Market By Category, Source, Product And Geography | Forecast 2019-2027

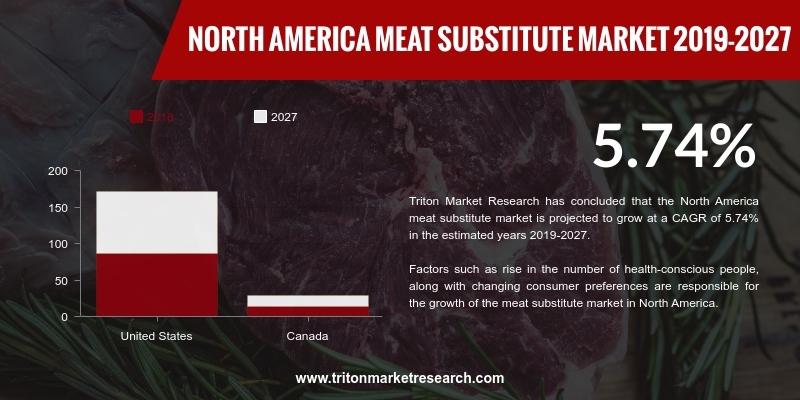

Triton Market Research has concluded that the North America meat substitute market is projected to grow at a CAGR of 5.74% in the estimated years 2019-2027.

The countries analyzed in the North America market for meat substitutes are:

• The United States

• Canada

Factors such as rise in the number of health-conscious people, along with changing consumer preferences are responsible for the growth of the meat substitute market in North America. Meat-based products are largely consumed in this region. However, the rising health concerns owing to the increase in cases of obesity, has fueled the demand for vegan and vegetarian food products. North America has witnessed a significant increase in the number of vegetarians over the last few years. An extensive range of foods and snacks prepared using plant-based meat alternatives has gained popularity among consumers in the region.

Report scope can be customized per your requirements. Request For Customization

The United States is the leading producer of soybean globally. Moreover, with the growing number of vegetarians in the country, the market for meat substitutes in the country shows immense potential. Due to factors such as convenience, along with food safety concerns and busy lifestyles of consumers in the US, frozen meat substitutes have become immensely popular; and this segment has shown the strongest sales growth. Besides, the surging cost of meat is also responsible for several consumers turning towards meat substitutes. Also, taste and clean-label features, such as high protein content and absence of artificial ingredients, are further propelling the growth of this market.

MGP Ingredients, Inc. produces and supplies premium distilled spirits and specialty wheat protein & starch food ingredients. The company’s protein and starch food ingredient products are derived from corn, barley, rye and wheat flour. MGPI operates in the United States; it is headquartered in Atchison, the US. MGP Ingredients reported revenues of US $88.3 million for the second quarter ended June 2018, an increase of 0.3% over the previous quarter.

1.

NORTH AMERICA MEAT SUBSTITUTE MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

GROWING ADOPTION OF WHEAT-BASED FOODS

2.2.2.

RISE IN VEGAN CAFES AND RESTAURANTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1.

UPSURGE IN HEALTH-CONSCIOUS POPULACE

2.6.2.

HIGH DEMAND FOR PLANT-BASED DIET

2.6.3.

INCREASE IN OBESITY AIDS MARKET GROWTH

2.7. MARKET RESTRAINTS

2.7.1.

EASY ACCESS TO ALTERNATIVE PRODUCTS

2.8. MARKET OPPORTUNITIES

2.8.1.

GROWING ADOPTION OF VEGANISM

2.8.2.

INFILTRATION OF RETAIL CHAIN

2.9. MARKET CHALLENGES

2.9.1.

HIGH COST LEVIED ON ANALOG MEAT

2.9.2.

RISE IN ALLERGIES OWING TO SOYA-BASED PRODUCTS

3.

NORTH AMERICA MEAT SUBSTITUTE MARKET OUTLOOK - BY CATEGORY

3.1. FROZEN

3.2. REFRIGERATED

3.3. SHELF-STABLE

4.

NORTH AMERICA MEAT SUBSTITUTE MARKET OUTLOOK - BY SOURCE

4.1. SOY-BASED

4.2. WHEAT-BASED

4.3. MYCOPROTEIN

4.4. OTHER SOURCES

5.

NORTH AMERICA MEAT SUBSTITUTE MARKET OUTLOOK - BY PRODUCT

5.1. TOFU-BASED

5.2. TEMPEH-BASED

5.3. TVP-BASED

5.4. SEITAN-BASED

5.5. QUORN-BASED

5.6. OTHER PRODUCTS

6.

NORTH AMERICA MEAT SUBSTITUTE MARKET - REGIONAL OUTLOOK

6.1. NORTH AMERICA

6.1.1.

UNITED STATES

6.1.2.

CANADA

7.

COMPETITIVE LANDSCAPE

7.1. AMY’S KITCHEN INC.

7.2. BEYOND MEAT

7.3. CAULDRON FOODS LTD

7.4. QUORN FOODS LTD

7.5. KELLOGG CO.

7.6. TOFURKY

7.7. SUPERBOM

7.8. MEATLESS B.V.

7.9. VBITES FOOD LTD.

7.10. MGP INGREDIENTS

7.11. IMPOSSIBLE FOODS INC.

7.12. CONAGRA BRANDS INC.

7.13. THE CAMPBELL SOUP COMPANY

7.14. SONIC BIOCHEM LTD

7.15. VEGABOM HEALTHY OPTION

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027 (IN

$ MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY CATEGORY, 2019-2027

(IN $ MILLION)

TABLE 5: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY SOURCE, 2019-2027 (IN

$ MILLION)

TABLE 6: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY PRODUCT, 2019-2027 (IN

$ MILLION)

TABLE 7: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027 (IN

$ MILLION)

FIGURE 1: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY CATEGORY, 2018 &

2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY FROZEN, 2019-2027 (IN

$ MILLION)

FIGURE 4: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY REFRIGERATED,

2019-2027 (IN $ MILLION)

FIGURE 5: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY SHELF-STABLE,

2019-2027 (IN $ MILLION)

FIGURE 6: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY SOY-BASED, 2019-2027

(IN $ MILLION)

FIGURE 7: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY WHEAT-BASED,

2019-2027 (IN $ MILLION)

FIGURE 8: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY MYCOPROTEIN,

2019-2027 (IN $ MILLION)

FIGURE 9: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY OTHER SOURCES,

2019-2027 (IN $ MILLION)

FIGURE 10: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY TOFU-BASED,

2019-2027 (IN $ MILLION)

FIGURE 11: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY TEMPEH-BASED,

2019-2027 (IN $ MILLION)

FIGURE 12: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY TVP-BASED, 2019-2027

(IN $ MILLION)

FIGURE 13: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY SEITAN-BASED,

2019-2027 (IN $ MILLION)

FIGURE 14: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY QUORN-BASED,

2019-2027 (IN $ MILLION)

FIGURE 15: NORTH AMERICA MEAT SUBSTITUTE MARKET, BY OTHER PRODUCTS,

2019-2027 (IN $ MILLION)

FIGURE 16: NORTH AMERICA MEAT SUBSTITUTE MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 17: UNITED STATES MEAT SUBSTITUTE MARKET, 2019-2027 (IN $

MILLION)

FIGURE 18: CANADA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)