Market By Type, Technology, Application, End-user And Geography | Forecast 2019-2027

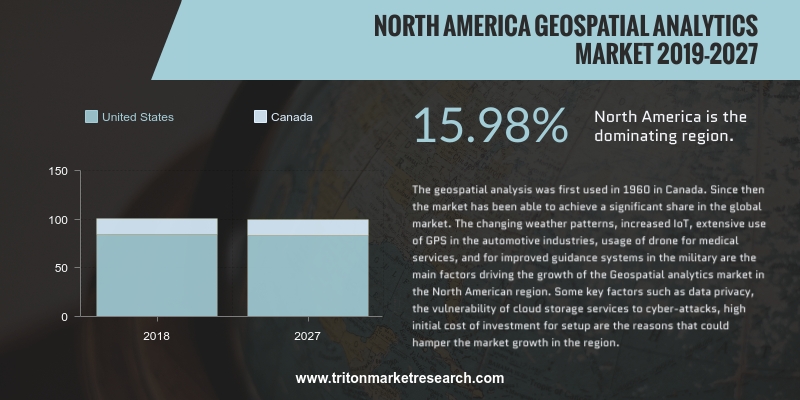

As per Triton, the North America geospatial analytics market is expected to grow at a CAGR of 15.98% during the forecasting duration of 2019-2027.

Countries covered in the North American geospatial analytics market are:

• United States

• Canada

We provide additional customization based on your specific requirements. Request For Customization

North America is the leading hub for technologies. The main demand for geospatial analytics in this region has been observed from the defense & intelligence and the transportation & logistics sector. The U.S. allots the most of its budget for its defense expenditure globally. In 2014, United States defense spending was USD 609 million, that accounted to 34% of the total military expenditure of the world (USD 1747 million). However, over the period of last three years, as a result of the global political situation and strife’s in the countries of Afghanistan and Iraq, the United States Department of Defense minimized their defense budget. This led to a slight dip in the growth of the aerospace and defense sector worldwide.

Geospatial analysis was first used in 1960 in Canada. Since then, the market in this region has been able to achieve a significant share in the global market. The changing weather patterns have increased the usage of IoT. Extensive use of GPS in the automotive industries, usage of drone for medical services and improved guidance systems in the military are the main factors driving the growth of the geospatial analytics market in the North American region. Some key factors such as data privacy, the vulnerability of cloud storage services to cyber-attacks and the high initial cost of investment for set-up are the reasons that could hamper the market growth in the region.

Triton has discussed the market definition, evolution, transition of geospatial, key market sights, vendor scorecard, Porter's five force analysis, and the market attractiveness index for the geospatial analytics market.

1. NORTH

AMERICA GEOSPATIAL ANALYTICS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF GEOSPATIAL ANALYTICS

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. REGULATORY

FRAMEWORK

2.7. VENDOR

SCORECARD

2.8. KEY

IMPACT ANALYSIS

2.9. MARKET

DRIVERS

2.9.1. COMMERCIALIZATION

OF SPATIAL DATA

2.9.2. RISING

DEMAND FROM DIFFERENT END-USER INDUSTRIES

2.9.3. TECHNOLOGICAL

ADVANCEMENTS

2.10.

MARKET RESTRAINTS

2.10.1.

HIGH COSTS ASSOCIATED WITH

GEOSPATIAL TECHNOLOGIES

2.10.2.

OPERATIONAL & LEGAL CONCERNS

2.11.

MARKET OPPORTUNITIES

2.11.1.

USE OF BIG DATA & CLOUD IN

GEOSPATIAL ANALYTICS

2.11.2.

INCREASED SMART CITY &

INFRASTRUCTURE PROJECTS

2.11.3.

HIGH USAGE IN ENVIRONMENTAL MONITORING & LAND MANAGEMENT

2.12.

MARKET CHALLENGES

2.12.1.

PRIVACY & SECURITY

CONCERNS

2.12.2.

INTEROPERABILITY ISSUES

3. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY TYPE

3.1. SURFACE

ANALYSIS

3.2. NETWORK

ANALYSIS

3.3. GEO-VISUALIZATION

3.4. OTHER

TYPES

4. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY TECHNOLOGY

4.1. REMOTE

SENSING

4.2. GLOBAL

POSITIONING SYSTEM (GPS)

4.3. GEOGRAPHIC

INFORMATION SYSTEM (GIS)

4.4. OTHER

TECHNOLOGIES

5. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY APPLICATION

5.1. SURVEYING

5.2. DISASTER

RISK REDUCTION & MANAGEMENT

5.3. MEDICINE

& PUBLIC SAFETY

5.4. OTHER

APPLICATIONS

6. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY END-USER

6.1. BUSINESS

6.2. UTILITY

& COMMUNICATION

6.3. DEFENSE

& INTELLIGENCE

6.4. GOVERNMENT

6.5. AUTOMOTIVE

6.6. OTHER

END-USER

7. GEOSPATIAL

ANALYTICS MARKET - REGIONAL OUTLOOK

7.1. UNITED

STATES

7.2. CANADA

8. COMPETITIVE

LANDSCAPE

8.1. ATKINS

8.2. AUTODESK,

INC.

8.3. BENTLEY

SYSTEMS, INC.

8.4. ESRI,

INC. (ENVIRONMENTAL SYSTEMS RESEARCH INSTITUTE)

8.5. FUGRO

8.6. GENERAL

ELECTRICAL COMPANY

8.7. GOOGLE,

INC.

8.8. HARRIS

CORPORATION

8.9. PITNEY

BOWES, INC.

8.10. HARRIS CORPORATION

8.11. HEXAGON AB (SUBSIDIARY: INTERGRAPH)

8.12. MDA CORPORATION (MACDONALD DETTWILER, AND ASSOCIATES)

8.13. PITNEY BOWES, INC.

8.14. TRIMBLE GEOSPATIAL

8.15. URTHECAST CORPORATION

9. METHODOLOGY & SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1 MARKET ATTRACTIVENESS MATRIX FOR

GEOSPATIAL ANALYTICS MARKET

TABLE 2 VENDOR SCORECARD OF GEOSPATIAL ANALYTICS

MARKET

TABLE 3 REGULATORY FRAMEWORK OF GEOSPATIAL

ANALYTICS MARKET

TABLE 4 NORTH AMERICA GEOSPATIAL ANALYTICS

MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 5 NORTH AMERICA GEOSPATIAL ANALYTICS

MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 6 NORTH AMERICA GEOSPATIAL ANALYTICS

MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 7 NORTH AMERICA GEOSPATIAL ANALYTICS

MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 8 NORTH AMERICA GEOSPATIAL ANALYTICS

MARKET, BY END-USER, 2019-2027 (IN $

MILLION)

FIGURE 1 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 2 PORTER’S FIVE FORCE ANALYSIS OF GEOSPATIAL

ANALYTICS MARKET

FIGURE 3 KEY IMPACT ANALYSIS

FIGURE 4 TIMELINE OF GEOSPATIAL ANALYTICS

FIGURE 5 USE OF LOCATION-BASED

DATA IN NUMEROUS INDUSTRIES (IN %)

FIGURE 6 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET,

BY SURFACE ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 7 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET,

BY NETWORK ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 8 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET,

BY GEO-VISUALIZATION, 2019-2027 (IN $ MILLION)

FIGURE 9 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET,

BY OTHER TYPE OF ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 10 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

REMOTE SENSING, 2019-2027 (IN $ MILLION)

FIGURE 11 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

GLOBAL POSITIONING SYSTEM (GPS), 2019-2027 (IN $ MILLION)

FIGURE 12 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

GEOGRAPHIC INFORMATION SYSTEM (GIS), 2019-2027 (IN $ MILLION)

FIGURE 13 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

OTHER TECHNOLOGIES, 2019-2027 (IN $ MILLION)

FIGURE 14 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

SURVEYING, 2019-2027 (IN $ MILLION)

FIGURE 15 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

DISASTER RISK REDUCTION & MANAGEMENT, 2019-2027 (IN $ MILLION)

FIGURE 16 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

MEDICINE & PUBLIC SAFETY, 2019-2027 (IN $ MILLION)

FIGURE 17 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

OTHER APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 18 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

BUSINESS, 2019-2027 (IN $ MILLION)

FIGURE 19 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

UTILITY & COMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 20 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

DEFENSE & INTELLIGENCE, 2019-2027 (IN $ MILLION)

FIGURE 21 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

GOVERNMENT, 2019-2027 (IN $ MILLION)

FIGURE 22 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 23 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET, BY

OTHER END-USER, 2019-2027 (IN $ MILLION)

FIGURE 24 NORTH AMERICA GEOSPATIAL ANALYTICS MARKET,

COUNTRY OUTLOOK, 2018 & 2027 (IN %)

FIGURE 25 UNITED STATES GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 26 CANADA GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)