Market By Dosages, Formulation And Geography | Forecast 2019-2027

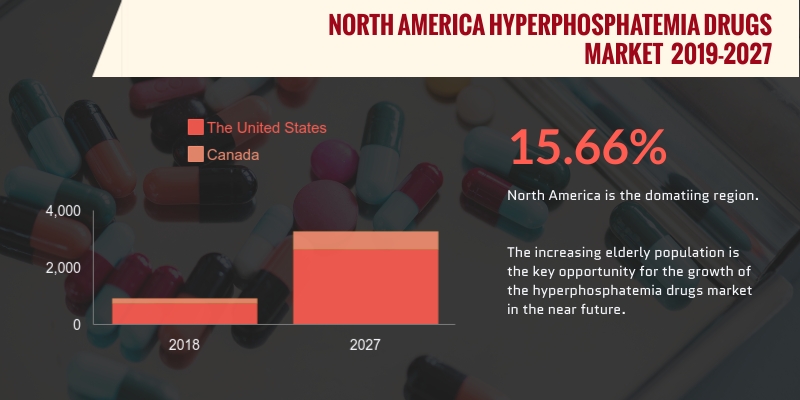

According to Triton Market Research, the North America hyperphosphatemia drugs market is estimated to increase in terms of revenue at a CAGR of 15.66% during the forecasting years 2019-2027.

Countries scrutinized in the North America hyperphosphatemia drugs market:

• United States

• Canada

Report scope can be customized per your requirements. Request For Customization

The rise of the North America market is attributable to the rise in the aging populace, increasing cases of osteoporosis and the changing dietary habits of people, among which, the increasing cases of osteoporosis are majorly driving the hyperphosphatemia drugs market in North America. Osteoporosis is a disease of the bone that occurs when the body makes extremely less amount of bone, loses a considerably large amount of bone, or both. In some patients, the bones may easily break from minor falls or become weak. The presence of better healthcare infrastructure along with the increased public awareness propel the market growth in the region. In addition, most of the major vendors in the region are focusing on drug development, which will lead to an increase in the number of drug approvals in North America.

As per the present scenario in the U.S., one-fourth of the women aged 65 or above, and nearly 6% of the male population from the same age group are reported to be suffering from weakening of the bones due to osteoporosis. The disease is mainly an issue for women between the ages of 50-60, due to low estrogen levels on account of an abnormal or total absence of menstrual periods, or due to amenorrhea in premenopausal women. Also, the rate of osteoporosis increases with age. Osteoporosis occurs at the more unadorned phase and can frequently result in pain and disability and can sometimes also lead to multiple fractures in the spine. It is believed that the diet prescription of Vitamin-D or calcium is most beneficial in these cases as it helps strengthen the bones. Additionally, bone mineral density screening is suggested for postmenopausal women and also for men aged 50 years or above.

The report on the hyperphosphatemia drugs market from Triton comprises a detailed analysis of Porter’s five force model, key buying outlook, key insights, key market trends and guidelines related to phosphate binders.

1.

NORTH AMERICA HYPERPHOSPHATEMIA

DRUGS MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCE MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

BARGAINING POWER OF BUYERS

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

THREAT OF SUBSTITUTE PRODUCT

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. KEY BUYING OUTLOOK

2.5. KEY INSIGHTS

2.6. KEY MARKET TRENDS

2.7. GUIDELINES RELATED TO THE PHOSPHATE BINDERS

2.8. MARKET DRIVERS

2.8.1.

CHRONIC DISORDERS ARE INCREASING RAPIDLY

2.8.2.

INCREASE IN PUBLIC COGNIZANCE

2.8.3.

INCREASE IN GERIATRIC POPULATION

2.9. MARKET RESTRAINTS

2.9.1.

SIDE-EFFECTS RELATED TO THE USAGE OF HYPERPHOSPHATEMIA DRUGS

2.9.2.

STRICT FOOD AND DRUG ADMINISTRATION (FDA) REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

RISE IN THE AGING POPULATION

2.11.

MARKET CHALLENGES

2.11.1.

ALTERNATIVE DIALYSIS TECHNIQUES

2.11.2.

ACCESSIBILITY OF DRUGS IS LIMITED

2.11.3.

NON-ADHERENCE TO TREATMENT REGIMES

3.

HYPERPHOSPHATEMIA DRUGS MARKET OUTLOOK - BY DOSAGES

3.1. SOLID

3.1.1.

TABLET

3.1.2.

POWDER

3.2. LIQUID

3.2.1.

SOLUTION

4.

HYPERPHOSPHATEMIA DRUGS MARKET OUTLOOK - BY FORMULATION

4.1.1.

CALCIUM-BASED PHOSPHATE BINDERS

4.1.2.

ALUMINUM-BASED PHOSPHATE BINDERS

4.1.3.

MAGNESIUM-BASED PHOSPHATE BINDERS

4.1.4.

IRON-BASED PHOSPHATE BINDERS

4.1.5.

OTHER PHOSPHATE BINDERS

5.

HYPERPHOSPHATEMIA DRUGS MARKET - REGIONAL OUTLOOK

5.1. NORTH AMERICA

5.1.1.

COUNTRY ANALYSIS

5.1.1.1.

THE UNITED STATES

5.1.1.2.

CANADA

6.

COMPETITIVE LANDSCAPE

6.1. JOHNSON AND JOHNSON

6.2. ZERIA PHARMACEUTICAL

6.3. AMAG PHARMACEUTICALS

6.4. SANOFI

6.5. BRUNO FARMACEUTICI S.P.A.

6.6. ROCHE DIAGNOSTICS CORPORATION

6.7. ROYAL DSM N.V.

6.8. SHIRE

6.9. CIPLA

6.10.

ULTRAGENYX PHARMACEUTICAL, INC.

6.11.

FERMENTA BIOTECH, LTD.

6.12.

BIOTECH PHARMACAL

6.13.

SUN PHARMACEUTICAL INDUSTRIES, LTD.

6.14.

KERYX BIOPHARMACEUTICALS, INC.

6.15.

FRESENIUS MEDICAL CARE

6.16.

PFIZER, INC.

7.

METHODOLOGY & SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

TABLE 2 PHOSPHOROUS LEVELS

IN SELECT FOODS

TABLE 3 NORTH AMERICA HYPERPHOSPHATEMIA

DRUGS MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 4 DIAGNOSIS AND CLINICAL INDICATORS OF CHRONIC KIDNEY DISEASE

TABLE 5 NORTH

AMERICA HYPERPHOSPHATEMIA DRUGS MARKET COUNTRY ANALYSIS 2019-2027 ($ MILLION)

FIGURE 1 PORTER’S FIVE FORCES

MODEL OF HYPERPHOSPHATEMIA DRUGS MARKET

FIGURE 2 IRON-BASED

HYPERPHOSPHATEMIA DRUG APPROVAL STATUS 2014-2017

FIGURE 3 RATE OF ADHERENCE TO

PHOSPHATE BINDERS

FIGURE 4 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET IN CALCIUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 5 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET IN ALUMINUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 6 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET IN MAGNESIUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 7 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET IN IRON-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 8 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET IN OTHER PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 9 NORTH AMERICA HYPERPHOSPHATEMIA

DRUGS MARKET SHARE 2018 & 2027 (%)

FIGURE 10 NORTH AMERICA

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 11 UNITED STATES

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 12 CANADA

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)