Market By Component, Fidelity, End-user And Geography | Forecast 2019-2027

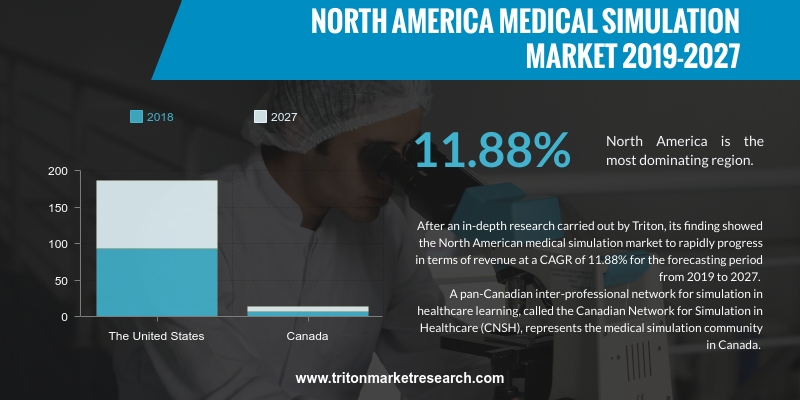

After an-in-depth research carried out by Triton, its finding showed the North American medical simulation market to rapidly progress in terms of revenue at a CAGR of 11.88% for the forecasting period from 2019 to 2027.

The countries examined in the North America market for medical simulation are:

• The United States

• Canada

A pan-Canadian inter-professional network for simulation in healthcare learning, called the Canadian Network for Simulation in Healthcare (CNSH), represents the medical simulation community in Canada. The country has an active ecosystem supporting its medical simulation market. The SIM-one (the Ontario Simulation Network), a not-for-profit organization connecting the simulation community with the simulation services, facilities & resources across Ontario, manages the developments in medical simulation. The association has full support from Ontario’s Ministry of Health and Long-term Care. The SIM-one states over 50 simulation centers to be present in Canada, with training programs being conducted in the universities, colleges, hospitals and non-profit sectors in the country.

Report scope can be customized per your requirements. Request For Customization

Besides these, there are medical centers, which procure manikins & simulators from medical simulation vendors for ad-hoc simulation workshops. Private market players such as CAE Healthcare, a global leader that delivers training & simulation services across several industry verticals, are present in Canada, which provide medical simulation products & services. Thus, the interest of the government in promoting medical simulation is expected to enhance the sales of medical simulation services in the country, as a result of which, the Canadian medical simulation market may grow significantly over the forecasted period.

CAE Healthcare offers specialized educational tools to help healthcare professionals in providing safe & high-quality patient care. The company has a broad product portfolio, CAE Apollo, CAE HPS, CAE Lucina, CAE Athena and CAE iStan, etc. Each product of the company is developed with guidance from clinicians and clinical educators. CAE Healthcare offers targeted training to hospital systems, nursing, medical programs, military branches, emergency response teams & nursing, and also respiratory & allied health programs. The Canada-based company is headquartered in Saint-Laurent, Québec. In April 2018, CAE Healthcare announced signing an agreement with WorldPoint for the distribution of CAE Juno products throughout the training & simulation centers in the United States.

1. NORTH

AMERICA MEDICAL SIMULATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL OUTLOOK

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. BARGAINING

POWER OF SUPPLIERS

2.2.5. THREAT

OF COMPETITIVE RIVALRY

2.3. MARKET

TRENDS

2.4. REGULATORY

OUTLOOK

2.5. MARKET

SHARE OUTLOOK

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. MARKET

DRIVERS

2.7.1. GROWING

CONCERN FOR PATIENT SAFETY

2.7.2. INCREASING

DEMAND FOR MINIMALLY INVASIVE SURGERY (MIS)

2.8. MARKET

RESTRAINTS

2.8.1. HIGH

COST OF MEDICAL SIMULATORS

2.8.2. LACK

OF SKILLED PROFESSIONALS

2.8.3. AVERSENESS

TO ADOPT NEW SIMULATION TECHNOLOGIES

2.9. MARKET

OPPORTUNITIES

2.9.1. TECHNOLOGICAL

ADVANCEMENTS

2.10.

MARKET CHALLENGES

2.10.1.

CHALLENGES IN THE MEDICAL

SIMULATION OPRATION

3. MEDICAL

SIMULATION MARKET OUTLOOK – BY COMPONENT

3.1. MODEL-BASED

SIMULATION

3.2. WEB-BASED

SIMULATION

3.3. SIMULATION

TRAINING SERVICES

4. MEDICAL

SIMULATION MARKET OUTLOOK – BY FIDELITY

4.1. LOW-FIDELITY

4.2. MEDIUM-FIDELITY

4.3. HIGH-FIDELITY

5. MEDICAL

SIMULATION MARKET OUTLOOK – BY END-USER

5.1. ACADEMIC

INSTITUTIONS & RESEARCH CENTERS

5.2. HOSPITALS

& CLINICS

5.3. MILITARY

ORGANIZATIONS

6. MEDICAL

SIMULATION MARKET – REGIONAL OUTLOOK

6.1. NORTH

AMERICA

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. THE

UNITED STATES

6.1.1.2. CANADA

7. COMPETITIVE

LANDSCAPE

7.1. GAUMARD

SCIENTIFIC COMPANY

7.2. CANADIAN

AVIATION ELECTRONICS (CAE)

7.3. MENTICE

AB

7.4. KYOTO

KAGAKU CO., LTD.

7.5. SIMULAIDS,

INC.

7.6. KINDHEART,

INC.

7.7. 3D

SYSTEMS CORPORATION

7.8. LAERDAL

MEDICAL AS

7.9. SURGICAL

SCIENCE SWEDEN AB

7.10.

LIMBS & THINGS LTD.

7.11.

INTELLIGENT ULTRASOUND GROUP

PLC (FORMERLY MEDAPHOR GROUP PLC)

7.12.

NASCO

7.13.

SIMULAB CORPORATION

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 NORTH AMERICA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

TABLE 2 COST OF SIMULATION EQUIPMENT

TABLE 3 NORTH AMERICA MEDICAL SIMULATION MARKET

BY COMPONENT 2019-2027 ($ MILLION)

TABLE 4 NORTH AMERICA MEDICAL SIMULATION MARKET

BY FIDELITY 2019-2027 ($ MILLION)

TABLE 5 NORTH AMERICA MEDICAL SIMULATION MARKET

BY END-USER 2019-2027 ($ MILLION)

TABLE 6 NORTH AMERICA MEDICAL SIMULATION MARKET

BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 NORTH AMERICA MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 2 COMPANY MARKET SHARE OUTLOOK OF MEDICAL

SIMULATION 2018 (%)

FIGURE 3 NORTH AMERICA MEDICAL SIMULATION MARKET BY

MODEL-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 4 NORTH AMERICA MEDICAL SIMULATION MARKET BY

WEB-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 5 NORTH AMERICA MEDICAL SIMULATION MARKET BY

SIMULATION TRAINING SERVICES 2019-2027 ($ MILLION)

FIGURE 6 NORTH AMERICA MEDICAL SIMULATION MARKET BY

LOW-FIDELITY 2019-2027 ($ MILLION)

FIGURE 7 NORTH AMERICA MEDICAL SIMULATION MARKET BY

MEDIUM-FIDELITY 2019-2027 ($ MILLION)

FIGURE 8 NORTH AMERICA MEDICAL SIMULATION MARKET BY

HIGH-FIDELITY 2019-2027 ($ MILLION)

FIGURE 9 NORTH AMERICA MEDICAL SIMULATION MARKET BY

ACADEMIC INSTITUTIONS & RESEARCH CENTERS 2019-2027 ($ MILLION)

FIGURE 10 NORTH AMERICA MEDICAL SIMULATION MARKET BY

HOSPITALS & CLINICS 2019-2027 ($ MILLION)

FIGURE 11 NORTH AMERICA MEDICAL SIMULATION MARKET BY

MILITARY ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 12 THE UNITED STATES MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 13 CANADA MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)