Market by Product, Type, End-user, and Geography | Forecast 2019-2027

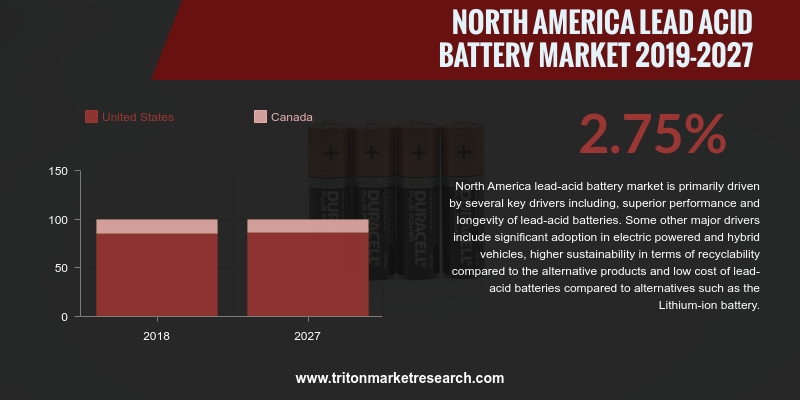

After studying the lead-acid battery market in North America, Triton Market Research has concluded that it would grow at a CAGR of 2.75% in the estimated years 2019-2027.

The countries scrutinized in the North America market for lead-acid batteries are:

• The United States

• Canada

The superlative performance and the longevity of lead-acid batteries are the primary drivers of the lead-acid battery market in North America. Besides, the high adoption of these batteries in for use in electric vehicles and their low cost in comparison with Li-ion batteries also drive the growth of this market. Stationary lead-acid or SLA batteries are used in data centers for energy storage purposes. Thus, the growing number of data centers also helps in adding growth to the market.

In 2018, the United States captured the largest share in the North American lead-acid battery market, and is as well expected to be the fastest-growing country in this market in the coming years. The escalating y-o-y automobile sales and the rising adoption of electric vehicles are driving the market growth in the US. In vehicles, lead-acid batteries are used for start-stop functions, and are thus extensively deployed for this purpose. Any growth in the production and sales of automobiles, therefore, drives the growth of the market for lead-acid batteries. Moreover, electric vehicles also require the usage of these batteries to perform the start-light-ignition (SLI) functions. Lead-acid batteries are 100% recyclable and emit less carbon dioxide; thus, their sustainability makes them a suitable choice for use in EVs.

NorthStar is a US-based company producing lead-acid batteries and battery cabinets. The company provides lead-acid batteries in various designs and specifications. In August 2018, it collaborated with Daimler to create a first-of-its-kind ultra-high-performance pure lead absorbent glass mat battery, with 220 Amp/Hr. Headquartered in Springfield, the company employs around 500 people in more than 120 countries.

1. NORTH

AMERICA LEAD—ACID BATTERY MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. RELIABLE

PERFORMANCE OF LEAD—ACID BATTERIES INCREASES THEIR SALES

2.2.2. LOW

ENERGY DENSITY OF LEAD—ACID BATTERY REDUCES THEIR SELLING POTENTIAL

2.2.3. VRLA

BATTERIES ARE THE FASTEST-GROWING LEAD—ACID BATTERIES BY TYPE

2.3. EVOLUTION

& TRANSITION OF LEAD—ACID BATTERY

2.4. PORTER’S

FIVE FORCES ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. APPLICATION

2.5.2. COST

2.5.3. LIFE

SPAN

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.9. REGULATORY

FRAMEWORK

2.10. MARKET

DRIVERS

2.10.1.

COMPARATIVELY LOW COST

2.10.2.

HIGH SUSTAINABILITY AS

COMPARED TO ALTERNATIVE PRODUCTS

2.10.3.

GROWING DEMAND FROM HYBRID

ELECTRIC VEHICLES

2.11. MARKET

RESTRAINTS

2.11.1.

SLOWDOWN IN AUTOMOTIVE SECTOR

2.11.2.

INCREASING LEAD POLLUTION

2.12. MARKET

OPPORTUNITIES

2.12.1.

GROWTH OF OFF-GRID RENEWABLE

ENERGY GENERATION

2.12.2.

INCREASING USE OF SLA

BATTERIES IN DATA CENTERS

2.13. MARKET

CHALLENGES

2.13.1.

ADOPTION OF DRY BATTERIES

3. NORTH

AMERICA LEAD—ACID BATTERY MARKET OUTLOOK – BY PRODUCT

3.1. SLI

BATTERIES

3.2. MICRO

HYBRID BATTERIES

4. NORTH

AMERICA LEAD—ACID BATTERY MARKET OUTLOOK – BY TYPE

4.1. FLOODED

BATTERIES

4.2. ENHANCED

FLOODED BATTERIES

4.3. VRLA

BATTERIES

5. NORTH

AMERICA LEAD—ACID BATTERY MARKET OUTLOOK – BY END-USER

5.1. AUTOMOTIVE

5.2. TELECOMMUNICATION

5.3. UPS

5.4. OTHERS

6. NORTH

AMERICA LEAD—ACID BATTERY MARKET – REGIONAL OUTLOOK

6.1. UNITED

STATES

6.2. CANADA

7. COMPETITIVE

LANDSCAPE

7.1. B.B.

BATTERY CO.

7.2. C&D

TECHNOLOGIES, INC. (ACQUIRED BY KPS CAPITAL PARTNER)

7.3. CROWN

BATTERY

7.4. CSB

BATTERY COMPANY LTD. (ACQUIRED BY HITACHI CHEMICAL ENERGY TECHNOLOGY)

7.5. EAST

PENN MANUFACTURING

7.6. ENERSYS

7.7. EXIDE

TECHNOLOGIES, INC.

7.8. GS

YUASA CORPORATION

7.9. CLARIOS

(FORMERLY JOHNSONS CONTROLS POWER SOLUTIONS)

7.10. NARADA

POWER SOURCE CO., LTD.

7.11. NIPRESS

7.12. NORTHSTAR

7.13. TOSHIBA

CORPORATION

7.14. ZIBO

TORCH ENERGY CO., LTD.

7.15. REEM

BATTERIES & POWER APPLIANCES CO. SAOC

TABLE 1: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: BATTERY

TECHNOLOGY COMPARISON

TABLE 3: VENDOR

SCORECARD

TABLE 4: REGULATORY

FRAMEWORK

TABLE 5: TECHNICAL

PERFORMANCE COMPARISON OF BATTERY

TABLE 6: WORLDWIDE

LITHIUM-ION BATTERY CAPACITY

TABLE 7: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 8: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 9: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 10: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: RECYCLING

RATES-PERCENTAGE OF RECLAIMED MATERIAL IN UNITED STATES

FIGURE 2: TIMELINE OF

LEAD—ACID BATTERY

FIGURE 3: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 4: KEY BUYING

IMPACT ANALYSIS

FIGURE 5: MARKET

ATTRACTIVENESS INDEX

FIGURE 6: INDUSTRY

COMPONENTS

FIGURE 7: ENERGY

CONSUMPTION BY BATTERIES IN MEGAJOULES PER KG

FIGURE 8: AVERAGE CO2

EMISSIONS PER KG BY BATTERY TECHNOLOGIES

FIGURE 9: NORTH AMERICA

LEAD—ACID BATTERY MARKET, BY SLI BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 10: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY MICRO HYBRID BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 11: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY FLOODED BATTERIES, 2019-2027 (IN $

MILLION)

FIGURE 12: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY ENHANCED FLOODED BATTERIES, 2019-2027 (IN

$ MILLION)

FIGURE 13: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY VRLA BATTERIES, 2019-2027 (IN $ MILLION)

FIGURE 14: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 15: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY TELECOMMUNICATION, 2019-2027 (IN $

MILLION)

FIGURE 16: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY UPS, 2019-2027 (IN $ MILLION)

FIGURE 17: NORTH

AMERICA LEAD—ACID BATTERY MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 18: NORTH

AMERICA LEAD—ACID BATTERY MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 19: UNITED

STATES LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: CANADA

LEAD—ACID BATTERY MARKET, 2019-2027 (IN $ MILLION)