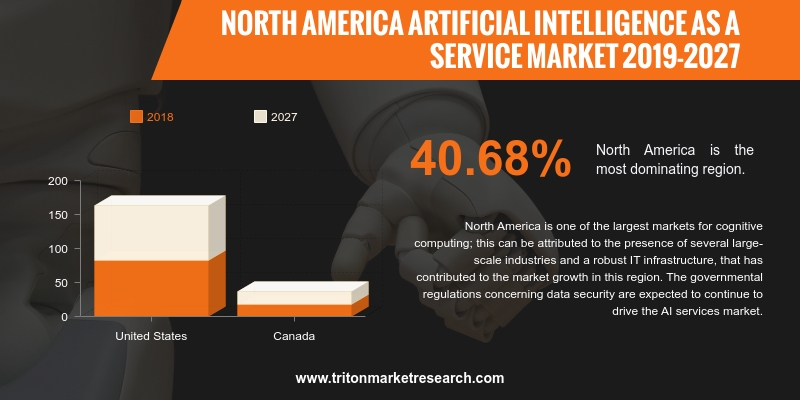

According to Triton Market Research, North American Artificial Intelligence as a Service market is anticipated to rise with a CAGR of 40.68% in the estimated years 2019-2027.

Artificial Intelligence as a Service market report on the North American region includes the countries of:

• Canada

• The United States

North America is one of the largest markets for cognitive computing; this can be attributed to the presence of several large-scale industries and a robust IT infrastructure, that has contributed to the market growth in this region. The governmental regulations concerning data security are expected to continue to drive the AI services market. Services such as security information and cloud applications are expected to be the drivers of this market. In addition, the strong presence of industry leaders such as Google, IBM, Microsoft, Amazon Web Services & others and diversified product offerings have further fueled the demand for Artificial Intelligence as a Service market in this region.

The United States Artificial Intelligence as a Service market is mainly driven by the presence of multinational organizations that are country-based such as Google, Microsoft Corporation, IBM Corporation, and Intel Corporation. The United States Artificial Intelligence as a Service market will be on the constant rise owing to the investments made by the federal government considering adoption and implementation of artificial intelligence along with the initiatives taken by the private organizations considering the development and innovation of AI paving the way for the growth of the Artificial Intelligence as a Service market in the country.

1. ARTIFICIAL

INTELLIGENCE AS A SERVICE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. IT

& TELECOM IS THE LARGEST SEGMENT BY INDUSTRY VERTICALS

2.2.2. AI

CAUSING DISRUPTIONS IN VARIOUS INDUSTRIES

2.2.3. HARDWARE

ARCHITECTURE PLAYS A CRUCIAL ROLE FOR CLOUD COMPUTING

2.3. EVOLUTION

& TRANSITION OF ARTIFICIAL INTELLIGENCE AS A SERVICE

2.4. PORTER’S

FIVE FORCES MODEL

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. INTENSITY

OF COMPETITIVE RIVALRY

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. MARKET

DRIVERS

2.7.1. COST

AND TECHNOLOGICAL ADVANTAGES OF AIAAS

2.7.2. RISING

CLOUD COMPUTING MARKET

2.8. MARKET

RESTRAINTS

2.8.1. LACK

OF AWARENESS

2.8.2. AI

INTELLIGENCE PROFESSIONAL SHORTAGE

2.9. MARKET

OPPORTUNITIES

2.9.1. UNCHARTED

MARKETS FOR ARTIFICIAL INTELLIGENCE

2.9.2. ANALYTICAL

SOLUTIONS SHOW GROWING TRENDS

2.9.3. GROWING

APPLICATION AREAS

2.10. MARKET

CHALLENGES

2.10.1. DATA

PRIVACY ISSUES

2.10.2. LACK

OF COMPUTING POWER

3. ARTIFICIAL

INTELLIGENCE AS A SERVICE MARKET OUTLOOK - BY INDUSTRY VERTICALS

3.1. BFSI

3.2. IT

& TELECOM

3.3. RETAIL

3.4. MANUFACTURING

3.5. PUBLIC

SECTOR

3.6. ENERGY

UTILITIES

3.7. HEALTHCARE

3.8. OTHERS

4. ARTIFICIAL

INTELLIGENCE AS A SERVICE MARKET OUTLOOK - BY TECHNOLOGY

4.1. MACHINE

LEARNING

4.2. COMPUTER

VISION

4.3. NATURAL

LANGUAGE PROCESSING

4.4. OTHER

5. ARTIFICIAL

INTELLIGENCE AS A SERVICE MARKET OUTLOOK - BY ORGANIZATION SIZE

5.1. SMALL

& MEDIUM ENTERPRISE

5.2. LARGE

ENTERPRISE

6. ARTIFICIAL

INTELLIGENCE AS A SERVICE MARKET - REGIONAL OUTLOOK

6.1. NORTH

AMERICA

6.1.1. UNITED

STATES

6.1.2. CANADA

7. COMPETITIVE

LANDSCAPE

7.1. ABSOLUTDATA

7.2. ALPHABET,

INC. (GOOGLE LLC)

7.3. AMAZON

7.4. APPLE,

INC.

7.5. BIGML

7.6. CENTURYSOFT

7.7. COGNITIVESCALE,

INC.

7.8. DATAROBOT,

INC.

7.9. FAIR

ISAAC CORPORATION

7.10. FUZZY.AI

7.11. H2O.AI

7.12. INTEL

7.13. INTERNATIONAL

BUSINESS MACHINES

7.14. MICROSOFT

CORPORATION

7.15. SALESFORCE

7.16. SAP

SE

7.17. SAS

7.18. VITAL

AI

7.19. YOTTAMINE

ANALYTICS

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS

A SERVICE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS

A SERVICE MARKET, BY INDUSTRY VERTICALS, 2019-2027 (IN $ MILLION)

TABLE 4: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS

A SERVICE MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 5: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS

A SERVICE MARKET, BY ORGANIZATION SIZE, 2019-2027 (IN $ MILLION)

TABLE 6: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS

A SERVICE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: MARKET ATTRACTIVENESS INDEX

FIGURE 2: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY BFSI, 2019-2027 (IN $ MILLION)

FIGURE 3: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY IT & TELECOM, 2019-2027 (IN $ MILLION)

FIGURE 4: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY RETAIL, 2019-2027 (IN $ MILLION)

FIGURE 5: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY MANUFACTURING, 2019-2027 (IN $ MILLION)

FIGURE 6: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY PUBLIC SECTOR, 2019-2027 (IN $ MILLION)

FIGURE 7: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY ENERGY UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 8: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY HEALTHCARE, 2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY MACHINE LEARNING, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY COMPUTER VISION, 2019-2027 (IN $ MILLION)

FIGURE 12: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY NATURAL LANGUAGE PROCESSING, 2019-2027 (IN $ MILLION)

FIGURE 13: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY OTHER, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY SMALL & MEDIUM ENTERPRISE, 2019-2027 (IN $ MILLION)

FIGURE 15: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, BY LARGE ENTERPRISE, 2019-2027 (IN $ MILLION)

FIGURE 16: NORTH AMERICA ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: UNITED STATES ARTIFICIAL INTELLIGENCE AS A

SERVICE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: CANADA ARTIFICIAL INTELLIGENCE AS A SERVICE

MARKET, 2019-2027 (IN $ MILLION)