arab Emirates, consumers tend to buy baby food to keep their children healthy. In addition, the spending power of the consumers is also high, which eventually increases the demand for premium & quality baby food products. The whey protein ingredients are used in infant formulae, which will help in the growth of the market in the country.

Fonterra Co-operative Group Limited is one of the world’s largest milk processors and dairy exporters. The company offers powdered milk, ready-to-drink milk, yoghurts, cheeses, spreads, butter, ice cream, everyday nutrition powders, advanced nutrition products, whey protein ingredients, and lactose ingredients. Fonterra classifies its business operations into five segments: Global Ingredients and Operations; Oceania; Latin America; Asia; and Greater China. The company operates in North and Latin America, Europe, Asia, the Middle East and Africa and Australia. It is headquartered in Auckland, New Zealand.

1. MIDDLE EAST AND AFRICA WHEY PROTEIN

INGREDIENTS MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCE ANALYSIS

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

BARGAINING POWER OF BUYERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. MARKET ATTRACTIVENESS INDEX

2.4. VENDOR SCORECARD

2.5. INDUSTRY COMPONENTS

2.5.1.

DAIRY/CHEESE INDUSTRY

2.5.2.

FOOD & BEVERAGE INDUSTRY

2.5.3.

VALUE-ADDED PRODUCT

2.5.4.

BIOETHANOL FUEL PRODUCTION

2.6. MANUFACTURING EXPENSES INVOLVED IN WHEY

PROTEIN INGREDIENTS MAKING PROCESS

2.7. MARKET DRIVERS

2.7.1.

GROWING AWARENESS OF WHEY PROTEIN INGREDIENTS

2.7.2.

HEALTH & WELLNESS PRODUCTS SHOW RISING TRENDS

2.8. MARKET RESTRAINTS

2.8.1.

RAW MATERIAL PRICE FLUCTUATIONS

2.8.2.

THE INDUSTRY IS HIGHLY FRAGMENTED IN NATURE

2.8.3.

HIGH COST OF MANUFACTURING

2.9. MARKET OPPORTUNITIES

2.9.1.

DEMAND FOR HIGH-QUALITY PROTEIN SUPPLEMENTS

2.9.2.

HEALTH-CONSCIOUS CONSUMERS ON THE RISE

2.9.3.

GROWTH OF PACKAGED & SPECIALTY FOOD

2.10. MARKET CHALLENGES

2.10.1.

INCIDENCE OF DISEASES FROM FARM ANIMALS REDUCES ADOPTION OF FARM

PRODUCTS

2.10.2.

HEALTH-RELATED PROBLEMS FROM WHEY PROTEIN INGREDIENTS

3. MIDDLE EAST AND AFRICA WHEY PROTEIN

INGREDIENTS MARKET OUTLOOK - BY TYPE (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILOTONS)

3.1. WPI

3.2. WPC 80

3.3. WPC 50-79

3.4. WPC 35

3.5. DWP

3.6. WPH

4. MIDDLE EAST AND AFRICA WHEY PROTEIN

INGREDIENTS MARKET OUTLOOK - BY END-USER (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILOTONS)

4.1. BAKERY & CONFECTIONERY

4.2. DAIRY PRODUCTS

4.3. FROZEN FOODS

4.4. SPORTS NUTRITION

4.5. BEVERAGES

4.6. MEAT PRODUCTS

4.7. MEDICINE

4.8. OTHERS

5. MIDDLE EAST AND AFRICA WHEY PROTEIN

INGREDIENTS MARKET OUTLOOK - BY APPLICATION (IN TERMS OF VALUE: $ MILLION &

IN TERMS OF VOLUME: KILOTONS)

5.1. FUNCTIONAL FOODS & BEVERAGES

5.2. INFANT NUTRITION

5.3. SPORTS FOOD & BEVERAGES

5.4. CLINICAL NUTRITION

5.5. OTHER APPLICATIONS

6. MIDDLE EAST AND AFRICA WHEY PROTEIN

INGREDIENTS MARKET - REGIONAL OUTLOOK (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILOTONS)

6.1. UNITED ARAB EMIRATES

6.2. TURKEY

6.3. SAUDI ARABIA

6.4. SOUTH AFRICA

6.5. REST OF MIDDLE EAST & AFRICA

7. COMPANY ANALYSIS

7.1. CARGILL, INCORPORATED

7.2. DANONE S.A.

7.3. ARLA FOODS

7.4. FONTERRA CO-OPERATIVE GROUP LIMITED

7.5. OMEGA PROTEIN

7.6. ERIE FOODS INTERNATIONAL, INC.

7.7. GRANDE CUSTOM INGREDIENTS

7.8. AGROPUR MSI, LLC

7.9. AMERICAN DAIRY PRODUCTS INSTITUTE

7.10. LEPRINO FOODS, CO.

7.11. MEGGLE GROUP

7.12. MILK SPECIALTIES

7.13. WARRNAMBOOL CHEESE AND BUTTER FACTORY

7.14. WESTLAND MILK PRODUCTS

7.15. SAPUTO INGREDIENTS

8. RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

COUNTRY, 2019-2027 (IN KILOTONS)

TABLE 3: VENDOR SCORECARD

TABLE 4: WHEY POWDER MANUFACTURING EXPENSES IN PERCENTAGE

TABLE 5: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

TYPE, 2019-2027 (IN $ MILLION)

TABLE 6: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

TYPE, 2019-2027 (IN KILOTONS)

TABLE 7: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

END-USER, 2019-2027 (IN $ MILLION)

TABLE 8: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

END-USER, 2019-2027 (IN KILOTONS)

TABLE 9: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 10: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

APPLICATION, 2019-2027 (IN KILOTONS)

TABLE 11: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 12: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

COUNTRY, 2019-2027 (IN KILOTONS)

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

WPI, 2019-2027 (IN $ MILLION)

FIGURE 5: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY WPC

80, 2019-2027 (IN $ MILLION)

FIGURE 6: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY WPC

50-79, 2019-2027 (IN $ MILLION)

FIGURE 7: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY WPC

35, 2019-2027 (IN $ MILLION)

FIGURE 8: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

DWP, 2019-2027 (IN $ MILLION)

FIGURE 9: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

WPH, 2019-2027 (IN $ MILLION)

FIGURE 10: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

BAKERY & CONFECTIONERY, 2019-2027 (IN $ MILLION)

FIGURE 11: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

DAIRY PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 12: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

FROZEN FOODS, 2019-2027 (IN $ MILLION)

FIGURE 13: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

SPORTS NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 14: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 15: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

MEAT PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 16: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

MEDICINE, 2019-2027 (IN $ MILLION)

FIGURE 17: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 18: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

FUNCTIONAL FOODS & BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 19: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

INFANT NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 20: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

SPORTS FOOD & BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 21: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

CLINICAL NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 22: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET, BY

OTHER APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 23: MIDDLE EAST AND AFRICA WHEY PROTEIN INGREDIENTS MARKET,

REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 24: UNITED ARAB EMIRATES WHEY PROTEIN INGREDIENTS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 25: TURKEY WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 26: SAUDI ARABIA WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 27: SOUTH AFRICA WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 28: REST OF MIDDLE EAST & AFRICA WHEY PROTEIN INGREDIENTS

MARKET, 2019-2027 (IN $ MILLION)