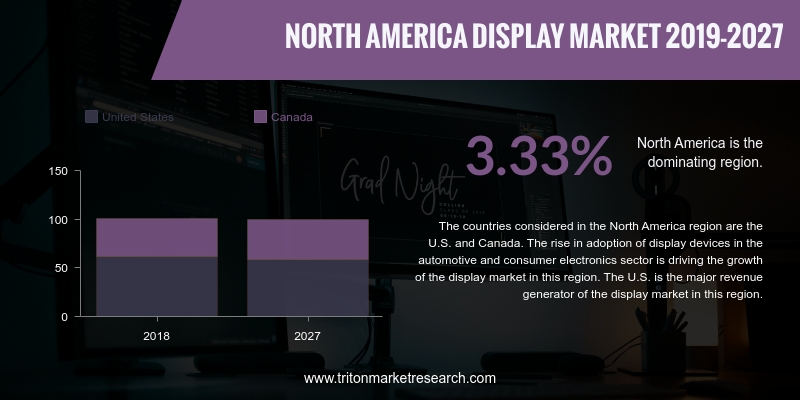

The North America display market, as stated by Triton in its research report, is anticipated to witness a growth in revenue, with a CAGR of 3.33% in estimated years of 2019 to 2027.

The countries studied in the North American display market are:

• The United States

• Canada

Report scope can be customized per your requirements. Request For Customization

North America is a technologically advanced region with a highly developed consumer electronics industry, owing to which, there is massive penetration of consumer electronics in the majority of the households in the region.

The development of smart offices and smart homes, as a result of the advancements in technology, has led to a rise in the demand for consumer electronic products such as smart TVs, smart refrigerators, smart air conditioners, and more. It can thus be said that the rise in the disposable incomes of people, increasing demand for consumer electronics, and the shift in consumer preferences towards smart homes and smart offices are primarily driving industry growth.

The increased innovations and interconnectivity among consumer electronic products have given rise to smarter consumer electronics. The applications of VR technology, IoT solutions, and robotics in the manufacturing of consumer electronics, which results in high-efficiency products with low manufacturing costs, have significantly benefited the North American consumer electronics industry.

Kent Displays, Inc. is a company well-known for its unique display technology called “eWriter,” as well as for its expertise in roll-to-roll manufacturing. It is engaged in the R&D, design, and assembly of consumer-packaged goods. The company has commercialized its eWriter technology and sells it under the brand “Boogie Board.” It is a private company, and hence, has not disclosed its financial information on the public domain. The growing e-learning and consumer electronics sector provides the company with an excellent opportunity to expand its business. Kent Displays, in October 2017, launched its electronic writing tool called Blackboard. The US-based company is headquartered in Kent, Ohio.

1. NORTH

AMERICA DISPLAY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. VEHICLE

DISPLAY IS A RAPIDLY GROWING APPLICATION IN THE DISPLAY MARKET

2.2.2. FLAT-PANEL

DISPLAY IS THE LARGEST DISPLAY TYPE DURING THE FORECAST PERIOD

2.2.3. CONSUMER

ELECTRONICS IS THE LARGEST INDUSTRIAL VERTICAL USING DISPLAYS DURING THE

FORECAST PERIOD

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISING

DEMAND FOR OLED DEVICES

2.6.2. INCREASING

DEMAND FOR TOUCH-BASED DEVICES

2.7. MARKET

RESTRAINTS

2.7.1. STAGNATION

IN THE GROWTH OF DESKTOP PC, NOTEBOOK, AND TABLET

2.7.2. INCREASING

COST OF CERTAIN DISPLAY TECHNOLOGIES

2.8. MARKET

OPPORTUNITIES

2.8.1. INCREASING

USE OF AR/VR DEVICES

2.9. MARKET

CHALLENGES

2.9.1. UNSTABLE

PRICING OF DISPLAY PANELS

3. DISPLAY

MARKET OUTLOOK – BY DISPLAY TYPE

3.1. FLAT-PANEL

DISPLAY

3.2. FLEXIBLE-PANEL

DISPLAY

3.3. TRANSPARENT-PANEL

DISPLAY

4. DISPLAY

MARKET OUTLOOK – BY TECHNOLOGY

4.1. OLED

4.2. QUANTUM

DOT

4.3. LED

4.4. LCD

4.5. E-PAPER

4.6. OTHER

TECHNOLOGIES

5. DISPLAY

MARKET OUTLOOK – BY APPLICATION

5.1. SMARTPHONE

& TABLET

5.2. SMART

WEARABLE

5.3. TELEVISION

& DIGITAL SIGNAGE

5.4. PC

& LAPTOP

5.5. VEHICLE

DISPLAY

5.6. OTHER

APPLICATIONS

6. DISPLAY

MARKET OUTLOOK – BY INDUSTRY VERTICAL

6.1. HEALTHCARE

6.2. CONSUMER

ELECTRONICS

6.3. BFSI

6.4. RETAIL

6.5. MILITARY

& DEFENSE

6.6. AUTOMOTIVE

6.7. OTHER

INDUSTRY VERTICALS

7. DISPLAY

MARKET – NORTH AMERICA

7.1. UNITED

STATES

7.2. CANADA

8. COMPETITIVE

LANDSCAPE

8.1. AU

OPTRONICS CORP.

8.2. CORNING

INCORPORATED.

8.3. E

INK HOLDINGS INC.

8.4. HANNSTAR

DISPLAY CORPORATION

8.5. JAPAN

DISPLAY INC.

8.6. KENT

DISPLAYS, INC.

8.7. LG

DISPLAY

8.8. NEC

DISPLAY SOLUTIONS, LTD.

8.9. SAMSUNG

ELECTRONICS CO., LTD.

8.10.

SONY CORPORATION

9. RESEARCH

METHODOLOGY & SCOPE

9.1. RESEARCH

SCOPE & DELIVERABLES

9.1.1. OBJECTIVES

OF STUDY

9.1.2. SCOPE

OF STUDY

9.2. SOURCES

OF DATA

9.2.1. PRIMARY

DATA SOURCES

9.2.2. SECONDARY

DATA SOURCES

9.3. RESEARCH

METHODOLOGY

9.3.1. EVALUATION

OF PROPOSED MARKET

9.3.2. IDENTIFICATION

OF DATA SOURCES

9.3.3. ASSESSMENT

OF MARKET DETERMINANTS

9.3.4. DATA

COLLECTION

9.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: NORTH AMERICA

DISPLAY MARKET, BY COUNTRY, 2019-2027 (IN $ BILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: NORTH AMERICA

DISPLAY MARKET, BY DISPLAY TYPE, 2019-2027 (IN $ BILLION)

TABLE 4: NORTH AMERICA

DISPLAY MARKET, BY TECHNOLOGY, 2019-2027 (IN $ BILLION)

TABLE 5: NORTH AMERICA

DISPLAY MARKET, BY APPLICATION, 2019-2027 (IN $ BILLION)

TABLE 6: NORTH AMERICA

DISPLAY MARKET, BY INDUSTRY VERTICAL, 2019-2027 (IN $ BILLION)

TABLE 7: NORTH AMERICA

DISPLAY MARKET, BY COUNTRY, 2019-2027 (IN $ BILLION)

FIGURE 1: NORTH AMERICA

DISPLAY MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: NORTH AMERICA

VEHICLE DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 3: NORTH AMERICA

FLAT-PANEL DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 4: NORTH AMERICA

CONSUMER ELECTRONICS MARKET, 2019-2027 (IN $ BILLION)

FIGURE 5: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 6: MARKET ATTRACTIVENESS

INDEX

FIGURE 7: NORTH AMERICA

DISPLAY MARKET, BY FLAT-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 8: NORTH AMERICA

DISPLAY MARKET, BY FLEXIBLE-PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 9: NORTH AMERICA

DISPLAY MARKET, BY TRANSPARENT- PANEL DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 10: NORTH

AMERICA DISPLAY MARKET, BY OLED, 2019-2027 (IN $ BILLION)

FIGURE 11: NORTH

AMERICA DISPLAY MARKET, BY QUANTUM DOT DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 12: NORTH

AMERICA DISPLAY MARKET, BY LED, 2019-2027 (IN $ BILLION)

FIGURE 13: NORTH

AMERICA DISPLAY MARKET, BY LCD, 2019-2027 (IN $ BILLION)

FIGURE 14: NORTH

AMERICA DISPLAY MARKET, BY E-PAPER, 2019-2027 (IN $ BILLION)

FIGURE 15: NORTH

AMERICA DISPLAY MARKET, BY OTHER TECHNOLOGIES, 2019-2027 (IN $ BILLION)

FIGURE 16: NORTH

AMERICA DISPLAY MARKET, BY SMARTPHONE & TABLET, 2019-2027 (IN $ BILLION)

FIGURE 17: NORTH

AMERICA DISPLAY MARKET, BY SMART WEARABLE, 2019-2027 (IN $ BILLION)

FIGURE 18: NORTH

AMERICA DISPLAY MARKET, BY TELEVISION & DIGITAL SIGNAGE, 2019-2027 (IN $

BILLION)

FIGURE 19: NORTH

AMERICA DISPLAY MARKET, BY PC & LAPTOP, 2019-2027 (IN $ BILLION)

FIGURE 20: NORTH

AMERICA DISPLAY MARKET, BY VEHICLE DISPLAY, 2019-2027 (IN $ BILLION)

FIGURE 21: NORTH

AMERICA DISPLAY MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ BILLION)

FIGURE 22: NORTH

AMERICA DISPLAY MARKET, BY HEALTHCARE, 2019-2027 (IN $ BILLION)

FIGURE 23: NORTH

AMERICA DISPLAY MARKET, BY CONSUMER ELECTRONICS, 2019-2027 (IN $ BILLION)

FIGURE 24: NORTH

AMERICA DISPLAY MARKET, BY BFSI, 2019-2027 (IN $ BILLION)

FIGURE 25: NORTH

AMERICA DISPLAY MARKET, BY RETAIL, 2019-2027 (IN $ BILLION)

FIGURE 26: NORTH

AMERICA DISPLAY MARKET, BY MILITARY & DEFENSE, 2019-2027 (IN $ BILLION)

FIGURE 27: NORTH

AMERICA DISPLAY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ BILLION)

FIGURE 28: NORTH

AMERICA DISPLAY MARKET, BY OTHER INDUSTRIAL VERTICALS, 2019-2027 (IN $ BILLION)

FIGURE 29: NORTH

AMERICA DISPLAY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 30: UNITED

STATES DISPLAY MARKET, 2019-2027 (IN $ BILLION)

FIGURE 31: CANADA

DISPLAY MARKET, 2019-2027 (IN $ BILLION)