Market By Type, Application, Technology And Geography | Forecast 2019-2027

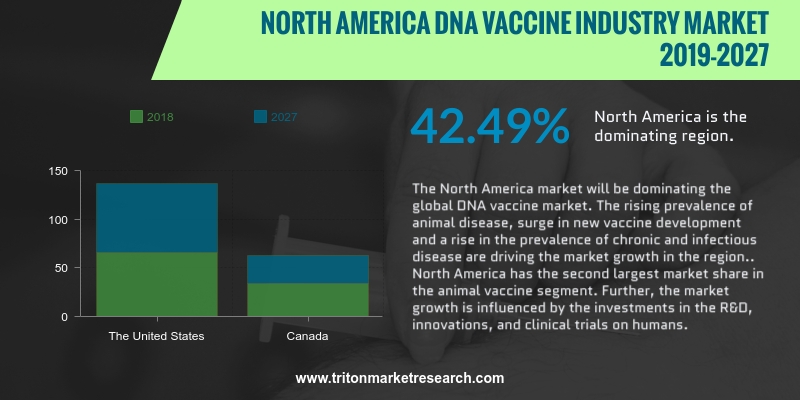

Triton Market Research forecasts the North America DNA vaccines market to progress during the forecast period of 2019-2027 at a CAGR of 42.49%, in terms of revenue.

The countries that have been scrutinized in the North America DNA vaccines market are:

• The United States

• Canada

The North America DNA vaccines market is developing and expanding at a rapid pace. The advancing growth of the North America market can be primarily attributed to the enhancement in the prevalence of chronic and infectious diseases in humans and animals. DNA vaccines are introduced for the prevention of diseases such as HIV, HPV, cardiovascular diseases, measles and those foot & mouth diseases that are most prevalent in animals. The market in North America is also on the verge of growth and development due to the rise in the amount of veterinary expenditure & investments made by the government and health institutions. The establishment and presence of various clinical research and testing laboratories in countries like the United States and Canada are paving the way for future opportunities for the DNA vaccines market.

We provide additional customization based on your specific requirements. Request For Customization

The DNA vaccines market in Canada is burgeoning, and it is majorly driven by the rising veterinary expenditure and investments made by the country’s government for increased R&D activities. The constant innovations and development of these vaccines for the prevention of chronic and infectious diseases are also contributing to the market growth. According to the National Center for Biotechnology Information, the Canadian government made an investment of $440 million in 2015 for the advancement and development of DNA vaccines in the country, focusing on both, the humans and animals. As per the government, in the present scenario, 73% of the population has pets in their household, which mostly includes dogs and cats. The prevention of chronic and infectious diseases in pets is creating growth opportunities for the DNA vaccines market in the country.

Eli Lilly and Company is a multinational healthcare company based in the United States. It is engaged in the manufacturing, discovery, development and sales of pharmaceutical products for humans and animals around the world. The company’s products include endocrine, neuroscience, anti-affective, oncology and cardiovascular agents, as well as animal healthcare products. At the end of 2016, the company achieved a revenue of around $21,222.1 million.

1.

NORTH AMERICA DNA VACCINES MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S FIVE

FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREATS OF SUBSTITUTE PRODUCT

2.2.3.

BARGAINING POWER OF BUYER

2.2.4.

BARGAINING POWER OF SUPPLIER

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR

SCORECARD

2.4. VALUE CHAIN

OUTLOOK

2.5. KEY INSIGHTS

2.6. REGULATORY

FRAMEWORK

2.7. KEY BUYING

OUTLOOK

2.8. MARKET

DRIVERS

2.8.1.

SURGE IN NEW VACCINE DEVELOPMENT

2.8.2.

RISE IN THE USAGE OF DNA VACCINES FOR ANIMAL

HEALTHCARE

2.8.3.

RISING PREVALENCE OF CHRONIC AND INFECTIOUS

DISEASES

2.9. MARKET

RESTRAINTS

2.9.1.

LACK OF LEGAL AND ETHICAL FRAMEWORK

2.9.2.

STRINGENT GOVERNMENT

REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

GROWING DEMAND FOR GENE THERAPY

2.10.2.

STEADY VACCINES ARE

EASY TO STORE AND TRANSPORT

2.10.3.

INCREASING NUMBER OF CLINICAL TRIALS ON

HUMANS

2.11.

MARKET CHALLENGES

2.11.1.

VARIATION IN THE REGULATORY PATHWAY AND THE

POINTS OF CONSIDERATION REGARDING ENVIRONMENTAL VALUATION

3.

DNA VACCINES MARKET

OUTLOOK - BY TYPE

3.1. ANIMAL DNA VACCINE

3.2. HUMAN DNA VACCINE

4.

DNA VACCINES MARKET

OUTLOOK - BY APPLICATION

4.1. HUMAN DISEASE

4.2. VETERINARY DISEASE

5.

DNA VACCINES MARKET

OUTLOOK - BY TECHNOLOGY

5.1. PLASMID DNA

VACCINES

5.2. PLASMID DNA

DELIVERY

6.

DNA VACCINES MARKET

OUTLOOK - BY REGION

6.1. NORTH AMERICA

6.1.1.

COUNTRY ANALYSIS

6.1.1.1.

THE UNITED STATES

6.1.1.2.

CANADA

7.

COMPETITIVE LANDSCAPE

7.1. ASTELLAS

PHARMA, INC.

7.2. DENDREON

CORPORATION (ACQUIRED BY SANPOWER GROUP)

7.3. ELI LILLY AND

COMPANY

7.4. EUROGENTEC

S.A.

7.5. GLAXOSMITHKLINE,

INC.

7.6. INOVIO

PHARMACEUTICALS, INC.

7.7. MADISON

VACCINES, INCORPORATED (MVI)

7.8. MERCK &

CO.

7.9. MERIAL

LIMITED (ACQUIRED BY BOEHRINGER INGELHEIM)

7.10.

NOVARTIS AG

7.11.

SANOFI

7.12.

VGXI

7.13.

VICAL, INCORPORATED

7.14.

XENETIC BIOSCIENCES, INC.

7.15.

ZOETIS, INC.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES OF

DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1 NORTH AMERICA DNA VACCINES MARKET 2019-2027 ($ MILLION)

TABLE 2 INTERVENTION AND PHASE OF SOME DISEASES/CONDITIONS

TABLE 3 REGULATIONS TO FOLLOW BEFORE COMMERCIALIZATION

TABLE 4 TEMPERATURE REQUIREMENT IN PRESERVATION FOR VARIOUS VACCINES

TABLE 5 APPROACHES BEING TESTED TO ENHANCE THE LOW IMMUNOGENICITY

TABLE 6 CLINICAL TRIALS ON HUMANS INVOLVING DNA VACCINES

TABLE 7 NORTH AMERICA DNA VACCINES MARKET BY TYPE 2019-2027 ($

MILLION)

TABLE 8 NORTH AMERICA DNA VACCINES MARKET BY APPLICATION 2019-2027 ($

MILLION)

TABLE 9 NORTH AMERICA DNA VACCINES MARKET BY TECHNOLOGY 2019-2027 ($

MILLION)

TABLE 10 NORTH AMERICA DNA VACCINES MARKET BY COUNTRY 2019-2027 ($

MILLION)

FIGURE 1 NORTH AMERICA DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 2 VALUE CHAIN ANALYSES FOR DNA VACCINE INDUSTRY

FIGURE 3 NORTH AMERICA DNA VACCINES MARKET IN VETERINARY DISEASES

2019-2027 ($ MILLION)

FIGURE 4 CLINICAL TRIALS OF GENE THERAPY

FIGURE 5 NORTH AMERICA DNA VACCINES MARKET IN ANIMAL DNA VACCINES

2019-2027 ($ MILLION)

FIGURE 6 NORTH AMERICA DNA VACCINES MARKET IN HUMAN DNA VACCINES

2019-2027 ($ MILLION)

FIGURE 7 NORTH AMERICA DNA VACCINES MARKET SHARE BY APPLICATION 2017

& 2026 (%)

FIGURE 8 NORTH AMERICA DNA VACCINES MARKET IN HUMAN DISEASES 2019-2027

($ MILLION)

FIGURE 9 NORTH AMERICA DNA VACCINES MARKET IN VETERINARY DISEASES

2019-2027 ($ MILLION)

FIGURE 10 NORTH AMERICA DNA VACCINES MARKET IN PLASMID DNA VACCINES

TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 11 NORTH AMERICA DNA VACCINES MARKET IN PLASMID DNA DELIVERY

TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 12 THE UNITED STATES DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 13 CANADA DNA VACCINES MARKET 2019-2027 ($ MILLION)