Market By Technology, Application, Component, End-user, And Geography | Forecast 2019-2027

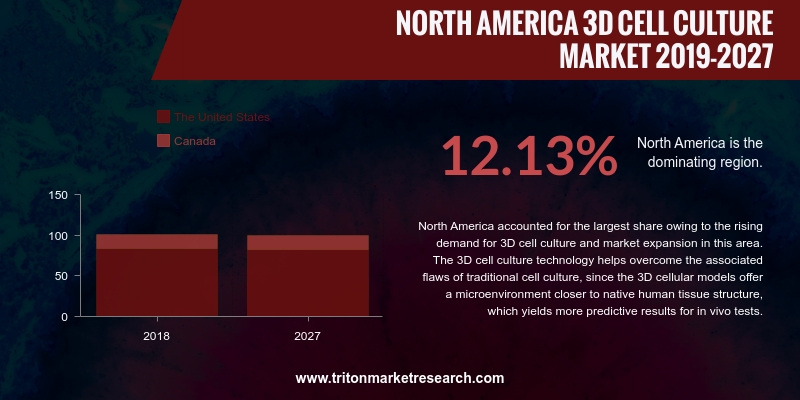

Triton Market Research anticipates North America 3D cell culture market to rise in terms of revenue, exhibiting a CAGR of 12.13% in the estimated period of 2019-2027.

The countries analyzed in the report on the North American 3D cell culture market are:

• The United States

• Canada

In the United States, large sums of healthcare expenses are incurred for the treatment of chronic diseases. The country is enormously strained by the rising cases of chronic diseases affecting the population, and this has driven the demand for the 3D cell culture, owing to the wide applications of this technique. The large-scale adoption of 3D cellular systems is expected to boost the revenues of companies such as Thermo Fisher Scientific, Inc. and Nano3D Biosciences, that offer 3D cell culture products.

Report scope can be customized per your requirements. Request For Customization

3D cell culture techniques have gained preference for the purposes of drug discovery and tissue engineering, as these techniques offer predictive data for in-vivo tests as well as data that is more relevant physiologically. The introduction of 3D cell culture models has been successful with the country adopting 3D cell culture technology at a wide scale. Canada’s 3D cell culture market is also expected to register significant growth, owing to the presence of several companies focusing on mammalian research and also molecular research & development laboratories.

The US-based Nano3D Biosciences, Inc., or ‘n3D,’ was established by four PhDs, David J. Lee, Glauco R. Souza, Robert M. Raphael, and Thomas C. Killian. The company provides solutions for toxicology, drug discovery, regenerative medicine, precision medicine, and biomedical research. Assay development, oncology screening, vasoactivity screening, wound healing screening, and toxicity screening are some of the company’s service offerings. Nano3D Biosciences has partnered with Greiner Bio-One, which provides its platform to the company for 3D cell culture purposes. Nano3D Biosciences, Inc. is headquartered in Houston, Texas.

1. NORTH

AMERICA 3D CELL CULTURE MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. BARGAINING

POWER OF SUPPLIERS

2.2.5. THREAT

OF COMPETITIVE RIVALRY

2.3. ECONOMIC

TECHNOLOGICAL, AND POLITICAL & LEGAL OUTLOOK

2.4. REGULATORY

OUTLOOK

2.5. KEY

INSIGHT

2.6. MARKET

DRIVERS

2.6.1. GROWING

CANCER PREVALENCE

2.6.2. HIGH

DEMAND FOR ORGAN TRANSPLANTATION

2.6.3. PROMISING

DEVELOPMENTS USING REGENERATIVE MEDICINE

2.7. MARKET

RESTRAINTS

2.7.1. LACK

OF SKILLED PROFESSIONALS

2.7.2. INCOMPATIBILITIES

OF THE PREFERRED ANALYTICAL TECHNOLOGIES WITH 3D CELL CULTURE

2.8. MARKET

OPPORTUNITIES

2.8.1. INCREASING

USAGE OF 3D CELL CULTURE IN ORGAN TRANSPLANTATION AND DRUG SCREENING

2.8.2. TECHNOLOGICAL

ADVANCEMENT

2.9. MARKET

CHALLENGES

2.9.1. LACK

OF AVAILABILITY OF DATA FOR RESEARCH ON 3D CELL CULTURE

2.9.2. CHALLENGES

ASSOCIATED WITH 3D CELL CULTURE IN PERFORMING EXPERIMENTS

3. 3D

CELL CULTURE MARKET OUTLOOK – BY TECHNOLOGY

3.1. SCAFFOLD-BASED

3.1.1. HYDROGELS

3.1.2. POLYMERIC

SCAFFOLDS

3.1.3. MICROPATTERNED

SURFACE MICROPLATES

3.2. SCAFFOLD-FREE

3.2.1. HANGING

DROP MICROPLATES

3.2.2. SPHEROID

MICROPLATES CONTAINING ULTRA-LOW ATTACHMENT (ULA) COATING

3.2.3. MICROFLUIDIC

3D CELL CULTURE

3.2.4. MAGNETIC

LEVITATIONS & 3D BIOPRINTING

3.3. 3D

BIOREACTORS

4. 3D

CELL CULTURE MARKET OUTLOOK – BY APPLICATION

4.1. CANCER

4.2. TISSUE

ENGINEERING & IMMUNOHISTOCHEMISTRY

4.3. DRUG

DEVELOPMENT

4.4. STEM

CELL RESEARCH

4.5. OTHER

APPLICATIONS

5. 3D

CELL CULTURE MARKET OUTLOOK – BY COMPONENT

5.1. MEDIA

5.2. REAGENTS

AND CONSUMABLES

6. 3D

CELL CULTURE MARKET OUTLOOK – BY END-USER

6.1. BIOTECHNOLOGY

AND PHARMACEUTICAL ORGANIZATIONS

6.2. RESEARCH

LABORATORIES AND INSTITUTES

6.3. HOSPITALS

AND DIAGNOSTIC CENTERS

6.4. OTHER

END-USERS

7. 3D

CELL CULTURE MARKET – REGIONAL OUTLOOK

7.1. NORTH

AMERICA

7.1.1. COUNTRY

ANALYSIS

7.1.1.1. THE

UNITED STATES

7.1.1.2. CANADA

8. COMPANY

PROFILES

8.1. BECTON

DICKINSON AND COMPANY

8.2. TECAN

GROUP LTD.

8.3. PROMOCELL

GMBH

8.4. CORNING

INC.

8.5. NANO3D

BIOSCIENCES, INC.

8.6. 3D

BIOTEK, LLC

8.7. MERCK

KGAA

8.8. EMULATE

8.9. THERMO

FISHER SCIENTIFIC, INC.

8.10.

GE HEALTHCARE

8.11.

INSPHERO

8.12.

LONZA GROUP AG

8.13.

VWR CORPORATION

8.14.

SYNTHECON, INCORPORATED

9. RESEARCH

METHODOLOGY & SCOPE

9.1. RESEARCH

SCOPE & DELIVERABLES

9.1.1. OBJECTIVES

OF STUDY

9.1.2. SCOPE

OF STUDY

9.2. SOURCES

OF DATA

9.2.1. PRIMARY

DATA SOURCES

9.2.2. SECONDARY

DATA SOURCES

9.3. RESEARCH

METHODOLOGY

9.3.1. EVALUATION

OF PROPOSED MARKET

9.3.2. IDENTIFICATION

OF DATA SOURCES

9.3.3. ASSESSMENT

OF MARKET DETERMINANTS

9.3.4. DATA

COLLECTION

9.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 NORTH AMERICA 3D CELL CULTURE MARKET

2019-2027 ($ MILLION)

TABLE 2 NORTH AMERICA 3D CELL CULTURE MARKET BY

TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 3 NORTH AMERICA SCAFFOLD-BASED MARKET BY

TYPE 2019-2027 ($ MILLION)

TABLE 4 NORTH AMERICA SCAFFOLD-FREE MARKET BY

TYPE 2019-2027 ($ MILLION)

TABLE 5 NORTH AMERICA 3D CELL CULTURE MARKET BY APPLICATION

2019-2027 ($ MILLION)

TABLE 6 NORTH AMERICA 3D CELL CULTURE MARKET BY

COMPONENT 2019-2027 ($ MILLION)

TABLE 7 USAGE OF MEDIA IN DIFFERENT STAGES OF

ORGANOIDS FORMATION

TABLE 8 NORTH AMERICA 3D CELL CULTURE MARKET BY

END-USER 2019-2027 ($ MILLION)

TABLE 9 NORTH AMERICA 3D CELL CULTURE MARKET BY

COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 NORTH AMERICA 3D CELL CULTURE MARKET

2019-2027 ($ MILLION)

FIGURE 2 NORTH AMERICA 3D CELL CULTURE MARKET BY

SCAFFOLD-BASED 2019-2027 ($ MILLION)

FIGURE 3 NORTH AMERICA 3D CELL CULTURE MARKET BY

HYDROGELS 2019-2027 ($ MILLION)

FIGURE 4 NORTH AMERICA 3D CELL CULTURE MARKET BY

POLYMERIC SCAFFOLDS 2019-2027 ($ MILLION)

FIGURE 5 NORTH AMERICA 3D CELL CULTURE MARKET BY

MICROPATTERNED SURFACE MICROPLATES 2019-2027 ($ MILLION)

FIGURE 6 NORTH AMERICA 3D CELL CULTURE MARKET BY

SCAFFOLD-FREE 2019-2027 ($ MILLION)

FIGURE 7 NORTH AMERICA 3D CELL CULTURE MARKET BY

HANGING DROP MICROPLATES 2019-2027 ($ MILLION)

FIGURE 8 NORTH AMERICA 3D CELL CULTURE MARKET BY

SPHEROID MICROPLATES CONTAINING ULTRA-LOW ATTACHMENT (ULA) COATING 2019-2027 ($

MILLION)

FIGURE 9 NORTH AMERICA 3D CELL CULTURE MARKET BY

MICROFLUIDIC 3D CELL CULTURE 2019-2027 ($ MILLION)

FIGURE 10 NORTH AMERICA 3D CELL CULTURE MARKET BY

MAGNETIC LEVITATIONS & 3D BIOPRINTING 2019-2027 ($ MILLION)

FIGURE 11 NORTH AMERICA 3D CELL CULTURE MARKET BY 3D

BIOREACTORS 2019-2027 ($ MILLION)

FIGURE 12 NORTH AMERICA 3D CELL CULTURE MARKET BY

CANCER 2019-2027 ($ MILLION)

FIGURE 13 NORTH AMERICA 3D CELL CULTURE MARKET BY

TISSUE ENGINEERING & IMMUNOHISTOCHEMISTRY 2019-2027 ($ MILLION)

FIGURE 14 NORTH AMERICA 3D CELL CULTURE MARKET BY DRUG

DEVELOPMENT 2019-2027 ($ MILLION)

FIGURE 15 NORTH AMERICA 3D CELL CULTURE MARKET BY STEM

CELL RESEARCH 2019-2027 ($ MILLION)

FIGURE 16 NORTH AMERICA 3D CELL CULTURE MARKET BY OTHER

APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 17 NORTH AMERICA 3D CELL CULTURE MARKET BY MEDIA

2019-2027 ($ MILLION)

FIGURE 18 NORTH AMERICA 3D CELL CULTURE MARKET BY

REAGENTS AND CONSUMABLES 2019-2027 ($ MILLION)

FIGURE 19 NORTH AMERICA 3D CELL CULTURE MARKET BY

BIOTECHNOLOGY AND PHARMACEUTICAL ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 20 NORTH AMERICA 3D CELL CULTURE MARKET BY

RESEARCH LABORATORIES AND INSTITUTES 2019-2027 ($ MILLION)

FIGURE 21 NORTH AMERICA 3D CELL CULTURE MARKET BY

HOSPITALS AND DIAGNOSTIC CENTERS 2019-2027 ($ MILLION)

FIGURE 22 NORTH AMERICA 3D CELL CULTURE MARKET BY OTHER

END-USERS 2019-2027 ($ MILLION)

FIGURE 23 THE UNITED STATES 3D CELL CULTURE MARKET

2019-2027 ($ MILLION)

FIGURE 24 CANADA 3D CELL CULTURE MARKET 2019-2027 ($

MILLION)