Market by Delivery Model, End User, Solutions and Geography | Forecast 2019-2027

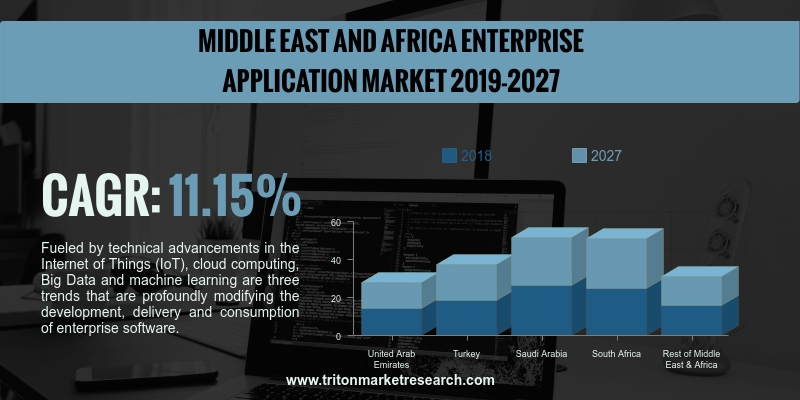

As per Triton's research report, the Middle East & African enterprise applications market is anticipated to upsurge with a CAGR of 11.15% in the forecasting years of 2019-2027.

The Middle East & Africa market report considers the countries of:

O Turkey

O The U. A. E.

O Saudi Arabia

O South Africa

O Rest of the Middle East & Africa

We provide additional customization based on your specific requirements. Request For Customization

Fueled by technical advancements in the Internet of Things (IoT), cloud computing, Big Data and machine learning are three trends that are profoundly modifying the development, delivery and consumption of enterprise software. These trends include - enterprise systems paving ways to business networks, systems of record permitting systems of engagement to take the lead and tailored modular solutions replacing rigid commercial off-the-shelf (COTS) software.

Cloud-based enterprise application market can manage the finance, inventory control, purchasing, order management, customer interaction and responsive & manufacturing functionalities. Many SMEs worldwide are now opting for cloud-based enterprise software as a cost-effective alternative by paying in instalments. The rise in the demand for cloud-based software from SMEs is driving the growth of Enterprise Application Market as many companies avoid heavy, upfront capital investments and mostly prefer low initial investment.

Based on solutions, delivery models and end users, the Enterprise Application Market is divided into three segments. End users can be sub-segmented into manufacturing & services, banking, financial services and insurance (BFSI), healthcare, aerospace & defense, retail, government, telecom and other end users. Delivery models are on-premise and cloud.

Triton's report provides information about the market attractiveness index, market definition, key insights regarding the industry, Porter’s five force analysis, industry components, key impact analysis and the vendor scorecard.

1. MIDDLE

EAST & AFRICA ENTERPRISE APPLICATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. INCREASING

FOCUS ON REAL-TIME DECISION-MAKING

2.2.2. INORGANIC

GROWTH THROUGH ACQUISITIONS IS PREFERRED GROWTH STRATEGY

2.2.3. ON

PREMISE SEGMENT LEADS THE DELIVERY MODEL SEGMENT

2.2.4. GROWING

INTEREST TOWARDS CLOUD BASED ENTERPRISE APPLICATIONS

2.3. PORTERS

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. CUSTOMER

CENTRIC APPROACH

2.4.2. COMPETITIVE

ADVANTAGES

2.4.3. EMERGING

TRENDS OF CLOUD

2.4.4. HIGHER

COST

2.4.5. OPEN

SOURCE APPLICATION

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.7.1. ELEMENT

PROVIDERS

2.7.2. APPLICATION

DEVELOPERS

2.7.3. DISTRIBUTION

CHANNEL

2.8. MARKET

DRIVERS

2.8.1. BUSINESS

SPECIFIC ADVANTAGES OFFERED BY ENTERPRISE APPLICATIONS

2.8.2. GROWING

DEMAND FOR REAL-TIME DATA ACCESS

2.8.3. CUSTOMER

ORIENTED APPROACH OF ENTERPRISES

2.8.4. EMERGENCE

OF CLOUD COMPUTING & MOBILE APPLICATIONS

2.9. MARKET

RESTRAINTS

2.9.1. COMPLEXITIES

IN DATA MIGRATION

2.9.2. DATA

SECURITY AND PRIVACY CONCERNS

2.9.3. COSTS

ASSOCIATED WITH ENTERPRISE APPLICATIONS

2.9.4. LACK

OF CONTROL AND FLEXIBILITY OVER CLOUD BASED ENTERPRISE APPLICATION SOFTWARE

2.10.

MARKET OPPORTUNITIES

2.10.1.

TRANSFORMING OR EVOLVING BUSINESS MODELS

2.10.2.

INCREASED ADOPTION FROM SMALL & MEDIUM-SIZED

ENTERPRISES

2.10.3.

GLOBALIZATION OF BUSINESS

2.11.

MARKET CHALLENGES

2.11.1.

OPEN SOURCE & FREEWARE APPLICATIONS

2.11.2.

LACK OF SKILLED PROFESSIONALS

3. MIDDLE

EAST & AFRICA ENTERPRISE APPLICATION MARKET OUTLOOK - BY DELIVERY MODEL

3.1. ON-PREMISES

3.2. CLOUD

4. MIDDLE

EAST & AFRICA ENTERPRISE APPLICATION MARKET OUTLOOK - BY END USER

4.1. MANUFACTURING

& SERVICES

4.2. BANKING,

FINANCIAL SERVICES & INSURANCE (BFSI)

4.3. HEALTHCARE

4.4. RETAIL

4.5. GOVERNMENT

4.6. AEROSPACE

& DEFENSE

4.7. TELECOMMUNICATIONS

4.8. OTHER

END USERS

5. MIDDLE

EAST & AFRICA ENTERPRISE APPLICATION MARKET OUTLOOK - BY SOLUTIONS

5.1. CUSTOMER

RELATIONSHIP MANAGEMENT (CRM)

5.2. ENTERPRISE

RESOURCE PLANNING (ERP)

5.3. SUPPLY

CHAIN MANAGEMENT (SCM)

5.4. WEB

CONFERENCING

5.5. BUSINESS

INTELLIGENCE (BI)

5.6. BUSINESS

PROCESS MANAGEMENT (BPM)

5.7. CONTENT

MANAGEMENT SYSTEM (CMS)

5.8. ENTERPRISE

ASSET MANAGEMENT (EAM)

5.9. OTHER

SOLUTIONS

6. MIDDLE

EAST & AFRICA ENTERPRISE APPLICATION MARKET - REGIONAL OUTLOOK

6.1. UNITED

ARAB EMIRATES

6.2. TURKEY

6.3. SAUDI

ARABIA

6.4. SOUTH

AFRICA

6.5. REST

OF MIDDLE EAST & AFRICA

7. COMPETITIVE

LANDSCAPE

7.1. EPICOR

SOFTWARE CORPORATION

7.2. HEWLETT

PACKARD ENTERPRISE COMPANY

7.3. INDUSTRIAL

& FINANCIAL SYSTEMS, AB (IFS)

7.4. INFOR,

INC

7.5. INTERNATIONAL

BUSINESS MACHINES CORPORATION (IBM)

7.6. MICROSOFT

CORPORATION

7.7. ORACLE

CORPORATION

7.8. QAD,

INC

7.9. SALESFORCE.COM,

INC

7.10.

SAP SE

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE

1: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY COUNTRY, 2019-2027

(IN $ BILLION)

TABLE

2: MARKET ATTRACTIVENESS INDEX

TABLE

3: VENDOR SCORECARD

TABLE

4: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY COUNTRY,

2019-2027 (IN $ BILLION)

TABLE

5: ADVANTAGES OF ON-PREMISES MODEL

TABLE

6: ADVANTAGES OF CLOUD BASED MODEL

TABLE

7: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY DELIVERY MODEL,

2019-2027 (IN $ BILLION)

TABLE

8: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY END USER,

2019-2027 (IN $ BILLION)

TABLE

9: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY SOLUTIONS,

2019-2027 (IN $ BILLION)

FIGURE

1: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY SOLUTIONS, 2018

& 2027 (IN %)

FIGURE

2: KEY BUYING IMPACT ANALYSIS

FIGURE

3: INDUSTRY COMPONENTS

FIGURE

4: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY ON-PREMISES,

2019-2027 (IN $ BILLION)

FIGURE

5: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY CLOUD, 2019-2027

(IN $ BILLION)

FIGURE

6: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY MANUFACTURING

& SERVICES, 2019-2027 (IN $ BILLION)

FIGURE

7: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY BANKING,

FINANCIAL SERVICES & INSURANCE (BFSI), 2019-2027 (IN $ BILLION)

FIGURE

8: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY HEALTHCARE, 2019-2027

(IN $ BILLION)

FIGURE

9: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY RETAIL, 2019-2027

(IN $ BILLION)

FIGURE

10: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY GOVERNMENT,

2019-2027 (IN $ BILLION)

FIGURE

11: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY AEROSPACE &

DEFENSE, 2019-2027 (IN $ BILLION)

FIGURE

12: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY

TELECOMMUNICATIONS, 2019-2027 (IN $ BILLION)

FIGURE

13: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY OTHER END USERS,

2019-2027 (IN $ BILLION)

MIDDLE

EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY CUSTOMER RELATIONSHIP

MANAGEMENT (CRM), 2019-2027 (IN $ BILLION)

FIGURE

14: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY ENTERPRISE

RESOURCE PLANNING (ERP), 2019-2027 (IN $ BILLION)

FIGURE

15: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY SUPPLY CHAIN

MANAGEMENT (SCM), 2019-2027 (IN $ BILLION)

FIGURE

16: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY WEB

CONFERENCING, 2019-2027 (IN $ BILLION)

FIGURE

17: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY BUSINESS

INTELLIGENCE (BI), 2019-2027 (IN $ BILLION)

FIGURE

18: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY BUSINESS PROCESS

MANAGEMENT (BPM), 2019-2027 (IN $ BILLION)

FIGURE

19: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY CONTENT

MANAGEMENT SYSTEM (CMS), 2019-2027 (IN $ BILLION)

FIGURE

20: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY ENTERPRISE ASSET

MANAGEMENT (EAM), 2019-2027 (IN $ BILLION)

FIGURE

21: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, BY OTHER SOLUTIONS,

2019-2027 (IN $ BILLION)

FIGURE

22: MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, REGIONAL OUTLOOK,

2018 & 2027 (IN %)

FIGURE

23: UNITED ARAB EMIRATES ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $

BILLION)

FIGURE

24: TURKEY ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

25: SAUDI ARABIA ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

26: SOUTH AFRICA ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

27: REST OF MIDDLE EAST & AFRICA ENTERPRISE APPLICATION MARKET, 2019-2027

(IN $ BILLION)