Market By Fuel Type, Power, Application, End-user, And Geography | Forecast 2019-2027

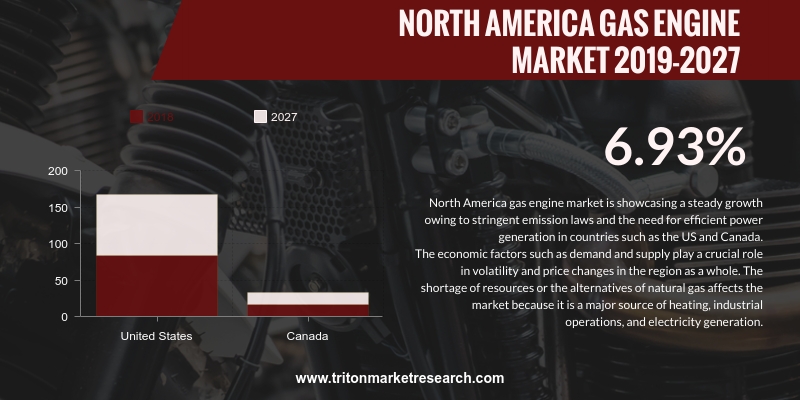

Triton Market Research, in its report on the North America gas engine market, has concluded that the industry would grow at a CAGR of 6.93% in the estimated years of 2019 to 2027.

The countries analyzed in the North America market for gas engines are:

• The United States

• Canada

Canada is one of the largest natural gas producers in the world, and its gas engine market depicts stable growth during the forecast period. There is an abundance of natural gas resources in the country. The share of natural gas in the total electricity produced was 11% in 2017. After ratifying the Paris Agreement in 2016, Canada committed to decrease its overall greenhouse gas emissions by 30% by 2030.

Report scope can be customized per your requirements. Request For Customization

Moreover, factors such as the decreased natural gas prices as a result of the increase in production of shale and tight gas in North America; phasing-out of coal power plants for electricity generation; developed natural gas infrastructure, and the overall increase in the demand for electricity in Canada are expected to provide a boost to the use of natural gas power generation in the country. This is expected to raise the demand for gas engines in Canada, thereby boosting its gas engine market.

Fairbanks Morse Engine (a subsidiary of EnPro Industries, Inc.) is an engine equipment company manufacturing power solutions. The company offers diesel engines, OEM parts, and dual-fuel engine generator sets. Along with these, it also provides diesel products, dual-fuel products, gas products, gasoline engines, the Train Master locomotive, and others.

Fairbanks Morse offers services such as diesel engine remanufacturing, factory-direct field service & support, and engine inspection are among the several services offered by Fairbanks. The company offers its products and services to various sectors, including stationary power, marine power, power generation, nuclear standby power, oil & gas, and locomotive power. With its headquarters in Beloit, Wisconsin (US), Fairbanks Morse Engine operates in the United States as well as Canada. The company ships propulsion and shipboard power for the United States Navy & Coast Guard and commercial vessels.

1. NORTH

AMERICA GAS ENGINE MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. ADVENT

OF DUAL FUEL ENGINES

2.2.2. CONSUMPTION

OF ALTERNATE GASES AS FUELS

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. EFFICIENCY

2.4.3. EMISSION

2.4.4. MAINTENANCE

2.4.5. FLEXIBILITY

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. REGULATORY

FRAMEWORK

2.8. MARKET

DRIVERS

2.8.1. DECREASE

IN GAS PRICES

2.8.2. GROWING

ELECTRICITY DEMAND WORLDWIDE

2.8.3. SURGE

IN ECOLOGICAL CONCERNS

2.8.4. INDUSTRIAL

EXPANSION LEADING TO ENVIRONMENTAL POWER GENERATION

2.9. MARKET

RESTRAINTS

2.9.1. ABNORMALITIES

IN NATURAL GAS RESERVES & PROVISIONS DUE TO REGIONAL INSTABILITY

2.9.2. RISE

IN SAFETY CONCERNS

2.9.3. PRICE

DISPARITY AMONG FUELS

2.10. MARKET

OPPORTUNITIES

2.10.1.

EMERGENT INCLINATION TOWARDS

DISTRIBUTED POWER GENERATION

2.10.2.

ADVENT OF GAS-FIRED POWER

PLANTS

2.11. MARKET

CHALLENGES

2.11.1.

DIMINISHING NATURAL GAS

RESERVES

2.11.2.

FIRM REGULATIONS LEVIED BY

AUTHORITIES

3. NORTH

AMERICA GAS ENGINE MARKET OUTLOOK – BY FUEL TYPE

3.1. NATURAL

GAS

3.2. SPECIAL

GAS

3.3. OTHER

GAS

4. NORTH

AMERICA GAS ENGINE MARKET OUTLOOK – BY POWER

4.1. 0.5

MW-1.0 MW

4.2. 1.0-2.0

MW

4.3. 2.0-5.0

MW

4.4. 5.0

MW-10.0 MW

4.5. 10.0

MW-20.0 MW

5. NORTH

AMERICA GAS ENGINE MARKET OUTLOOK – BY APPLICATION

5.1. POWER

GENERATION

5.2. CO-GENERATION

5.3. OTHER

APPLICATIONS

6. NORTH

AMERICA GAS ENGINE MARKET OUTLOOK – BY END-USER

6.1. UTILITIES

6.2. MANUFACTURING

6.3. OIL

& GAS

6.4. TRANSPORTATION

6.5. OTHER

END-USERS

7. NORTH

AMERICA GAS ENGINE MARKET – REGIONAL OUTLOOK

7.1. UNITED

STATES

7.2. CANADA

8. COMPETITIVE

LANDSCAPE

8.1. 3W-INTERNATIONAL

GMBH

8.2. CATERPILLAR

INC.

8.3. CUMMINS INC.

8.4. CHINA

YUCHAI INTERNATIONAL LTD.

8.5. CLARKE

ENERGY

8.6. DEUTZ

AG

8.7. DRESSER-RAND

GROUP INC.

8.8. DOOSAN

INFRACORE CO. LTD.

8.9. FAIRBANKS

MORSE ENGINE

8.10. GENERAL

ELECTRIC COMPANY (INNIO)

8.11. HYUNDAI

HEAVY INDUSTRIES CO. LTD.

8.12. IHI

CORPORATION

8.13. KAWASAKI

HEAVY INDUSTRIES LTD.

8.14. MAN

SE

8.15. MITSUBISHI

HEAVY INDUSTRIES LTD.

8.16. WÄRTSILÄ

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: NORTH AMERICA

GAS ENGINE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: REGULATORY

FRAMEWORK

TABLE 4: NATURAL GAS

PRICES (DOLLARS PER THOUSAND CUBIC FEET)

TABLE 5: COMPARISON OF

CARBON DIOXIDE EMISSION LEVELS FOR DIFFERENT FUELS (1990-2040) (MILLION METRIC

TONS)

TABLE 6: NORTH AMERICA

GAS ENGINE MARKET, BY FUEL TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: NORTH AMERICA

GAS ENGINE MARKET, BY POWER, 2019-2027 (IN $ MILLION)

TABLE 8: NORTH AMERICA

GAS ENGINE MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 9: NORTH AMERICA

GAS ENGINE MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 10: NORTH AMERICA

GAS ENGINE MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: NORTH AMERICA

GAS ENGINE MARKET, BY FUEL TYPE, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 3: KEY BUYING

IMPACT ANALYSIS

FIGURE 4: MARKET

ATTRACTIVENESS INDEX

FIGURE 5: NORTH AMERICA

GAS ENGINE MARKET, BY NATURAL GAS, 2019-2027 (IN $ MILLION)

FIGURE 6: NORTH AMERICA

GAS ENGINE MARKET, BY SPECIAL GAS, 2019-2027 (IN $ MILLION)

FIGURE 7: NORTH AMERICA

GAS ENGINE MARKET, BY OTHER GAS, 2019-2027 (IN $ MILLION)

FIGURE 8: NORTH AMERICA

GAS ENGINE MARKET, BY 0.5 MW-1.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA

GAS ENGINE MARKET, BY 1.0-2.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 10: NORTH

AMERICA GAS ENGINE MARKET, BY 2.0-5.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 11: NORTH

AMERICA GAS ENGINE MARKET, BY 5.0 MW-10.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 12: NORTH

AMERICA GAS ENGINE MARKET, BY 10.0 MW-20.0 MW, 2019-2027 (IN $ MILLION)

FIGURE 13: NORTH

AMERICA GAS ENGINE MARKET, BY POWER GENERATION, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH

AMERICA GAS ENGINE MARKET, BY CO-GENERATION, 2019-2027 (IN $ MILLION)

FIGURE 15: NORTH

AMERICA GAS ENGINE MARKET, BY OTHER APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 16: NORTH

AMERICA GAS ENGINE MARKET, BY UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 17: NORTH

AMERICA GAS ENGINE MARKET, BY MANUFACTURING, 2019-2027 (IN $ MILLION)

FIGURE 18: NORTH

AMERICA GAS ENGINE MARKET, BY OIL & GAS, 2019-2027 (IN $ MILLION)

FIGURE 19: NORTH

AMERICA GAS ENGINE MARKET, BY TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 20: NORTH

AMERICA GAS ENGINE MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 21: NORTH

AMERICA GAS ENGINE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 22: UNITED

STATES ENGINE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: CANADA GAS

ENGINE MARKET, 2019-2027 (IN $ MILLION)