Market By Blood Type, Application, End-users And Geography | Forecast 2019-2027

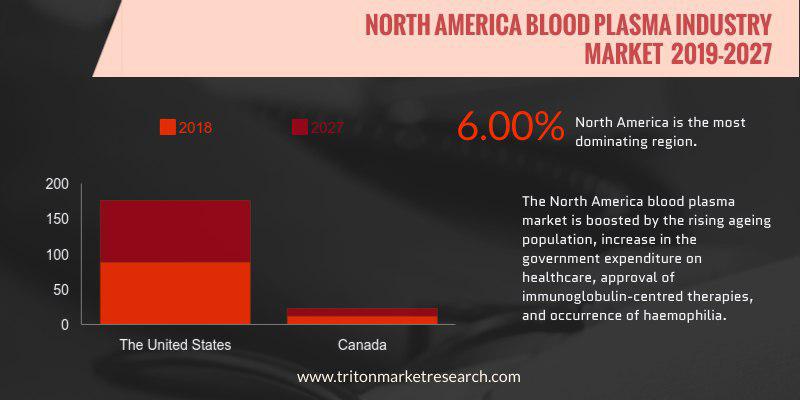

After in-depth research conducted by Triton Market Research, the finding shows that the North America blood plasma market will grow progressively at a CAGR of 6.00% in terms of revenue for the forecast period of 2019-2027.

The countries that have been analyzed in the North America blood plasma market are:

• The United States

• Canada

Blood plasma is essentially employed in the therapeutic treatment of various chronic diseases in which patients experience excessive bleeding as hemophilia, leukemia and other disorders. North America is the centre for research & development in blood plasma therapy, which is integrated into several treatment methods in the region. The region has generated various advanced modalities pertaining to blood plasma and has also advanced such therapies on a large scale. Increasing demand for plasmapheresis has further boosted the growth of blood plasma in North America. Large scale employment of blood plasma in this region is attributed to the increasing number of people suffering from chronic diseases such as hemophilia. North America has witnessed a rise in the occurrences of hemophilia, leukemia and several other disorders that require the administration of blood plasma. General blood cancers that are most prevalent in the US include leukemia, myeloma, lymphoma and myelodysplastic syndromes (MDS). Such blood cancers affect various parts of the body such as bone marrow, blood cells and the lymphatic system. General blood cancers largely affect the US population reaching an estimated 171,550 cases in 2016, with the majority of patients suffering from leukemia, lymphoma and myeloma. Statistics from the American Cancer Society suggested around 1,237,824 people from the US were either suffering from one of these blood cancers or were in the process of recovery.

Baxter International, Inc. is a US-based company that is engaged in the development, manufacturing and marketing of hospital products for the treatment of immune disorders, hemophilia, kidney disease, infectious diseases, trauma, as well as other acute and chronic medical conditions. Baxter offers products through two of its major segments, hospitals and renal, to combine expertise in pharmaceuticals, biotechnology and medical devices, to develop products that improve patient care. The company manufactures products in 20 countries and distributes them in over 100 countries.

1.

NORTH AMERICA BLOOD PLASMA MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTES

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF RIVALRY

2.3. VENDOR SCORECARD

2.4. CLINICAL GUIDELINES

2.5. REGULATION IN THE PLASMA THERAPEUTICS

2.6. KEY INSIGHTS

2.7. REGULATORY OUTLOOK

2.8. MARKET TRENDS

2.9. MARKET DRIVERS

2.9.1.

EXPANSION IN INDICATION FOR NEW THERAPEUTIC AREAS

2.9.2.

APPROVAL OF IMMUNOGLOBULIN-CENTERED THERAPIES

2.9.3.

SURGE IN THE HEMOPHILIA TREATMENT

2.10.

MARKET RESTRAINTS

2.10.1.

HIGH COSTS OF BLOOD PLASMA TREATMENTS

2.10.2.

EASY AVAILABILITY OF RECOMBINANT PLASMA

2.11.

MARKET OPPORTUNITIES

2.11.1.

INCREASING PUBLIC COGNIZANCE

2.11.2.

RISE IN THE PLASMA-DERIVED PRODUCTS OPPORTUNITIES

2.11.3.

INCREASING OCCURRENCE OF HEMOPHILIA

2.12.

MARKET CHALLENGES

2.12.1.

SPREAD OF PATHOGENIC CONTAMINANTS

2.12.2.

HIGH REGULATIONS IN THE MARKET

2.13.

BLOOD PLASMA INDUSTRY BY MODE OF DELIVERY

2.13.1.

INFUSION SOLUTIONS

2.13.2.

GELS

2.13.3.

SPRAYS

2.13.4.

BIOMEDICAL SEALANTS

3.

BLOOD PLASMA MARKET OUTLOOK - BY BLOOD TYPE

3.1. ALBUMIN

3.2. IMMUNOGLOBULIN

3.2.1.

INTRAVENOUS IMMUNOGLOBULIN

3.2.2.

SUBCUTANEOUS IMMUNOGLOBULIN

3.2.3.

OTHER IMMUNOGLOBULIN TYPE

3.3. COAGULATION FACTOR CONCENTRATES

3.4. HYPERIMMUNE

3.5. OTHER PLASMA FRACTIONATION PRODUCTS

4.

BLOOD PLASMA MARKET OUTLOOK - BY APPLICATION

4.1. ONCOLOGY

4.2. HEMATOLOGY

4.3. TRANSPLANTATION

4.4. RHEUMATOLOGY

4.5. NEUROLOGY

4.6. IMMUNOLOGY

4.7. PULMONOLOGY

4.8. OTHER APPLICATIONS

5.

BLOOD PLASMA MARKET OUTLOOK - BY END-USER

5.1. ACADEMIC INSTITUTIONS

5.2. RESEARCH LABORATORIES

5.3. HOSPITALS AND CLINICS

6.

BLOOD PLASMA MARKET - REGIONAL OUTLOOK

6.1. NORTH AMERICA

6.1.1.

COUNTRY ANALYSIS

6.1.1.1.

THE UNITED STATES

6.1.1.2.

CANADA

7.

COMPANY PROFILES

7.1. SHIRE PLC

7.2. ARTHREX

7.3. OCTAPHARMA AG

7.4. BAXTER INTERNATIONAL, INC.

7.5. GRIFOLS INTERNATIONAL S.A.

7.6. BIOTEST AG

7.7. CSL LTD.

7.8. ADMA BIOLOGICS, INC.

7.9. CHINA BIOLOGIC PRODUCTS, INC.

7.10.

GENERAL ELECTRIC CO.

7.11.

CERUS CORP.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 NORTH AMERICA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

TABLE 2 BLOOD PLASMA

COMPONENTS

TABLE 3 NORTH AMERICA BLOOD

PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 4 NORTH AMERICA BLOOD

PLASMA MARKET IN IMMUNOGLOBULIN BY TYPES 2019-2027 ($ MILLION)

TABLE 5 PROTEASE INHIBITORS

USED IN THE HIV INFECTION TREATMENT

TABLE 6 NORTH AMERICA BLOOD

PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 7 NORTH AMERICA BLOOD

PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 8 NORTH AMERICA BLOOD

PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 NORTH AMERICA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 2 IMMUNOGLOBULIN

INFUSIONS SIDE-EFFECTS

FIGURE 3 ROLE OF FIBRIN

SEALANT IN COAGULATION CASCADE

FIGURE 4 NORTH AMERICA BLOOD PLASMA

MARKET IN ALBUMIN 2019-2027 ($ MILLION)

FIGURE 5 NORTH AMERICA BLOOD

PLASMA MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 6 NORTH AMERICA

IMMUNOGLOBULIN MARKET IN INTRAVENOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 7 NORTH AMERICA IMMUNOGLOBULIN

MARKET IN SUBCUTANEOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 8 NORTH AMERICA

IMMUNOGLOBULIN MARKET IN OTHER IMMUNOGLOBULIN TYPE 2019-2027 ($ MILLION)

FIGURE 9 NORTH AMERICA BLOOD

PLASMA MARKET IN COAGULATION FACTOR CONCENTRATES 2019-2027 ($ MILLION)

FIGURE 10 HYPERIMMUNES ISOLATION

PROCESS

FIGURE 11 NORTH AMERICA BLOOD

PLASMA MARKET IN HYPERIMMUNES 2019-2027 ($ MILLION)

FIGURE 12 NORTH AMERICA BLOOD

PLASMA MARKET IN OTHER PLASMA FRACTIONATION PRODUCTS 2019-2027 ($ MILLION)

FIGURE 13 NORTH AMERICA BLOOD

PLASMA MARKET IN ONCOLOGY 2019-2027 ($ MILLION)

FIGURE 14 NORTH AMERICA BLOOD

PLASMA MARKET IN HEMATOLOGY 2019-2027 ($ MILLION)

FIGURE 15 NORTH AMERICA BLOOD

PLASMA MARKET IN TRANSPLANTATION 2019-2027 ($ MILLION)

FIGURE 16 LUPUS INFECTION SYMPTOMS

FIGURE 17 NORTH AMERICA BLOOD

PLASMA MARKET IN RHEUMATOLOGY 2019-2027 ($ MILLION)

FIGURE 18 NORTH AMERICA BLOOD

PLASMA MARKET IN NEUROLOGY 2019-2027 ($ MILLION)

FIGURE 19 NORTH AMERICA BLOOD

PLASMA MARKET IN PULMONOLOGY 2019-2027 ($ MILLION)

FIGURE 20 NORTH AMERICA BLOOD

PLASMA MARKET IN IMMUNOLOGY 2019-2027 ($ MILLION)

FIGURE 21 NORTH AMERICA BLOOD

PLASMA MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 22 NORTH AMERICA BLOOD

PLASMA MARKET IN ACADEMIC INSTITUTIONS 2019-2027 ($ MILLION)

FIGURE 23 NORTH AMERICA BLOOD

PLASMA MARKET IN RESEARCH LABORATORIES 2019-2027 ($ MILLION)

FIGURE 24 NORTH AMERICA BLOOD

PLASMA MARKET IN HOSPITALS AND CLINICS 2019-2027 ($ MILLION)

FIGURE 25 NORTH AMERICA BLOOD PLASMA

MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 26 THE UNITED STATES BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 27 CANADA BLOOD PLASMA MARKET 2019-2027 ($ MILLION)