Market By Type, Cable Type, Material, Application And Geography | Forecast 2019-2027

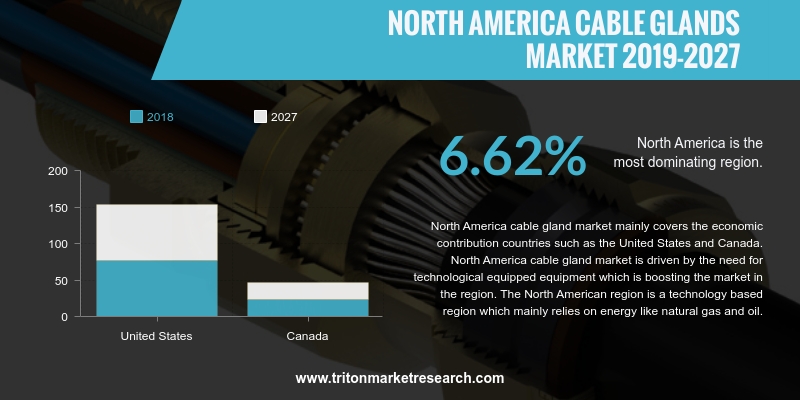

Triton Market Research, in its report, has concluded that the North American cable glands market is set to grow with a CAGR of 6.62% in the forecasting years of 2019-2027.

The countries analyzed in the report on the North America market for cable glands are:

• The United States

• Canada

The demand for technologically advanced equipment is boosting the demand for cable glands in North America, thereby driving the market growth in the region. North American is a technology-based region mainly relying on energy like oil & natural gas. The rise in population has led to an increase in demand for energy and infrastructure, thus propelling the region’s construction industry during the forecasted years. Heavy investments in the commercial & residential sector have resulted in an increase in the cash flow into the economy. This has boosted the demand for the cable glands in the region, thereby leading to the growth of North America’s cable glands market.

Report Scope Can Be Customized Per Your Requirements. Request for Customization

The ancient construction present in the United States, coupled with enhanced usage of electrical devices & energy, have necessitated the implementation of new cable connections and the installation of high-tech connections in the country. This factor is driving the growth of the US market for cable glands.

Amphenol Corporation is one of the leading companies in the world dealing with interconnect products. It is engaged in designing, manufacturing and marketing of interconnecting systems; electrical, electronic & fiber optic connectors; antennas; coaxial and high-speed specialty cables; and sensors & sensor-based products. Amphenol, Socapex, Kai Jack, Tuchel, Spectra-Strip, Sine, Matrix, Pyle-National and Times Fiber are some of the brands under which the company markets its products. Amphenol caters to various industries, such as IT, automotive, and defense & aerospace, among others. The US-based company is headquartered in Wallingford, Connecticut. In March 2019, Amphenol launched its new plastic cable gland called ‘Durometer AHDP’; the launch of new products by the company is expected to boost its growth.

1. NORTH

AMERICA CABLE GLANDS MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. RISING

DEMAND FOR HAZARDOUS CABLE GLANDS

2.2.2. SWELLING

DEMAND FOR CABLE CONNECTORS IN THE AEROSPACE SECTOR

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. SCALABILITY

2.4.3. EASE

OF USE

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. MARKET

DRIVERS

2.7.1. GOVERNMENT

REGULATIONS FUEL THE DEMAND FOR CABLE GLANDS

2.7.2. RESTORATION

OF ELECTRICAL NETWORKS IN SEVERAL REGIONS

2.7.3. RISE

IN CONSTRUCTION UNDERTAKINGS IN DEVELOPING REGIONS

2.7.4. WIDE

ADOPTION OF AUTOMATION

2.8. MARKET

RESTRAINTS

2.8.1. VARIABILITY

IN RAW MATERIAL PRICES

2.9. MARKET

OPPORTUNITIES

2.9.1. EMERGING

GROWTH IN BUDDING MARKETS

2.9.2. SURGE

IN COUNT OF DATA CENTERS

2.10. MARKET

CHALLENGES

2.10.1.

SUSPENSION OF THE LOCAL

MARKETS

3. NORTH

AMERICA CABLE GLANDS MARKET OUTLOOK – BY TYPE

3.1. INDUSTRIAL

3.2. HAZARDOUS

3.2.1. INCREASED

SAFETY

3.2.2. FLAME-PROOF

3.2.3. EMC

CABLE GLANDS

3.2.4. OTHERS

4. NORTH

AMERICA CABLE GLANDS MARKET OUTLOOK – BY CABLE TYPE

4.1. ARMORED

4.2. UNARMORED

5. NORTH

AMERICA CABLE GLANDS MARKET OUTLOOK – BY MATERIAL

5.1. BRASS

5.2. STAINLESS

STEEL

5.3. PLASTIC/NYLON

5.4. OTHERS

6. NORTH

AMERICA CABLE GLANDS MARKET OUTLOOK – BY APPLICATION

6.1. OIL

& GAS

6.2. MINING

6.3. AEROSPACE

6.4. MANUFACTURING

& PROCESSING

6.5. CHEMICAL

6.6. OTHERS

7. NORTH

AMERICA CABLE GLANDS MARKET – REGIONAL OUTLOOK

7.1. NORTH

AMERICA

7.1.1. UNITED

STATES

7.1.2. CANADA

8. COMPETITIVE

LANDSCAPE

8.1. ABB

LTD.

8.2. AMPHENOL

CORPORATION

8.3. EATON

CORPORATION

8.4. EMERSON

ELECTRIC CO.

8.5. HUBBEL INCORPORATED

8.6. THOMAS

& BETTS

8.7. CMP

PRODUCTS

8.8. CORTEM S.p.A

8.9. BARTEC

8.10. JACOB

GMBH

8.11. SEALCON

LLC

8.12. R.

STAHL AG

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: NORTH AMERICA

CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: NORTH AMERICA

CABLE GLANDS MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 5: NORTH AMERICA

CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN $ MILLION)

TABLE 6: NORTH AMERICA

CABLE GLANDS MARKET, BY CABLE TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: NORTH AMERICA

CABLE GLANDS MARKET, BY MATERIAL, 2019-2027 (IN $ MILLION)

TABLE 8: NORTH AMERICA

CABLE GLANDS MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 9: NORTH AMERICA

CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: NORTH AMERICA

CABLE GLANDS MARKET, BY TYPE, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE

FORCE ANALYSIS

FIGURE 3: KEY BUYING

IMPACT ANALYSIS

FIGURE 4: NORTH AMERICA

CABLE GLANDS MARKET, BY INDUSTRIAL, 2019-2027 (IN $ MILLION)

FIGURE 5: NORTH AMERICA

CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN $ MILLION)

FIGURE 6: NORTH AMERICA

CABLE GLANDS MARKET, BY INCREASED SAFETY, 2019-2027 (IN $ MILLION)

FIGURE 7: NORTH AMERICA

CABLE GLANDS MARKET, BY FLAME-PROOF, 2019-2027 (IN $ MILLION)

FIGURE 8: NORTH AMERICA

CABLE GLANDS MARKET, BY EMC CABLE GLANDS, 2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA

CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: NORTH

AMERICA CABLE GLANDS MARKET, BY ARMORED, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH

AMERICA CABLE GLANDS MARKET, BY UNARMORED, 2019-2027 (IN $ MILLION)

FIGURE 12: NORTH

AMERICA CABLE GLANDS MARKET, BY BRASS, 2019-2027 (IN $ MILLION)

FIGURE 13: NORTH

AMERICA CABLE GLANDS MARKET, BY STAINLESS STEEL, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH

AMERICA CABLE GLANDS MARKET, BY PLASTIC/NYLON, 2019-2027 (IN $ MILLION)

FIGURE 15: NORTH

AMERICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 16: NORTH

AMERICA CABLE GLANDS MARKET, BY OIL & GAS, 2019-2027 (IN $ MILLION)

FIGURE 17: NORTH

AMERICA CABLE GLANDS MARKET, BY MINING, 2019-2027 (IN $ MILLION)

FIGURE 18: NORTH

AMERICA CABLE GLANDS MARKET, BY AEROSPACE, 2019-2027 (IN $ MILLION)

FIGURE 19: NORTH

AMERICA CABLE GLANDS MARKET, BY MANUFACTURING & PROCESSING, 2019-2027 (IN $

MILLION)

FIGURE 20: NORTH

AMERICA CABLE GLANDS MARKET, BY CHEMICAL, 2019-2027 (IN $ MILLION)

FIGURE 21: NORTH

AMERICA CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 22: NORTH

AMERICA CABLE GLANDS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 23: UNITED

STATES CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: CANADA CABLE

GLANDS MARKET, 2019-2027 (IN $ MILLION)